Key Metrics

[REITs]Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Overview & Current Events

Aqua America is a water and wastewater utility company that, through operating subsidiaries, serves more than 3 million customers in the states of Pennsylvania, Ohio, North Carolina, Illinois, Texas, New Jersey, Indiana, and Virginia. The company was founded in 1968 and has grown to a market capitalization of $6 billion. Aqua America has increased its dividend for 25 consecutive years, which qualifies it to be a member of the Dividend Champions.

In late February, Aqua America reported (2/27/18) financial results for the fourth quarter of fiscal 2017. In the quarter, revenues increased by 3.3% and earnings-per-share increased by 7.1%. The company’s full-year financial performance was not quite as strong. Aqua America reported a 1.3% decline in revenue and a 2.3% increase in earnings-per-share. The company’s revenue decline was primarily driven by decreases in water consumption and market-based activities.

Aqua America also introduced financial guidance for fiscal 2018 with the release of its fourth quarter financial results. The company is expecting to invest $500 million in infrastructure investments for the fiscal year, generating customer growth of between 2% and 3%. In addition, Aqua America is expecting to spend a total of $1.4 billion on capital expenditures through 2020 in existing operations. Most importantly, Aqua America is expecting to generate between $1.37 and $1.42 of earnings-per-share in the upcoming fiscal year.

Growth on a Per-Share Basis

Aqua America has compounded its adjusted earnings-per-share at a rate of 9.8% per year over the last decade. Looking ahead, we believe that the company’s growth will likely moderate as near-double digit earnings growth is difficult to sustain for any regulated utility business. Instead, we believe that Aqua America is likely to deliver 6% earnings growth over full economic cycles. The company is forecasting earnings-per-share of $1.40 (at the midpoint) in the upcoming fiscal year. Applying a 6% growth rate to this figure allows us to compute a 2023 earnings-per-share estimate of $1.87.

Aqua America’s historical growth strategy has been to acquire smaller water utility businesses and integrate them into its vast operations. The company’s investor relations page proudly states that “its aggressive growth-through acquisition strategy has resulted in nearly 200 acquisitions and growth ventures in the last ten years.” We believe that more acquisition-based growth is likely for Aqua America moving forward.

Valuation Analysis

While we are usually hesitant to publish research that deviates significantly from historical base rates, we believe that Aqua America’s 10-year average price-to-earnings ratio of 22.6 is significantly higher than where the water utility ought to be trading. Instead, we believe that fair value for a company like Aqua America lies somewhere around 18 times earnings. If the company reverts to a price-to-earnings ratio of 18 over the next 5 years, this will reduce the company’s annualized returns by 6.1% during this time period.

Safety, Quality, Competitive Advantage, & Recession Resiliency

Aqua America’s balance sheet has been about 70% debt over the last decade, with very little change in its leverage level. The company’s interest coverage has also been quite stable, typically ranging between 3 and 4. We note that the stability of a regulated utility business model means that the company can safely operate with a lower interest coverage ratio than its peers in other sectors. The same is true for other utility businesses.

Aqua America’s competitive advantage comes from its entrenched position in a highly capital-intensive and regulated industry. The company’s fee hikes must be approved by a governmental regulatory authority, and it has invested billions of dollars into its network of infrastructure assets. For prospective competitors in the water utility space, these barriers are highly discouraging, which limits Aqua America’s competition and leads us to believe that the company will continue to be a profitable business for decades to come.

Final Thoughts & Recommendation

America’s presence in the water utility industry gives it a higher level of stability than almost any other company in our investment universe. With that said, the company is overvalued at current prices. Our conservative estimates of Aqua America’s future total returns are resoundingly lackluster. Accordingly, we recommend that investors avoid this stock for the time being, instead looking elsewhere for opportunities to add to the utility portions of their investment portfolios.

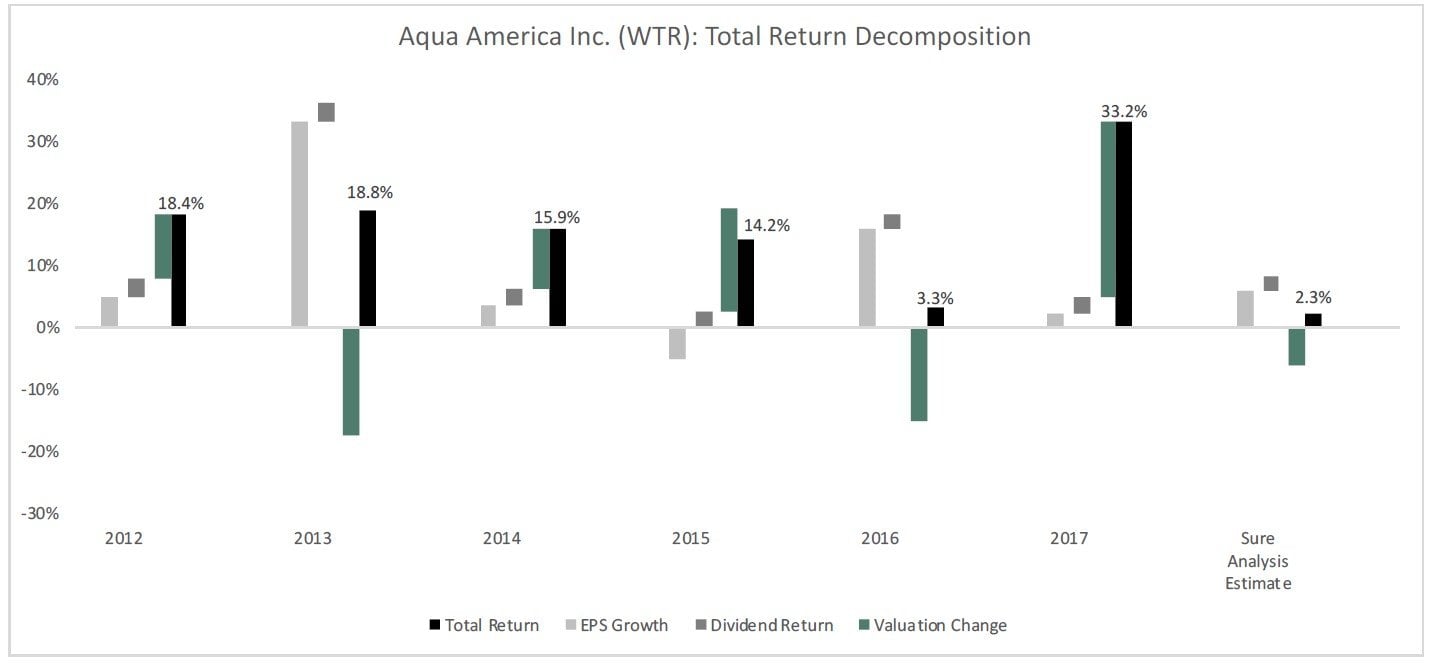

Total Return Breakdown by Year

Article by Nick McCullum, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.