The healthcare sector has an abundance of dividend growth stocks. For evidence of this, look no further than the list of Dividend Aristocrats.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

The Dividend Aristocrats are a select group of 53 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases. There are currently 6 healthcare sector Dividend Aristocrats.

You can download an Excel spreadsheet of all 53 (with metrics that matter) by clicking the link below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

It is easy to see why healthcare stocks make for strong dividend payers. Healthcare is a very stable industry. People often cannot go without healthcare, regardless of the economic climate. And, with an aging population, the healthcare industry is expected to see robust demand going forward.

The rankings in this article are derived primarily from our expected total return estimates for every healthcare dividend stock found in the Sure Analysis Research Database.

The one exception here is Johnson & Johnson, which has been included in this article due to its exceptional stability despite not quite ranking in the top 7 of healthcare stocks in the Sure Analysis Research Database.

For investors interested in high-quality dividend growth stocks, this article will discuss the top seven dividend-paying healthcare stocks. Keep reading for detailed analysis on each of these 7 high quality healthcare sector dividend growth stocks.

No. 7: Becton, Dickinson and Company (BDX)

Becton, Dickinson provides a wide range of medical supplies, including diagnostics, infection prevention, surgical equipment, and diabetes management. It is one of the six healthcare Dividend Aristocrats, as it has increased its dividend for more than 40 years in a row. It is also a high-growth dividend stock. In the past 10 years, the company has increased its dividend by 10% per year, on average.

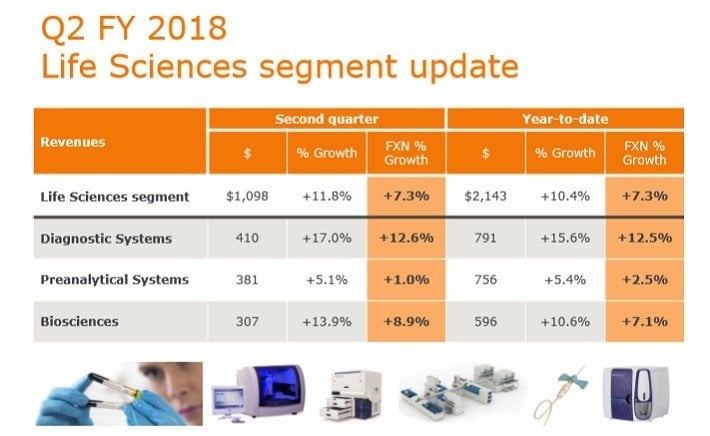

Such a high dividend growth rate is supported by the company’s strong earnings growth. On 5/3/18, Becton Dickinson reported quarterly earnings results that beat on revenue and earnings. Revenue of $4.22 billion beat expectations by $100 million, while earnings-per-share of $2.65 beat by $0.02 per share. The Life Sciences segment led the way, with 7.3% organic revenue growth.

Source: Earnings Presentation, page 9

Total revenue rose 42% last quarter, due largely to the December 2017 acquisition of C.R. Bard.

The $24 billion acquisition brought together two medical supply industry leaders, to create one healthcare giant. Together, the combined company will generate annual revenue of approximately $16 billion.

The two companies will be able to service the treatment of disease for patients, as well as the process of care for health care providers. The acquisition provides Becton, Dickinson with an expanded product portfolio, as well as greater exposure to the high-growth emerging markets.

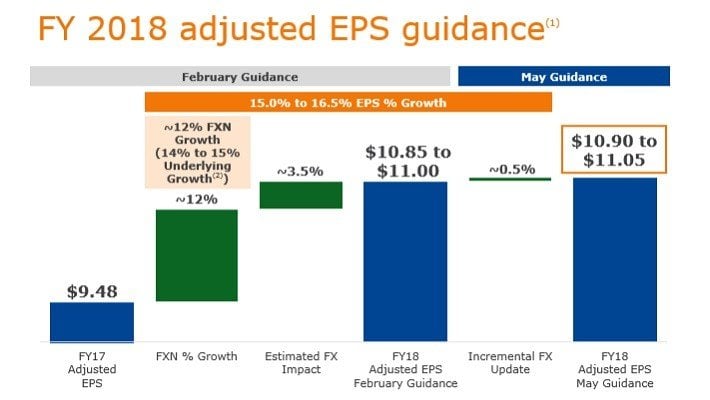

Becton Dickinson’s adjusted earnings-per-share increased 7.8% last quarter, and the company raised guidance for the full year. Earnings-per-share are expected to rise at least 15% in fiscal 2018, to between $10.90 and $11.05.

