New Residential (NRZ) offers a very tempting 11% yield, but before diving in headfirst, investors should be aware of the big risks that this mortgage REIT faces. After explaining how NRZ makes money, this article reviews six big risks, followed by seven reasons why NRZ is attractive and may be worth considering.

Note: This report was originally released to Blue Harbinger members on June 16th.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

How NRZ Makes Money…

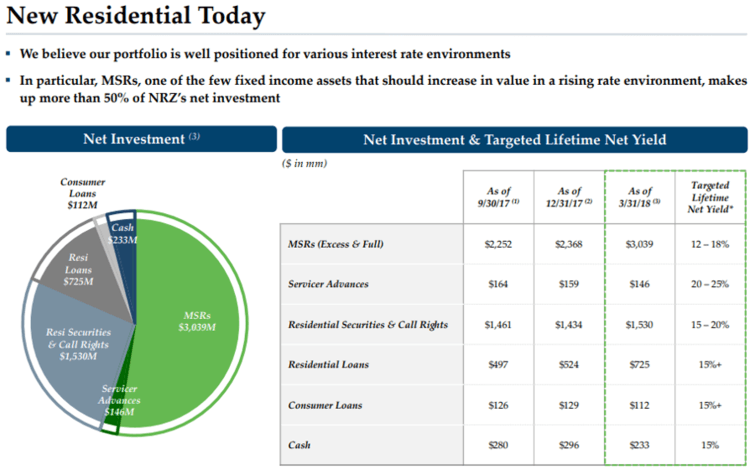

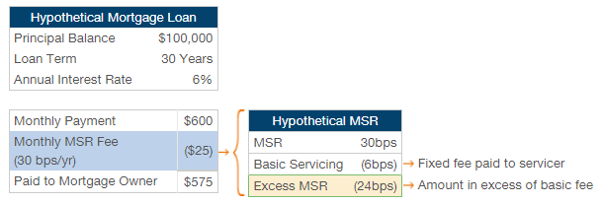

NRZ invests in higher yielding residential-mortgage-related assets that offer steady longer-term yields (this is how NRZ supports its big dividend), as shown in the following graphic.

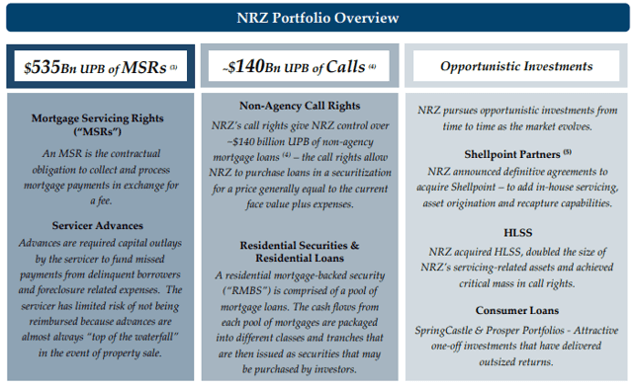

Specifically, NRZ’s largest investment class is Mortgage Servicing Rights (“MSRs”). If you don’t know, an MSR provides a mortgage servicer with the right to service a pool of mortgage loans in exchange for a fee. NRZ was a pioneer of this asset class following the housing crisis and all of its subsequent complex regulatory requirements. This is a lucrative asset class (as evidenced by the high yields in the table above), and NRZ is one of only a few companies with the scale and sophistication to be a leader in this space. For more information on MSRs and NRZ’s other investment types (which are much easier to understand than MSRs) check it out these explanations on NRZ’s website and also the graphic below.

NRZ Uses Lower Cost Debt to Fund Its Investments…

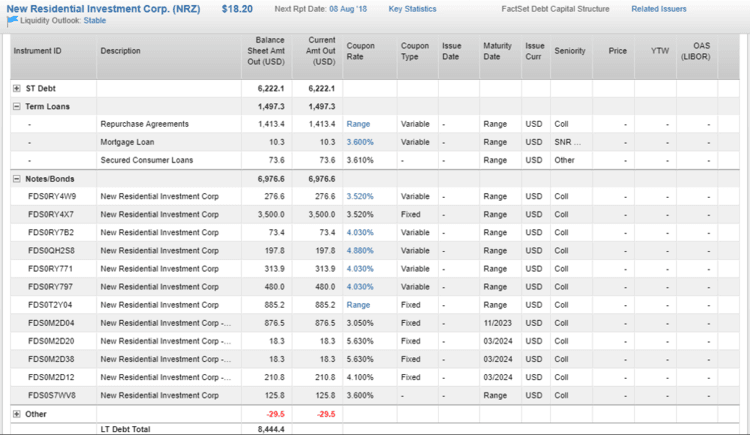

The “Coupon Rate” column in the following table shows the low rates NRZ pays on the loans it uses to invest in its higher yielding assets.

