Detailed notes of Rich Pzena, Alissa Corcoran, Doug Noland, Andrew Russell, Dennis Johnson and Jeff Jacobs from the NYSSA Ben Graham annual conference which took place on Wednesday, June 27th 2018 in New York.

Q2 hedge fund letters, conference, scoops etc

NYSSA Ben Graham Annual Conference - Rich Pzena And First Panel And Q&A

[00:05:28] Male 1: Good morning, thank you Jim for the invitation about the Centre and thank you too for everything you have done for the Centre after it was started. My name is [inaudible 00:05:39] and I work very closely with Jim on many activities at the Centre. So Jim has asked me to say a few words about the academic side, and I’m very happy to say a few words. Our association with the CFA actually goes back a number of years. It started with both our investment intensive programs we recognised by the CFA Society that the students applied for a CFA scholarship. So we are very proud to have the CFA school status.But more in line with today’s conference and the mission of the Gabelli Centre as Jim briefly mentioned our undergraduate program now has a 3 course value investing concentration with introduction to investing staffed by Jim and also Bradford, I see Bradford sitting there thank you. We have an advanced value investing process which is staffed by Jim Roland which I think he will be here some time today. Then we have another course on finance.

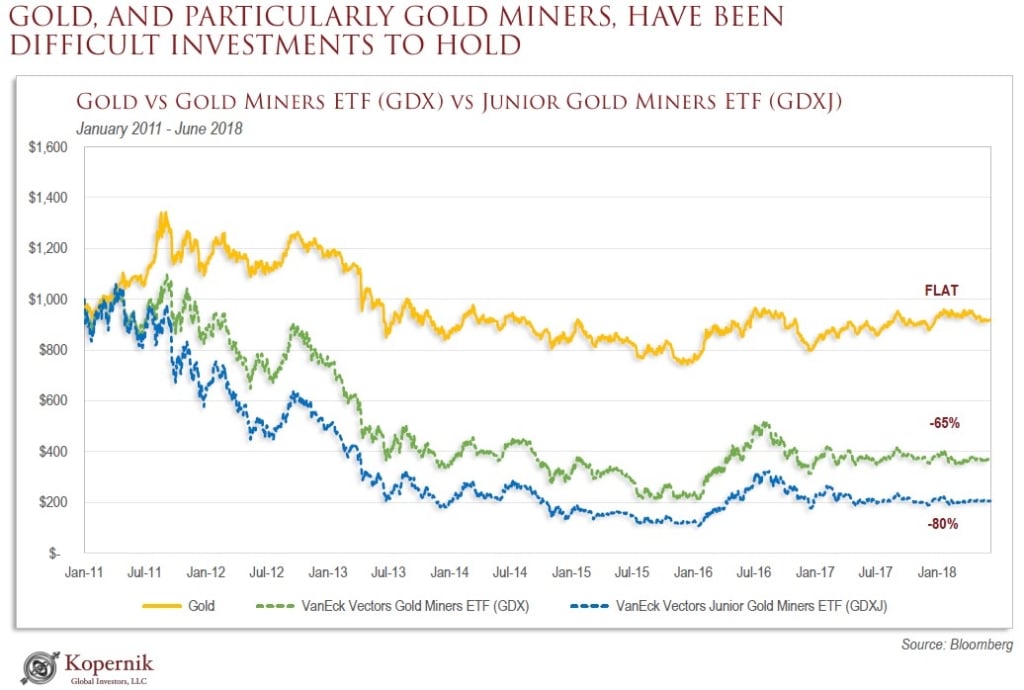

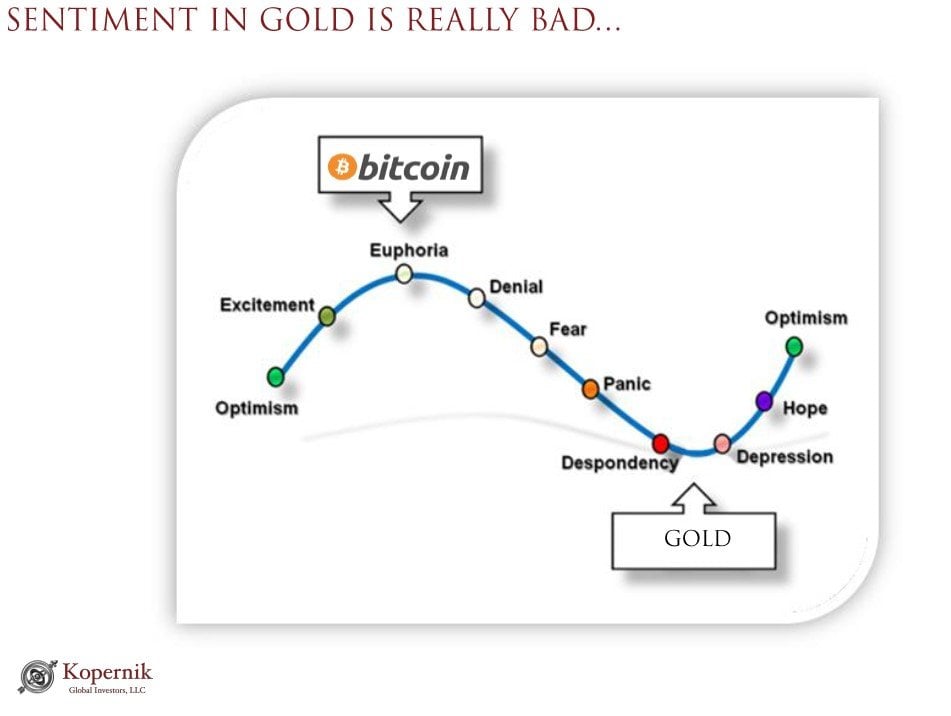

Alissa Corcoran, Kopernik Global Investors & Doug Noland, Mcalvany Wealth Management on Systemic Risks / Value in Gold

We have two presenters today, Alissa Corcoran is an investment at [inaudible 00:01:13] Global Investors. She covers healthcare, materials and mining and currently has a very heavy allocation towards precious metals, so it’s 25% of their assets under management is allocated to precious metal miners for gold, silver and iron.

[inaudible 00:01:33] was an analyst with [inaudible 00:01:34] and she has a CFA, so welcome to the CFA conference. [inaudible 00:01:44] someone with very good experience in different asset classes so it’s definitely from commodities as well as management analysis and [inaudible 00:01:58] security, individual security analysis.So [inaudible 00:02:04] his career when he was working as a treasury analyst at [inaudible 00:02:10] in the US. He witnessed first hand the Japanese bubble appear and then prior to the 87 market crash. He later assisted Dr [inaudible 00:02:20] with a publication on a macro ladder in the later 90’s.

Andrew Russell, PBUCC & Dennis Johnson, TIAA-CREF Trust Company on Plan Sponsors View

