If you like monthly income, then BlackRock’s Multi-Sector Income Closed-End Fund (BIT) is worth considering for a variety of reasons, such as its discounted price, relatively low interest rate risk, attractive sector tilts, institutional leverage rates and management, to name a few. However, there are also risks that should be considered, such as the focus on income over price appreciation, the potential for credit spreads to widen, a limited amount of interest rate risk, distribution coverage, and the risks associated with using leverage. This article reviews the attractive qualities and risks, and draws some conclusions at the end about who might want to consider this CEF.

Overview:

The primary objective of BlackRock’s Multi-Sector Income Trust (BIT) is high current income (the secondary objective is capital appreciation). The fund generates this income mainly by investing in debt securities (more on holdings later).

Why BIT is Attractive:

Closed-End Structure: Importantly, the fund is organized as a Closed-End Fund (“CEF”) which means it’s not forced to buy or sell its holdings in the open market based on investor demand (this can be a costly problem for ETFs and mutual funds when either the buys or sells are considerably larger than the other, but not for CEFs). Rather, the fund has a set investment pool, and its market price varies based and supply and demand for the fund. This is an advantage for CEFs, particularly now as interest rate movements continue to be an emotionally-charged headline-driven force behind some investors decisions.

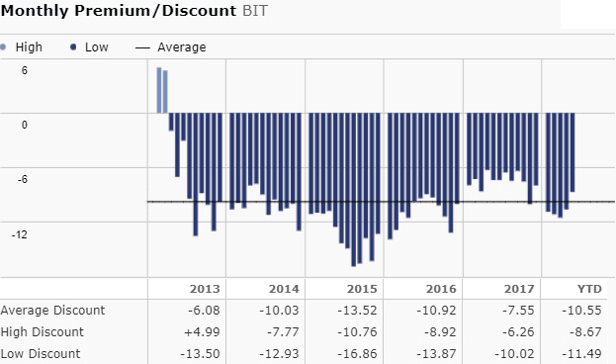

Discounted Price: Another advantage of the CEF structure is that CEF shares can trade at attractively discounted prices relative to the actual market value of the underlying holdings (i.e. the fund’s NAV). As shown in the following chart, BIT currently trades at an 8.4% discount to its net asset value (i.e. the value of its underlying holdings).

This discount varies overtime (it’s currently very close to its average size over the last year). We generally like to buy things at a discount, not a premium, because it means we’re getting more for less. In this case, BIT allows investors to buy the underlying pool of income-producing bonds at a discounted price, which basically means investors are getting more yield for less dollars (i.e. the discount contributes to BIT’s outsized yield). Yield is important if you are an income-focused investor.

Lower Interest Rate Risk: Another thing we like about BIT is its relatively lower interest rate risk, as measured by duration. Specifically, BIT’s effective duration is currently 2.71 years. For perspective, the duration on a 10-year treasury bond is around 8.5 and it’s yield is much lower (around 2.9%). Duration is important because as interest rates rise, bond prices fall, and the higher the duration, the higher the interest rate risk (i.e. bond price fall further). BIT’s duration is lower than many other CEFs as well, particularly those with similarly high yields. Also worth noting, BIT’s duration was higher last year (3.5 years on 6/30/2017), and the fact that its come down seems a prudent decision by management considering our current rising interest rate environment.

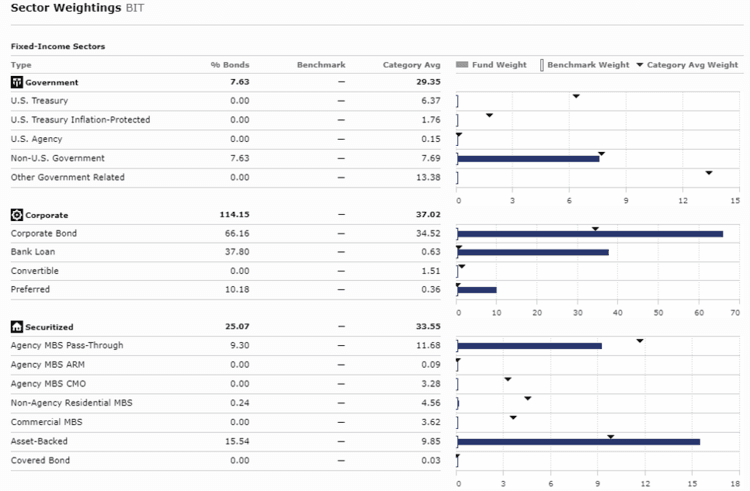

Attractive Sector Tilts: Another thing we like about BIT is its current diversified sector tilts, as shown in the following graphic:

Specifically, the exposure across government, corporate and securitized products helps diversify the risks (i.e. the fund is not necessarily over-exposed to one sector versus another). And in addition to keeping risk exposures in check, these allocations also help keep the yield high.

