GreenWood Investors letter for the first quarter ended April 30, 2018;titled, “A Builder’s Approach To Public Markets.”

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

A Builder's Approach to Public Markets

Our first quarter letter for 2018 explores how our approach to investing allows us to find assets that are systematically shunned by our peers, despite having very high-quality characteristics.

Speed Read:

- Our quarterly performance was decent (+8.7%) but we are not satisfied and have tweaked our portfolio to a very high aggregate risk-reward ratio;

- Value-creation is similar to investing in that it requires a period of negative returns to generate future value. Very few public market investors are willing to underwrite value creation and we discuss the implications;

- Our business builders-approach to public markets has given us a very uncrowded set of opportunities, often with the same attributes of a unicorn, but with highly attractive valuations;

- We detail how our Coinvestment, TripAdvisor, Rolls-Royce, Bolloré and EXOR positions (well over half of our portfolio) are giving us outstanding businesses for either free or we are getting paid to take them.

Dear GreenWood Investor:

The fundamental function of investing requires laying out capital to enable a collection of people, things, and land to come together and create something out of thin air. While capital is a fundamental part of the value creation process, much to the chagrin of Wall Street, it is not the only variable. And in public markets, rarely does it ever create value.

The very nature of investment requires a period of negative cash flow to fund a future stream of cashflows. While your author is sure he's already bored half the readers with this simple lesson, it is worth remembering that nearly all our peers, and according to recent research, 78% of chief executives, have forgotten this very simple lesson. Not only have they forgotten it, but they have literally run away from it, in hopes of making the ephemeral quick buck.

This public-markets myopia has meant that young companies, which require significant early stage investments, have completely shunned public markets in favor of venture capital, which at least understands this fundamental aspect of investing. Because of this shortage of earlier-stage growth companies in public markets, investors have been deploying vast amounts of capital into these private markets. Some, like Masayoshi Son at Softbank, have literally been shoving capital down the throats of these entrepreneurs in a way that makes gavage look humane. These large investors, desperate for growth, have pushed private market valuations of emerging companies to atmospheric levels. In investing, it pays to buy investments from emotional or irrational sellers. In venture, the counterparty almost never is.

We do identify with the venture-capitalist mentally that invests in technology, employees, and infrastructure to support long-term value creation. But while most investors that share our philosophy are focusing on unicorns and Series E rounds, sometimes we feel like lone wolves in public markets. This relative isolation has given us a very large and less competitive global opportunity set. Because we force-rank these opportunities on two continuums of risk-reward (value) and conscious capitalist aspects (quality), we’ve been able to find opportunities that are uncrowded, or often despised, but share the same high-quality characteristics as their unicorn peers.

We look at quality differently than most of our peers, and focus more on conscious capitalist qualitative assessments. Since we are long-biased, this typically means we love companies that create positive economic externalities. Perhaps exemplified by our former Whole Foods investment, at their best, these businesses change the way industry operates, define new levels of customer satisfaction and expectations, inspire suppliers to innovate, and build healthier communities. Aside from generating better sales growth for the company, none of these aspects were showing up in the profit & loss (P&L) statement of Whole Foods. But they created a substantial competitive advantage for the company that built a very loyal ecosystem that could only be purchased, rather than duplicated. Of course businesses of this caliber rarely trade cheaply, which is why we rank our opportunities on both quality and value continuums.

Conversely, on the short-side, we have always been attracted to short companies that create large negative economic externalities, where the P&L of the business ignores substantial costs that are forced upon other players, or upon themselves eventually. The Canadian housing-related short we initiated in the second quarter will impose deep financial losses on the government for its reckless behavior at the top of the housing cycle in Canada. At a time when the housing market is showing signs of a material weakening, it is obfuscating this by taking market share, buying stock, and increasing dividends. We would prefer it to do so, as it only hastens its own demise.

Alternatively, we prefer to invest with companies that make friends everywhere they go. But the process cannot be that simple, as sometimes companies that do well for their stakeholders miss fundamental aspects of value creation and give too much away. Conversely, other companies like cigarette makers, have very powerful financial strength. Preventing investment errors in these fields also requires us to add other qualitative criteria to our analysis, such as understanding the competitive advantages, industry lifecycle, and investment runway. By and large, however, highly conscious businesses grow faster and generate more economic value than their counterparts. Accordingly, many of these businesses are given very high valuations that, for value-focused investors, make us move on.

