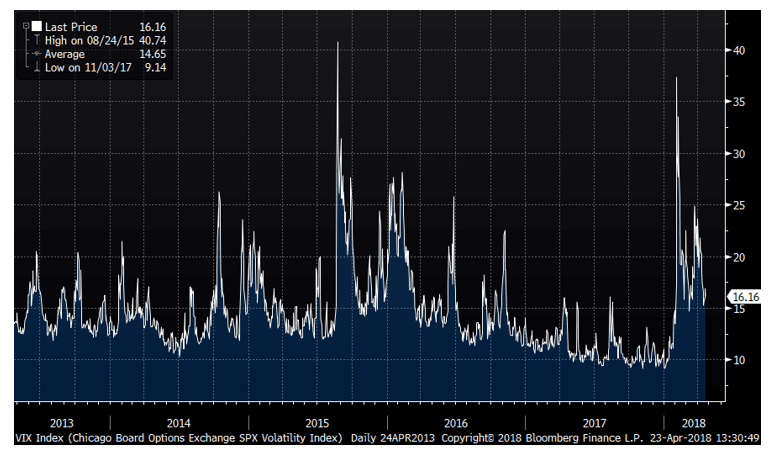

The first quarter of 2018 began much the same way 2017 ended: with markets steadily grinding higher daily, while expected volatility plummeted. It seemed almost natural as analysts updated and revised higher their bottoms up and top down estimates to account for the impact of the Tax Cuts and Jobs Act of 2017. Alas, the trend was too good to be true and swiftly reversed without even a modest pause. The VIX, a popular measure of expected volatility in markets, went from exceedingly placid levels to its most extreme positioning in years over the course of a few days. So harsh was the sudden surge in volatility that two popular volatility ETFs essentially perished in the storm: XIV and SVXY.

Q1 hedge fund letters, conference, scoops etc

In markets, volatility clusters; it does not mean revert. This distinction matters, but is often mistaken. Mean reversion implies that an average level of volatility exists and exerts some degree of gravity when conditions move too far from the mean. In contrast, as Benoit Mandelbrot first observed, with clustering, “large changes tend to be followed by large changes, of either sign, and small changes tend to be followed by small changes.” [1]

Many pundits have called this upswing in volatility a natural reversion following 2017s exceedingly low levels of volatility. This lends to the belief that the volatility we are now seeing is only temporary. Instead, when thinking of this as a cluster, what we have witnessed since February of 2018 is what should be called “regime change” and the expectation from here on out should be that volatility will be persistently higher than what we have experienced over the past few years.

