Editor’s Note: New instalment, check out previous instalments here.

Growing up I would help out serving customers in my grandparent’s corner convenience store (Milk Bar) on weekday afternoons and weekends.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

My late Grandfather in his convenience store, better known as Parris’s Milkbar.

There was only one cash register on top of the counter, which received cash from the customer’s purchase, and my grandmother would take out money, from the cash register, to buy new stock for the shelves, pay the utility bills, and pay me.

My grandparents would then have to choose, either to, invest in growth, pay down debt, or pay their own living expenses, out of the remaining amount of money left in the cash register.

Little did I now then, that those are the key ingredients to understanding the cash flows operations of any business.

Those individual elements are:

- Income

- Working Capital Expenses

- Maintenance Capital Expenditures

- Growth Capital Expenditures (Investment in expansion)

- Profit

For instance, the income is the cash received from customers. The working capital expenses is the cash taken out of cash register to pay for new stock that is then sold on the shop floor.

The maintenance capital expenditures were the expenses my grandparents had to spend to maintain the shop equipment (the ice-cream machine, soft drink fridges, milkshake machines, etc) at a safe level to meet government health & safety regulations, and also because equipment wears out as it gets used. Included in the maintenance capital expenses is the shop building itself, which resulted in occasionally paying tradesman to repair leaks, install power-points, or install new shop signage.

My grandparents didn’t, at that time spend money to expand the business. And finally, after all those expenses were meet my grandparents pocketed the after-tax difference.

These fundamental elements are found in every business, small and large. From these elements, we begin to understand the earnings power and intrinsic value concepts.

Now that common-stock values come to depend exclusively upon the earnings exhibit, a gulf has been created between the concepts of private business and the guiding rules of investment.

When a businessman lays down his own [financial] statement[s] and picks up the report of a large corporation, he apparently enters a new and entirely different world of values. For certainly he does not appraise his own business solely on the basis of its recent operating results without reference to it financial resources.

Benjamin Graham and David Dodd

My grandparent’s shop provides a simple example of free cash flow. The excess cash leftover in the cash register is what Benjamin Graham referred to as ‘earning power” or what Warren Buffett refers to as “owner earnings.” That’s the amount of cash my grandparents pocketed after paying all the expenses and making the necessary investments to maintain the shop.

This free cash flow is the well from which all returns are drawn, whether they are dividends, stock buybacks, or investments capable of enhancing future returns.

Bruce Berkowitz

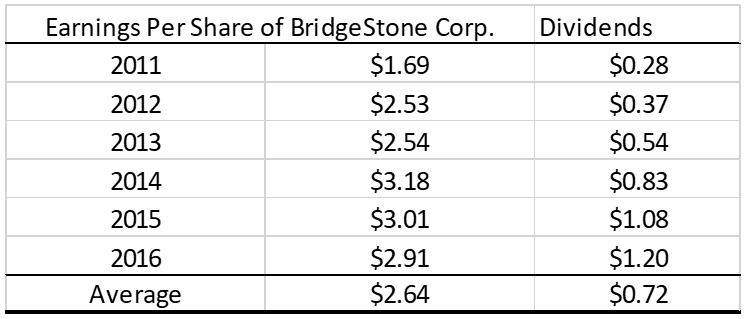

Benjamin Graham recognised that Intrinsic Value is an elusive concept, and wrote: “In general terms it is understood to be that value which is justified by the facts, e.g., the assets, earnings, dividends, definite prospects, as distinct from the market quotations established by artificial manipulation or distortion of by psychological excesses. But it is a great mistake to imagine that intrinsic value is as definite and as determinable as is the market price.”Graham explained that the intrinsic value of a business was determined by its earnings power.Example: Let’s make this reasoning clearer, let us consider a concrete and typical example. What would we mean by the intrinsic value of Bridgestone Corp., (BRDCY U.S.: OTC) in 2018.The market price was $22; the enterprise value per share was $22.95; $1.20 per share were paid out in dividends for 2017 and the six-year average is $0.72 per share; the average earnings for six years had been $2.64 per share. If we followed the customary method of appraisal, we might take the average earnings per share for the six years, multiply this average by ten, and arrive at an intrinsic value of $26.40.

Let us examine the reported individual figures which make up this six-year average.

The individual figures are the reported net income per share figures for the six years from 2011 to 2016.

We established earlier that the maintenance capital expenditures spent by my grandparents to maintain shop equipment and the shop building came at a cost, if neglected, both equipment failures and building repairs will damage their reputation in the eyes of customers.

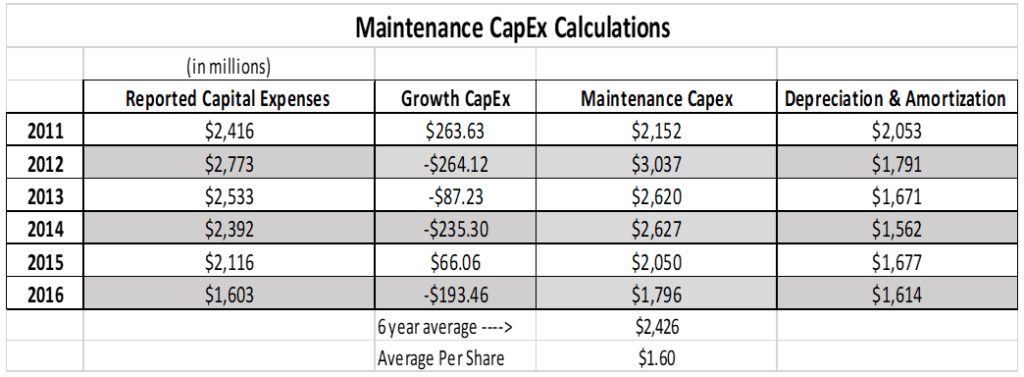

Bridgestone’s reported earnings per share figures need to be adjusted to take into account the required maintenance capital expenses, which maintain the current level of revenue.

This table provides the approximate figures for each of our elements, and so we deduct from the reported net earnings figure $1.60 to get a truer picture of Bridgestone’s earnings per share.

So, $2.91 minus $1.60 equals $1.31 per share.

A good comparison is Free-Cash-Flow per share, which is $1.44 per share. It’s in the ball park.

As the old saying goes, ‘earnings is an opinion but cash is a fact.’

You now see the folly of a company reporting their earnings as Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA).

For those interested in how Warren Buffett calculates his “Owner Earnings” and see it in action click here.

Yours in Investing

– Adam

P.S. You can Subscribe Free to the email list and gain access to exclusive FREE content that others make you pay $$$ for – Click Here.

Article by Adam Parris, Searching For Value