Yet there are still many high-quality businesses hiding in plain sight, as economic value creation does not immediately translate to the short-term financial statements. Value creation, just like the fundamental nature of investing, almost always creates short-term expenses and negative cash-flow. In fact, the internal rate of return (IRR, a calculation that Wall Street created to obscure lackluster results) cannot be calculated without a period of negative cash-flow. Investment-driven expenses, which lower profitability, cause many companies to lose a lot of investors, particularly if the companies have already gone public and have long been out of the venture capitalists’ hands. When these companies find they need to reinvest in their businesses, momentum investors abandon these companies. This creates very attractive opportunities for investors willing to forgo near-term returns for a better long-term business. And because these new business units often burn cash or lose money, they are not only ignored by Mr. Market, but are actually given a negative value.

Rolls-Royce, which makes the world’s most efficient long-haul airplane engine, is taking substantial market share away from United Technologies’ Pratt & Whitney. In the earlier stages of an engine’s life-cycle, these engines lose considerable amounts of money in exchange for as many as twenty years of high-margin maintenance business. Because of this, the current cash generation of the company has been essentially breakeven. Given the FCF multiple was essentially infinity, investors had trouble valuing this company, particularly when we built the position, and sold shares down to levels which capitalized these industry-leading engine programs at a deeply negative valuation. The company’s marine business, which looks set to lead in autonomous ships, is also generating losses and requiring research & development expenditures. Accordingly, this division, which is now being entertained for sale or spin, is also being given a negative value by our dear friend Mr. Market. It will not sell for a negative value. While analysts are focused on how quickly Rolls-Royce will ramp free-cash-flow to £1 billion (6.5% implied yield), we are focused on how quickly the company can scale beyond £2 billion (13.2% implied yield) as it is enters a period of mature growth which will allow margins and cash-flow to slingshot in the other direction.

These losses on emerging technology and businesses are exactly what created the opportunity for us to build our position in our coinvestment at what we believe is >40x risk-reward ratio, in a business with substantial competitive advantages. The growth business, which has just achieved best-in-class customer satisfaction, is requiring capital and profit sacrifice to grow as quickly as possible. Given the earnings dilution and capital requirements, not only is an industry-leading asset at the infant stages of a long growth trajectory being given a negative valuation by the market, but it has led to deep pessimism among investors. Shares have declined significantly while the company has continued to build long-term economic value. We named the coinvestment fund the Builders Fund because in this instance, we have an ability to actually partner with the company to help it build its business for the long-term, while also removing the reasons for the widespread pessimism in the market.

It’s often the non-quantitative measures, or rather, non-financial measures, which are better signals for value creationat least in the very early stages. Thankfully, robots and most of Wall Street are focused on quarterly earnings, which cannot tell us anything meaningful about future prospects. CNBC sends out continuous alerts on whether or not a company has beat or missed expectations of earnings, exacerbating the casino-behavior of much of Wall Street trading. While eventual cash-flow is crucial to ensuring the success of any endeavor, focusing on other aspects has given us an advantage of looking where most humans and machines are systematically ignoring.

We are keenly focused on customer satisfaction in any business, and Net Promotor Scores (NPS). This view allowed us to see that not only did TripAdvisor have 2.6x the organic traffic than its next largest competitor (which has 22.7x the enterprise value), but it had a best-in-class NPS with a highly engaged ecosystem. The fact that it only monetized fractions of these users didn’t bother us as much as most pessimistic traders, and we saw it as a great opportunity.

These highly engaged online travel bookers created a positive externality that we believe the company can slowly but surely recapture. TripAdvisor has been giving far too much of this externality away to competitors in the past, and now that it is seeking to capture more of the customers’ activities, the Goliath of the industry, Booking Holdings, has become very restive and increasingly aggressive. TripAdvisor’s crown jewel, it’s Experiences business, required years of negative earnings and capital investment to build its market-dominant position. Until last year, it had been given a negative value by public markets as it was only profitable for the first time in 2017. If we owned 100% of TripAdvisor, we would keep this business on a high-cash-burn pace with all revenues reinvested into efforts to further widen its large lead ahead of competitors, as well as educate consumers through more advertising that they no longer need to wait an hour in line at the Louvre. We are in the very early days of queues disappearing at a tourist attraction near you.

