LISI investment letter for the third quarter of 2018, titled, “Reflections On Inflection.”

Q2 hedge fund letters, conference, scoops etc

Summary Points

- Flat equity returns this year mask considerable volatility that may signal an inflection point for markets. Stock prices seem reluctant to follow accelerating economic growth in the US amid investor fears that reflation will poke a gradualist Fed into more aggressive tightening. Additional angst stems from the potential for a widespread and protracted trade war that could inflict lasting damage on the international ecosystem of trade agreements and regulations

- On July 6th the US officially put into force tariffs covering some $34 billion in Chinese imports with talk of ratcheting the level up to half a trillion dollars, while trading partners applied or prepared retaliatory actions. Trade restrictive measures have increased over the last few years and populist nationalists from both the left and the right are challenging the global interdependence model

- The globally coordinated monetary accommodation that helped markets shake off threats to the post-Great Recession economic recovery has now splintered into different paths, with the Euro-zone and Japan maintaining a loose stance and US policy makers shifting to fiscal stimulus that has propelled growth and pushed inflation toward the Fed's 2% symmetrical target

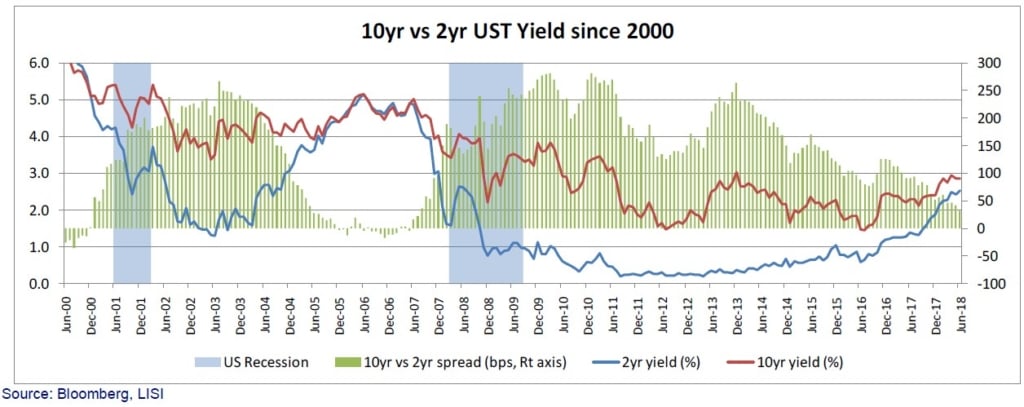

- We expect the FOMC to hike rates by December 2018, which would push the Fed funds rate to 2.25%-2.50%. The Fed wants to maintain its maneuverability on interest rates in the event of an economic downturn that necessitates monetary accommodation. Still, the Fed may end the expansion in the usual way, by over-tightening. The probability of such an outcome increases slightly with each strong data reading on inflation, housing, confidence and other measures. Signs of trouble exist with 2-yr/10-yr US Treasury yield curve heading toward inversion

- Higher interest rates also drive dollar strength. Consequences of a strengthening reference currency include pressure on smaller, highly indebted economies that may encounter difficulty via a liquidity crunch or run on their currencies. We have already seen weakness in the Turkish lira and Mexican peso, and an IMF intervention to help Argentina defend its currency

- The US administration's gamble that growth-driven corporate and individual tax collections will rise to offset tax cuts may pay off. If not, though, public debt-to-GDP in the US may rise to uncomfortable levels and drive up borrowing costs for the US Treasury. That would exacerbate any downturn as borrowing costs increase across the spectrum of businesses that need to refinance their debt

- We see continuing volatility in the markets, particularly in equities, and are beginning to question the resilience of the market to potential shocks from an escalating trade war and possible geopolitical flare-ups. With general uncertainty and the possibility of a true inflection developing, the LISI Investment Committee voted at its late-June meeting to keep Tactical Asset Allocations as is, but determined to watch upcoming data and events carefully for signs of a definitive turn in the fortunes of the markets

