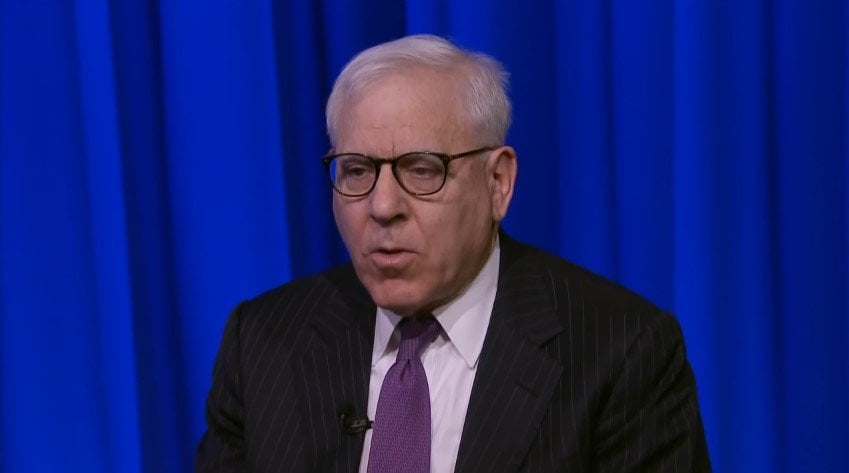

An interview with billionaire Private Equity titian and co-founder of The Carlyle Group, David Rubenstein. In this interview, David discusses starting Carlyle and their successful investing in China. David also talks about the economy, talk shows and philanthropy.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

David Rubenstein: Carlyle, Investing In China And US Economy

Transcript

A group evolved into the giant that it is today. OK. While I’m a lawyer as you suggested and if you’re a very good lawyer you probably are practicing law. I wasn’t that good a lawyer. I started Paul Weiss and after a couple of years people hinted maybe I should do something else and I went to work and the government I opened he worked in the White House for President Carter and we lost the election to Ronald Reagan in 1980. I went back and practiced law once again my clients and colleagues said I’m not that good a lawyer. So I decided to do something different and I decided to start a private equity firm in Washington. And it took off and we did reasonably well and it grew to be one of the largest in the world. So it was not something I’d planned on doing. I didn’t go to business school. I didn’t have a finance background. And like many people who start companies you do it by feeling your way and I got lucky. Well tell her about how you came to go to the Carter White House. There you are. Paul Weiser of first year associate a second year associate. What attracted you to poor advice and then what attracted you to government. Well when I was in the sixth grade I heard John Kenny’s favorite famous speech I should say about asking not what your country can do for you but what you can do for your country.

And that was his great inaugural address written to a large extent with the help of Ted Sorensen and Ted Sorensen was somebody I idolized because he was a Great White House role model person I’ve been a great White House aide. And I thought maybe I could go in the White House. I wasn’t handsome enough to be a candidate I wasn’t wealthy enough to be a candidate but I could be an adviser I thought. So after law school I went to work in his firm Paul Weiss and after a few years of working there it became clear I wasn’t a great lawyer but he helped me get a job in government and ultimately got me a job working the Carter campaign and then Carter won the Elize the election in 1976 I joined Carter when he was 30 points ahead of Gerald Ford. And after my work Carter won by one point. So you might say what was my contribution. But I got a job in the White House at the age of 27. I was a deputy domestic policy adviser to United States a job I really wasn’t qualified for but it was very enjoyable for me. So that’s how you get to go to the White House you work in the campaign. You don’t apply and take a test like getting into college. It’s not the 80s. No they usually don’t go survey the best people in the country and say we want to hire you. They usually get people working the campaign to obviously fill in spots. But working in the campaign helps. OK. So Ronald Reagan defeats Carter and you’re out of a job. That’s right.

People came to me all the time when I was working in the White House said you’re a bright young man if you want a job. Call me up. But then after we lost the election I started calling them none of them call me back because who one of the Carter White House aide and I should add that I wanted to run against Ronald Reagan unless I went to Carter to run against Ronald Reagan because they said he’s so old he’s 69 years old. Nobody that old can possibly run for president. Now I’m 68 and it looks like a teenager to me at this age. But 69 seem old when I was then 31. I had to go back and practice law because I didn’t have any other skills. Finally a lot to go again while I had no skills other than training trying to practice law. But people must have heard of my reputation because it’s simply many months after the Carter years they get a job and I used to say to my mother I have so many offers I don’t know which one to take. She said just take one but three four five six months after Carter last I was still looking for a job. Finally somebody felt sorry for me. I got a job practicing law and I realize again I wasn’t that good at it. OK. You realized you weren’t good at it. So what do you do. You had a problem. You heard about something that Bill Simon had done. He had done a leveraged buyout of a company called Gibson Greeting Cards in the early 1980s. He put a million dollars in and made about 80 million dollars and I read about it I said that’s for me.

I don’t know what it is but I’ve got to do a leveraged buyout business better than a legal business so I decided to put a firm together that would do leveraged buyouts in Washington. I recruited people actually had some financial experience I really didn’t. I helped raise the money to get off the ground and then we started and you know we had a lot of mistakes in the early years but after 30 years it grew to be one of the largest in the world. So we were able to put in the money yourself well in the early days I had modest amounts of money and invested it and I put in what I had. But it wasn’t till later on that I had a lot of money to reinvest in the company. Now I am I guess one of the larger investors and the biggest shareholder. OK. So you start the Carlyle Group and it’s a private equity firm maybe you can tell us what private equity or private equity is essentially a two word phrase that means to some people investing in privately owned companies fixing them up and then taking in public or selling at a pretty good rate of return. Some people would include venture capital in it. Some people would say private equity means just buy outs but using the generic term of private equity it’s any type of private investment in a private company where you’re designed to get 20 30 percent annualized rates of return after improving the company or doing things that make it much better than it was before. So you don’t invest in public corporations that are listed on the Stock Exchange. Historically private equity firms don’t do that now.

Occasionally they now take some stakes in minority stakes in private and publicly traded companies where they might later take the company private. But generally it’s designed to do things in the private setting and he started the Carlyle Group in 1987 and you’ve averaged over the years something like 17 to 20 percent rate of.