The SEC still has not declared Net Element’s (NETE) S-3 effective despite it being filed five months ago. This is a much longer review process than we typically see, so it appears the SEC is taking a close look at the company. Furthermore, based on the potentially troubling issues we and Barron’s magazine have reported, it would not surprise us if the SEC was examining things at NETE in addition to its reported financials.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Our previous articles have raised some serious questions about Net Element's management, its investors and its promotional activities. Today we raise some questions about NETE’s audit committee which includes Jon Najarian of CNBC.

- How can NETE be operating with Net Fixed Assets of only $52k (as per its latest 10Q)? NETE is a “global technology group that supports electronic payments acceptance in a multi-channel environment including point-of-sale (POS), ecommerce and mobile devices.” Furthermore, the company generates $60 million of annual revenue, has 97 full time employees and offices in the USA and Russia. As a result it seems very suspicious to us that the company’s Net Fixed Assets (which includes computers, software, equipment, furniture) is so little. Furthermore, the company’s gross investment in computers (as listed in the balance sheet under Fixed Assets) as of March 2018 is only $157k and that figure is unchanged since Sept. 2017. So, are we to believe this global technology company has not bought any computers in 6 months and that the company can be successful without having apparently invested much money into computers?

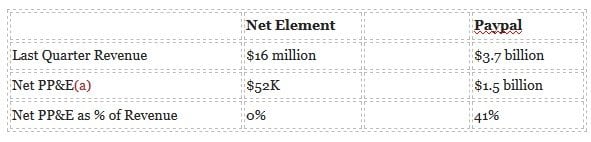

We’ve compared the Net Fixed Assets as a percent of the last quarter’s revenue of NETE and of PayPal. As you can see, NETE’s investment is significantly lower than PayPal’s. While this is not a perfect comparison, it reinforces our concerns about how little NETE appears to be spending on its business.

- Should Net Element write off its Goodwill and would this lead to a Nasdaq delisting? NETE currently has $9.6 million of goodwill and $2.9 million of Intangible assets, net. Collectively, these two assets represent 43% of the company’s assets. Companies are required to test their goodwill for impairment to determine if the carrying amount of the intangible asset exceeds its fair value. While NETE claims to have conducted these tests, we question how thorough these tests have been.

NETE’s goodwill is a result primarily of two acquisitions. In April 2013 the company bought Unified Payments (from NETE’s current CEO, Oleg Firer!!) for $21 million and allocated $17 million of the purchase price to goodwill. Months later, in a highly unusual move, the company wrote down $11 million of this goodwill, reducing the balance to $6 million. The fact that so much of the purchase price was allocated to goodwill and that so much of it was written off so soon raises obvious red flags for us, as does the fact the asset was acquired from the current CEO.

Net Element's goodwill then increased by $3 million when the company purchased Payonline in May 2015 for $8 million.

Since these two acquisitions were completed, NETE has lost tens of millions of dollars and the company has needed to raise additional capital. As a result, we wonder if these assets are really worth as much as NETE has them listed for on its book or if NETE should write off additional goodwill. We believe NETE would prefer not to take a goodwill write-off because:

- It may result in the company being delisted for no longer meeting the Nasdaq’s Continued Listing Standards.

- It would require the company to take a charge which would further reduce net income.

- It would further harm management’s credibility.

3) Is your auditor truly qualified to fulfill its responsibilities and can its work be trusted? Net Element has complicated accounting issues and derives revenues from various countries. It is surprising to us that NETE uses an auditing firm that appears quiet small, has limited experience with public companies, and has been faulted for having deficiencies by an accounting oversight board. NETE’s auditor is Daszkal Bolton LLP, a not widely known firm based in Florida. Last year the Public Company Accounting Oversight Board issued a report which indicated Daszkal had 3 offices (all in Florida) and only 6 Issuer audit clients. The report also identified several audit deficiencies in the Daszkal’s work. .

4) Are the Audit Committee members truly qualified to fulfill their responsibilities considering the complexities of Net Element's financials? One longstanding committee member is James Caan, the 78 year old actor about whom NETE states “Mr. Caan’s tenure working as an actor and director in the film and television industry, qualifies him to serve as a director of the Company.” Mr. Caan does not appear to be a CPA, have an MBA or to have served on the audit committee of any other public company. Several other NETE Audit Committee Members also appear to lack what we would consider to be basic qualifications for serving on the audit committee of a company like NETE.

Short NETE

(a) Reflects figures PayPal classifies as Property and equipment, net and NETE classifies as Fixed assets, net.