Source: Earnings Presentation, page 16

We have a fair value price of $202 per share for Becton Dickinson shares, which means we believe the stock is currently overvalued. This could drag on the stock’s total returns going forward.

That said, we think the company’s high earnings growth will more than offset its elevated price-to-earnings ratio. Going forward, we see potential for 10% annual earnings growth for the company. Combined with the 1.3% dividend yield, total returns could still reach 10% per year, even including the potential impact of a declining price-to-earnings ratio.

No. 6: Johnson & Johnson (JNJ)

A discussion about the best healthcare dividend stocks would not be complete without Johnson & Johnson. J&J has increased its dividend for 56 consecutive years, which makes it a member of an even more exclusive club. J&J is a Dividend King, a small group of 24 stocks with 50+ consecutive years of dividend growth. You can see all 24 Dividend Kings by clicking the link below:

Click here to download your Dividend Kings Excel Spreadsheet List now.

For the 2018 first quarter, J&J generated earnings-per-share of $2.06 on revenue of $20.01 billion. Both figures handily beat analyst expectations. Revenue and earnings-per-share were above consensus estimates by $0.05 and $630 million, respectively. On a year-over-year basis, total revenue increased 12.6% (core organic revenue up 4.3%), while adjusted earnings-per-share rose 13%.

Source: Earnings Presentation, page 1

In consumer products, beauty and oral care grew 10.5% and 4.7%, respectively. In the pharmaceutical portfolio, infectious diseases revenue increased 10.8%, while oncology sales soared 45% year over year. J&J has positive growth potential thanks to a strong pipeline. J&J is on track to meet its goal of filing 10 new major products by 2019, each with at least $1 billion in annual sales potential.

For 2018, J&J expects at least 6% organic revenue growth this year, along with 10%+ adjusted earnings growth.

The only reason why J&J is not higher on this list, is because the stock is not significantly undervalued at this time. Based on 2018 earnings-per-share forecasts, J&J stock has a price-to-earnings ratio of 15.7, which is exactly at its 10-year average valuation.

We believe J&J is fairly valued, with a fair value price estimate of $121 to $130. Even though investors may not see continued expansion of J&J’s price-to-earnings ratio, the stock will continue to generate returns from earnings growth and dividends. Combining 7%-9% projected annual earnings growth with a 2.8% current dividend yield, this would result in total returns of 10%+ per year.

No. 5: Stryker (SYK)

Stryker is a medical technology company. It manufactures medical products in three focus areas, which include Orthopaedics, Medical & Surgical, and Neurotechnology & Spine. The company had sales of $12.4 billion in 2017.

On 4/26/18, Stryker reported strong first-quarter financial results. Net sales increased 9.7%, while organic revenue increased 7% from the same quarter last year. Adjusted earnings-per-share increased 13.5% for the quarter. Both revenue and earnings-per-share beat analyst expectations.

The Medical & Surgical, and Neurotechnology & Spine segments grew sales by 9.1% and 8.2% last quarter, respectively. Stryker grew sales by 8% in the U.S. as well as the international markets.

Stryker’s growth over the past several years was driven largely by acquisitions, to further strengthen its position in the medical technology industry.

Source: Investor Presentation, page 13

Stryker expects 6.5%-7% revenue growth for the full year. Adjusted earnings-per-share are expected in a range of $7.18 to $7.25 in 2018.

Stryker has a relatively low dividend yield of just 1.1%, but the company increases its dividend at a high rate. For example, on 5/2/18, Stryker increased its dividend by 11%.

We have a fair value estimate of $160 per share for Stryker stock, which represents a target price-to-earnings ratio of 22 to 23. With the stock currently trading at ~$169, shares are slightly overvalued, which means the stock might not see further expansion of the price-to-earnings ratio. Instead, future returns will be driven by earnings growth and dividends.

We believe a long-term earnings growth rate of ~10% per year is a reasonable expectation for Stryker. The current dividend yield of 1% could essentially balance out a slight reduction in the price-to-earnings ratio. As a result, annual returns are expected to reach 10%.

