Activist Insight data show renewed interest in settlements after a more rambunctious 2017.

The Activist Investing Half-Year Review 2018, produced by Activist Insight in association with Olshan Frome Wolosky, was released today. The special edition of Activist Insight Monthly magazine analyzes trends in shareholder activism during the first six months of the year.

Q2 hedge fund letters, conference, scoops etc

According to data from Activist Insight, activist investors in the U.S. had gained more board seats by June 30 than in the same period, and won more contested votes for board seats.

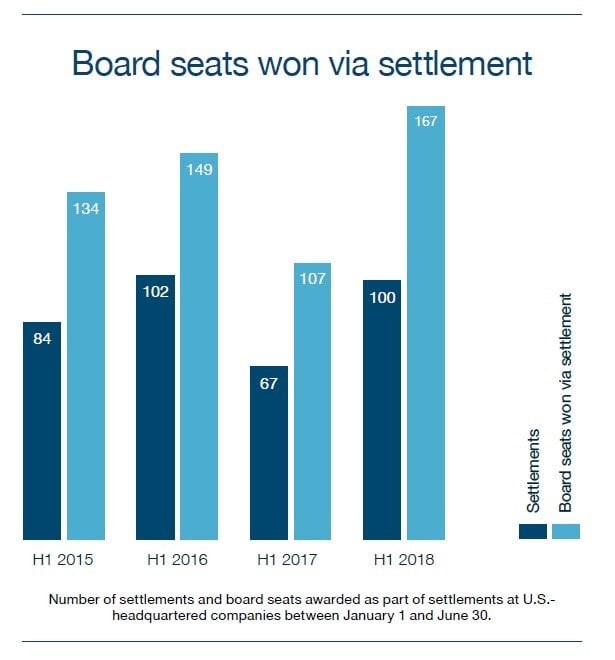

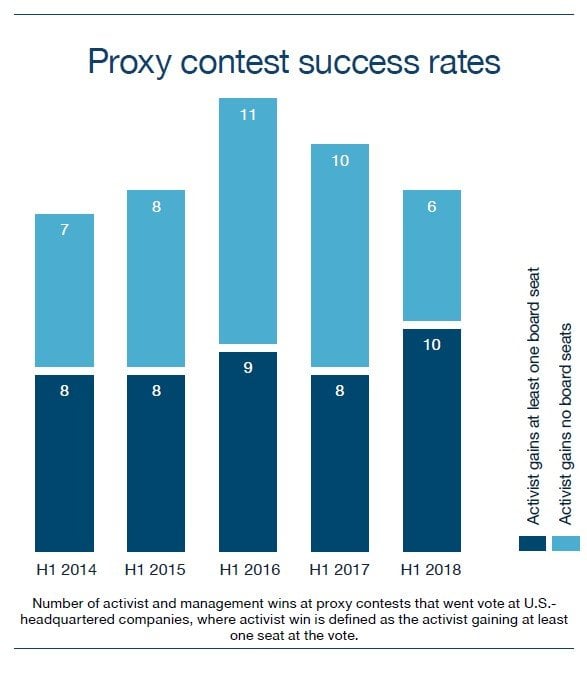

Activists gained 167 board seats through settlements during the first half of 2018, representing a 56% increase to the 107 seats obtained through the same means in the same period last year. In addition, activists won 27 board seats in proxy contests that went to vote year-to-date, the highest number since 2014.

The results reflect a renewed interest in settlements, as the number increased 49% year-to-date from the amount in the same period, with 100 settlements in the first half of 2018 compared to 67 during the same period in 2017. Meanwhile, the number of proxy contests decreased from 18 to 16.

Other highlights from the Half-Year Review:

- The first half of 2018 saw more activist investors making public demands than in the past, with 524 “active activists” counted year-to-date.

- Most regions experienced more activity than in prior years. The U.S. hit a record number of 367 companies targeted by activists during the first six months of 2018, while Asia saw 60 companies targeted and Canada 57.

- Europe, however, experienced less activity, with only 52 companies targeted year-to-date, down from 76 during the same period last year despite greater amounts being invested in stocks. Activity in the U.K. remained stable, with 25 companies targeted during the first half of 2018 – the same amount as during the same period the prior two years.

Steve Wolosky and Andrew Freedman, co-chairs of Olshan’s Shareholder Activism & Engagement Practice Group, contributed expert commentary to the review.

Quotes

Josh Black, Activist Insight’s Editor-in-Chief: “Activists moved quickly to take advantage of a favorable environment for M&A in 2018 but continued to downplay requests for capital to be returned to shareholders – perhaps because companies so readily repurchased shares on their own. Six withhold campaigns and the first use of the universal proxy card made this proxy season an unpredictable and exciting one to cover."

Andrew Freedman, co-chair of Olshan’s Shareholder Activism & Engagement Practice Group: “No companies – regardless of jurisdiction, size or ownership structure – are beyond an activist campaign. Since many undervalued opportunities lie with companies that have either remained under the radar or are so entrenched that activists have steered clear, investors now realize putting a spotlight directly on a company and its numerous shortcomings, governance or otherwise can compel the company to action.”

Further data are contained in the Review, a copy of which can be accessed here.

For bespoke requests, please email [email protected]. Requests may take up to 48 hours depending on the complexity of the research required.

Kind regards,

Josh Black

About Activist Insight

Since 2012, Activist Insight (www.activistinsight.com) has provided its diverse range of clients with the most comprehensive information on activist investing worldwide. Regularly quoted in the financial press, Activist Insight is the trusted source for data in this evolving space. Activist Insight offers five industry-leading products: Activist Insight Online, Activist Insight Shorts, Activist Insight Governance, Activist Insight Vulnerability – a tool for identifying potential activist targets – and Activist Insight Monthly – the world's only magazine dedicated to activist investing.

About Olshan Frome Wolosky

Olshan Frome Wolosky LLP, a law firm based in New York, represents major businesses and entrepreneurs in their most significant transactions, problems and opportunities. Olshan’s clients range from public companies, hedge, venture capital, private equity and other investment funds to entrepreneurs and private companies worldwide. Clients choose Olshan for innovative strategies and sophisticated, game-changing advice in corporate, securities law, equity investment and shareholder activism, complex commercial, corporate and securities litigation, real estate, intellectual property, bankruptcy and creditors’ rights, and advertising. Since its founding, Olshan has offered an alternative to the AmLaw 50 law firm business model with responsive, independent and client-focused legal counsel provided by the firm’s lawyers.