Wedgewood Partners commentary for the first quarter ended March 31, 2018; titled, “Hello Volatility, My Old Friend, I’ve Come To Talk With You Again.”

H/T Dataroma

"I have never seen a market this volatile to this extent in my career…Now that’s only 66 years…I've seen two 50 percent declines, I've seen a 25 percent decline in one day and I’ve never seen anything like this before." - John Bogle, Founder of The Vanguard Group

Review and Outlook

Our Composite (net-of-fees)i declined -0.65% during the first quarter of 2018. The benchmark Russell 1000 Growth Index gained +1.42%. The S&P 500 Index declined -0.76% during the quarter.

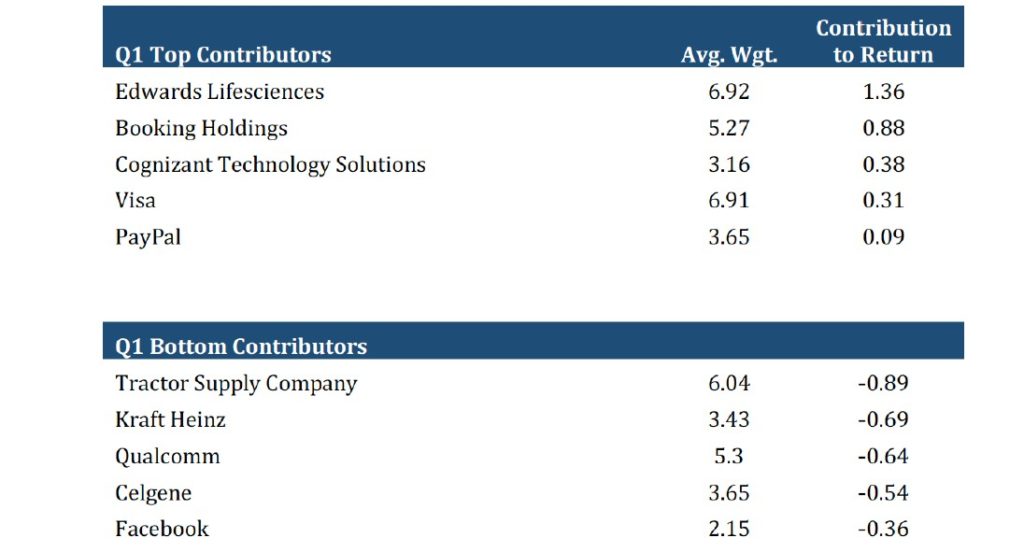

Top first quarter performance detractors include Tractor Supply, Kraft Heinz, Qualcomm, Celgene, and Facebook. Top first quarter performance contributors include Edwards Lifesciences, Booking Holdings, Cognizant Technology, Visa, and PayPal.

Stock market volatility returned with a thunderclap during the first quarter – consequently, we were quite happy – and quite busy. We sold T.J. Maxx and Verisk Analytics. We bought Facebook (in fact, we added to Facebook three times during the quarter). We trimmed Alphabet twice. We added to Apple, PayPal, and Ross Stores.

During the quarter we liquidated our positions in Verisk Analytics. Over the past several years, Verisk has gone outside its core competency of serving the Insurance Industry, in an effort to drive continued revenue and earnings growth. Although the Company has executed well in the insurance vertical, we are less impressed with the execution of their acquisitions in the energy, health care, and financial verticals. Those verticals still represent a minority of their profitability (they exited health care in 2016); however, we think the returns to date have not justified the balance sheet risk the Company has taken and would prefer management return capital to shareholders, rather than growing for growth’s sake. We reinvested proceeds into better opportunities that were presented during the brief bouts of heightened volatility.

We liquidated our positions in T.J. Maxx and used the proceeds to add to faster growing businesses. The Company continues to be exceedingly well-run and has pioneered many new concepts in the off-price retail industry and managed to expand the concept internationally, where price umbrellas have emerged. However, there are few markets where that off-price opportunity is better than in the U.S. We think T.J. Maxx is further along the maturity curve in the U.S., relative to another portfolio holding, Ross Stores, which also competes well within the off-price space. Ross continues to have ample room to grow its footprint in the highly lucrative off-price space through core concept expansion and potential entry into new, relatively underpenetrated retail segments, particularly in home.

