Business Owners Are Losing Sleep Over the “Capital Access Challenge,” According to study by The Firmament Group

Q2 hedge fund letters, conference, scoops etc

While the investment community leaves no stone unturned when it comes to new opportunities, a new study by The Firmament Group, a leading provider of tailored debt and equity capital solutions to small- and medium-sized enterprises (SMEs), found that business owners/decision makers are not getting the capital they want to grow.

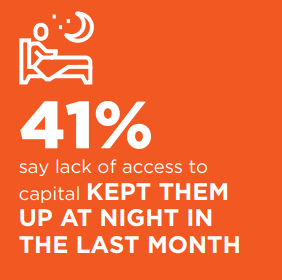

In a survey conducted by The Firmament Group and The Center for Generational Kinetics, a leading research firm focused on solving cross-generation challenges, half of small business owners have been denied access to capital in the past year. Their report, titled “The Capital Access Challenge,” found in addition to causing financial strains on their growth plans, this is having an emotional impact on these businesses as well: 51% worry about access to capital at least once per week and 41% say the lack of access to needed capital has kept them up at night in the last month.

Source: The Capital Access Challenge Report, Firmament Group

Christopher Smith and Franklin McLarty, co-founders and co-presidents of The Firmament Group said in a press release, “Our report finds some very troubling trends impacting not only small- and medium- sized businesses, but the national economy as a whole. Companies with a healthy financial record and strong future prospects should not have any problems finding flexible growth capital solutions, yet this seems to be a massively underserved portion of the market.”

Theses business are not in distress or looking to pay off debts. The top reasons the small businesses surveyed are seeking capita was to expand their business. 29% of respondents said they would make operational upgrades, 24% would build and develop the company’s staff, and another 24% would use the capital to meet new market opportunities.

Source: The Capital Access Challenge Report, Firmament Group

“Most troubling is that many small business owners, regardless of their age and experience, don’t even know where to look for a creative capital solution,” added Smith and McLarty.

Even if these businesses are keyed into sources of capital, 46% say current lenders will not loan any additional capital. 24% say they do not know where to go for additional capital. When accessing capital, the study found that half of small business decision makers think of contacting a bank first when seeking access to capital to grow their business. 59% of Baby Boomers say they would go to a traditional bank first, Millennials exhibit the least comfort with banks as a source of capital, turning to credit unions, private equity and venture capital instead. VCs were are seen safer to Millennials as 67% of Millennials would consider accessing capital from a VC fund compared to just 46% of Baby Boomers.

“We find it interesting that different age groups are looking for capital from different sources, reflecting some broader generational assumptions Baby Boomers and Millennials have when it comes to business growth,” said Jason Dorsey, president of The Center for Generational Kinetics. “Millennials are more open to using a less traditional route to access capital, but that may not actually open the right doors to help grow their business.”

The survey found that 43% of decision makers at small businesses with annual revenues between $5.0 - $9.9 million are concerned about having access to capital compared to 51% of decision makers at small businesses with annual revenues between $80 - $99.9 million.