No. 4: Pfizer (PFE)

Pfizer is one of the largest pharmaceutical companies in the world, with a market capitalization of $211 billion. The most common therapeutic areas for Pfizer are internal medicine, oncology, immunology, inflammation, and rare diseases. Pfizer’s global portfolio is based mostly on biopharmaceuticals, but it also includes vaccines and consumer products.

On 5/1/18, Pfizer released first-quarter financial results. Revenue of $12.91 billion missed expectations by $240 million, but rose 1% from the same quarter a year ago. Adjusted earnings-per-share of $0.77 beat expectations by $0.02, and increased 12% year-over-year. Double-digit earnings growth was mostly due to the company’s anchor products, specifically Ibrance, Eliquis, and Xeljanz.

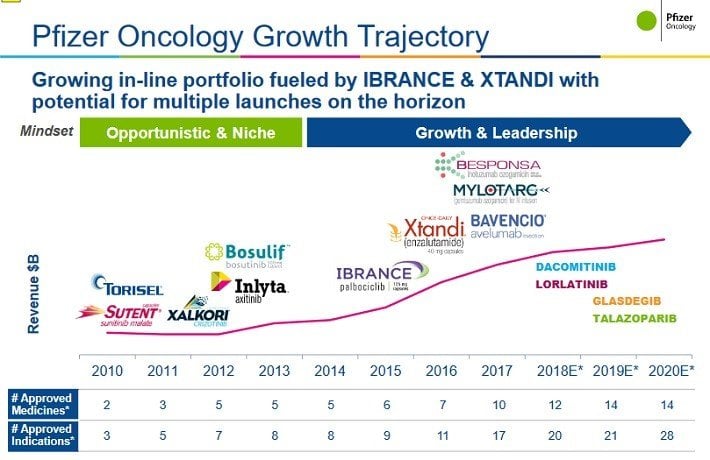

Pfizer is investing heavily in future growth, by strengthening its pipeline. Pfizer has had 22 key approvals since 2011, which will help the company overcome patent expirations. Pfizer believes it will achieve as many as 30 product approvals over the next five years, 15 of which have the potential to be blockbusters. It expects seven of the 15 to receive approval by 2020. Within the pharmaceutical pipeline, oncology is a specific focus area for Pfizer.

Source: Cowen Healthcare Conference, page 3

Pfizer’s massive R&D budget is a competitive advantage, as it has provided the company with a strong pipeline. For example, Pfizer utilized at least $7.6 billion for R&D spending from 2015 through 2017, and the company expects to invest $7.4 billion to $7.9 billion in 2018.

Pfizer expects revenue growth of 1.9% to 5.7% in 2018, while earnings-per-share are expected to rise 9% to 13% this year. Over the next five years, we forecast earnings-per-share and dividends to grow at 5% each year.

Earnings-per-share are expected at $2.95 at the midpoint of Pfizer’s full-year guidance. As a result, the stock trades for a price-to-earnings ratio of 12.0. Pfizer has had an average valuation of 17 for the last 10 years, although 10-year average has been influenced by a three-year period over 2014-2016 where the ratio jumped to over 20.

We are expecting that the P/E will average around 13-14 going forward. This would result in a fair value share price of $40 for the stock. Over the next five years, an expansion of the price-to-earnings ratio could add roughly 2.4% to annual returns. Expansion of the valuation and earnings growth, along with a 3.8% dividend yield, means total returns could reach 11%-12% each year going forward.

No. 3: AbbVie (ABBV)

AbbVie is a research-focused biopharmaceutical company that was spun-off from Abbott Laboratories (ABT) in 2013. Today, AbbVie has approximately 29,000 employees, and a market capitalization of $163.2 billion. Its research and development focuses on the following areas: immunology, oncology, neuroscience, virology, and general medicine.

On 4/26/18, AbbVie reported excellent first-quarter financial results. The company delivered excellent growth in both revenues and earnings. Net revenue increased by 18%, while adjusted earnings-per-share rose by more than 40%.

Global Humira sales increased by 11% for the quarter. Going forward, AbbVie will continue to generate growth from Humira, as well as from a robust drug pipeline. For example, last quarter Imbruvica revenue increased 38%.

AbbVie also increased full-year guidance, and now expects 38% adjusted earnings-per-share growth in 2018. The company is now expected to generate adjusted earnings-per-share in the range of $7.66 to $7.76 this year.

