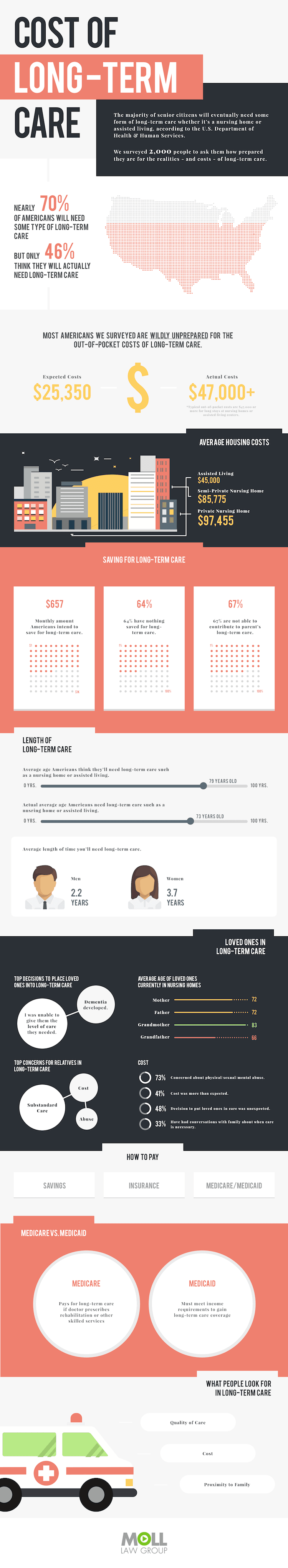

Less than half of Americans think they’ll ever need long-term care (i.e. nursing home, assisted living facility), but in reality, 70% will end up there.

Q2 hedge fund letters, conference, scoops etc

We looked past retirement and asked 2,000 Americans if they've started planning for late-in-life medical expenses. We found the majority are wildly unprepared:

- Expected vs. actual out-of-pocket long-term care costs: $25,350 vs. $47,000+

- 64% have nothing saved

- 67% aren't able to contribute to parents' actual or potential long-term care

Americans Grossly Unprepared For Long-Term Care Costs

When it comes to predicting the future, no one has a crystal ball. But planning for the future can be a different story. It can be daunting to think of how to best plan for long-term care—for ourselves and for our loved ones—while factoring in the many unknown factors, such as health setbacks or financial obstacles. We surveyed 2,000 people to see how prepared they are for the realities and costs of long-term care.

There’s a big discrepancy between what people think and what they know: only 46% of Americans think they’ll need some type of long-term care, such as a nursing home or assisted living, in the future, whereas the number is closer to nearly 70%. Also, many thought that $25,000 would cover the out-of-pocket costs at a long-term nursing home or assisted living facility, when the reality is that it’s nearly double at $47,000. According to the survey, most Americans are “wildly unprepared” for the actual costs of living for many years into the future.

This survey also highlights the length of time people expect to need long-term care. While most Americans think that they’ll need assisted living help by the age of 79, studies show that by 73, many Americans are in need of personalized care. Those six years difference translates into several thousand extra dollars in savings and options.

Unfortunately, long-term care is not a guaranteed balm. In fact, several concerns surrounding out-of-home care can heighten an already difficult situation. Many people noted concerns for potential abuse and substandard treatment at assisted living facilities. Others fret over the cost over an unknowing period of time. Added to these worries is not being able to provide the best level of care for their loved ones personally, especially for family members that develop dementia or require 24-hour care, and Americans are rightly feeling stressed about it.

Since most people do not have endless sources of money, especially after retiring from the work force, saving for long-term care must be factored in early to get the most return. While private nursing home care is probably most desired option, it is also the most expensive, costing on average $97,455. Semi-private facilities are slightly less at $85,775, while assisted living facilities are closer to $45,000. Having sound financial plans—and sticking to them—is the key to peace of mind later in life.

The truth is that discussing long-term care is a hard and uncomfortable conversation, one that most people do not have. In fact, only 33% of those surveyed have discussed options with their loved ones, and for 48%, the decision to move a loved one into long-term care was unexpected. By putting the forethought into what kind of future and quality of life you and your loved ones want, Americans can lessen the stress and feel more prepared for the curveballs life is known to thrown.

Article by Moll Law Group