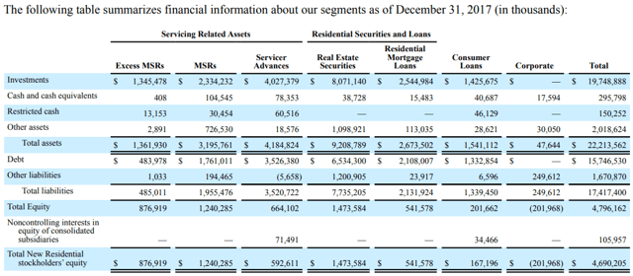

With interest rates ranging from 3.5% to 5.6% its easy to see how NRZ generates all that cash to support its big dividend payments (i.e. NRZ earns the spread between the yield on its investments and the cost of its debts). And for more perspective, here is the amount of debt NRZ has taken on relative to its investments in each of its segments.

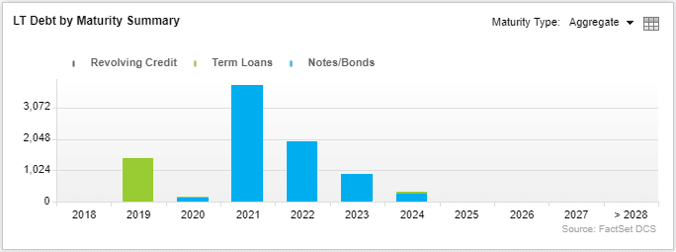

These debt-to-asset ratios by business segment add some color to the amount of risk for each asset class (i.e. if there’s less debt to assets that’s a good indication that those assets are more risky (more on risks later). And for still more perspective, here is a look at the total amount of NRZ debt and when it comes due (this will be important when we discuss risks, later).

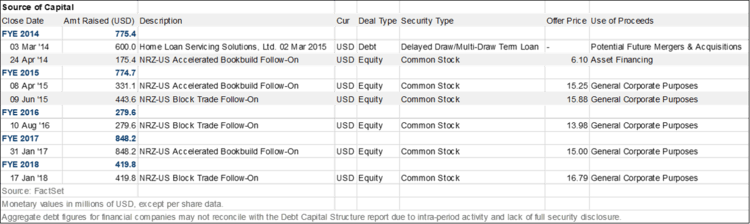

In addition to borrowing, NRZ also goes to the equity market to raise cash when needed, as shown in the following table:

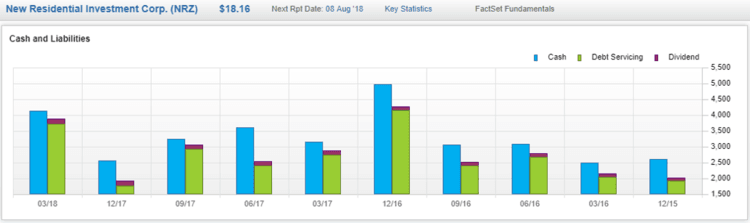

And for more perspective on how NRZ uses all the debt and equity cash it raises, here is a look at its “uses of cash.”

Specifically, debt servicing is a much bigger use of cash than the dividend payments. And for more information, here is a more granular look at “uses of cash” in table format.

As would be expected for a mortgage REIT, the uses of cash are tight (i.e. there is not a ton of cushion), and this will be important later when we consider risks (particularly credit spreads).

Nonetheless, the economics of NRZ’s business is attractive (as we’ll discuss more later), but first here are the big risks that NRZ faces that investors should be aware of.