TripAdvisor, Rolls-Royce, and our coinvestment, have been abandoned by investors who ran away as reinvestment in the business caused earnings contraction. But all of these companies are investing in their future, and the initiatives are already showing tangible evidence outside of quarterly earnings that their bets are paying off. At our entry points, we are effectively getting these hat tricks for either free or are getting paid to take them.

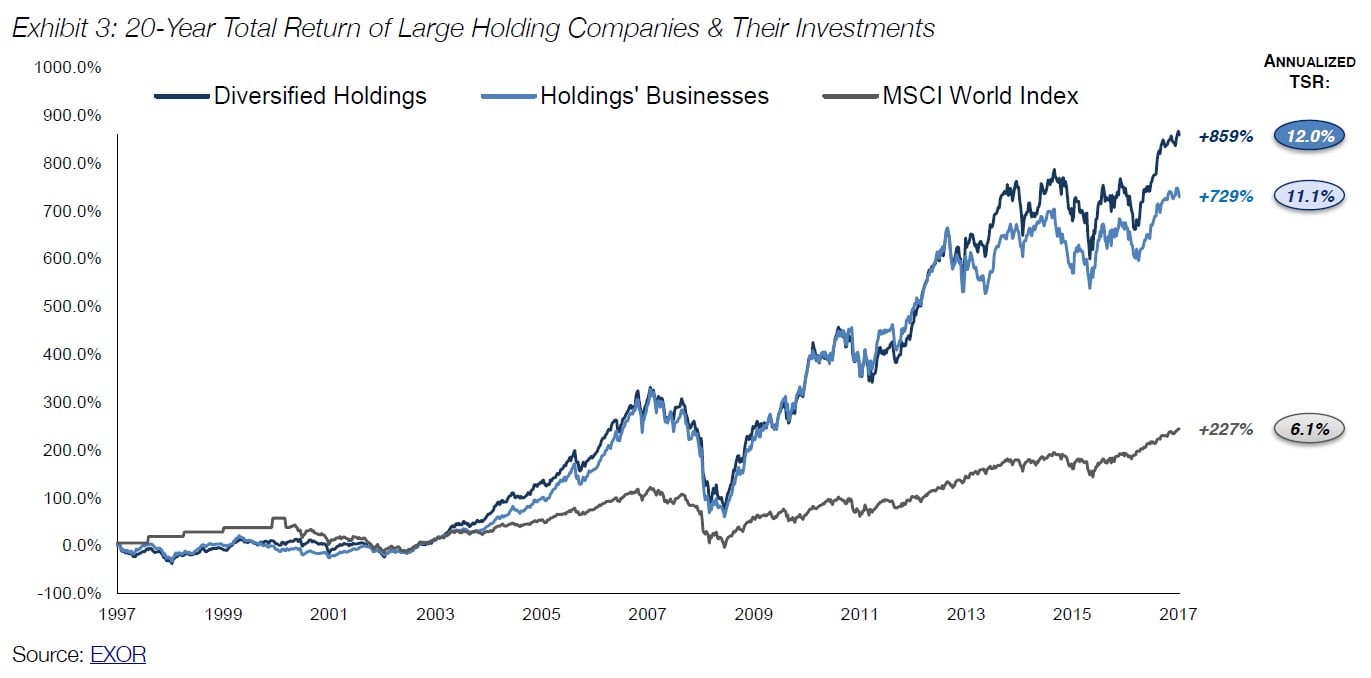

We are comforted that most of our portfolio companies have controlling shareholders that have allowed them to ignore the short-term vagaries of market “expectations,” and have invested in the future despite investment banking and sellside analysts urging action to beef up short-term earnings. These long-term-focused shareholders systematically beat their competitors who aren’t as lucky and are run by managers that have short-term incentives. These incentives, in turn, cause managers to guide their company strategy by giving post-graduate consultants and sell-side analysts exactly what they want- the quick buck. At the most recent EXOR investor day, CEO John Elkann showed how large holding companies, many of which are family-controlled, routinely beat the options gamblers.

