We recently completed a 2 page PDF research report on Walgreens (WBA).

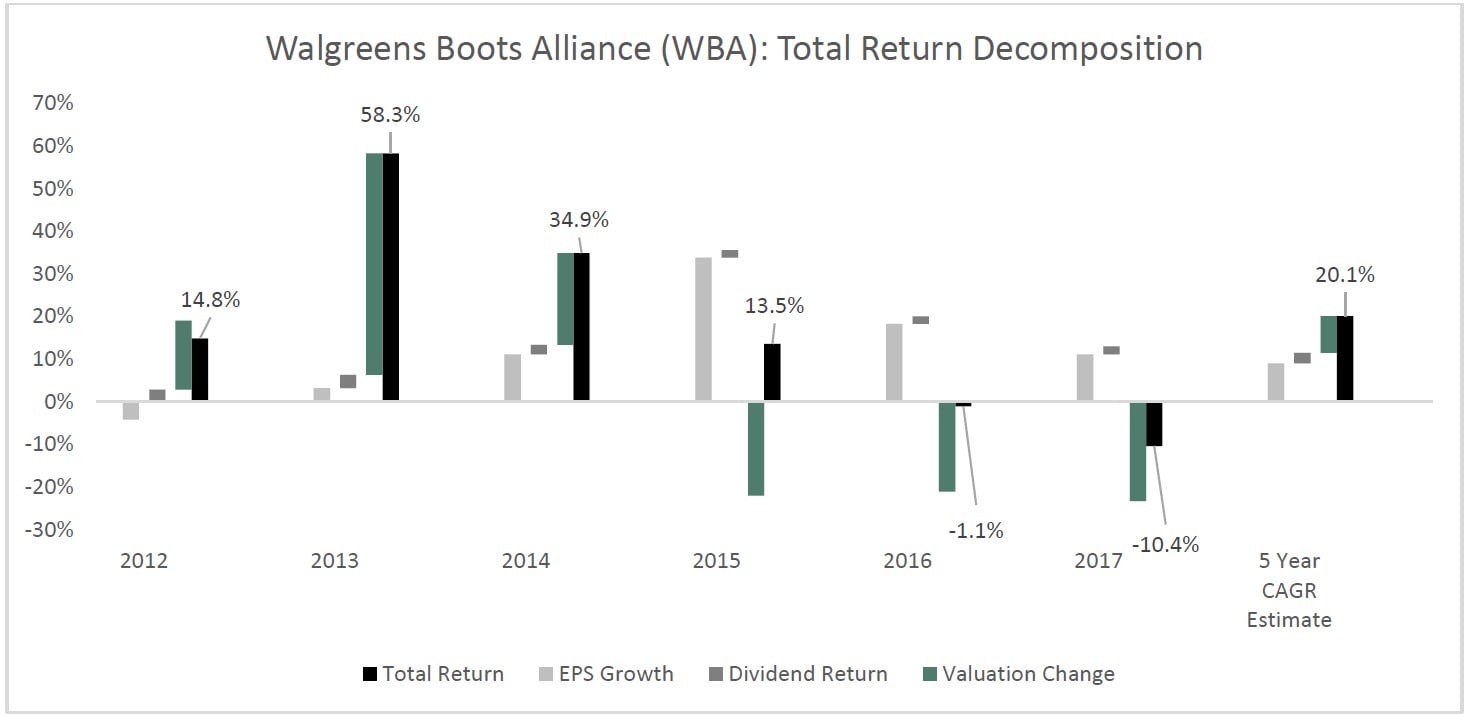

Walgreens is an interesting case. In 2015, 2016, and 2017 Walgreens delivered strong adjusted earnings-per-share growth… And in each year its valuation multiple declined.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

This has created a potential buying opportunity at Walgreens.

Walgreens is certainly a high quality dividend growth stock trading at a bargain price… But there are other dividend growth buys out there – even in today’s overvalued market.

