Hidden Champions Capital Management commentary for the month of June 2018.

Dear Clients and Partners,

While going about our daily process of turning around rocks (and many are empty or worse, crap) to look for gems, we are constantly looking at ways to do so in a more efficient and effective manner. This is obviously achieved by the adoption of relevant technologies to supply, calculate, collate and even analyse the data, but we must also investigate deeply into the business model and the leadership’s mindset and capabilities.

Recently, we surfaced a company that was doing amazingly well for many years in a regional exchange. In fact, the company was in our own watch list as the company seemingly had good fundamentals, and the share price had jumped multiple folds (more than 50x since January 2012 at its peak). However, we had some skepticism about the business model even though the financials and cash position seems very healthy.

After reviewing the company, we felt that there were too many questions that we could not find an answer by ourselves. Hence, we decided to launch a deeper investigation into the company by calling the company investor relations and directors. While it cleared many points off our standard checklist, it boiled down to the most basic question: does the business model make sense? As we dug deeper into the company, we realised that there are some parts of the business model that do not seem to make any sense. Some factors did not gel when we applied a more commonsensical approach to the company. Even after numerous rigorous discussions, our team was still divided over the company. Like what Ray Dalio stated in his book “Principles”, if many people who are credible and smart are disagreeing with me, I must ask myself what did I miss. It is unlikely that all these people are wrong and I am right. Eventually, we decided to drop it, but continued to monitor the company to learn the relevant investing lessons in this company. Its share price continued to free-fall significantly since we dropped the idea, and there were accusations of possible fraud, including the resignation of their auditors.

Do you recall the ancient story of the 4 blind men that were tasked with describing an Elephant based on their touch? Each of them came up with vastly different descriptions of how exactly an elephant looks like as they touched different parts of the elephant, and ended up arguing among themselves, wondering why the others could not “see” the truth.

However, a passerby with the ability of sight would be able to share with them that they are, in their own ways, right, but wrong at the same time. Therefore, when we are investigating a company, we would want to be as open as possible to all credible facts, assessments and opinions to get to the “truth” of the matter. If anything, we will do my best not to allow our own thoughts or opinions prevent others from speaking their truth.

In the initial stages, it may seem as if we have no stand/opinion, but the real intent is to allow people to share their truth without judgements. Some, if not many, people (particularly in leadership or powerful positions) may have missed the opportunity to know more possibilities or hurdles that could have allow them to make better decisions. Investing is but increasing the likelihood of making the best decisions based on all possible information, be it considerations from a portfolio, individual companies, industry and even macro level.

Within our HCF team, I have always asked the team members (and more importantly, myself) to not assume that we know everything. In fact, I realised that most investors know little of the challenges that each company have to deal with and more importantly, the risk that the company may be taking on. We must recognize and accept the truth if it surfaces during our research work, especially when we have a vested interest in it. Many a times, without us realizing, confirmation bias tends to set in which may lead us to allocating oversized amount of resources to the companies that we like.

In the next section, Joshua will be sharing with you more about the assessment of goodwill in a company, one of the key indicators that we look out for when examining companies with good corporate governance and sound capital allocation.

Warm regards,

Clive Tan | CEO

Hidden Champions Capital Management

Are You Paying For Air?

“ABC Group today announced that it has entered into an agreement to acquire the assets and operations of XYZ Pte Ltd, an industry leader in factory automation. The amalgamated company forecasted an unaudited post-amalgamation EBITDA of SGD $20.5m (32% increase) and an EBIT of SGD $15.4 (28% increase) for FY19.”

News of acquisitions from stock holdings often sends us jumping for joy as market expectations shoot through the roof. While the CEO rushes people to the income statement to highlight the revenue and EPS increase, the supposedly key drivers of stock performance, many often neglect to question the premium paid above the tangible assets.

Goodwill is created by company acquisitions, and is the difference between the price paid and the value of the assets acquired when both the tangible and intangible assets of the business are purchased.

This difference is usually assumed to be the premium paid to the seller’s original shareholders as an exit sweetener for intangibles such as company’s licenses, patents, brand reputation, loyalty, management skills, customer relationships and distribution networks built. Goodwill is capitalized onto the buyer’s balance sheet (not amortized) and is subject to periodic impairment tests.

Probability Of Value Creation In Goodwill Creation

Goodwill is often viewed as irrelevant to the valuation of companies with cult-like following such as Netflix, Tesla and Facebook. When Facebook purchased WhatsApp for US$21.8 bn in 2014, the accountants calculated a fair value consideration of $17.2 bn to the WhatsApp acquisition. However, US $15.3 bn was accounted for as goodwill.

Investors did not seem to be bothered that 28% of Facebook’s total assets were represented by goodwill and that WhatsApp, as a fairly new startup lacking a proven business model appears to be extremely high.