NRZ’s Big Risks

- The Yield Is High For a Reason

NRZ’s dividend yield is high for a reason (i.e. it’s risky). For example, if there wasn’t much risk associated with MSRs, then they wouldn’t offer such high yields (because the market would have arbitraged it away). Granted, NRZ deserves some credit for the high yield due to its first mover advantage (they essentially pioneered the industry), the low levels of competition (not many other companies have the scale and sophistication to compete), and because management is smart (they’ve continued to evolve with the evolving mortgage industry), but remember that NRZ was only able to get into this business in the first place because big banks were forced to “de-risk” after the housing crisis by selling off risky mortgage servicing business (and NRZ was willing to take on that risk).

- Competition May Grow

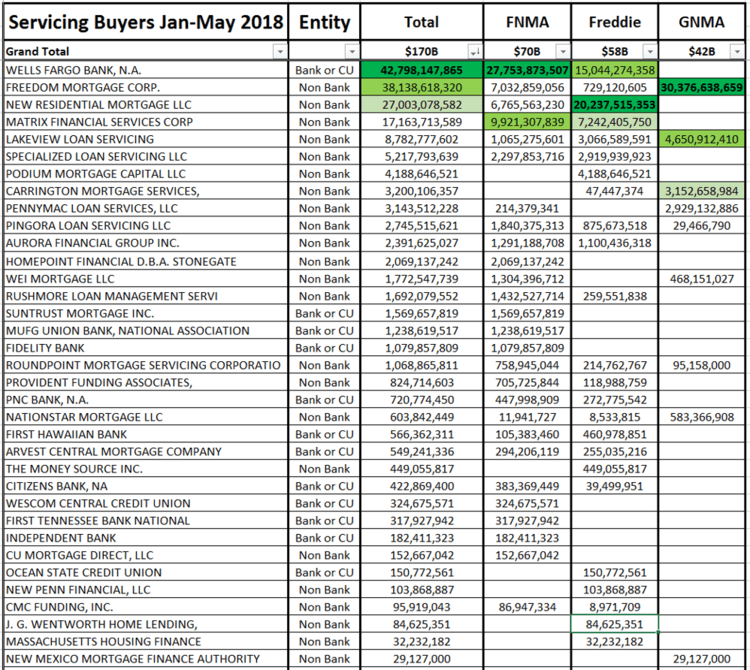

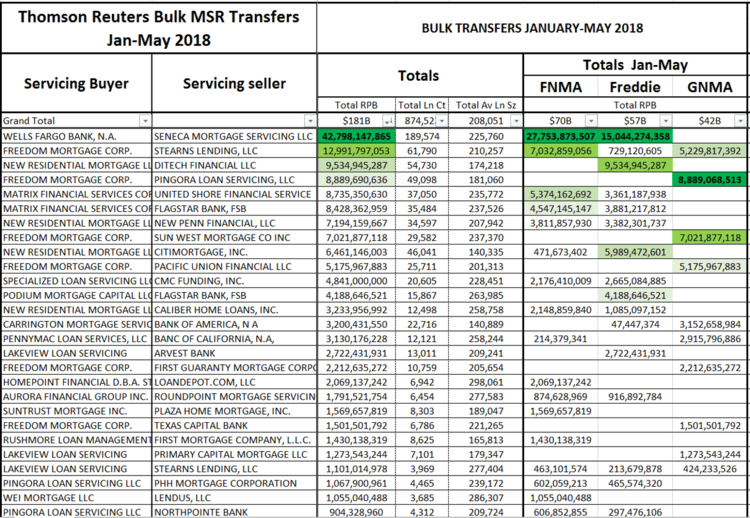

And as a related risk, big banks may soon get back into riskier investment types (such as MSRs) as the current White House and Congress look to roll back regulations (such as parts of Dodd Frank). Growing competition from big banks is a risk for NRZ. And for perspective, the following tables show the year-to-date mortgage servicing buyers, and Wells Fargo (a big bank) is leading the way (Not NRZ).

Mortgage Servicing Transfers - Bulk Agency MSR Analysis 2018 YTD and Rankings

From a competitive perspective, Wells Fargo has much deeper pockets than NRZ, and that could become a growing risk (i.e. more competition from big banks).

