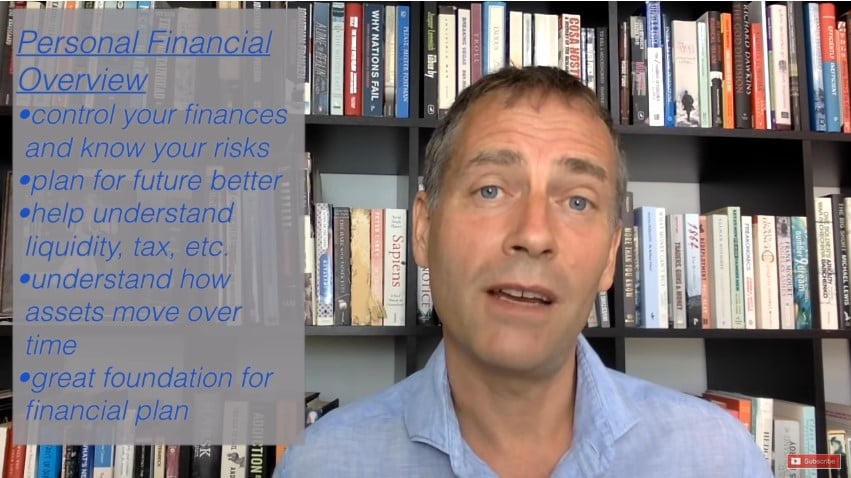

Take control of your finances by building your own financial overview spreadsheet that outline all your assets and liabilities. This can be the basis of better financial planning, understanding risks, liquidity, etc.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Build Your Own Financial Overview Spreadsheet

Transcript

Hi. In this video I'm going to be building a financial model that will help give you an overview of your personal assets and liabilities or your financial situation. And there are many reasons we do this but at the heart of it is that it will help you get control of your financial situation and perhaps plan better for the future. It will also help you understand things like liquidity and future taxes how your assets and liability move over time and if you incorporate certain Britannic to stations and ability to put money aside in the future. It it'll provide a fantastic foundation for the kind of financial plan that we really should all have for for or for the future. And my name is Los Kroijer. I'm a former hedge fund manager who has written a couple books about finance and I'm not doing these videos as a hobby so I'm going to build the specialty entirely from scratch and let's get straight to so here we are on an entirely blank scripts Richie and Eilish going to go and let's call this vid this spreadsheet Ansah overview and then let's say we did this. This essay from 7 2008 team. So this is. So let's start with the first one let's say you have a portfolio of assets of securities let's say you have some Vanguard equities. So I think the we are let's say Hesam government bonds and let's say you have some Facebook shares and some Apple shares and I just looked up these tickers say that currency you have them in GBP 80 and this is USD USD.

So basically here we have your portfolio on us on the line in italic. I'm a huge stickler for this let's say your position and position and let's say yes and 50 of these I'm being a stickler for formatting and let's make every input number blue and copy the formula down and then let's say at twelve hundred of these two of them to these 300 of these. And I also just looked up the price of the mark to market a finance term for the price really. So let's say these are sixty two. And the reason I copy down the sell is because it's easier than changing that format every time 192 is it does look this up a while ago. So don't worry if it's not entirely right. So then what is that value. Am in Lokodo terms. So we're doing this in pounds and I want to start by saying by the way don't discount entirely fictitious numbers I hope I'm not offending anyone by having these numbers be too big or perhaps even too small. The whole idea is I'm building this spreadsheet so that you can adjust it for your own for your own benefit. So don't worry you know numbers are vastly different from this it almost certainly will be this is and in case you all know this is not me either. So then this say what is the local value of the pound value and that's the position we have times Mark. Let's just make that in in single digit and then I would say what I always do here is add sort of a note and well let's just make this is that the current pound value of this and then that loped.

So then let's note could be at say this is your pension and the on the wound on the right time meant for debt to be more and let's say this is a tax free account that say this is you can just say this is this. You can put it in each other you don't have to do this. Why. Why. Why. Then what we should also do is we should have what is the pound dollar tax rate and let's say I think it's one point thirty one point three three now and that should be a blue number.