LISI 3Q18 Investment Letter

Flat equity returns this year mask considerable volatility that may signal an inflection point as stock prices seem reluctant to follow accelerating economic growth in the US. The "reflation trade" is back on, but fears of too much reflation poking a gradualist Fed into more aggressive tightening weighs on investor confidence. Much of the angst that accompanies range-bound equity returns since January centers on uncertainty about the speed and magnitude of Fed rate hikes and about the potential for a widespread and protracted trade war. The latter issue has been rumbling for the last few years as trade restrictive measures have increased and insular political parties have assumed power across different regions. That swing of the nationalistic pendulum yielded votes that brought us Brexit, the Five Star Party in Italy, AMLO in Mexico, immigration tantrums for centrist parties throughout Europe, and now the first salvos of a "trade war" between the US and China. Given the long evolution of global economic integration, it remains to be seen how extensive the rollback might become, but populist nationalists from the left and the right are beginning to alter the landscape of international affairs and challenge the interdependence model.

Over the last few years, the markets have shaken off a variety of threats to the post-Great Recession economic recovery that could have interrupted its long march. The globally coordinated monetary accommodation in which major central banks engaged over the last few years has now splintered into different paths. The Euro-zone and Japan maintain a loose stance to support their slowly growing economies, while US policy makers have shifted to ample fiscal stimulus that has propelled growth indicators and pushed inflation toward the Fed's 2% symmetrical target. Still, the Fed may end the expansion in the usual way, by over-tightening, an outcome for which the probability increases slightly with each strong data reading on inflation, housing, confidence and a host of other measures.

With general uncertainty and the possibility of a true inflection developing, the LISI Investment Committee voted at its late-June meeting to keep Tactical Asset Allocations as is, but determined to watch upcoming data and events carefully with a view toward anticipating a definitive turn in the fortunes of the markets.

1. Adverse Trade Tariffs in Play

After a series of threats and counter-threats, on July 6th the US officially put into force tariffs covering some $34 billion in imports, while a number of its trading partners applied or prepared retaliatory actions. The Trump administration was reportedly preparing additional tariffs, and the President talked of ratcheting up that level to $500 billion dollars. These raise the specter of a "trade war" between the US and China that, given the half-century development of global supply chains, also envelops some of the US's historically close allies.

Whether these actions inflict lasting damage on the international ecosystem of trade agreements and regulations remains to be seen. It depends on whether the parties arrest the issue or proceed with a tit-for-tat escalation. Certain industries and companies will suffer, but in the aggregate there is likely to be a limited blow to growth at these levels. Concern revolves about the secondary effects, many of which are hard to quantify. China immediately responded with tariffs on a similar volume of US goods exports, including a 40% assessment on soybeans, which represent the biggest US agricultural export. The Chinese tariffs apply also to vehicles made in the US, which for some European or Japanese auto makers could effectively cut sales for some models or classes of vehicles built on the same chassis and fabricated at a US plant. Note that China imported $130 billion from the US in 2017, a level that is less than a third of the volume of just over $500 billion in US imports from China. Combined, the total trade affected forms a small chunk of aggregate flows, which the World Trade Organization reported to reach $23 trillion in 2017. That year marked a significant improvement as merchandise trade grew 4.7% to $17.7 trillion, while commercial services grew 7% to $5.3 trillion. Were the US to impose tariffs on all Chinese imports and China retaliated in kind, the total affected trade flows would amount to about 3.6% of total trade.

