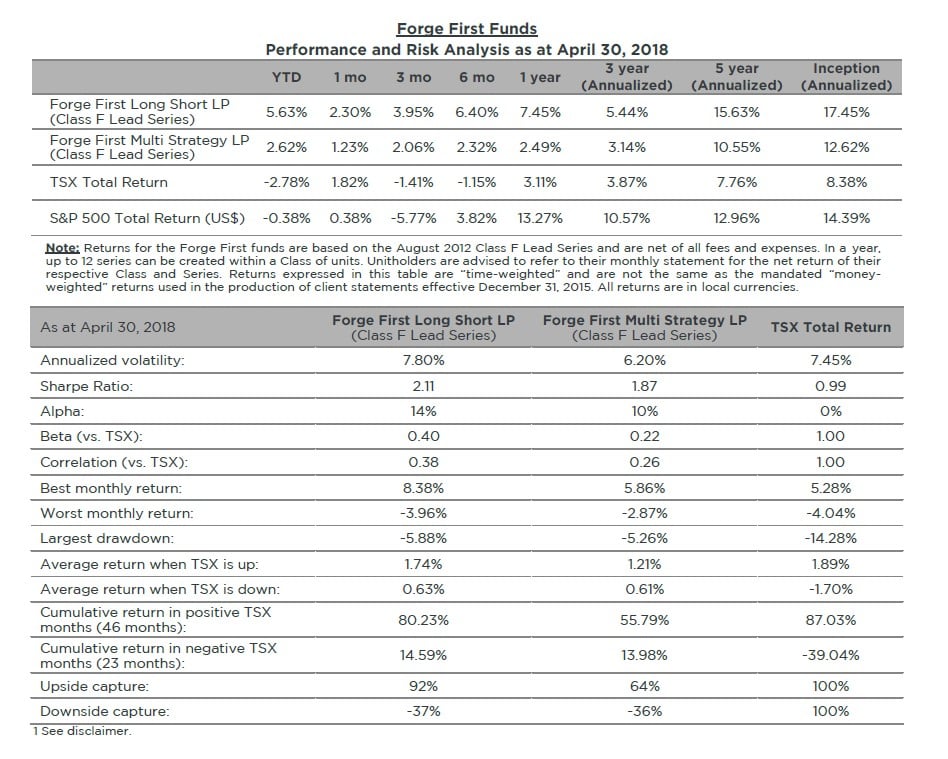

Forge First Funds commentary for the month ended April 30, 2018.

April experienced more of the same volatility in equity markets that has persisted for most of the year, and as a result, Forge First continued to play things safe, ending another month with positive net returns for investors. Expectations around inflation caused the US 10-Year Treasury yield to briefly touch 3% for the first time in over four years, oil prices increased 7% for the month (making commodities the top performing asset class), and of the 32% of S&P 500 companies having reported more than 75% exceeded expectations. The TSX Total return index generated a 1.8% return for April (-2.8% YTD) and the S&P 500 Total Return Index (US$) was up a modest 0.4% for the month (-0.4% YTD).

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

One trend we found troubling was the inability of large cap stocks to rally after either beating or meeting earnings expectations. Examples of this that were of particular note to us include Caterpillar, Google and JP Morgan, however the list is extensive. To this point, we were reminded for the first time in years that if stocks are trading poorly, it doesn’t matter how good your earnings look, you’re going to trade down. This phenomenon coupled with a mild first quarter rollover in leading economic indicators gave both us and the investing community at large reason to begin to question whether the best of this market and economy is now behind us. Is this as good as it gets? To be fair, for those fully invested in equities the “getting has been good” for some time now, and like every other cycle, this one too must come to an end.

As it relates to those leading economic indicators, our team relies on ISM and Markit Purchasing Manager’s Index surveys for guidance as we believe they give the best read you can get on the future direction of the economy. Released on April 24th, the Richmond Fed manufacturing survey was weak, missing estimates with a reading of -3 vs. estimates of 16 and a prior reading of 15. This was notable in that it represented the first contraction since September 2016. While the Empire and Philly Fed manufacturing surveys showed more stability month-over-month (15.8 vs. 22.5 for the Empire survey and 23.2 vs. 22.3 for the Philly Fed survey), the Richmond Fed contracted with higher wage pressures and lower received prices. Very broadly speaking, this represents a negative read through for margins. This data read bearishly but isn’t yet a trend in the US.