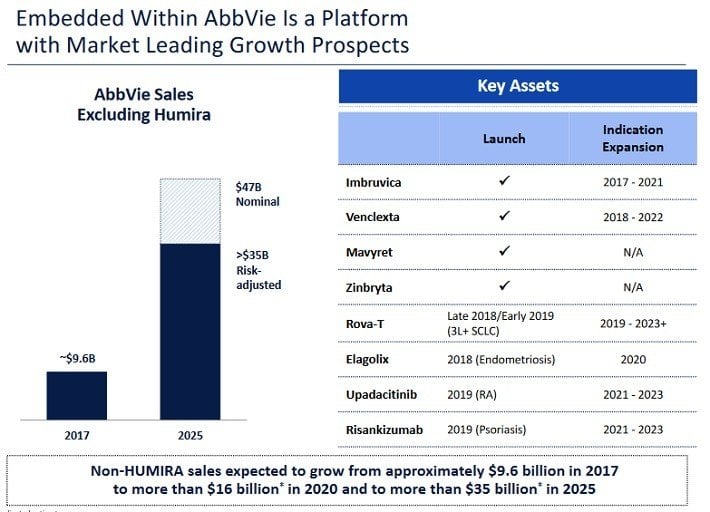

Company management believes Humira will continue growing at a high rate through 2020. After that, the company expects new products to take the lead.

Source: JP Morgan Healthcare Conference page 15

AbbVie expects non-Humira sales to reach more than $16 billion by 2020, and more than $35 billion by 2025. The company expects to launch 20 new products or indications by 2020. Its growth and secure dividend are the result of its research and development capabilities. The company spent $5 billion in 2017 on R&D, and over $4 billion each year in 2016 and 2015, to build and maintain a robust pipeline. Its R&D investments are a major competitive advantage.

The stock is currently trading for a price-to-earnings ratio of about 13.5. Since the spin-off from Abbott in 2013, AbbVie has held an average price-to-earnings ratio of 14.2.

Assuming a price-to-earnings ratio of at least 15.0, AbbVie stock could see annual returns boosted by roughly 2.7% per year, from a rising valuation. In addition, we believe that investors can count on annualized earnings-per-share growth of about 10% over full economic cycles.

Combined with the 3.8% dividend yield, AbbVie could generate total returns of approximately 16% to 17% per year over the next five years.

No. 2: Cardinal Health (CAH)

Cardinal Health is also a Dividend Aristocrat. The stock has an attractive dividend yield of 3.5%, and the company has increased its dividend for 33 consecutive years.

Cardinal Health is a pharmaceutical and medical supply distributor. Business conditions have become more challenged for Cardinal Health in the past few years, due to falling prices in pharmaceutical products.

The most recent quarter reflected the challenges Cardinal Health is facing. Revenue increased 5.7% from the same quarter a year ago, as falling prices has helped lift sales. However, adjusted earnings-per-share of $1.39 declined 9%.

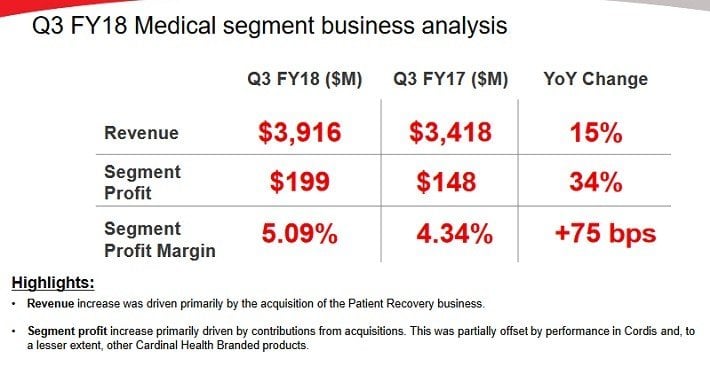

Pharmaceutical segment operating profit declined by 3% last quarter reflecting the margin erosion from price deflation. The medical segment continued to perform well, with revenue and operating profit growth of 15% and 34%, respectively.

Source: Earnings Presentation, page 6

However, the pharmaceutical segment comprises nearly 90% of Cardinal Health’s total revenue, which limits the impact of the medical segment.