Institutional Leverage Rates and Management: Leverage (borrowing money) is another thing that helps BIT keep its yield high. Similar to other bond CEFs, BIT uses leverage, currently 39%. This leverage is not entirely different that the leverage you’d use when you take out a mortgage on a home. And bond CEFs are allowed to use more leverage than stock CEFs because bonds are generally less risky than stocks. Further still, this fund is professional managed by a large institution (BlackRock) that is able to get attractive borrowing rates, likely much better than the rates most retail investors could get on their own. Plus BlackRock monitors this CEF closely on a daily basis. The management fee on this fund is currently 1.29% which is consistent (actually a little lower) than many bond CEFs, and it is more than offset by the high yield, which is net of the management fee and operating expenses.

Risks:

In addition to the attractive qualities, BIT investors should also be aware of the risks.

Income Over Price Appreciation: As mentioned earlier, the primary objective of this fund is income, and price appreciation is secondary, but it’s important to mention this again. Many investors dive into closed-end funds headfirst when they see the high yields, but then they have buyer’s remorse years later when they realize the price of their investment hasn’t moved much (because they’ve been spending the dividends, not reinvesting them, while the S&P 500 has increased significantly). For some perspective, here is a look at the historical price of BIT (the blue line) over the last 5+ years (this price does not include the dividend payments). And while the price has moved around a bit, it hasn’t gone decidedly higher (while the S&P 500, for example, has increased significantly).

If you’re going to invest in a fund like BIT, and you’re going to spend the dividends instead of reinvest them, your account value isn’t going to change much. Some investors are totally fine with this, but it’s something investors need to be aware of upfront.

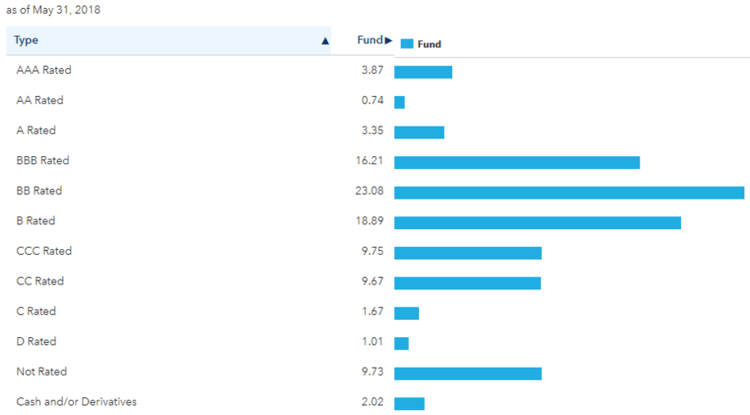

Credit Spread Risk: Credit risk is another important risk factor that investors need to be aware of when investing in BIT. Specifically, because the investments in this fund are generally lower quality than triple-A credit rating US treasuries, this fund is exposed to credit risk (i.e. the risk that the value of the underlying bonds decrease because the perceived credit-worthiness of their issuers also decrease). First, here is a look at the credit ratings of BIT’s underlying holdings:

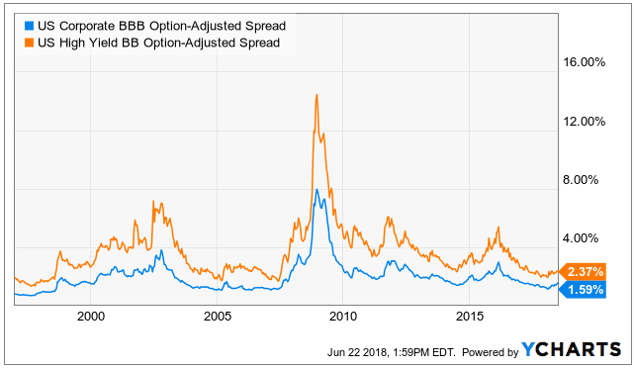

And while we believe these exposures are very reasonable, they are also a risk factor. For further perspective here is a look at historical credit spreads (i.e. the difference in yield offered by the safest versus less safe bonds).