- Interest Rate Risk

NRZ often brags about how MSRs are one of the few asset classes that actually benefit from rising interest rates (because as rates rise, mortgage pre-payment speeds slow, and NRZ gets to collect MSR fees for a longer period of time). And while this is true, NRZ still faces risks from rising interest rates, as they describe in the “Risk Factors” section of their annual report:

As of December 31, 2017, an immediate 50 basis point increase in short term interest rates, based on a shift in the yield curve, would decrease our cash flows by approximately $11.4 million in 2018, whereas a 50 basis point decrease in short term interest rates would increase our cash flows by approximately $13.7 million in 2018, based solely on our current net floating rate exposure and assuming a static portfolio of investments.

- Credit Spread Risk

In our view, it seems intentional that management often talks about the benefits of rising interest rates to MSR assets during conference calls and in investor presentations, but they seem to intentionally avoid talking about the very real risks posed by the potential for credit spreads to widen. Specifically, the market has been in a decreasingly volatile, “risk-on” environment, whereby credit spreads are very low, and this has been great for NRZ’s business. More specifically, as credit spreads decrease, the value of NRZ’s risky assets increase, and this makes the company’s stock price go up, as well as making its debt appear less risky. In reality, if credit spreads blow out, NRZ could be in big trouble depending on the extent and duration of widening credit spreads. For starters, here’s what NRZ has to say about “Credit Spread Risk” in its annual report:

Widening credit spreads would result in higher yields being required by the marketplace on financial instruments. This widening would reduce the value of the financial instruments we hold at the time because higher required yields result in lower prices on existing financial instruments in order to adjust their yield upward to meet the market.

As of December 31, 2017, a 25 basis point increase in credit spreads would decrease our net book value by approximately $186.4 million, and a 25 basis point decrease in credit spreads would increase our net book value by approximately $190.3 million, based on a static portfolio of investments, but would not directly affect our earnings or cash flow. As of December 31, 2016, a 25 basis point increase in credit spreads would have decreased our net book value by approximately $114.1 million, and a 25 basis point decrease in credit spreads would have increased our net book value by approximately $110.5 million

If spreads blowout it could become challenging to refinance debt because loan to values will be less attractive.

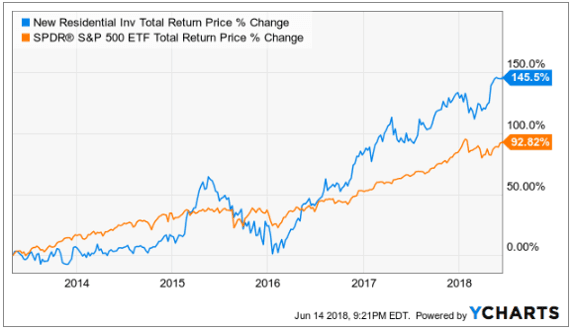

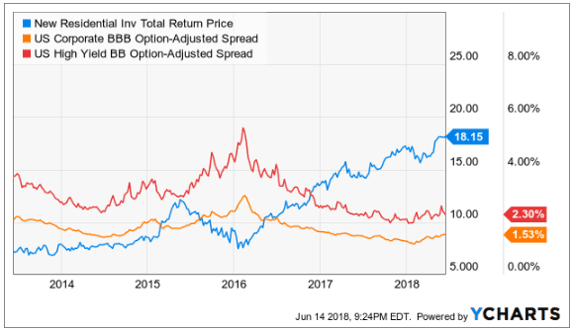

For some perspective, NRZ sold-off hard in late 2015 and early 2016 when credit spreads last widened significantly.

And even though NRZ’s assets are not your typical high yield investments (because they’re residential mortgage related) they’re still high yield and sold-off in sympathy, as shown in the following chart.

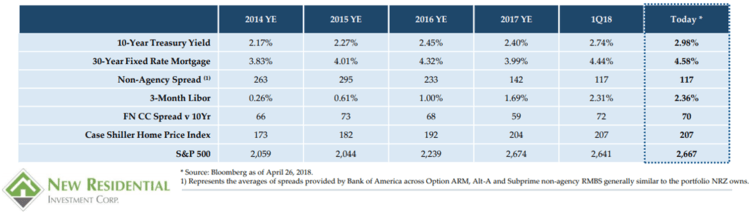

Also, the “Non-Agency Spread” line in the following table gives some perspective about where we are with regards to NRZ’s mortgage-related higher-yielding credit spreads.