Goodwill also represents the management’s optimism in the markets and their ability to monetize on an intangible asset in the future. If Facebook is able to fully monetize on WhatsApp’s 1.2 billion monthly active users, then the ‘overpayment’ for WhatsApp could very well represent an immense financial upside.

However, a KPMG report [1] abstract shown below presented findings on issues surrounding M&A that are consistently in line with empirical evidences. While other researchers [2] arrived at different numbers, majority agree that more than half of the mergers and acquisitions destroy more shareholder value than it creates. [3][4]

“We found that only 17% of deals had added value to the combined company, 30% produced no discernible difference, and as many as 53% actually destroyed value. In other words, 83% of mergers were unsuccessful in producing any business benefit as regards shareholder value.”

KPMG – UNLOCKING SHAREHOLDER VALUE: THE KEYS TO SUCCESS

Eyeing The Goodwill & Intangibles In Merger & Acquisitions

‘Goodwill’ and ‘Other intangible assets’, like many of the more uncommon balance sheet items, tends to get glossed over or brushed-off as non-cash items when looking at financial statements.

However, these intangible asset line items hold critical information on the capital allocation mentality of the management during merger and acquisitions. Excessive intangible assets in the books can signal two things.

- First is the reckless use of shareholder’s capital when stupendous premiums are paid over the firm’s value.

- Second, being the more severe, potential cash tunneling out of the listed entity ESPECIALLY where there is pattern of serial acquisition and write-offs.

Whatever the case, both reflects a certain kind of mentality in the management which we seek to avoid. We can also safely conclude that the higher the intangible asset buildup as a percentage of total asset, the greater potential it has for damaging write-downs and destruction of shareholder value in the near-future when deals don’t work out as expected.

In the earlier example, this CEO’s art of misdirection to the earnings could potentially be intending to conceal one of the many ‘secret’ outflow of shareholder’s cash via intangible assets that we have observed.

For example, the buyer can pre-arrange with the seller to pay $100m for the acquisition assets worth $40m in actual value. The remaining $60m can be split between ‘justifying’ it in the goodwill or agreeing to inflate the not-so-fair value calculation of the underlying asset.

The most horrific of the transaction would be that the auditors, seeing matching figures and documentation of the fair trade, would sign off the financial statements oblivious to the market-rate of these assets. The lawyers and dealmakers would be glad about the tidy commission sum.

What about the $60m of shareholder’s cash brought out of the listed company? It is now liberated from privy eyes of the shareholders, with the ‘reward’ free to be split among various parties including the mastermind management of the company that bought the dubious asset and tunnelled out the cash.

After a series of acquisitions and a snowballing of intangible assets which now occupy a huge portion of its total asset in the books, this crime trail would then need a write-off ‘rinse & repeat’ to prevent shareholders from questioning the bloat in the balance sheet.

As our team analyzes thousands of business model and financial statements for the fund, we place very strong emphasis on the management character analysis and stay away from companies who, despite a very sexy sounding business and growth story, portrays a lack of integrity in their business and personal life.

“Somebody once said that in looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don’t have the first, the other two will kill you. You think about it; it’s true. If you hire somebody without [integrity], you really want them to be dumb and lazy.”

–Warren Buffett

Case study – WorldCom: Failed to impair goodwill

The 2002 accounting scandal at WorldCom was the largest accounting shenanigan in American history until Bernard Madoff’s US$64bn Ponzi scheme was exposed in 2008. WorldCom illustrates how companies can engineer goodwill using accounting gimmicks.

It apparently started out as a rather small accounting trespass during mid-1999 but snowballed until May 2002. Once the fraud was exposed by a team of internal auditors, the company restated its earnings. From a total asset of USD $104 bn, 67% of the assets (USD $71 bn) were written down to just USD $34 bn towards the end of 2001 and shareholders’ equity fell from positive USD $58 bn, to negative equity of US $12.9 bn. Essentially, the company was bankrupt.

With write-downs totalling US$31bn in 2000 and US$4.8bn in the restated financials for 2001, almost half of these asset write-downs came from writing down 90% of their goodwill in the consolidated balance sheet. Company’s auditors even complained that there was no evidence of impairment analysis.

Part of WorldCom’s strategy for growth had been through acquisitions. Between 1983 to 2001, they conducted 65 mergers, ending with the largest corporate merger in US history of their time, a USD $37 bn merger with MCI in 1997. From this corporate exercise, a huge goodwill totalling US$41bn, or 39% of total assets was by end 2001.

For their acquisitions to appear earnings accretive, WorldCom employed accounting gimmickry and restated 2001 financial statements files with the SEC. WorldCom disclosed that it understated the consideration paid for acquisitions and so lowered goodwill and amortization.