Tractor Supply Company posted solid same-store sales (“comp”) growth of 4%, topping consensus expectations. Despite providing good comp guidance for the coming year, and a longer-term plan for operating margin expansion, investors ignored this and shifted their gaze to the Company’s lower near-term operating margin guidance. We think the recent selloff is overdone. Lower margins are being driven by investments in distribution and personnel capabilities, which were telegraphed a few quarters ago; and therefore they are not new developments. We continue to think the reinvestment of excess capital into new productive assets and workflows will result in sustainable longer-term sales and operating leverage. Further, gross margins continue to be steady, leaving little sign that there has been a meaningful change in competitive encroachment. For example, we think many of the Company’s most popular consumable, usable, and edible (CUE) items do not lend themselves well to fulfillment by the U.S. Postal Service; instead they’d do well to leverage Tractor’s brick-and-mortar locations. Tractor has long focused on niche merchandising and services – focusing on rural land owners with higher than average income – that fall outside the purview of typical mass-market retailers. We think expectations for the Company are quite low, as consensus expects flat margins for several years, despite the Company reaching a point where we expect they can leverage their overhead investments from the past several quarters and drive low double-digit earnings per share growth.

Notably, the benchmark Russell 1000 Growth Index capped its 10th consecutive gain and has finished higher during 20 out of the past 21 quarters. Despite this relentless appreciation, there was enough volatility this quarter to serve up a few good opportunities. Most of the volatility occurred in February and March but was not enough to repeal January’s meteoric gain. Most of our relative underperformance for the quarter was posted during January, as a few large weightings in the benchmark, namely Microsoft, Netflix and Amazon (the three roughly 10% of the total benchmark weighting), tacked on almost $250 billion in market cap in only 21 trading days and ended up detracting around 130 basis points from our relative performance for the full quarter.

We continue to be skeptical that the value the aforementioned businesses are creating is anywhere near enough to justify such price appreciation, but we are also well aware that this skepticism can be viewed as obstinacy. However, we continue to invest with the basic expectation that value creation is not just a revenue function driven by customer delight; but instead is a series of prudent and sustainable tradeoffs between revenue opportunity and the very real shareholder capital required to address that opportunity.

Further, when a business successfully manages that difficult balance, it is not necessarily sustainable for several years, let alone decades – or even centuries. We think a multi-century time horizon is patently absurd, yet there are exceedingly large pools of capital that invest in our universe using that framework.2 So although this capital continues to flow into the system, we continue to focus on stocks that reflect much more modest expectations. Of course, we also think our prudence will be rewarded in our lifetime, and even sooner – likely within this market cycle.

“A dangerous feedback loop now exists between ultra-low interest rates, debt expansion, asset volatility and financial engineering that allocates risk based on the volatility.” Volatility and the Alchemy of Risk, Artemis October 2017 In our recent Client Letters, we have chronicled the astonishing, historically low stock market volatility over the past few years. With the clarity of hindsight, it looks like 2017 was a capstone to the one-way direction bull market. In all due respect to Mr. Bogle, we believe Mr. Market just might be getting warmed up.

Speaking of volatility, this is what we wrote just last quarter:

Incredibly, the Great Bull Market of 2009-2017 momentum actually increased during the fourth quarter. Volatility in the stock market appears to be a thing of the past. (We are dubious.) 2017 set numerous records for historically low volatility in both the stock and bond markets. The fourth quarter represented the 20th positive quarter over the past 21.

The last negative quarter was two years ago when the stock market “suffered” a -6.6% “collapse” during the third quarter of 2015. In fact, if the current bull advances without at least a -5% correction by the third week in January, it will the longest such streak since 1928. Further, the stock market has not suffered just a -3% drawdown in over 13 months, by far the longest in history.

In 2017 alone, the stock market was up every month (a calendar year record) and now up 14 months in a row (a record). 95% of the trading days during 2017 had an intraday swing of less than 1% - another historic record. The Dow Jones Industrial Average set 71 new highs in 2017 – the most since 1910. The second most new highs (65) was recorded back in 1925. The last notable double-digit “correction” was six years ago way back in 2011. The stock market has recorded positive gains 9 consecutive years and 14 out of the past 15 years.