- Illiquidity Risk

NRZ’s assets are relatively illiquid (the assets are not traded in the public market like a stock), and this could create a big problem for NRZ right when they need liquidity the most. For example, if spreads blow out when debt is due, it’ll be harder to refinance because it’ll throw off the coverage ratios, and because the assets are hard to sell for cash (i.e., they’re illiquid right when you need liquidity the most). Here’s what NRZ’s annual report has to say about liquidity risk:

The assets that comprise our asset portfolio are generally not publicly traded. A portion of these assets may be subject to legal and other restrictions on resale or otherwise be less liquid than publicly-traded securities. The illiquidity of our assets may make it difficult for us to sell such assets if the need or desire arises, including in response to changes in economic and other conditions.

- Market Cycle Risk

NRZ has benefited from being in the right place at the right time (i.e. they got into the MSR business when credit spreads were wider and shrinking, and when banks were selling off mortgage-related investments at attractive low prices due to new regulations). However, the market has moved beyond the early-post-housing-crisis days, and the opportunities may not be as attractive going forward. Not only are credit spreads currently compressed, but if the housing market slows, spreads will widen, NRZ assets will decrease in value, and its share price (and eventually its dividend) will face pressure. Also banks may continue to re-enter the space more aggressively (as we saw Wells Fargo in our earlier table) especially if regulations are rolled back thereby allowing big banks to take on more risk.

Why NRZ is Attractive:

Despite the big risks (as described above), NRZ still possesses a variety of attractive qualities, such as the following seven:

- Management is Smart

NRZ’s management deserves credit for essentially building an industry (post-housing-crisis MSRs) and becoming an industry leader. For a little more perspective, the following graphic provides some color on how an MSR actually works:

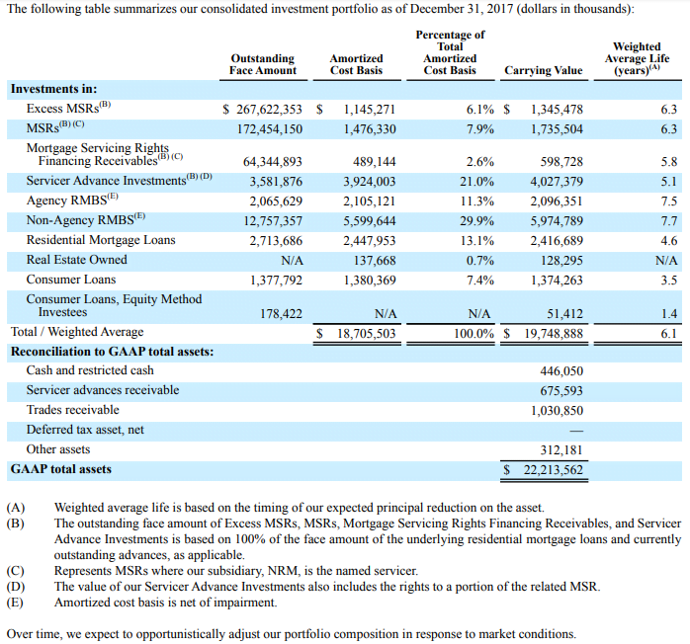

And for a little more perspective, here is a look at the face amount of mortgage loans upon which NRZ has MSRs:

The above table also provides more color on the size and weighted average life (in years) or NRZ’s total investments. NRZ is a unique business, and management deserves a lot of credit for being a post-housing-crisis innovator in this space. Further, management has continued to evolve with the industry as NRZ’s book evolved from MSR’s, to excess MSRs, as well as the recent acquisition of an actual mortgage servicer which could prove very valuable as the market cycle and industry continue to progress.

- The Economics Work

As we saw earlier, the yields NRZ earns are much higher than its cost of capital. This is because NRZ is willing to take on the risk, but also because NRZ is smart and innovative for building out a leading platform in this relatively new industry. As long as credit spreads don’t blow out dramatically, NRZ shouldn’t have any problems maintaining its big dividend.

- The Market is Big

According to NRZ latest investor presentation, they have a robust pipeline and potential opportunities across the $26 trillion U.S. housing market. Or more specifically, NRZ believes the approximately $10 trillion mortgage servicing market presents a number of compelling investment opportunities. As long as NRZ continues to evolve with the industry, there should be plenty of continuing opportunities for growth.