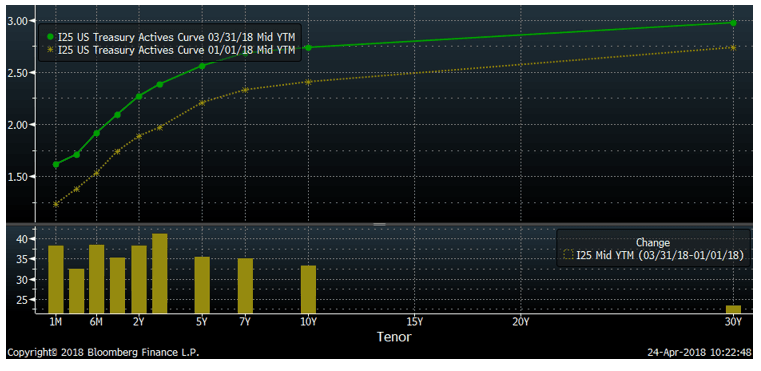

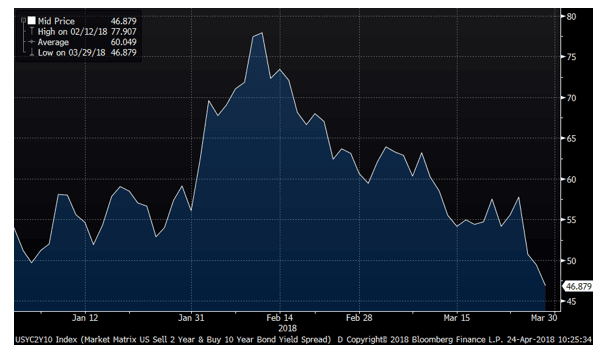

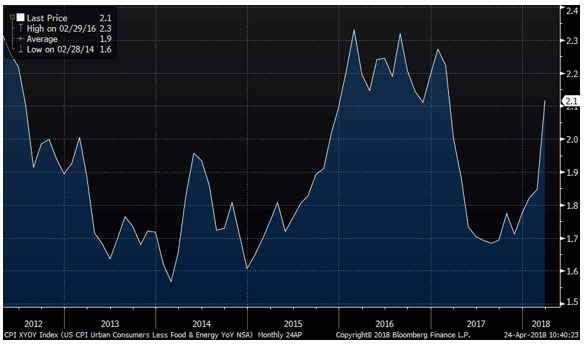

It’s challenging to isolate a specific cause for it, but in Q1 we believe that markets have grappled with a new reality that will remain, hence a regime change in volatility. Flash back to five years ago and the foremost risk in financial markets was the prospect of deflation. Central banks around the globe were either pursuing or commencing aggressive actions to ensure that deflation would not materialize. Just one year ago the risks were far more balanced—some argued that deflation might be the foremost risk and consequently, central banks should continue a dovish stance towards interest rates, while others argued inflation was the foremost risk and a “normalization” of interest rates was thus warranted. Today it is clear in the United States that a normalization is underway and as such, the interest rate curve took a mostly parallel jump higher (there was a degree of flattening between the two and ten year maturities but it was pretty modest during the quarter-as depicted by the 2nd chart below).

The Treasury curve:

The slope between the 2s and 10s:

Why is this happening? Look no further than core CPI. 2017 was “goldilocks” in markets for a reason:

There is good news and bad news out of all this and the two are interrelated. The bad news first: from here on out, the Federal Reserve Bank will continue raising interest rates as long as inflation is rising. Ultimately, the Fed will put the economy into a recession when inflation gets too hot for their tastes. The good news is that the Fed has far more tools and flexibility to deal with inflation today than it does deflation. A Fed-induced recession will be far more like the typical post-WWII recession than what we experienced in Financial Crisis. While the risk of inflation is real, its imminence and extent remain rather modest compared to historical norms. A recession is never fun for stocks, but with valuations comfortably within reasonable bounds the damage should be far more modest and the recovery swifter than the past recession. We do not know when this will take place, but we do know it is an eventuality that must be considered and find it helpful to think about how it should play out in advance. Given this outlook, we used the volatility to purchase two new positions, which we explain in more detail below.

The Power of Pricing Power:

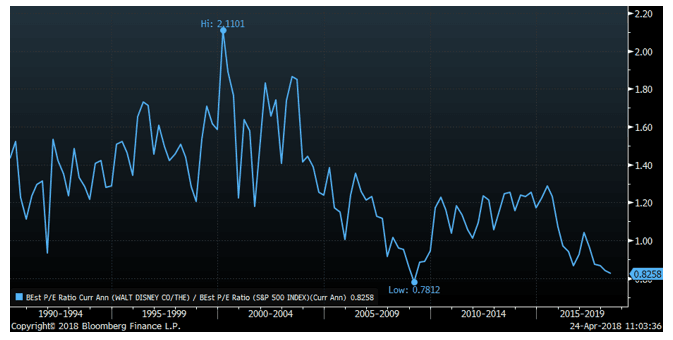

During the quarter, Disney announced it was raising single-day prices at its US parks by up to 9 percent. [2] With inflation reemerging as a risk for markets, companies that can raise prices faster than the rate of inflation become increasingly valuable in two respects: first is the obvious, as these companies can expand margins and make more money; second, the risk to these companies from an inflationary environment is far less, thus warranting a better relative cost of capital. One way to think about relative cost of capital is the P/E ratio of one company verse another. The company with a higher (lower) P/E ratio enjoys a lower (higher) cost of capital. Given what we have laid out above and Disney’s recent price action at theme parks, you might suspect that the relative cost of capital at Disney has been driven lower; however, as the following chart demonstrates, the opposite has been the case.