While Elkann presented this chart to a friendly audience, his company, like most of the rest of our portfolio trades in a market that is less forgiving and understanding. Most European institutional investors are even more short-term oriented than their American counterparts as their UCITs fund investors redeem at the slightest suggestion of under-performance. This has created a very interesting dichotomy in European markets which are filled with family-controlled businesses that systematically invest for the long-term. The time horizons of investors and managers could not be more poorly mismatched. We believe this cruel irony has given us the opportunity to buy EXOR’s and Bolloré’s collection of compelling assets at 40-65% discounts to their underlying values, both in tax-advantaged structures. While European investors are myopically focused on what the current discount is relative to history, we prefer asking where the underlying assets are headed over the next few years.

Guided by sound long-term capital allocation, both of these holding companies own very attractive assets that we believe are poised to continue outperforming. Because holding companies trade at sizable discounts, and have astute capital allocators, buybacks of their stock over time will add increased outperformance to a group of assets we very much like. Through these discounted valuations, we are getting some of these assets for free. As Elkann has pointed out, EXOR’s current valuation offers us the chance to own one of the best reinsurance companies in the world for free and pay market price for FCA, Ferrari and CNH Industrial, all of which we think should double over the next few years.

Similarly, the discount at Bolloré, which has recently widened, means that we are paying market price for Vivendi and getting a global logistics and African port monopoly for free, not to mention a promising next-generation battery technology. Vivendi itself is quite interesting, as its own misunderstood valuation is offering shares of the company to market for the value of its cash and securities plus Universal Music Group (UMG). We get its media business Canal and its advertising business of Havas for free. As UMG’s growth is accelerating, it is preparing to make its market debut. While venture capital and momentum investors have focused on Spotify and have given it a higher enterprise value than Vivendi, they would do well to ask themselves which business model they would prefer.

Would they prefer UMG, which has a superior bargaining position and is soundly profitable, or would they prefer faster revenue growth that is not profitable in a business that has minimal competitive advantages? Yet, we haven’t invested in UMG or Vivendi. Through Bolloré, we have effectively invested in UMG and received Bolloré’s African ports and logistics business, generating €700 million in annual cash-flow, Canal and Havas, generating nearly €900 million in annual cash-flow, and some other businesses for free. Not only are these businesses free, but they are run by a very astute capital allocator. Most of our peers paradoxically would prefer Spotify, as the momentum and “buzz,” gets the adrenaline running more effectively.

Take-outs are equally exhilarating, but if the acquirer is any good, rob us of substantial upside. While the market was not happy, we were very pleased Flybe rejected a take-out bid for the company at a fraction of its fair value. The company, beset by European terrorist attacks and Brexit, has taken a longer time to achieve the substantially higher run rate profitability that its low-cost model allows. Yet, now that it is on the eve of directing its low-cost fleet to only the most profitable and mature routes, it is set for pronounced margin expansion in the years ahead as it digests the significant fleet growth from the past few years. While this blocked take-out and operational focus will lower our IRR, we would much prefer a 10x return that has taken a bit longer to achieve than we initially anticipated, than have a fancily high IRR.

We will continue this dialogue on a “Builder’s” approach to public markets in the coming days with a comprehensive update on Ocado, which even after doubling, is worth less than its unicorn competitors with unsustainable business models. While we have been publishing a high volume of research and have been doubling-down on our transparency with investors, we decided the time has come to stop sharing our portfolio composition with the general public. Accordingly, please find our portfolio composition and statistics on our Portfolio Information page going forward. We aim to refresh this every month, though heavy research sometimes delays these refreshes, as it has in recent months.

Our recent results have been decent, but they have been generated with tailwinds coming from Mr. Market. At some point, perhaps in the near future, we are headed for stormier seas. Our companies, many of which are backed by controlling shareholders, will have the temerity and dry powder to not only survive the coming headwinds but will opportunistically take advantage of such chaos. We are setting ourselves up to do the same by continuously honing and optimizing our opportunity set and helping our coinvestment build value agnostic to the economic cycle. Many of you that are reading this are builders yourself. I continue to be humbled by your partnership and look forward to building value together.

Annuit coeptis,

Steven Wood, CFA

GreenWood Investors

See the full PDF below.