Without overloading you with data it should be pointed out that Markit’s manufacturing PMI matters because we believe it does a better job of capturing US domestic economic activity and GDP than the ISM’s index. Markit’s data has a solid 91% correlation with real GDP, while ISM sits at a still respectable 83%. Why do we point this out? Because while ISM data softened in April, Markit’s April national reading at 56.5 was the highest in three years, with the new orders component at the highest level in almost four years. So how will this seemingly contradictory data resolve itself over the coming months? Only time will tell but we believe there could be one final squeeze higher in stocks before the big rollover.

The caution of April spilled over into the first few days of May before strengthening meaningfully over the last few sessions. We aren’t complaining, but oil has gone ballistic on the combination of geopolitical risk (Iran/Venezuela) and seasonal tightness in crude markets. Fundamentally, we think demand strength is truly behind this move, but this is being exacerbated in the short term by the aforementioned issues. Somewhat concerning is the fact that the rise in oil and subsequent lift in gasoline prices has effectively offset the fiscal reform in the US that came in the form of tax cuts. For now, equity investors appear sanguine about the potential for escalation of trade wars (with China and now possibly with traditional US allies over the Iran nuclear accord) and also the potential escalation of a hot conflict in the Middle East. All of this adds to our belief that there are far too many balls in the air right now to invest aggressively in one direction or another, so we focus our attention on individual companies within our portfolios.

In those situations where markets appear directionless and the macro picture seems foggy, very much like the current environment, we find it is often best practice to reduce gross exposures and refocus on our bottom-up conviction rather than attempting to force conviction from the top down when it just isn’t there. With that in mind, we thought it would be helpful to share a new idea that we have been working on for some time that we believe we will be acting upon over the coming weeks.

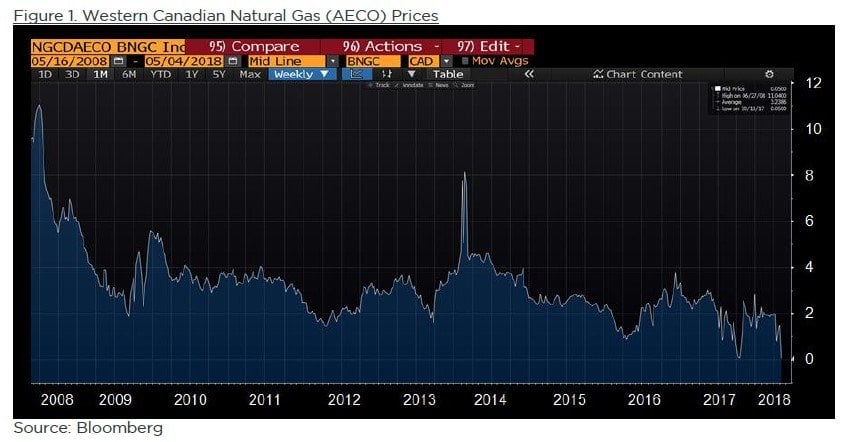

Canadian natural gas, which is perhaps the most unloved asset in the universe today, represents an interesting contrarian opportunity for investors willing to look past the second quarter of 2018; the quarter that we believe will represent the bottom in pricing for this hated commodity. Western Canadian natural gas, referred to as AECO, has been mired in an unrelenting 10-year bear market that we believe is on the precipice of ending. And while the natural gas quote you may see on your television reads US$2.75 per thousand cubic feet (mcf), as we type this, AECO is trading at C$.05 per thousand cubic feet (not a typo), as can be seen in Figure 1 below.

Yes, that very useful methane gas many of us use to heat and power our homes is essentially being given away right now. How did we get here? The long story short is that Canadian natural gas has been crowded out of its traditional end use market (the US) by growing US production while Canadian producers a) lacked the infrastructure to send that gas anywhere else and b) continued to produce even at a loss, because there are often coincident (more highly valued) hydrocarbons that help those producers turn a profit.