We need to repeat what we wrote in our last Letter; “volatility is a dear friend of the active, patient, value-sensitive investor. We miss it terribly.

Well. Welcome back, our old friend.

According to Jefferies, so far in 2018 (early April), the S&P 500 Index sustained its third highest sustained volatility this decade, the fifth +10% correction this decade. In fact, 24 of the past 43 trading days have experienced +1% S&P 500 moves. Over at the NASDAQ (QQQ), one week realized volatility reached a +52 volatility – the third highest this decade. In addition, QQQ registered 10 different +1% moves in just a single trading day (March 28th).

Recall that back in early February a volatility spike bludgeoned a few exchange-traded products to the point of forced liquidation. Such “products” allow speculators to bet on a volatility index such as the CBOE Volatility Index (VIX). As if speculating on the short-term rise or fall on stocks, commodities, or market indices themselves is daunting enough, imagine speculating on the speed of price movements themselves. Imagine betting on horses at the Kentucky Derby or drivers at the Indy 500. Now imagine betting on the speed of the horses or race cars during the race. Sounds nuts, right? Yep. It might too sound like some insignificant, perhaps even infinitesimal crap shooting game played in the far corners of financial markets by uber-speculators too, right? Nope.

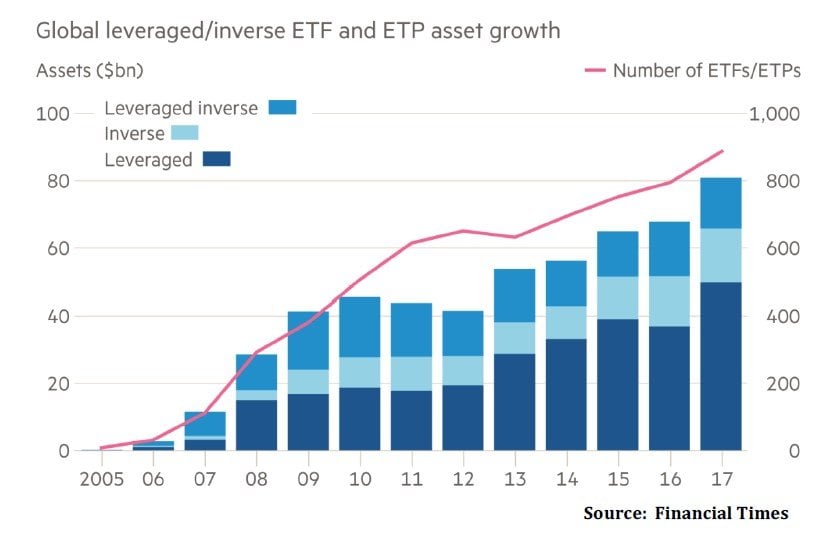

The Financial Times (FT) estimates that there is $80 billion in 883 global volatility-linked leveraged and inverse ETFs and ETNs. Further, the FT estimates that the plunge in the stock market was largely due to the automatic selling, triggered by a spike in volatility of up to $200 billion in such products. You read that right, automatic selling. Once the algorithmic machine selling starts, the viscous selling circle begets even more selling. Even more daunting is the lack of fundamental buyers stepping up to buy against the machines. Worse still, such structural fundamental buyers don’t exist. Here is an example of such exotica; VelocityShares Daily Inverse VIX Short Term ETN.

Such algorithmic products grew like weeds during the low-interest rate QE regimes of the global central banks against a backdrop of historically low asset price fluctuations and flourished for years in a sea of market tranquility. All told, Standard & Poor’s estimates that “financial engineering strategies” pegged to various algorithms of low-volatility still control from $1.5 trillion to $2.0 trillion of gasoline just waiting to be thrown upon even the smallest market fire. This is Mary Shelly’s Frankenstein redux of another, frightening order.

For some of our more senior readers, we confidently posit that such casino-like activity sounds all too familiar to the oh-so-sophisticated Portfolio Insurance crack-up circa 1987. We’ll let Warren Buffett continue the narrative from here. The following is excerpted from his 1987 Chairman’s Letter 30 years ago:

Let's look first at common stocks. During 1987 the stock market was an area of much excitement but little net movement: The Dow advanced 2.3% for the year. You are aware, of course, of the roller coaster ride that produced this minor change. Mr. Market was on a manic rampage until October and then experienced a sudden, massive seizure.

