The other day I published an article calling out the markets denial of rising risks.

Even with everything that’s happening in Italy and with the Emerging Markets blowing up – expected volatility has actually decreased. . .

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Basically, the stock markets pricing everything in for perfection - that the economy and markets will have low-volatility, steady growth, and calming inflation.

At least the bond market isn’t as gullible as the yield curve stays relatively flat – and heading towards inversion.

So, is it just us handful of skeptics and contrarians that don’t believe the mainstreams ‘everything’s great’ story?

Here are a couple other big names that are now doubting the ‘goldilocks’ scenario. . .

Ray Dalio and his firm, Bridgewater Associates – the world’s largest hedge fund, has been in the public eye lately thanks to his new, bestselling book - Principles.

In Bridgewater’s recent Daily Observations, the fund warns that, “2019 is setting up to be a dangerous year, as the fiscal stimulus rolls off while the Fed's tightening will be peaking…”

Bridgwater concluded with. . .

"We are bearish on financial assets as the US economy progresses toward the late cycle, liquidity has been removed, and the markets are pricing in a continuation of recent conditions despite the changing backdrop…"

Another added to the list of skeptics - a Morgan Stanley Top Analysts made statements on Bloomberg that markets are “heading into a summer that’s going to remain volatile...”

The question now we must ask is: what seems to be the common denominator behind all this volatility, instability in emerging markets, and liquidity problems?

The answer: The Federal Reserve's tightening.

The Fed has to realize what they’re doing – I refuse to believe that the supposedly ‘greatest financial minds’ don’t do their research about the correlation between ‘easy money booms’ and ‘tight money busts’.

As I’ve written about before, using the practical framework of the Austrian Business Cycle Theory (ABCT) - created by Ludwig Von Mises – we see that the Fed creates the ‘boom’ with low rates and easy money. And then ignites the ‘bust’ by raising rates and tightening financials.

