Iolite Partners performance review for the first half ended June 30, 2018.

Q2 hedge fund letters, conference, scoops etc

Investment strategy and rationale

The goal is to achieve sustainable, market-beating absolute returns by investing into a highly concentrated portfolio of global value stocks and bonds. Value investing is a low risk, high return strategy that has proven to work well over time if applied correctly and consistently. I believe iolite benefits from a stable and patient capital base, allowing me to be contrarian and to swim against the tide. The small size of the managed funds gives me the liberty to fish in small ponds, where the big funds cannot go. I have observed that large funds have their own guidelines for investing in stocks, such as a threshold market capitalization and liquidity, among several other factors. As a result, large funds often miss out on attractive opportunities, such as in special situations and micro caps, where there are a lot of market inefficiencies. With growing assets, I will look to take full control of smaller businesses.

Summary

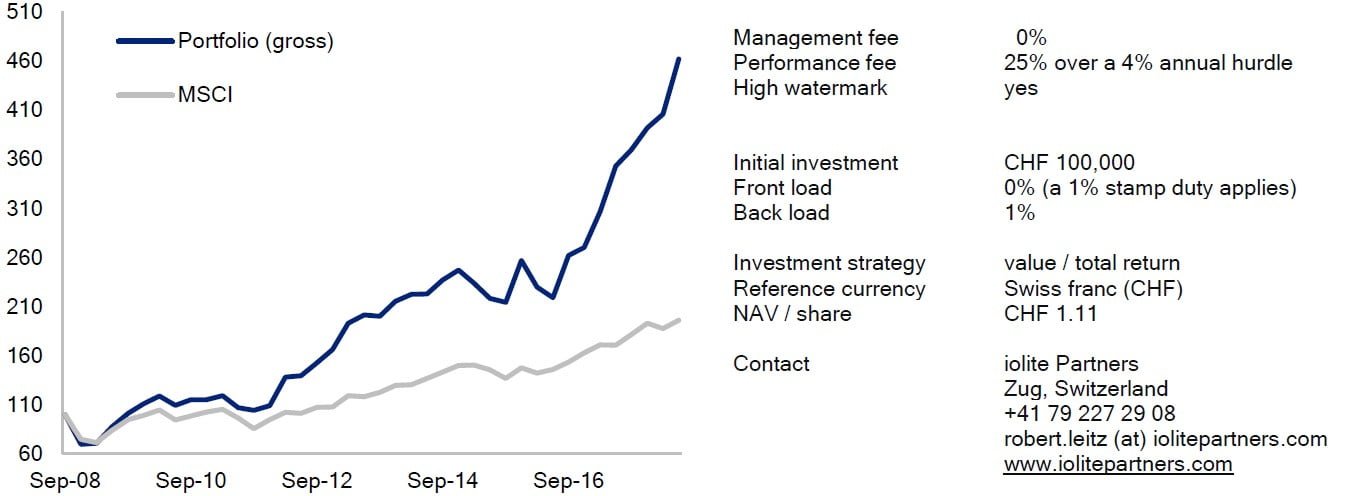

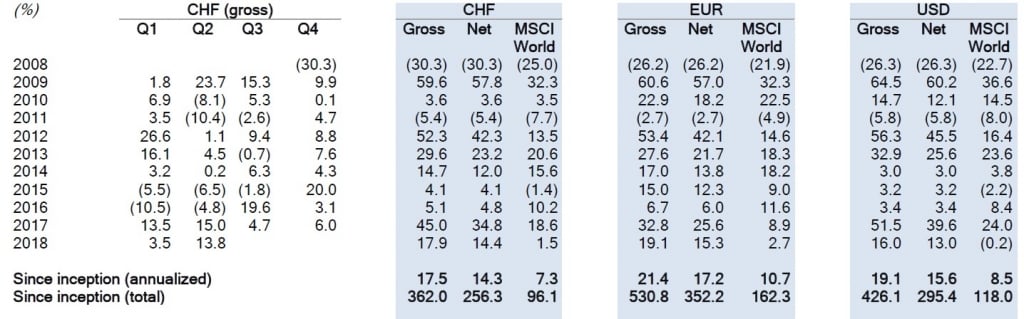

Performance

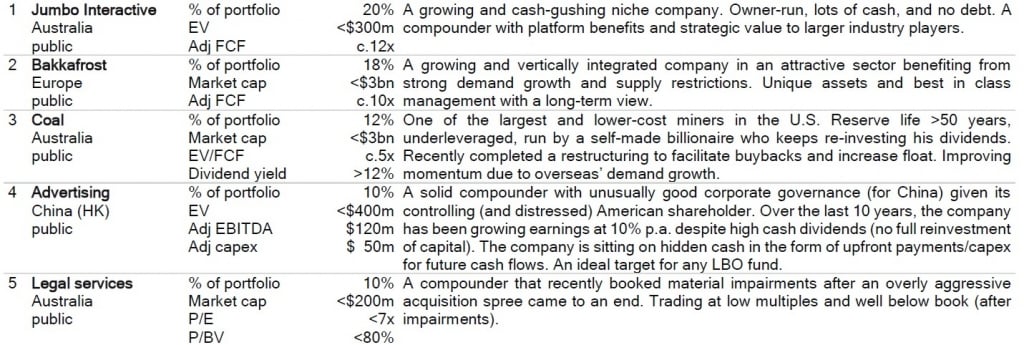

Portfolio overview

Robert Leitz

I am Robert Leitz, the sole investment professional at iolite. Before iolite, I held positions at various financial institutions, including TPG Credit (a hedge fund), Goldman Sachs’ European Special Situations Group, and KPMG Corporate Restructuring. I graduated from the University of St. Gallen (HSG), Switzerland, with a Master of Science in Business Administration and Economics, and wrote my master’s thesis under the guidance of Prof. Eli Noam at Columbia University, New York.