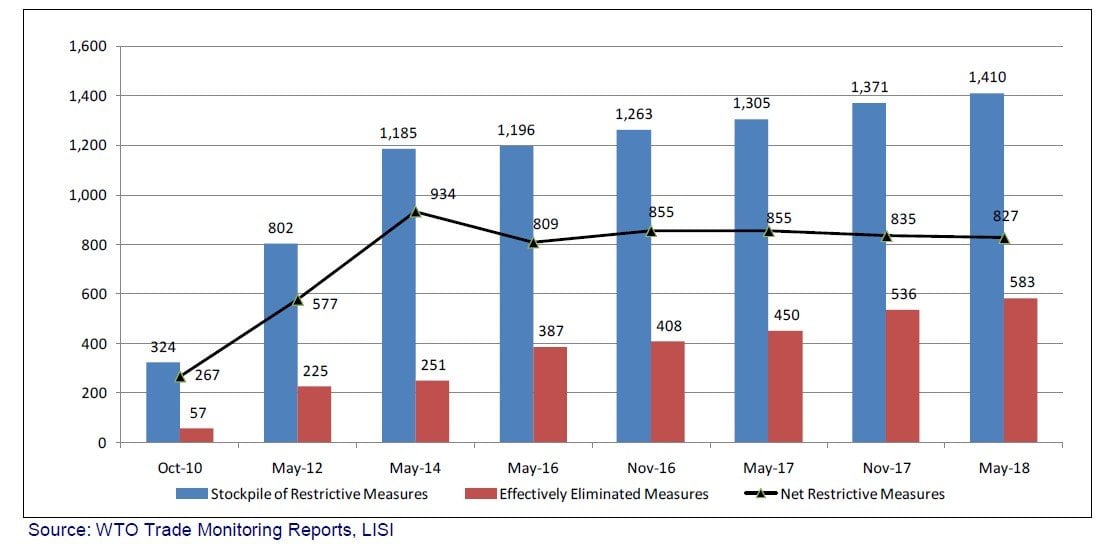

We see the current escalation of tariffs in the context of heightened levels of trade restrictions over the last few years. As we have noted in the past, such trade restrictive measures began to increase after 2010, when the stockpile of net measures among the G20 countries was just over 300. In the WTO's latest semi-annual trade monitoring report, released in early July, the net level continues to sit above 800, while the stockpile of trade restrictive measures has now exceeded 1,400 (see chart below).

WTO – G20 Trade Restrictive Measures, 2010-18

2. Fed Applying Additional Pressure via Rate Hikes

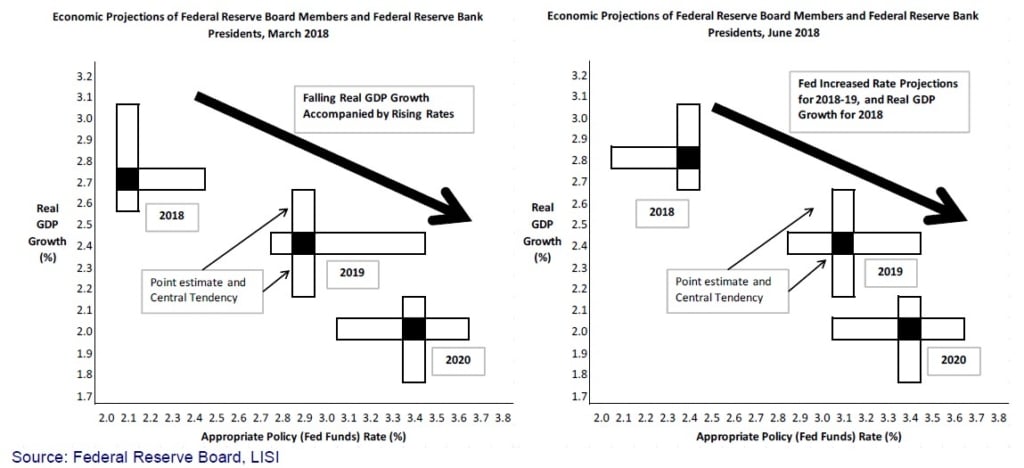

The US administration has taken a gamble in providing fiscal stimulus through expansive tax cuts that may serve to balloon the government’s deficit. Of course, stronger earnings mean higher tax collections but it remains to be seen whether the boost is a transitory effect or if it gains traction. As we have noted before, the Fed projects higher rates and lower growth over the next three years and into the medium term. This does not bode well for the outlook. The Fed has signaled a greater propensity to keep hiking rates gradually through the end of this year and into 2019, and futures markets are pricing in two more rate hikes by December 2018, which would push the Fed funds rate to 2.25%-2.50%. In fact, Fed projections released after the June FOMC meeting have increased expectations for both GDP growth and the level of the Fed funds rate for the short term, as compared to the March meeting (see charts below).

The charts above clearly show the expectation that higher rates will either trigger or accompany lower growth over 2019-20. The Fed wants higher rates in order to maintain its maneuverability on interest rates in the event of an economic downturn that necessitates monetary accommodation. However, their task is complicated by the broad fiscal stimulus wielded by the US administration in the form of tax cuts. The gamble that growth-driven corporate and individual tax collections will rise to offset the tax cuts may pay off. If not, then public debt-to-GDP in the US may rise to uncomfortable levels and drive up borrowing costs for the US Treasury. That would, of course, constitute a tightening factor that could exacerbate any downturn as borrowing costs increase across the spectrum of businesses that need to refinance their debt.