The blue line on the chart is the Disney forward P/E divided by the S&P 500 forward P/E going back to 1990. Historically, Disney has traded with a decent premium to the S&P. Since the crisis that premium has been less, but still existent. In the last two years, Disney has come to trade at a discount.

Our point above about the Parks is not exactly representative of the entire company, though it remains noteworthy. Parks and Resorts collectively account for one third of the company’s revenue base and EBITDA and one forth of operating profit. This is up nicely from 31% and 21% respective just five years ago. The big loser and focus of much attention here has been ESPN, which was over one forth of operating income five years but now represents about 15% of the total. ESPN is but one part of a broader narrative whereby people fear the end of the broadcast business as we know it and the colossal changes in the media industry.

We think these fears are both overblown and already discounted into Disney’s share prices. Plus, we think Disney with its lush trove of high quality franchises and content makes the company uniquely positioned to thrive in the push to a direct-to-consumer (DTC) relationship. DTC by nature is higher margin and less volatile than the traditional media business for how the relationship works via monthly recurring revenue subscriptions and by cutting out the middle-man in distribution. Some fear that Disney has been too slow and/or acting with too much sensitivity towards distribution. While we do think Disney should have moved faster, we do not think the window has shut by any means and the company’s complete acquisition of MLBAM was smart and necessary for creating a scalable and enduring platform.

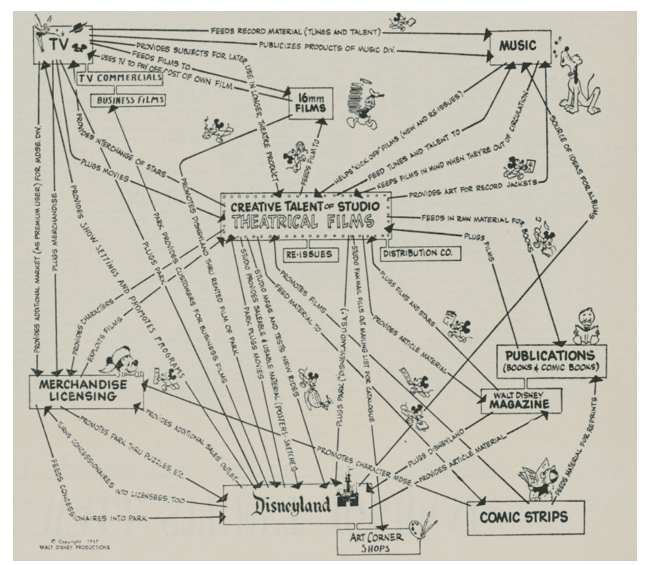

The penultimate read on Disney’s opportunity in DTC is Matthew Ball’s two-part piece on “Disney as a Service.” We encourage you all to check it out. [3] [4] The following image that Ball included in his piece is incredibly important. It is an “iteration of Walter Elias Disney’s corporate vision…codified back in 1957:”

This image demonstrates the flywheel that Walt Disney created within his company. As Ball explains, “Only two years after the company’s first theme park opened, Walt detailed an expansive vision for Disney – one where every segment of the business worked in concert. They would develop shared IP, foster shared creative talent and use shared managerial, promotional and financial infrastructure to tell stories that would define generations.” [5] This opportunity is even greater when a direct-to-consumer relationship is forged. Key to our bullishness on Disney is how deeply embedded these values are in the company’s culture. In fact, these values were essentially born with the company itself. It is a big part of why the recent acquisitions of Marvel Entertainment and Lucasfilm have been such immense successes for the bottom line. While many perceive Disney’s push to DTC as a wholesale strategy shift, it is more realistically a natural extension of an enduring corporate culture. We do not think “any” media company can pull off this transition and to that end, the uniqueness of Disney ultimately results in the company itself being a scarce asset that the market will reward in the long-run.