We have "professional" investors, those who manage many billions, to thank for most of this turmoil. Instead of focusing on what businesses will do in the years ahead, many prestigious money managers now focus on what they expect other money managers to do in the days ahead. For them, stocks are merely tokens in a game, like the Thimble and Flatiron in Monopoly. An extreme example of what their attitude leads to is

"Portfolio Insurance," a money-management strategy that many leading investment advisors embraced in 1986-1987. This strategy - which is simply an exotically-labeled version of the small speculator's stop-loss order dictates that ever increasing portions of a stock portfolio, or their index-future equivalents, be sold as prices decline. The strategy says nothing else matters: A downtick of a given magnitude automatically produces a huge sell order. According to the Brady Report, $60 billion to $90 billion of equities were poised on this hair trigger in mid-October of 1987.

If you've thought that investment advisors were hired to invest, you may be bewildered by this technique. After buying a farm, would a rational owner next order his real estate agent to start selling off pieces of it whenever a neighboring property was sold at a lower price? Or would you sell your house to whatever bidder was available at 9:31 on some morning merely because at 9:30 a similar house sold for less than it would have brought on the previous day?

Moves like that, however, are what portfolio insurance tells a pension fund or university to make when it owns a portion of enterprises such as Ford or General Electric. The less these companies are being valued at, says this approach, the more vigorously they should be sold. As a "logical" corollary, the approach commands the institutions to repurchase these companies - I'm not making this up - once their prices have rebounded significantly. Considering that huge sums are controlled by managers following such Alice-in-Wonderland practices, is it any surprise that markets sometimes behave in aberrational fashion?

Many commentators, however, have drawn an incorrect conclusion upon observing recent events: They are fond of saying that the small investor has no chance in a market now dominated by the erratic behavior of the big boys. This conclusion is dead wrong: Such markets are ideal for any investor - small or large - so long as he sticks to his investment knitting. Volatility caused by money managers who speculate irrationally with huge sums will offer the true investor more chances to make intelligent investment moves. He can be hurt by such volatility only if he is forced, by either financial or psychological pressures, to sell at untoward times.

Market participants have begun to react like something new indeed is afoot in the stock market. We can’t help but think that more and more investors are starting to realize that the recent unnerving volatility has little to do with the bulls’ and bears’ time-honored battling over cheap and expensive stocks.