Higher rates also drive dollar strength. Consequences of a strengthening reference currency include pressure on smaller, highly indebted economies that may encounter difficulty via a liquidity crunch or run on their currencies. We have already witnessed weakness in the Turkish lira and Mexican peso, and an IMF intervention to help Argentina defend its currency.

3. Markets React to Rate Hikes and Trade Uncertainty

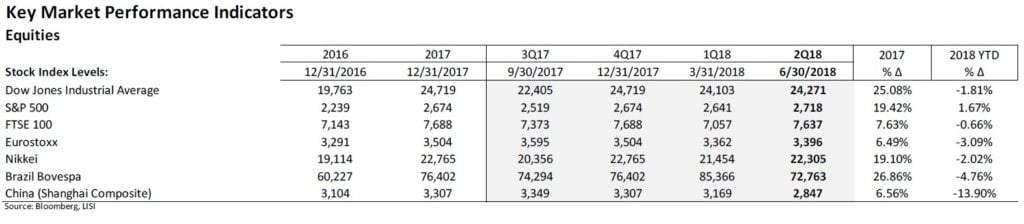

After their January peak, the US equity markets entered a sideways pattern as if all the value of tax cuts were realized in corporate earnings up front. Since February, the Dow has been range bound between 24,000 and 25,000, while the S&P ended the 2nd quarter slightly up from its 2017 close at just under 2,700. Emerging markets have taken a beating with the Brazil Bovespa Index down 5% for the year and China’s Shanghai Composite Index down nearly 14% (see table below).

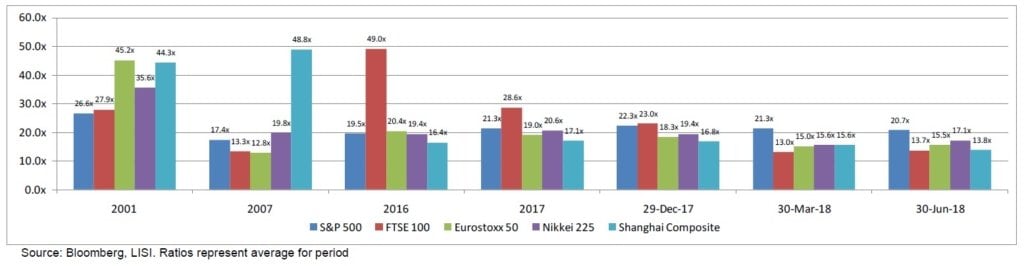

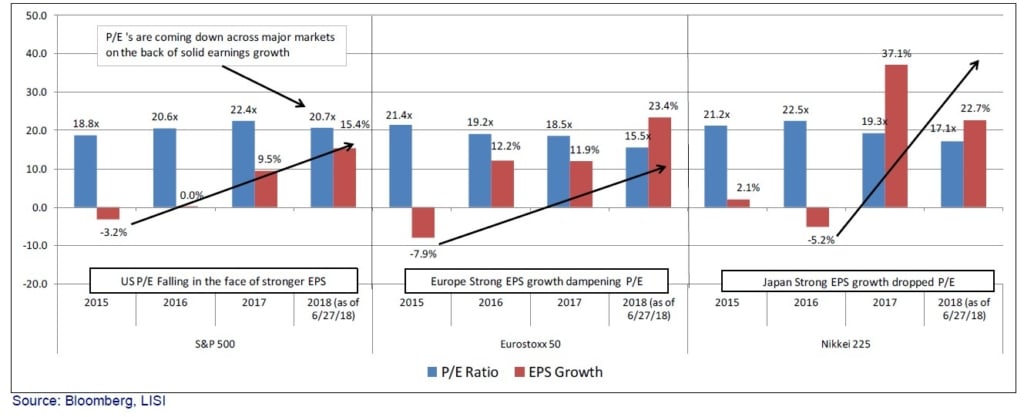

Price-to Earnings (P/E) ratios have seen a fairly steady fall since the end of 2017, and are approaching longterm averages. This has been due in part to stronger corporate earnings. The second quarter witnessed a mild updraft in valuations for the Euro-zone, the United Kingdom and Japan, while in the US strong earnings continued the downward P/E trend established in the 1st quarter to have the S&P 500 P/E ratio arrive at 20.7x by June 30th (see chart below).

