How to read an annual report made easy for investors with the help of this animated video.

[REITs]Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

How To Read Annual Report

Transcript

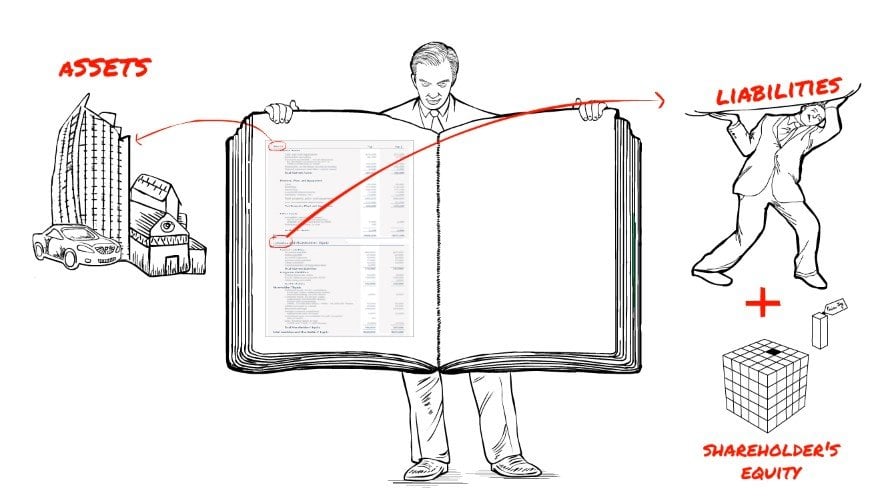

First modern corporate annual report was published by U.S. Steel in 1903. It was certified by Price Waterhouse company. Most annual reports have three components the letter to shareholders. It gives the chairman’s or CEO his overview of the company’s business and financial performance. The Business Review summarizes a company’s recent developments trends group structure its geographical presence and companies objectives. The Financial Review presents a company’s business performance management discussion and analysis or M.D. Anday and audited financial statements and other financial information. In M.D day significant changes industrial trends macroeconomics are pointed out in narrative format or with charts and graphs. The financial statements consist of balance sheet income statement statement of changes in shareholders equity statement of cash flows auditor’s report and footnotes. How to Read balance sheet the balance sheet represents the financial picture for a company at the last day of financial year the balance sheet is divided into two halves liabilities and shareholders equity generally assets equal to liabilities plus shareholders equity both halves are always in balance. The assets section includes all the goods property and uncollected amounts do the liabilities section includes all debts and amounts owed. The shareholders equity section shows the shareholders ownership valuations and the company the assets section consists of current assets and other assets. Current Assets include cash and those assets that will be turned into cash within a year from the balance sheet date. Cash and cash equivalents. This is money and bank in hand and treasury bills marketable securities. These are short term securities that are readily saleable like trading securities held to maturity securities available for sale securities.

Accounts receivable these are the amounts due from customers and allowance for doubtful accounts is deducted from total accounts receivable inventory inventory usually consists of raw materials work and process or partially completed goods and finished goods inventory is valued at its cost or market price whichever is lower. Prepaid Expenses those payments for which the company has not yet received benefits but for which it will receive benefits within a year all these heads sum up to total current assets other assets property plant and equipment or fixed assets fixed assets are reported as cost minus depreciation. Depreciation depreciation is the decline in useful value of a fixed asset due to wear and tear from use and the passage of time it is subtracted from property plant and equipment. Land is not subject to depreciation. Difford charges. These are expenditures for items that will benefit future periods beyond one year intangible assets. These are assets having no physical existence like Goodwill. These are gradually written off by periodic charges against income over estimated useful lives. The process is called amortisation investment securities. All of these current and other assets are added together to produce total assets liabilities and shareholders equity.