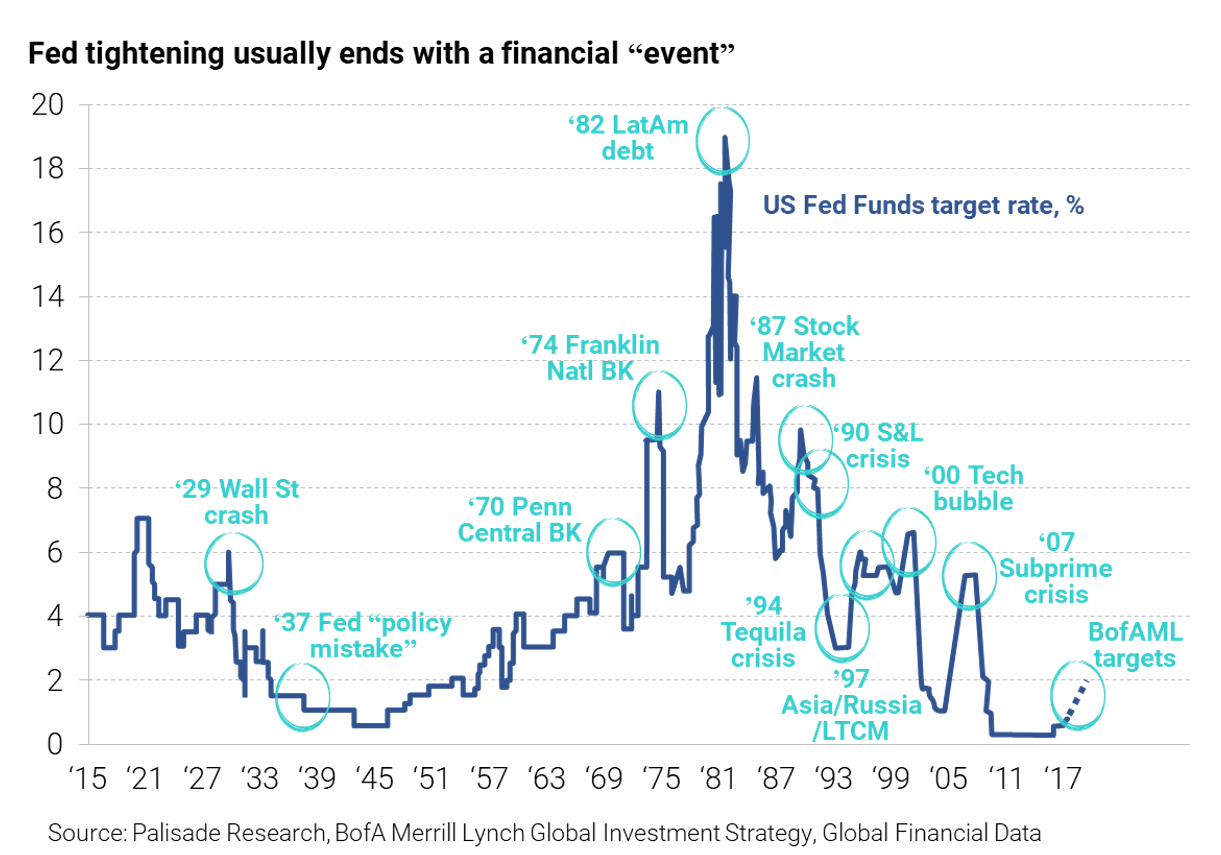

If you look back over the last 103 years – we see two important things bolstering the ABCT. . .

First: as the Fed began tightening after long periods of low rates, it soon ends in some sort of crisis.

Second: immediately after the crisis begins, the Fed cuts rates back even lower than before to kick start growth, help debtors and banks, and prevent a deepening crisis.

There’s a term called ‘Occam’s Razor’ – named after the 14th century Frayer, William Ockham - and it’s an important principle for helping us choose between explanations of subjects. Especially economic and monetary theories.

In summary, it means given many possible explanations – the simplest one is probably right i.e. the least complicated. That’s how it got its name, by ‘razoring away’ any unnecessary complications in favor of simplicity.

Using Occam’s Razor, we can see that Mises got it right with the Austrian Business Cycle Theory - both historically and logically.

Using a simple scenario - years of cheap debt lets people take out more loans they normally couldn’t. They go out and spend, fueling the economy. Then, eventually, rates rise. Interest payments increase, and this makes it harder to service outstanding debts. Consumers reduce their spending. Businesses in the economy (also huge debtors) tighten their belts from less expected consumer demand – which leads to layoffs. Now the unemployed who have debt can’t make their payments. The feedback loop continues.

Since debt markets are driven by liquidity - and the Fed controls liquidity - we can assume the following: The Fed or Central Bank is the main driver of boom and busts in the economy and markets through their monetary easing and tightening policies.

Markets are already very vulnerable because of the Fed's tightening. And the vulnerability adds to the probability of a crisis kicking off somewhere.

Yet the market isn’t pricing any of this increasing risk in at all.

Shifting through another great mind’s work - the 18th century Scottish philosopher, David Hume – we find some wisdom that’s very useful for today.

Hume said that people who’ve only ever seen white swans wouldn’t expect to see a black swan. But that doesn’t mean that black swans don’t exist.

What this means is, just because you’ve never seen a black swan doesn’t mean they don’t exist.

Currently, there are two big factors going in the contrarian investors favor:

- A tightening Fed that’s causing volatility, illiquidity, and burdening debt problems.

- The market believing in the ‘goldilocks’ story pushed by the mainstream and not pricing potential risks appropriately.

The first factor will eventually trigger the second factor to react – and it will wildly. What I mean is once the Fed's tightening causes a ‘black swan’ crisis, markets will be caught off guard and - like a rubber-band snapping back – cause volatility to spike.

This is an ideal time to join the likes of Bridgewater and take advantage of these factors and load up on positions that will benefit from volatility in the future.

I can’t stress enough to find things with ‘positive optionality’ – having massive upside with little downside risk.

Some examples of attractive ‘market crash’ hedges are long dated, out-of-the-money, gold and gold mining call options.

Just like before 2008, equities and high-risk assets were looking great. That is, right before Lehman imploded.

The black swan will show itself when it chooses too – whether you’re ready for it or not. . .

Adem Tumerkan