Major Market Price/Earnings Ratios in Late Cycle (2001-2Q18)

We believe that weakening investor sentiment and strong corporate earnings are pushing down the P/E ratio for the S&P 500. Note in the chart below that while corporate earnings growth on a LTM basis through 2Q18 are up roughly 50% in the US, corresponding to a drop from 22.4x at the end of 2017 to 20.7x as of June 30th. In the Euro-zone a doubling of corporate earnings growth has brought the P/E ratio down to 15.5x from 18.5x. In other words, a 50% gain in earnings for the US dropped the P/E ratio 7.6%. In contrast, a 100% gain in Euro-zone earnings yielded a similar percentage drop in the P/E ratio for the Eurostoxx 50.

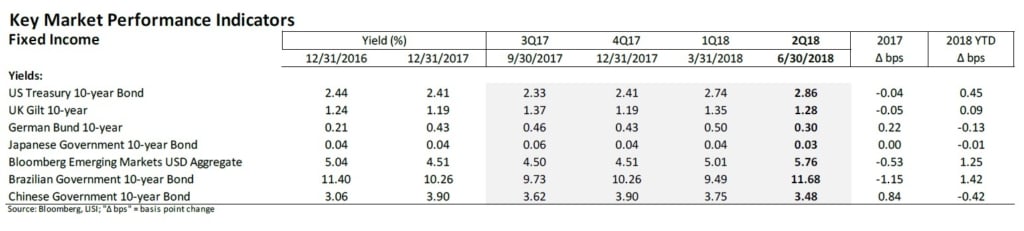

In fixed income, despite a higher Fed funds rate, US Treasury 10-year Note yields have held stubbornly below the 3.0% level even though they did briefly surpass it. The 10-year yield ended the 2nd quarter at 2.86%, well below its peak of 3.11% on May 17th (see table below). Comparable UK Gilts have widened slightly, while Japanese and German Government 10-year bonds continue to hug the zero mark (see table below).

We continue to watch closely whether the 2-year/10-year US Treasury yield curve will invert, a (non-causal) harbinger of a near-term recession. The spread as of June 29th was only 33 basis points. The Fed's June meeting Minutes show that some members question whether such a measure really provides a reliable turn signal. Yet, the logic makes sense: investors do not believe in the longer term (e.g., 10-year) economic outlook. Inversion here points to expectations of such an event in the near term.

Conclusion

At its late June meeting the LISI Investment Committee voted to maintain current Tactical Asset Allocations. We see continuing volatility in the markets, particularly in equities, and are beginning to question the resilience of the market to potential shocks from an escalating trade war and possible geopolitical flare-ups. While we still see support for equity valuations in improving corporate earnings, particularly in a US market helped by tax cuts, we will monitor closely indicators and events in the near term. Accordingly, across asset classes we favor the following in terms of allocation:

- Fixed Income – We recommend shortening duration and accepting somewhat higher credit risk to mitigate effects of the anticipated rate hike cycle, while taking advantage of improving fundamentals

- Equities – We maintain a cautiously positive view on equities and maintain allocations given improving EPS, support from impending US fiscal stimulus, and the Fed's slow and steady approach to hiking interest rates. We are cautious about the prospects for European equities and have shifted our stance somewhat away and toward Asia, in addition to the core US positioning

- Alternatives – We like the low correlation to core markets exhibited by alternative assets, and favor their inclusion as a small component of portfolios with moderate to higher risk profiles

- Cash – We recommend keeping a small allocation in cash to capitalize on any market dislocations

As a committee that operates incomplete information and varying viewpoints, we try to steer away from attempting to time the market. Occasionally, however, we feel the wind whip up and see the proverbial weathervane signal a coming storm. We can only resolve to persist in watching for signs of an inflection and change in course for markets, to which we must respond in our asset allocations. The recent WTO Trade Monitoring Report sums up well our latest and most prominent concern: "In light of recent trade policy developments, risks to the forecast are tilted to the downside. Increased use, as well as increasing threats, of restrictive trade policy measures contribute to uncertainty and could produce cycles of retaliation that would weigh on global trade and output."1