Data, “the new oil” hits an oil slick:

While news of Facebook’s shoddy data practices broke with respect to Cambridge Analytica and the 2016 election, we were patting ourselves on the back for having bought an under-the-radar data company playing an integral role in the online marketing ecosystem. Almost immediately after purchase, our shares in Acxiom were trading higher, until the last day of the quarter when Facebook decided to cut off Acxiom’s data broker as a third-party data provider on Facebook. The stock plummeted and at its worst was down over 40% from the prior week. Nonetheless, our conviction in Acxiom remained steadfast amidst the panic and we have since purchased more shares and dropped our average price accordingly.

This entire situation is one of the more unique and exciting ones we have seen in recent times. Before the Facebook news hit, Acxiom was lifting off on the heels of its intent to sell its legacy business—Acxiom Marketing Solutions—leaving its Connectivity segment (LiveRamp) as a standalone, pureplay growth company in an intriguing industry. Acxiom will surely lose some business from the Facebook change, but the vast majority of the value in this investment comes from the LiveRamp segment—a largely hidden jewel within the broader company. Acxiom acquired LiveRamp in 2014 and has scaled the business rapidly since.

LiveRamp is what is known as a data onboarder. Data onboarders help companies store, manage and use their data in constructive ways. A 2014 FTC report on data brokers defined “onboarding” as follows:

“Onboarding” refers to a process whereby a data broker adds offline data into a cookie (the process of onboarding offline data) to enable advertisers to target consumers virtually anywhere on the Internet. It allows advertisers to use consumers’ offline activities to determine what advertisements to serve them on the Internet.

Onboarding clients either (1) provide data about their customers to a data broker to facilitate the process of finding those consumers on the Internet to deliver targeted advertisements; or (2) use a data broker to identify an audience of consumers who are likely to share particular characteristics and find those consumers on the Internet to deliver advertisements. Three of the data brokers offer an onboarding product.

Onboarding typically includes three steps: (i) segmentation; (ii) matching; and (iii) targeting. [6]

There are elements of this definition that are not entirely accurate and nuances to how onboarding is deployed, but LiveRamp is essentially the only onboarder with robust offline to online capabilities. This being central to the FTC’s definition is demonstrative of how dominant LiveRamp is in the space. Importantly, it’s the kind of industry where network effects are key determinants of customer stickiness and growing value. The more data an onboarder has, the better its match rate will be (LiveRamp’s are the best) and the more use-cases that can be deployed on the platform. LiveRamp boasts a market share over 2x the next largest competitor and importantly, the key competitors including Oracle’s OnRamp (purchased in the $1.2b Datalogix acquisition in 2015) and Neustar are both heavily reliant on LiveRamp as key customers. Essentially, LiveRamp competitors cannot compete without access to LiveRamp itself and the role of competition has been relegated to either white labeling LIveRamp’s pipes or serving specific niches with unique, but not scalable value propositions.

LiveRamp makes money by charging its users subscription fees and tiered pricing depending on use. The majority of revenue comes from usage fees, and as such, the more use-cases LiveRamp can develop, the more it can grow its relevance and revenue base from customers new and old alike. Once the disposition of AMS is complete, LiveRamp will enjoy enhanced financial flexibility to deploy in developing and acquiring tuck-in applications that can expand the capabilities users will have on the platform. A recent example of such a move is the company’s acquisition of Pacific Data Partners to grow the B2B use-cases for LiveRamp. [7]

LiveRamp has been nurtured under smart, strong leadership. Scott Howe, Acxiom’s CEO, came to the company in 2011 from Microsoft, where he was the company’s top ad executive in charge of advertiser and publishing solutions, including Bing. As Howe explains, “The Axiom I walked into four years ago was really a legacy direct-mail database company but had developed some really great assets that could be extended to other channels and can be repurposed for the entire industry, and that’s the transition we’ve been making over time.” [8] Howe’s CFO, Warren Jenson, was an early CFO at Amazon where he is credited with helping lead the company to profitability in the wake of the dot com bust. The management team has been focused and determined in driving shareholder value and has held on to a material equity position in order to position for the upside they ultimately intend to achieve.

