No ordinary business can increase its dividend payments for 25+ consecutive years.

It takes a high quality company with a shareholder friendly management to accomplish this feat. But a long dividend streak alone doesn’t indicate a good investment moving forward….

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

In fact, we are projecting the 3 companies below to actually deliver negative returns over the next 5 years - even though they've been increasing their dividends for 25+ consecutive years.

That's because each is significantly overvalued. These companies' growth and dividend prospects just do not make up for their poor valuations.

Key Metrics

Overview & Current Events

West Pharmaceutical Services manufacturers packaging and components involved in the distribution and application of pharmaceuticals. The company’s products include Zenith Crystal, a medical glass alternative, and SmartDose, an automatic medication delivery system. West Pharmaceutical was founded in 1923, is headquartered in Exton, Pennsylvania, and trades with a market capitalization of $6.3 billion.

In mid-February, West Pharmaceutical reported (2/15/18) financial results for the fourth quarter of fiscal 2018. Revenues increased by 8.7% year-on-year, while constant-currency organic sales increased by 4.5% (which includes the impact of the deconsolidation Venezuela operations as well as significant hurricane-related operational shutdowns). On the bottom line, adjusted diluted earnings-per-share increased by 18.5%. Earnings growth was driven by double-digit sales growth in the company’s Biologics market unit and high-single-digit growth in the Generics market unit.

In the same announcement, West Pharmaceutical also announced a restructuring program aimed at streamlining its manufacturing network. These changes, to be implemented over the next twelve to twenty-four months, will require non-recurring restructuring expense in the range of $8.0 million to $13.0 million and additional capital expenditures in the range of $9.0 million to $14.0 million. Once completed, the plan should provide annualized cost savings in the range of $17 million to $22 million. For context, West Pharmaceutical generated $151 million of net income in fiscal 2017.

Growth on a Per-Share Basis

West Pharmaceutical projects long-term organic sales growth of 6%-8%. We believe this rate is overly optimistic – the company’s revenue has grown at 4.8% per year over the last 9 years. On the bottom line, West Pharmaceutical has compounded its adjusted earnings-per-share at a rate of 10.0% per year between 2008 and 2017, although this includes a significant 46% jump in 2017. Moreover, the company is expecting earnings growth of just 2.5% this year. We believe that long-term earnings-per-share growth of 7% is a reasonable estimate for West Pharmaceutical. The company’s growth will come from higher revenues, but also from a more favorable product mix. Its two operating segments have very different profitability profiles: the Proprietary Products segment reported an operating margin of 19.6% in the most recent fiscal year while the Contract-Manufactured Products segment had margins of just 13.3%. Accordingly, a focus on driving revenue growth in the Proprietary Products will be key to the company’s earnings growth moving forward.

