The two months of Q2 2018 prior to June seemed to be wanting to tell us something. Net flows for the industry in each were near flat, but there was “noise” being made within certain segments. That noise became audible in June as investors were net redeemers from the industry to end the quarter.

Q2 hedge fund letters, conference, scoops etc

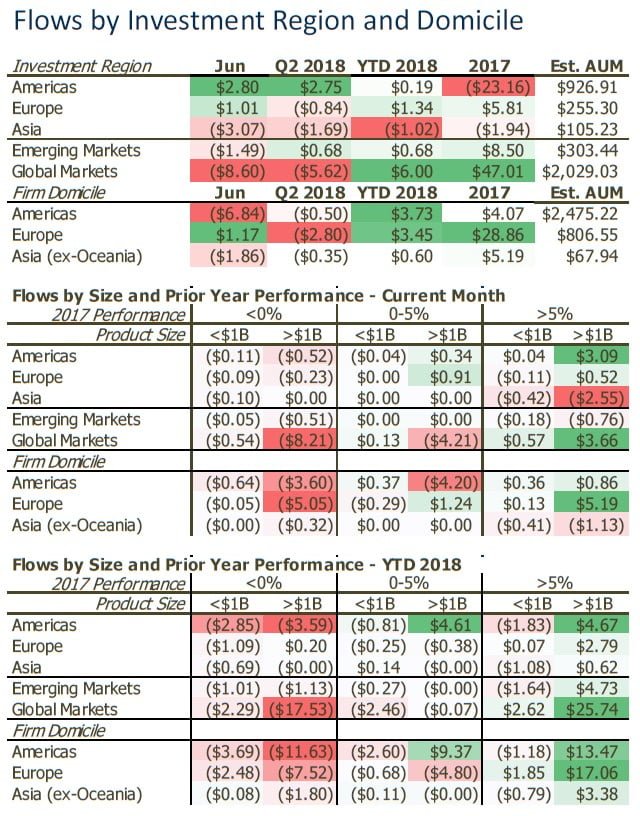

Q2 2018 is only the second quarter since 2016 where the industry faced net redemptions, and once again the culprit seems to be dissatisfaction with performance. Looking at cumulative flows by fund size and prior year returns on the following page sums up the point well. There is clearly strong demand for those that have performed well, with a preference for size, and clearly investors are willing to remove assets from those not meeting expectations. As a result, evidence of consolidation continues to show, and given recent returns current themes are likely to continue.

Highlights

- Investor flows firmly negative in June, however redemptions in the last month of a quarter have been the norm recently.

- Managed futures funds continued to face redemption pressures for a fourth consecutive month following February’s large losses.

- Macro fund flows rebound, but new allocations were not widespread.

- Emerging market strategies face redemptions as investor confidence in fixed income markets appears to quaver.

Quarter-end Brings Wave of Hedge Fund Redemptions

Investors withdrew an estimated $7.88 billion from hedge funds in June bringing Q2 2018 net flows for the industry to negative $5.43 billon. This was the industry’s second quarterly net redemption since Q4 2016. Total estimated hedge fund assets are now $3.308 trillion.

Key Points

- Net redemptions in the final month of a quarter are not surprising.

June was the fifth consecutive month to end a quarter where net flows for hedge funds were negative. The average net outflow over this streak is $7.43 billion, meaning June’s redemption figures are pretty much in-line with recent quarter-end estimates. During the heavier allocation years of 2010-2015, still more than half of the quarters’ final months had net redemptions. - An elevated proportion of larger funds lost a meaningful amount of their AUM in June.

Each month we measure how many $1b+ products lose or gain greater than 2%, or greater than 5% of their AUM due to redemptions or allocations. In June, nearly a quarter of reporting $1b+ products lost at least 2% of their AUM due to redemptions. Conversely, a very large proportion of new allocations went to a small proportion of funds. These two points combined are further indications of consolidation. - Managed futures redemption pressures continue for a fourth consecutive month.

The level of negative investor sentiment toward managed future products in the last four months is reaching the levels experienced after their post-Brexit volatility of late-2016. While the significance of investors’ concerns were likely heard immediately by managers in February when the universe produced one of their largest monthly losses on record, the conviction of those concerns has become clear. Historically, however, there have been no shortage of investors willing to come back to the strategy. - Positive net flows for macro funds in June is not the whole story.

We noted in last month’s summary that investors appeared to be responding negatively to macro funds’ recent string of losses (Feb to Apr). With net inflows in June it would appear the universe is bucking the month-end of a quarter outflow trend within much of the rest of the industry. Looking more closely shows that over 60% of reporting macro funds faced net redemptions in June, and products with net inflows were dominated by a small handful. That nearly 60% (57%) of reporting products have net redemptions this year, and the universe is still the largest asset gainer of 2018, is a clear indication of consolidation within the macro universe. - Long/short equity flows facing a similar scenario as managed futures.

Even though asset-weighted gains to start the year were very good, elevated losses within the strategy in February appear to have set off a string of net outflows that has persisted into a fourth month. Losses that popped up again in June make it unlikely investor sentiment will shift positive in the short term. - Investors showing demand for asset-backed strategies.

There has been no prolonged evidence of interest in MBS-focused products since 2014, until now. June was the fifth consecutive month of net inflows, the longest streak of positive sentiment since 2010.

Allocations to Emerging Markets Stalled in June, Outflows Elevated

- The source of EM redemptions in June is the same as what had been driving new allocations.

Fixed income-focused EM products were the primary cause of top-line redemption figures in June. Investors withdrew from products with varying regional focus, indicating perhaps that recent USD strength is a sustained concern. - Investors give mixed messages on China-focused fund preferences.

One of the main drivers of EM inflows in 2018 has been interest in funds focused on China-related credit opportunities. A handful of products had gained a meaningful level of new allocations, far outweighing the level of interest in equity exposure. Whether it is of longer-term concern or not, it was redemptions from these same products which was the primary cause of the universe’s net redemptions in June. - Europe-domiciled equity and macro strategies see mixed demand in June.

The primary reason net inflows resumed to Europe-domiciled funds in aggregate in June was because of new allocations to a handful of larger equity strategies and some macro managers. This is not a strategy-wide nod for macro funds, however. The largest redemption also came from a macro strategy in June. Performance was most likely an issue as the product had seen declines in seven of its last nine months.

Article by eVestment