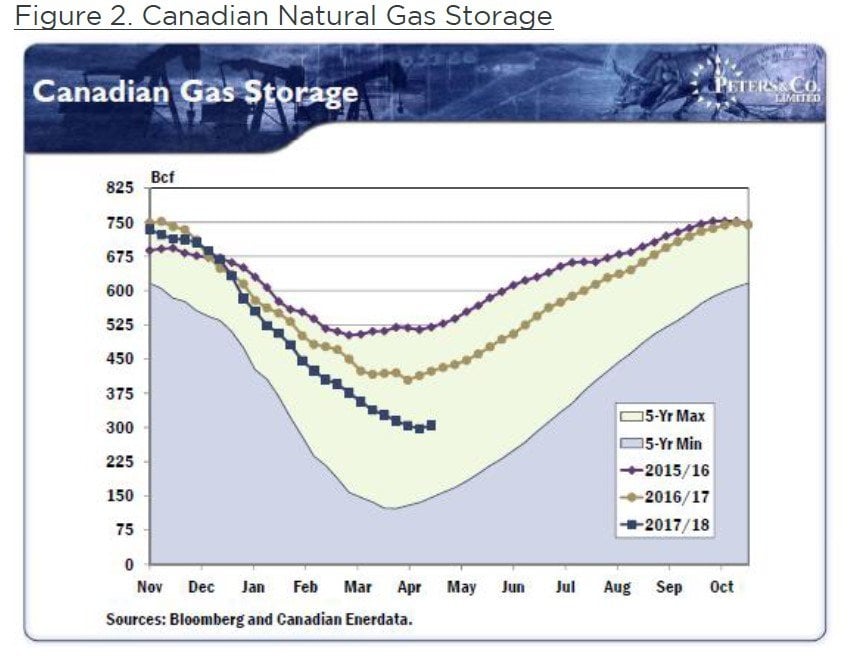

So here we are, prior to the frigid winter of 2017-2018 where Canadian inventories were frighteningly high. But after we all collectively took one for the team and froze all winter, inventories have now dropped below 5-year averages. This is where it gets interesting. Because of routine maintenance done by those companies that transport this gas, namely TransCanada Pipelines, for the time being there is currently nowhere for a lot of the gas to go. This has a twofold effect, 1) the price gets temporarily depressed as those still producing can’t store it themselves so they need to accept the best (very low) price they can get, and 2) many producers shut in production, and as a result the typical seasonal inventory builds that should be happening through May and June are likely to come in much lower than previous years. You can see the seasonal trends of gas inventories over the last three years in Figure 2 below, courtesy of our friends at Peters and Co.

We believe even an average winter could cause Canadian natural gas pricing to spike later this year as we could enter the withdrawal season with dramatically lower inventories than previous years. Should this play out the way we think it will, beaten down equities in the space look like exceptional value to us. Currently we only own one natural gas producer and that is Tourmaline Oil (TOU.CA). Tourmaline shares have already seen a nice bounce off the floor, but it is a company we believe in a few years will be worth multiples of where it is currently trading today. In our view, Tourmaline represents a rare combination of the best assets in the hands of the best management team at a company in a great financial position. There are other companies we are working on to add to this exposure and with the wildcard of a potential final investment decision on Shell’s LNG Canada (a topic that deserves its own commentary), we could see substantial demand growth in Canada over the coming years at a time when supply has been under-invested in (sound familiar?). Oil has had a very nice day in the sun since we were making a similar contrarian call roughly eight months ago, and we believe that natural gas from Western Canada represents an even more pronounced upside than oil did during the middle of 2017.

Each of our funds generated positive net returns during April, with Energy and Financials sectors leading the way for our unitholders. The net long exposure levels in each of the funds was mostly unchanged from their already conservative positioning in March – FFLSLP ended April 44% net long vs. 40% at the end of March and FFMSLP ended April 33% net long vs. 32% at the end of March. Some winners from the Energy long book include names such as Tamarack Valley Energy (TVE.CA), Whitecap Resources (WCP.CA), Trican Well Service (TCW.CA), Parex Resources (PXT.CA), and Tourmaline Oil (TOU.CA), where in Financials names such as JP Morgan Chase (JPM.US), Equitable Group (EQB.CA), and Visa (V.US) contributed to April’s positive performance. On the short side, names such as DHX Media (DHX.B.CA), Canaccord Genuity Group (CF.CA), and Enbridge (ENB.CA, position now covered) and CI Financial (CIX.CA) were some of the positive contributors to April’s return. We continue to have a positive view on Energy names with it remaining our largest weight in each of the portfolios (approximately 17% net long in FFLSLP and 11% in FFMSLP).

In conclusion, we think we are at the point in the market cycle where it makes sense for investors to look more closely at their asset mix and consider allocating to long/short strategies. Just as when it may make sense to have greater “long only” equity exposure at the bottom of a cycle, after 9 years of a bull market fuelled by quantitative easing and with substantial gains generated for equity investors over this period, it may now make sense to reallocate a portion of that equity exposure to solutions that can participate should markets go higher but also protect some of those hard-earned gains via a diversified shorting strategy should markets decline. We don’t know when the next recession will be, but history has shown it’s better to be positioned too early than too late.

Please do not hesitate to reach out to us if you wish to learn more about how our strategies can complement and lower volatility in your investment portfolio. As always, we welcome any feedback, and for more information please visit our website at www.forgefirst.com.

Thank you,

Daniel Lloyd Portfolio Manager

D: 416-597-7934

Andrew McCreath, CFA President and CEO

D: 416-687-6771

See the full PDF below.