Before this incident, amortizing goodwill was allowed and WorldCom’s goodwill from M&A were often amortized and stretched over 40 years. Assets were also understated which lowered the rate of depreciation. These manipulations doubled their pre-tax profit in 2000 and 2001. Without this, profits would have halved and the company would have been loss-making.

As with all patterns of serial acquisition strategy, “profit growth” can only be maintained as long as the company makes the next acquisition larger than the previous. When the regulators refused to allow WorldCom to make a US$129bn merger with Sprint in 2001, then the world’s largest proposed merger, the game was up for WorldCom as it could no longer cover its tracks.

Value Creation VS Asset Destruction In Asia

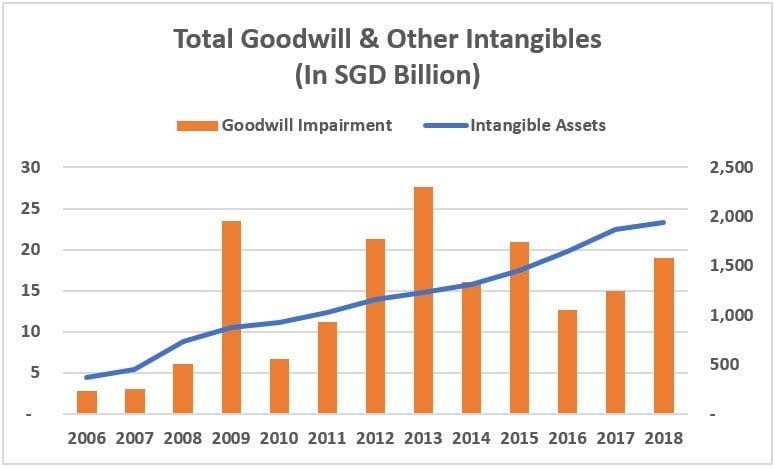

In our recent 2018 study of the Asia-Pacific markets, it was observed that there has been an increasing wave of acquisitions by Asian companies which have generated significant goodwill. Over the past five years, SGD $847 bn has been added to goodwill and intangible. Of this, SGD $104 bn (12.3%) of these shareholder’s wealth were destroyed by subsequent goodwill write-offs.

For the remaining 87.7%, risks still exist based on the acquirers’ ability to ensure the purchase generates positive returns and fair value adjustments hold to this goodwill asset indefinitely. Another risk is where management is reluctant to impair goodwill when it becomes worthless to prop up its asset base which support its key financial ratios.

Of the approximately 6000 Asia-Pacific companies in our investment universe above SGD $200 m in market capitalization excluding banks, 972 or 16.2% of these companies had more than 10% of their total asset made up of intangible assets.

What is interesting in this observation is that a high percentage of companies which are stock market darlings fall within this category and are reporting increased sales and earnings with their stock prices currently on a momentum roll.

Goodwill and intangible assets should never be analyzed as a sole indicator of company quality as the purchase of a high ROIC business, while it may create high levels of goodwill from its low asset base, can still prove earnings accretive earnings. [5]

As businesses continue to carry larger amounts of goodwill at an increasing rate, keep in mind these two points of potential conflicts of interest as each deal rolls on bigger and bigger.

- Merger & Acquisition deals usually results in large payouts for executives and insiders making the purchase decision. With lucrative potential rewards, management have a vested interest to continue singing the tune that acquisitions are good for shareholders.

- Investors buy into M&A with the hope earnings will increase but ignore the fact that earnings accretive deals are a mirage. Accounting profit don’t create value, economic profit do. [6][7]

Regards,

Joshua Zhang | Investment Manager

Hidden Champions Capital Management

[1] KPMG Report – Unlocking Shareholder Value: The Keys To Success – http://people.stern.nyu.edu/adamodar/pdfiles/eqnotes/KPMGM&A.pdf

[2] Overpriced Shares, Ill-Advised Acquisitions, and Goodwill Impairment – http://aaapubs.org/doi/pdf/10.2308/accr-10131?code=aaan-site

[3] Consequences of booking market-driven goodwill impairments –https://accountancy.smu.edu.sg/sites/default/files/accountancy/pdf/Papers/pervinshroff_paper.pdf

[4] The effects of goodwill impairments on stock prices – https://core.ac.uk/download/pdf/36692422.pdf

[5] 2018 First Quarter Corporate Insights Behind the numbers: Mastering M&A – https://www.credit-suisse.com/media/assets/microsite/docs/corporate-insights/corporate-insights-q1-2018.pdf

[6] What is the difference between economic profit and accounting profit? – https://www.investopedia.com/terms/e/economicprofit.asp [7] Economic Profit and Costs – https://youtu.be/06j_zPdPWOY