Andrew: Thanks for your time and for having me today. My name is Andrew I’m the director of fixed income on the pension board of the Church of Christ. I’ve been there for 15 years, in fact I was recently awarded a plaque and cheque in celebration of my time to the UCC. The Church of Christ is a protestant denomination and in our denomination we are not nearly as big as methodists or presbyterians.

The church itself is headquartered in Cleveland, Ohio. Pension division we are in Colombia University across the street from what was formerly [inaudible 00:02:32]. The UCC has 5000 member churches nationwide, we are predominantly in New England and middle western states and we have exposure across the country.

Originally the UCC was founded from the roots of puritan, puritan is a member of the [inaudible 00:02:58]. More recently there’s been a [inaudible 00:03:01] regarding social issues. The board and the pension [inaudible 00:03:10] and the folks come from a variety of backgrounds to do the churches bidding. The investment committee is derived from that and most of those folks come from the investment community save for one or two. We do have members who are now more focused stable investing and in ESG.

Jeff Jacobs - Distressed Debt Investing

Jeff: So thanks for having me. I was delighted to be invited here today as a distressed investor you don’t get the chance to talk at conferences very often these days. I was delighted at the invitation, I got the conference material and realised that the theme of the conference was exactly what I do, it’s kind of like giving the eulogy at your funeral.

Anyway I’m asked to give a little bit of perspective on finding value in this environment of low rates and perceived low risk from a high yield distressed perspective. I’ve been involved in distressed investing for 25 years now, I started at Merrill Lynch back in the early 90’s. I quickly gravitated to the high yield department and then the newly formed distressed trading business. I was a fundamental credit analyst by the training of background and I was really drawn to the deep fundamental research, intrinsic value aspect, investing in capital structures through the dip at discount, sometimes at pennines on the dollar to add value through that market capital structure.

From my perspective at that time, and I still hold this belief, I really feel like distressed investing is the quintessential value investing strategy. I think a distressing strategy or a distressed strategy is that involved, buying debt and creating and unlocking value through a bankruptcy process using contract law assisted by bankruptcy law. It really actually does incorporate a lot of the critical elements that Ben Graham actually used to describe originally value investing.

See the full article here.