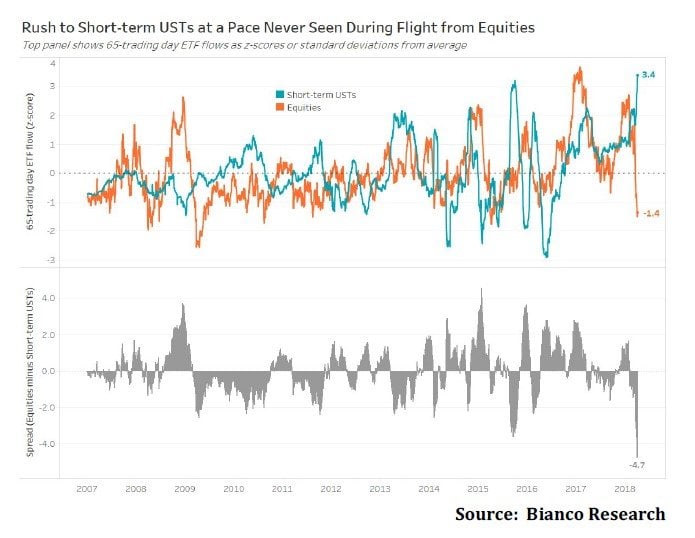

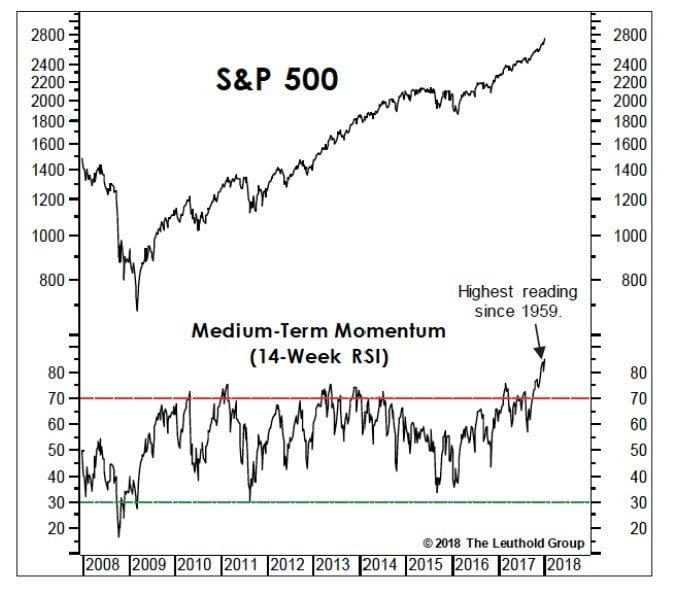

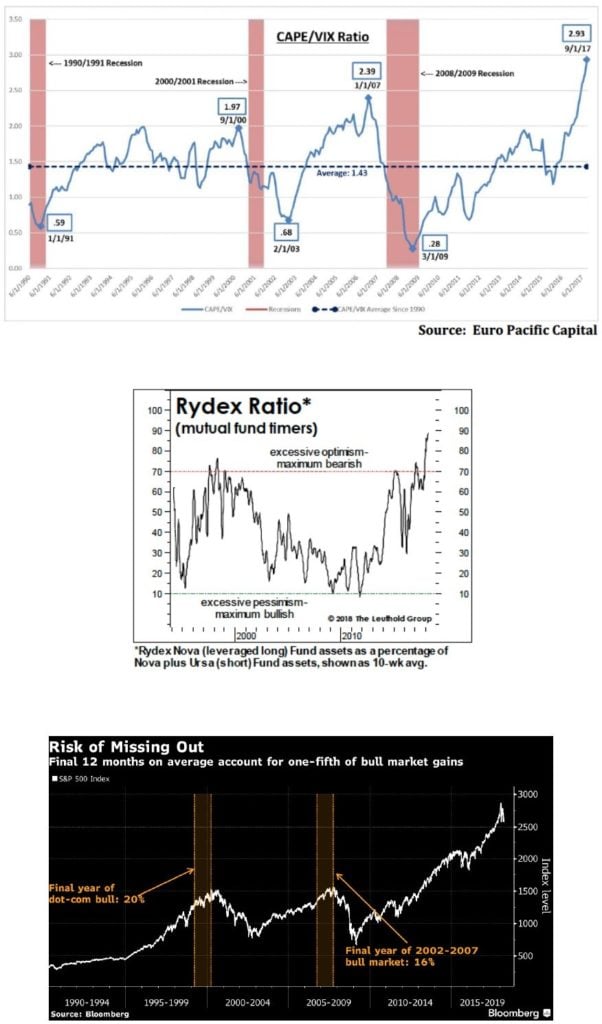

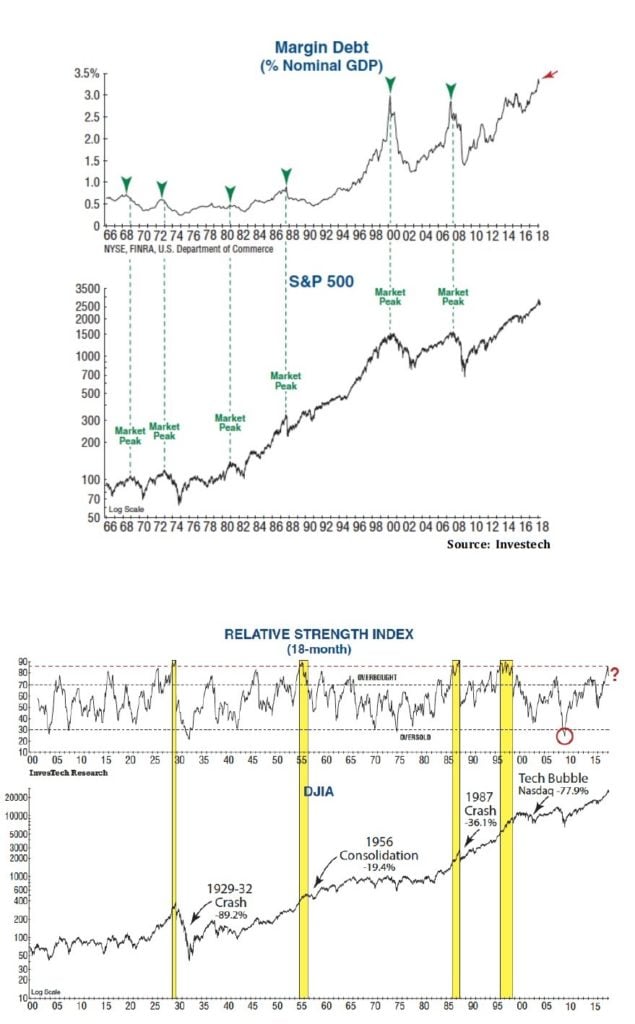

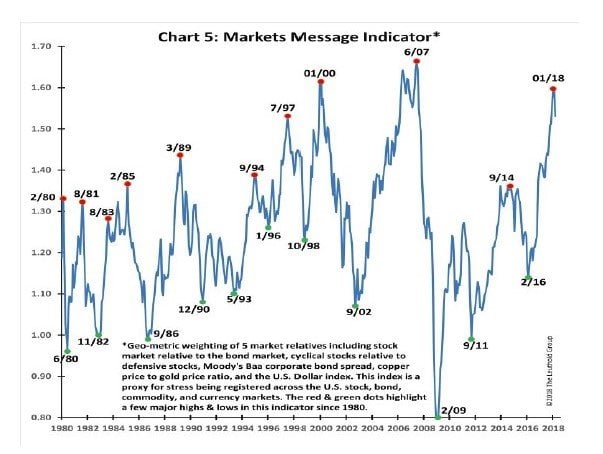

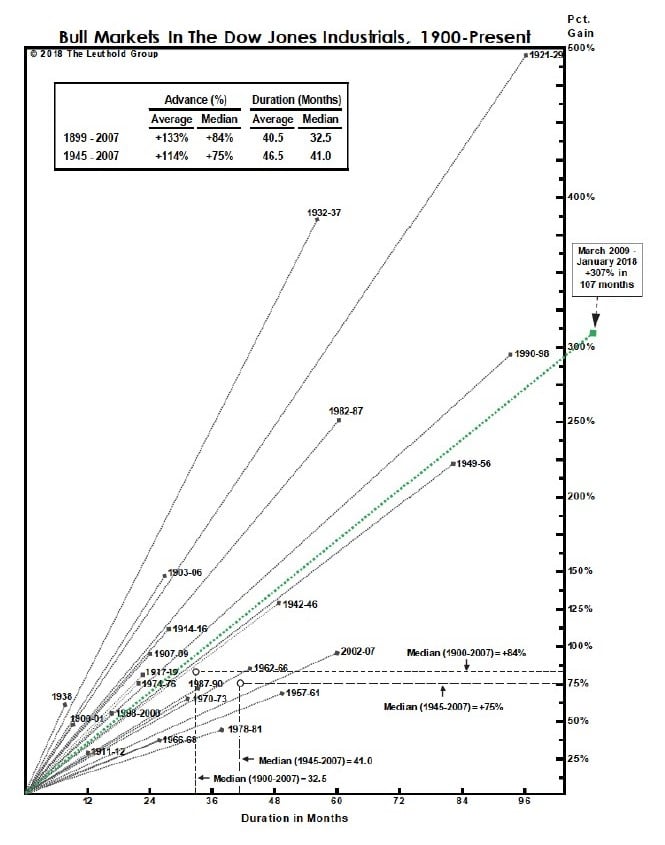

We certainly welcome our old friend volatility, as it serves up opportunity. However, we are still cognizant that every major index (and asset class) is near all-time, historic highs. That said, we are still able – because of our Focus – to construct a portfolio of growth companies with much better growth and profitability profiles, but at quite favorable valuations. Here are a few more graphics (including the first two from our last Letter) that speak to a current market environment that is quite ripe for many more numbing stock market flash crashes.

Last, but not least, the stock market’s recent bout of EKG-like volatility knocked the Great Bull Market of 2009-2018’s ninthth birthday celebration off the front pages.

See the full PDF below.