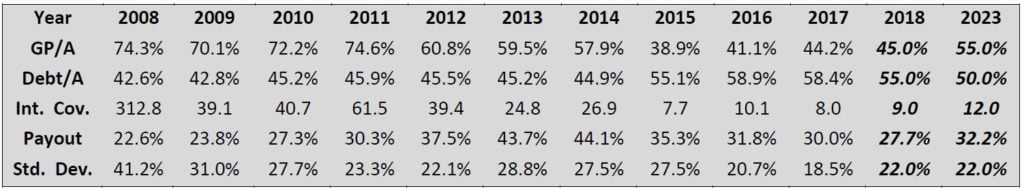

Key Metrics

Overview & Current Events

Walgreens is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures (including equity method investments), Walgreens has a presence in more than 25 countries and employs more than 385,000 people. In its leading retail pharmacy business, Walgreens operates approximately 13,200 stores in 11 countries. The company also operates one of the largest global pharmaceutical wholesale and distribution networks, with more than 390 centers that deliver to upwards of 230,000 pharmacies, doctors, health centers, and hospitals each year. Walgreens operates in three financial segments: Retail Pharmacy USA, Retail Pharmacy International, and Pharmaceutical Wholesale.

On March 28th, Walgreens reported financial results for its fiscal 2018 second quarter. Sales increased by 12.1% (9.4% on a constant-currency basis) and adjusted diluted earnings-per-share increased by 27.2% (25.7% on a constantcurrency basis). Walgreens also hiked its guidance for fiscal 2018, now expecting adjusted earnings-per-share in the range of $5.85 to $6.05. The company’s robust performance was driven by its Retail Pharmacy USA segment, which is in the process of acquiring more than 2,000 stores from Rite Aid. Given Walgreens track record of acquiring other pharmaceutical chains, we believe the Rite Aid acquisition should close smoothly and continue to boost the company’s performance moving forward.

Growth on a Per-Share Basis

Walgreens has compounded its adjusted earnings-per-share at 9.6% per year over the last decade. Due to the company’s expanding international presence and competency in the mergers and acquisitions arena, we believe that Walgreens is capable of delivering similarly high single-digit growth for the foreseeable future. Our earnings growth estimate for Walgreens is 9.0% per year, which is implied in our $9/share earnings estimate for 2023.

From a dividend perspective, we believe that Walgreens is likely to increase its dividend at a faster pace than its earnings for the foreseeable future. Our 2023 dividend-per-share estimate implies 12% annualized growth over the next halfdecade.

Valuation Analysis

Walgreens increased its fiscal 2018 earnings guidance with the release of its second quarter earnings report. The company now expects to report adjusted earnings-per-share in the range of $5.85 to $6.05. The midpoint of this guidance band implies a current price-to-earnings ratio of just 11.0. Walgreens has traded at an average price-toearnings ratio of 16.7 over the last decade, implying a fair value of $99. The company is deeply undervalued. If Walgreens’ stock can revert to this historical valuation over the next 5 years, this will add 8.7% per year to the company’s annualized returns during that time period.

Safety, Quality, Competitive Advantage, & Recession Resiliency

Walgreens is a very safe blue-chip investment. Consumers are very unlikely to cut spending on prescriptions and other healthcare products, even when disposable income declines noticeably. Walgreens’ adjusted earnings-per-share declined by just 7% during 2009 – the worst of the global financial crisis – and the company actually grew its adjusted earnings-per-share from 2007-2010, following this up with 20%+ earnings growth in 2011.

Walgreens has a number of competitive advantages, the first being scale. The company’s global presence helps differentiate it from its major peer, CVS Health Corporation (CVS). Walgreens’ expertise in acquisitions is also very beneficial, allowing it to penetrate new markets with less risk than a more organic approach. Walgreens’ Chief Executive Officer Stefano Pessina stated on a recent conference call that “we are convinced that our strategy of entering markets through strong local partners with excellent local management teams is the best approach.” Based on this statement, we believe more acquisition-based growth is likely.

The downside to acquisition-based growth is its impact on the company’s balance sheet. As the table above demonstrates, Walgreens’ leverage metrics and interest coverage have fluctuated tremendously over the last decade. While this may sound some quantitative alarms, our qualitative analysis combined with the company’s track record lead us to believe that acquisition-based growth is a sound approach for the company moving forward.

Final Thoughts & Recommendation

With 9% earnings growth and a 2.4% dividend yield, Walgreens already has attractive total return potential. Combine this with the company’s compelling valuation and it presents a rare opportunity indeed. Valuation reversion will contribute 8.7% per year to Walgreens returns if such multiple expansion occurs over a 5-year period. All said, this gives 20% annualized total return potential and earns the company a buy recommendation from Sure Analysis.

Total Return Breakdown by Year

Article by Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.