Article by RCM Alternatives

Don’t look now, but it appears everyone’s talking about commodities these days. The latest is Zerohedge pointing out that more than half of the commodities listed in the GSCI Commodity index are now in backwardation: a rather marked shift from most of last year.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Goldman: we calculate that 13 out of 24 commodities are in backwardation. pic.twitter.com/bxk3rREmxt

— zerohedge (@zerohedge) May 1, 2018

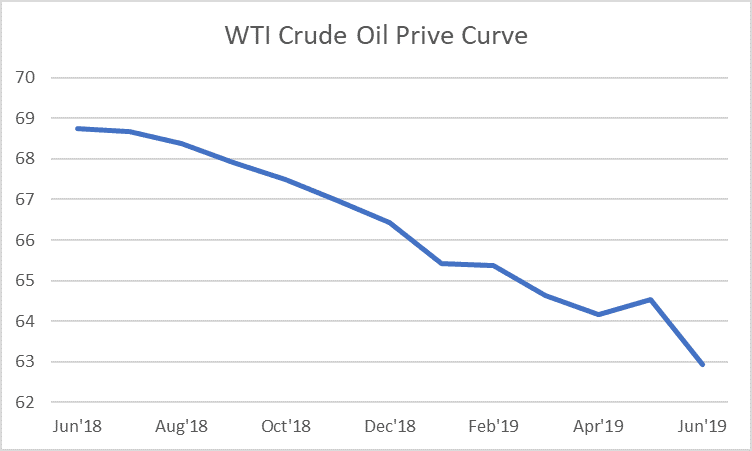

For those that don’t know, Backwardation is a futures market term defining a period where the further out contracts are priced lower than the nearer term contracts. Contango, its opposite, is where the further out contracts are priced higher than the nearer term contracts. Remember, this isn’t Apple’s stock price with its single price quote. There are multiple futures contracts for each market – with each contract expiring at specific dates, and many different ‘contract months’ for each commodity futures market. For example, you can trade May 2017 Crude Oil, or March 2018 Crude Oil, or December 2020 Crude Oil – where you pay a price today for delivery of 100 barrels of Oil at a future date. Plotting out the price of each contract month’s price is what’s called the futures price curve. Here’s an example of WTI crude futures contract price on a price curve.

(Past performance is not necessarily indicative of future results)

As you can see from Zerohedge’s tweet of the Goldman Sachs chart, the markets in contango (blue) have slowly been turning to red (backwardation). All of the energy markets (WTI Crude Oil, Heating Oil, Gas Oil, Brent, and RBOB Gasoline) except for Natural Gas are in backwardation and since most of the long-only commodity indices get most of their exposure from the energy markets, this could be a good sign for them. Why? For the same reason Contango is bad for them. The buy and hold indices actually can’t just buy and hold, they have to buy and roll, buy and roll, over and over. When a market is in backwardation, they end up selling the more expensive front month and buying the less expensive next month, creating what’s called a roll yield.

For Commodity Trading Advisors (CTAs) going long those commodity markets in backwardation, the roll yield can be a boost for performance, adding return simply by holding the position. Tack on a recent uptrend in the U.S. Dollar (which raises the prices of commodities since they are valued in the dollar) and there’s a great potential for gaining money on long trends in the commodity markets this year.

But before you go googling the best energy ETFs, we encourage you to look at “4 More Realistic Ways to Invest in Oil” and “How to play a bounce in Oil – Hint: (Not USO)” followed by “Commodity ETFs are a bad long term Bet – Duh.” Backwardation will help – but it’s also not a permanent state of affairs. The markets could just as easily switch back to contango, creating that roll cost which eats up long exposure in commodity ETFs. Adding unique return drivers like commodities to your portfolio is important, but there’s a whole bevy of factors to consider before jumping in (volatility and low returns being chief among them). When the headlines start praising commodities after calling them “dead” no so long ago; it’s probably worth a look – but look for exposure via a dynamic long and short investment like those highlighted in our Ag traders collection.