Valuation Analysis

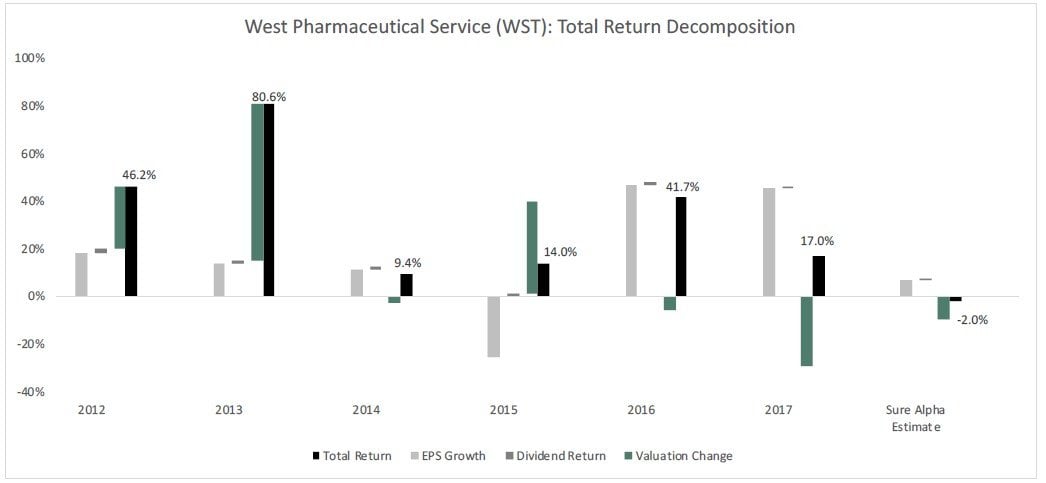

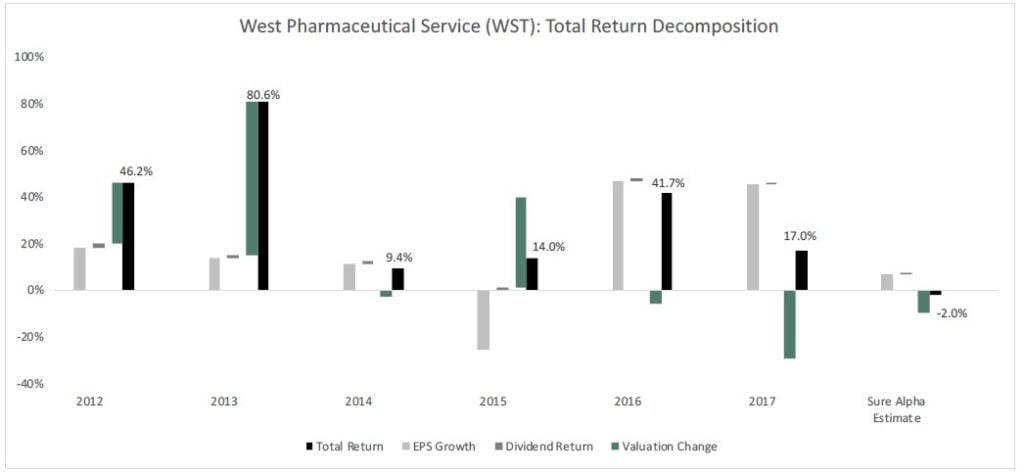

West Pharmaceutical’s most recent quarterly earnings release provided initial earnings guidance for fiscal 2018. The company is expecting to generate adjusted earnings-per-share of $2.80-$2.90 during the twelve-month period. Using the midpoint of this guidance band ($2.85), West Pharmaceutical is trading at a price-to-earnings ratio of 29.9. This is well above the company’s long-term average price-to-earnings ratio, which has trended around 18 during the last decade (using the median, to avoid the outsized impact that 2015 and 2016’s outlying figures will have on the dataset). A price-to-earnings ratio of around 18 is also close to what other similar healthcare businesses trade at. A valuation reversion to a price-to-earnings ratio of 18 over a 5 year period would impair this stock’s future returns by 9.7% per year, removing all of the returns generated from business growth and dividend payments (and then some).

Safety, Quality, Competitive Advantage, & Recession Resiliency

West Pharmaceutical’s presence in the healthcare industry automatically provides the company with a level of resistance to economic recessions. From a financial perspective, West Pharmaceutical is well-positioned to endure any industry volatility in the near-term due to its conservative balance sheet. The table above shows how West Pharmaceutical’s quality metrics have steadily improved over the years. Interest coverage has expanded from the high-single-digits to over thirty, while the company’s debt-to-assets ratio has declined from nearly 60% to almost 30%.

Final Thoughts & Recommendation

West Pharmaceutical Services has an entrenched position in a niche part of the healthcare industry. The company’s business model of manufacturing unglamorous components of the drug distribution chain is appealing because it benefits from the recession resiliency of the healthcare industry without attracting the competition of its more exciting sector counterparts (like biotechnology).

With that said, we cannot stomach the company’s current valuation. Healthcare stocks – even healthcare stocks of the highest quality – are trading around 18x earnings right now. West Pharmaceutical’s valuation is closer to 30. The quantitative impact that this has on our return estimations is extraordinary – valuation contraction will likely provide a near-double-digit headwind to the company’s annualized returns in the near-term. Accordingly, we recommend that investors sell this security and reinvest the proceeds into more compelling opportunities in the healthcare space.

Total Return Breakdown by Year

Article by Nick McCullum, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.