The author of this article is short Noble

Noble wasn’t the strongest or the smartest but its temptation, planning, co-opting with some actors and mindfuking of the Press, employees and markets- may allow them to execute highly reprehensible plans.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

- What strikes with Noble Q1-2018 unaudited results is their US$ 902,222 million NET LIABILITIES (A-L=E), a financial position usually associated to negative working capital company but reading Noble, it’s a -US$ 902M equity company with a US$648M positive working capital ??!

- The Net Fair value gains on commodity derivative is US$ +272M but how much of it is ever translated into cash, how to know the face value from Noble (…) except by negative assurance).

- The management doesn’t want some long-term coal contracts to be written down, this despite their negative cash conversion and it doesn’t want you to see these contracts.

- The performance is far worse than what management wants the market to know.

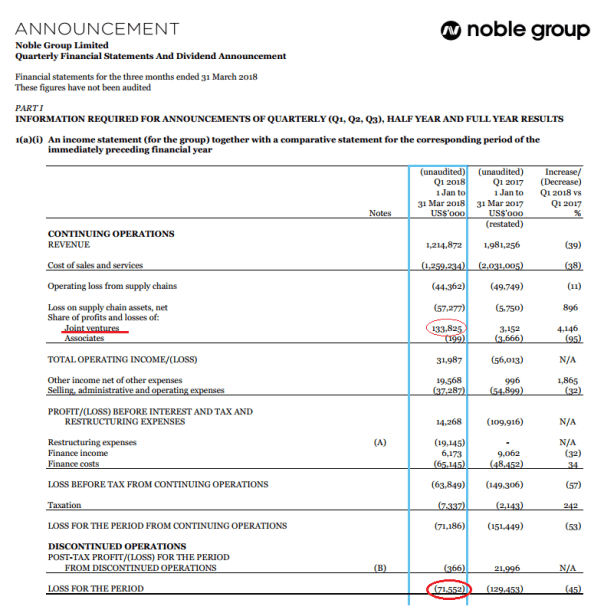

- Noble Q1-2018 real loss is

-US$ 205M.

Noble real loss is for Q1-2018 is -205M

“Share of profits and losses of joint ventures and associates increased to US$134 million as a result of the increase in fair value of the Group’s investment in Harbour Energy – which has benefitted from an increase in value of their asset portfolio”.

-Q1-2018 MD&A

(…)

What is Harbour Energy ?

What we refer to is US $10.2B pending takeover with a dilutive effect for Noble even if conclusive. What we observe is Noble increasing its fair-value into Harbour– in an attempt to completely obfuscate their financial results– despite it can’t never pretend to fund a 75 percent equity contribution into Harbour Energy.

http://www.harbourenergy.com/news/press-releases/harbour-energy-proposal-acquire-santos-limited

Noble is very confident about the business model better known as mark-to-infinity.

They’ve unstoppably used the trick in the past when Noble was building-up assets and now as Noble changes its shelf.

Article by The Noble Files