What’s important to realize is that credit spreads are currently very low because the economy is strong, but if the economy gets less strong then credit spreads will increase and the value of bonds could decrease. This is a risk that investors need to be aware of.

Interest Rate Risk: We mentioned BIT’s relatively low interest rate risk earlier as evidenced by its relatively low duration. However this fund still has some interest rate risk nonetheless. If interest rates rise dramatically, then the value of this fund will decrease (it just won’t decrease nearly as much as investments with much higher durations).

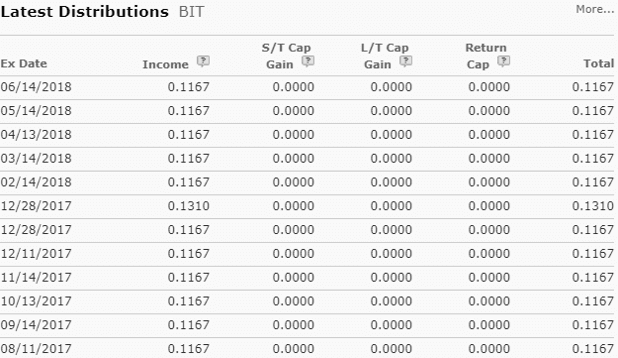

Distribution Coverage: Distributions coverage is something to pay attention to with fund like this. Ideally, the interest payments from the fund’s underlying holdings will be enough to cover the fund’s distribution as has historically been the case as shown in the following table (i.e. the distributions come from income, not necessarily capital gains or a return of capital).

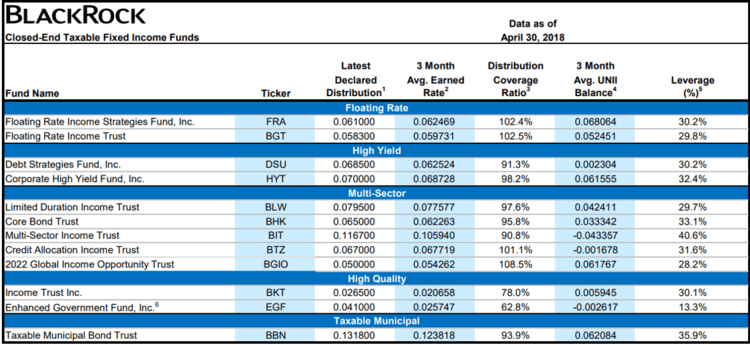

BlackRock makes it a little easier to track the distribution coverage by releasing the following data periodically:

Per the above table, we can see that BIT’s distribution coverage ratio was recently 90.8%. This might be alarming to some (because it’s less than 100%), but realistically, the underlying income payments are lumpy (bonds often pay only twice per year, not monthly like this fund does). The distribution coverage has been less than 100% in previous years, only for the fund to finish the year with extra income thereby resulting in an extra year-end distribution payment (i.e. more money paid to you as the investor). For example, this was the case last year, and you can see the extra distribution payment in our earlier (above) table titled “Latest Distributions” whereby there was an “extra” income distribution payment in December 2017—a good thing for investors.

Leverage: Finally, this fund’s use of leverage (currently 39.0%) poses a risk. In good times leverage magnifies returns (in this case income), but in bad times it can magnify losses. However, in this case the fund is using the leverage prudently to invest in relatively safe fixed income securities. We view the use of leverage as appropriate, not overly risky or concerning, but something investors should be aware of nonetheless (i.e. we don’t see the fund’s use of leverage as a problem).

Conclusion:

The BlackRock Multi-Sector Income Trust (BIT) offers an attractive high yield (currently 8.2%) paid monthly. And if you are looking for a diversified professionally managed source of high income, this fund is worth considering. The drawbacks of the fund are the risks described above, but also the absence of meaningful security selection (the returns are going to be based on the sector tilts, not security selection because its hard for security selection to make a meaningful impact when the fund holds nearly 1,400 different individual securities). Also, keep in mind, this fund is focused on generating high income, not necessarily price appreciation. Nonetheless, given the current price and current market conditions, we view BIT as a prudently managed, well-diversified and attractive high-income option to consider for your income-focused investment portfolio.

Article by Blue Harbinger