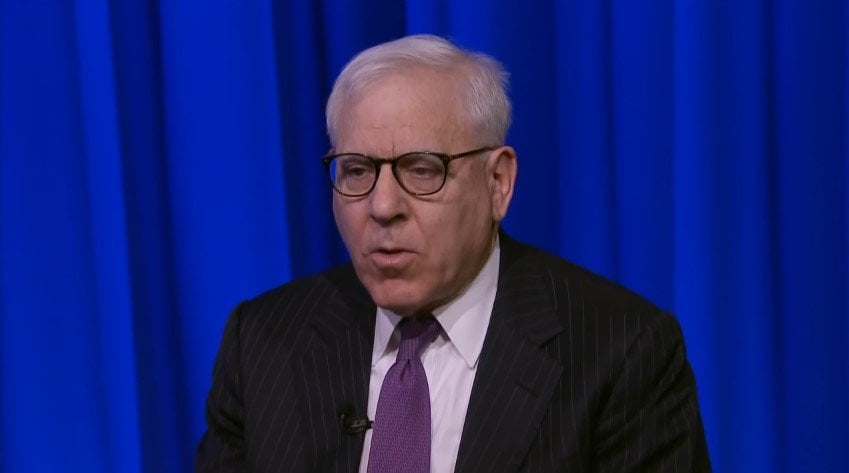

Carlyle CEO David M. Rubenstein takes questions from CNBC’s Becky Quick at the Delivering Alpha conference.

Q2 hedge fund letters, conference, scoops etc

See our Delivering Alpha Conference coverage here.

Carlyle CEO: No evidence of an economic slowdown

Transcript

The people that have done the best though are not just the sponsors but the general partners. But the people that invest in the funds the pension funds they've done extremely well they've gotten very high returns a higher highest rate of returns for pension funds in the last 20 years have come from private equity funds. So let's talk a little bit broadly about the markets at this point. And I think back to 2007 when Chuck Prince infamously said that as long as the music is playing you've got to get up and dance and you were much more circumspect around that same time I think in 2006 you said something like right now we're operating as if the music's not going to stop playing and it is going to stop. So what made you think it had a point. What did you see that maybe he didn't see. If you're Jewish you always think something bad is going to happen. So it is kind of that you know you know something bad is going to happen eventually so I thought eventually something bad will happen because he can't keep going on forever. And I have been concerned now. We've been in what is now the second longest growth period since World War II. At some point it will slow down as Herb Stein the former head of the Council Economic Advisers once said If something can't keep going on forever it will at some point there will be a slowdown. I don't know what will cause it. I can speculate. I don't think it's imminent now. I don't see it coming at some point or slowdown at that time.

I did think people were paying very high prices. The deals were fairly highly levered and there was basically a view that nothing could go wrong and that was probably a bad attitude. But you are opportunistic at times where you think you need to be you just say it's the easiest time you've ever seen to raise money. Right. How are you take all your concerns about when things are going too good. And how do you match that up with right now. Are we in a situation of musical chairs right now or not. There's no doubt that when you look at an investment committee memo and you see what the projected returns are and you see that there is no projection for a recession or slowdown over a next five or six years. Those returns are probably too optimistic. So when we look at deals we do assume that there'll be some slowdown and then have to be a great recession but there will be a slowdown. So I think to be very cautious you have to assume you can have some slowdown in the next five or six years and that point be prepared for it. Now one of the things that makes it a little bit easier is that the debt terms are much more favorable to general partners than they used to be and the sponsors. So before the Great Recession about 70 percent of that debt was was we had covenants that 30 percent did not. Today it's probably the reverse. Maybe only 30 percent of that debt has covenants maybe 70 percent is not.

So there's a lot of covenant light debt out there so that if something goes down the economy slows down. I think you are a chance to work through the debt problems. But why is that. Well I think lenders have felt that private equity people are pretty responsible and they're likely to make these deals work. And I guess there's competition but generally very little money has been lost. Relatively speaking when buyouts by banks and so they feel fairly comfortable with the sponsors also the sponsors are different that used to be the old days they were investment bankers who knew a little bit but not that much about operating companies over the last 20 years. The private equity firms have an enormous amount of operational experience. And so it's not investment bankers or people like me who are former lawyers really running these companies are overseeing and their people have real operational experience so the banks have much more comfort. Is part of it just what the Federal Reserve has done with interest rates being alone with so much money sloshing around too. Well I wouldn't say I'm an expert on the Federal Reserve though I hired somebody years ago to join the Carlyle I thought it was a very talented person leaving the government and his name was Jay Powell. And he worked in our firm for a number of years. I thought he was a very good private good person when one of the team I sent the highest calling of mankind is private equity why would you want to do something else. But he decided he wanted to do something in public policy.

And now the chairman of the Federal Reserve he testified the other day that right now he doesn't see any reason not to continue the program that they have which is basically probably have interest rates go up two more times this year or 25 basis points apiece and probably get interest rates up to the Fed funds rate to about two point four percent by next year. So that slowdown does come they can lower interest rates. But right now I think he feels the economy is doing reasonably well and. We don't see any evidence of a slowdown. We can have 275 companies or Karlo owns around the world and we get every quarter their numbers and we correlate them with what we see GDP trends to be. And we don't really see any slowdown right now.

Carlyle CEO David Rubenstein: Minority stake is not completely passive position

David M. Rubenstein, Co-Founder & Co-Executive Chairman of The Carlyle Group, takes questions from CNBC's Becky Quick at the Delivering Alpha conference.

Carlyle Group's Rubenstein: Don't see recession in the near-term

David Rubenstein, The Carlyle Group co-founder and co-executive chairman, speaks to CNBC on the sidelines of the Delivering Alpha conference about his investment strategies and the state of the economy.