Still, Cardinal Health is highly profitable. The company expects adjusted earnings-per-share in a range of $4.85 to $4.95. As a result, the stock is significantly undervalued. Based on 2018 earnings estimates, the stock has a price-to-earnings ratio of 11.3. We estimate a price-to-earnings ratio of 16.8 as fair value, which is equal to its 10-year average.

Cardinal Health stock could generate 8% annual returns going forward, just from expansion of the price-to-earnings ratio. In addition, we believe the company has potential for 5% annual earnings growth, in a normalized operating environment. In addition to the 3.5% dividend yield, total returns could reach nearly 17% per year going forward.

No. 1: Owens & Minor (OMI)

Taking the top spot is healthcare distributor Owens & Minor, which offers distribution, transportation, and data analytics services. It is a smaller competitor to Cardinal Health, and it has equally struggled from a more difficult operating environment.

On 2/10/18, the company released first-quarter financial results. Earnings-per-share of $0.43 missed analyst expectations by $0.04 per share. Quarterly revenue of $2.37 billion increased 1.7% year over year, but also missed expectations, by $20 million.

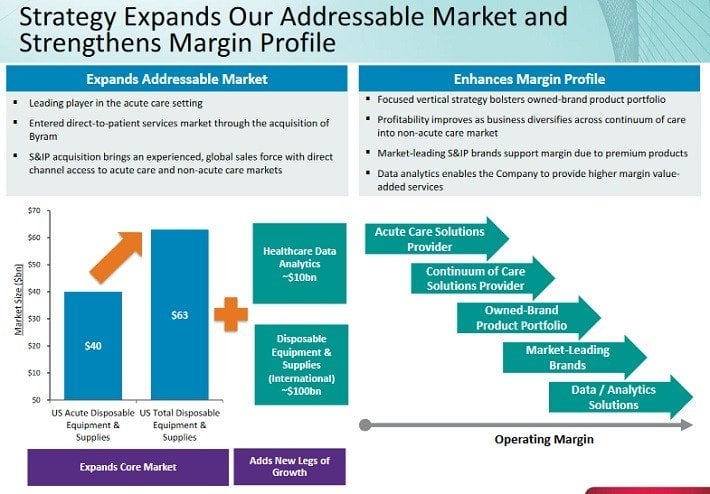

To generate a turnaround, the company is investing in growth initiatives such as acquisitions. For example, Owens & Minor acquired Byram Healthcare, a distributor of direct-to-patient medical supplies. This acquisition boosted Owens & Minor’s position in at-home healthcare. Byram added $118 million to Owens & Minor’s first-quarter revenue.

Also, in the 2018 first quarter the company closed on its acquisition of the surgical and infection prevention business of Halyard Health. This deal expands Owens & Minor’s portfolio, to include new medical supplies like sterilization wraps, surgical drapes and gowns, facial protection, protective apparel, and medical exam gloves.

These acquisitions are part of a broader portfolio repositioning for Owens & Minor.

Source: April Investor Presentation, page 14

We believe Owens & Minor’s turnaround will ultimately prove successful. Healthcare distribution is still a growth industry, driven by demographic changes. The U.S. is an aging society, and Owens & Minor has an entrenched competitive position. It distributes approximately 220,000 medical and surgical supplies to roughly 4,400 hospitals.

Owens & Minor’s short-term growth is being negatively impacted by acquisitions and other investment spending, but this should pay off in the long run. The company believes it can achieve a long-term annual earnings growth rate of 8% to 10% after the various acquisitions are completed.

In the meantime, investors have a unique opportunity to buy the stock at a significant discount to fair value. Consensus estimates call for earnings-per-share of $2.00 for Owens & Minor in 2018. As a result, the stock trades for a price-to-earnings ratio of just 8.1. We believe the stock deserves a price-to-earnings ratio of 14-15, since Owens & Minor has strong customer relationships and a highly profitable business model.

Owens & Minor has a leadership position across many of its product categories.

Source: April Investor Presentation, page 23

Therefore, we believe Owens & Minor stock is worth approximately $29 per share. Over the next five years, a return to fair value could add 12% per year to shareholder returns. This underscores the low valuation being given to the stock right now.

If Owens & Minor can meet its long-term earnings growth forecast, annual returns could reach 26%, including earnings growth and its 6.5% dividend yield. Such a high rate of expected return makes Owens & Minor our top healthcare dividend stock right now.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Bob Ciura, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.