While we have adjusted our expectations for the full brunt of the Facebook hit, we think there are very real mitigants to this loss. Companies like General Motors which advertise on Facebook by nature rely on third party data—dealers sell the cars, not GM, so as such, GM needs to stitch together a profile of its own end customers. In the past, Facebook enabled Acxiom’s data to be sold directly on the platform.That will stop in the second half of this calendar year; however,this revenue can be replaced in the following process, by way of example:

- GM can now buy this data directly from Acxiom.

- GM can then create its own custom audiences, in its own files

- GM can upload those newly created customer audiences as “1st party data” for Facebook’s purposes

- Advertisements can be targeted exactly as they had been on Facebook before

LiveRamp’s revenue run-rate has grown from $16m annualized in Q1 of 2015 (shortly after Acxiom acquired it) to $224m annualized in Q3 of 2018. The average customer spends over $1.7m per year on the platform and revenue retention is at 110%. At the shares’ worst price on Friday, March 30th, we think LiveRamp itself was worth more than the entire company even though the legacy company will do around $130m in EBIT after accounting for the Facebook hit.

If the AMS business fetches 4-5x EBITDA, the company will get between $1 and $1.4 billion in proceeds. Despite the Facebook news, the Acxiom remains intent on selling its AMS business and focusing purely on LiveRamp. Should a sale not materialize (though the company sounds confident it will) they can consider a spinoff instead. One way or another, LiveRamp will come to be independent in the near future. It’s large enough, self-sustainable on its own cash flow generation, and poised to benefit from strategic flexibility and customer relationships that were limited by its corporate parenthood. Assuming AMS fetches the low-end of our expected proceed range, that leaves half of the company’s value to be accounted for by a $224m run-rate business growing at rates upwards of 40%, likely to grow in the mid-30s for the upcoming year, with the potential to reaccelerate growth with the strategic flexibility afforded by being a standalone pure-play. Our bear case on a sum of the parts is that Acxiom is worth $27 per share, base case is $40 per share and bull case is $58 per share. Looking out further, standalone LiveRamp has the potential to capture a large and growing total addressable market and will very likely catch the eye of the well-capitalized behemoths who facilitate online advertising with their software solutions. It’s only a matter of time before this Facebook news is far in the rearview mirror.

Thank you for your trust and confidence, and for selecting us to be your advisor of choice. Please call us directly to discuss this commentary in more detail – we are always happy to address any specific questions you may have. You can reach Jason or Elliot directly at 516-665-1945. Alternatively, we’ve included our direct dial numbers with our names, below.

Warm personal regards,

Jason Gilbert, CPA/PFS, CFF, CGMA

Managing Director

O: (516) 665-1940

M: (917) 536-3066

Elliot Turner, CFA

Managing Director

O: (516) 665-1942

M: (516) 729-5174

[1]Mandelbrot, Benoit. “The Variation of Some Other Speculative Prices” https://www.unc.edu/~fbaum/teaching/articles/MandelbrotCottonPrices1967.pdf

[2] https://www.reuters.com/article/us-disney-parks/disney-raises-prices-of-some-u-s-theme-park-tickets-idUSKBN1FV0YE

[3] https://redef.com/original/disney-as-a-service-why-disney-is-closer-than-ever-to-walts-60-year-old-vision

[4] https://redef.com/original/disney-as-a-service-pt-ii-and-the-future-of-the-house-of-mouse?curator=MediaREDEF

[5] https://redef.com/original/disney-as-a-service-why-disney-is-closer-than-ever-to-walts-60-year-old-vision

[6] https://www.ftc.gov/system/files/documents/reports/data-brokers-call-transparency-accountability-report-federal-trade-commission-may-2014/140527databrokerreport.pdf

[7] https://martechtoday.com/liveramp-moves-b2b-data-purchase-pacific-data-partners-211174

[8] https://www.forbes.com/sites/brucerogers/2015/11/16/scott-howe-positions-acxiom-to-be-data-driven-commerce-and-marketing-leader/#5a0df8c253d0

Article by Jason Gilbert, CPA/PFS, CFF, CGMA & Elliot Turner, CFA - RGA Investment Advisors