- Competition is Low

As mentioned earlier, NRZ is one of only a few market participants that have the combination of capital, industry experience and key business relationships that seem necessary to take advantage of the opportunity created by the increasingly complex residential housing market. Specifically many banks exited this business shortly after the housing crisis, thereby creating less competition for NRZ. For reference, we saw a handful of NRZ’s competitors (most of them much smaller) in our earlier table of year-to-date mortgage servicing buyers.

- The Market Is Strong

The housing market, and the overall economy, remain strong, and another housing crises seems unlikely, especially considering all of the new regulations and risk constraints that were put in place. Also, rising interest rates will likely reduce mortgage pre-payment speeds, thereby increasing the value of NRZ’s MSRs. Further, the sheer size and lack of competition in the mortgage asset servicing space should help NRZ remain a leader in the space. If credit spreads were to widen significantly—that would be concerning, but it also seems unlikely we’ll experience anything as severe as the last housing crisis anytime soon.

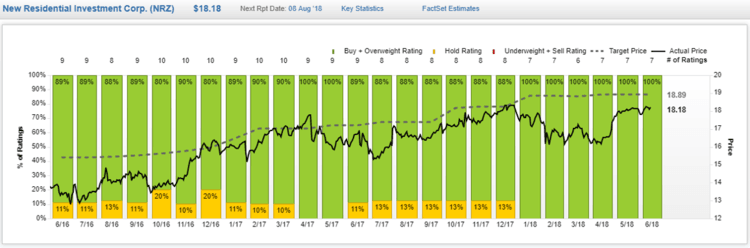

- Analysts like NRZ

For what it’s worth, all seven of the Wall Street analysts currently covering NRZ have a “buy” recommendation and believe the shares should trade higher, as shown in the following chart.

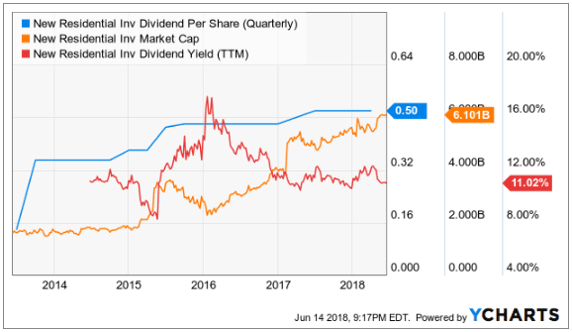

- The Dividend is Big

We’d be remiss not to explicitly mention the attractiveness of NRZ’s big dividend. And even if the market gets a little jittery, and credit spreads widen, and the value of NRZ’s assets and stock price both decline, the assets will likely keep producing the income necessary to continue supporting NRZ’s big dividend. Specifically, it would take somewhat extreme conditions for the dividend to be reduced in the near-term, and it will likely sustain and grow in the long-term as long as NRZ can keep evolving with the large and evolving residential mortgage market. For perspective, the following chart shows NRZ’s dividend per share has increased as its market cap has increased, and the dividend yield is currently reasonable relative to its historical levels.

Conclusion:

New Residential is able to offer a big dividend yield because the company continues to be a smart innovator in an evolving industry. In our view, NRZ faces both risks and has attractive qualities, as described in this article. However, the biggest risk is if credit spreads widen so dramatically that NRZ’s asset values fall far enough that it isn’t able to refinance its debts and is thereby forced to cut its dividend to free up cash. However, that scenario seems extremely unlikely, especially considering our current strong market environment. Nonetheless, we continue to monitor the market and NRZ closely. We have owned NRZ in our Blue Harbinger Income Equity portfolio since May of 2016, and we have no plans to sell any of our shares at this time (we'd consider adding on a pullback).

Further still, NRZ is a unique high-yielder, and we believe it can add significant value to an income-focused portfolio. For this reason, we have added NRZ to our list of 5 Attractive High-Yields from across the capital structure, which includes preferreds, debt and equity opportunities. We are most certainly not advocating for an over-diversified "closet index fund," we're simply acknowledging that it can be beneficial to consider attractive high-yield opportunities from across the capital structure, especially if you are an income-focused investor.

Article by Blue Harbinger