Summary: Remain long equities, be prepared to buy dips, minimise the use of leverage and seek portfolio protection via derivatives where possible.

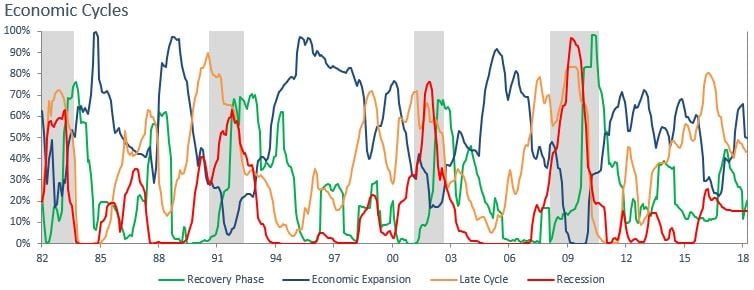

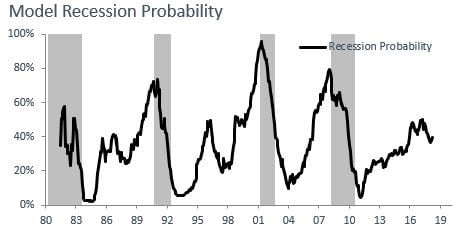

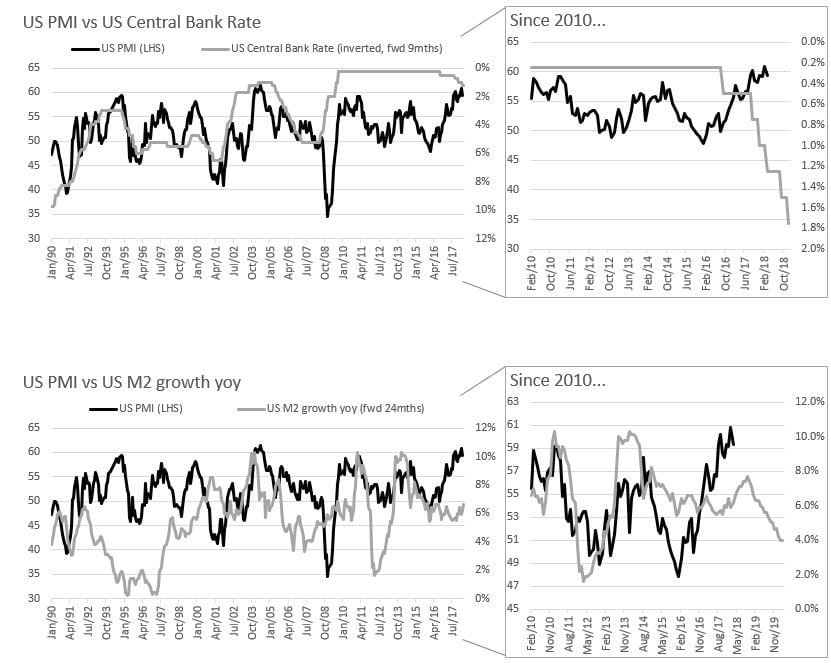

Equity markets are likely to volatile, but the overarching risk of a recession is not high. Volatility will arise as expensive equity markets and deteriorating liquidity conditions (rising central bank rate & decelerating M2 growth) compete with the positive effects of fiscal stimulus (tax cuts). The economy remains in its “expansion” phase per our Economic Cycle model, and the probability of recession remains modest. We recommend investors remain long equities, be prepared to buy dips, minimise the use of leverage and seek portfolio protection via derivatives where possible.

In order to begin to become negative on risk assets such as equities, we are looking for the “late cycle” conditions to become prevalent on our Economic Cycle chart, alongside a rising in the Recession Probability to the 70% market. At such a time, we will begin to recommend selling risk assets and moving to cash.

The economic cycle is showing continued Economic Expansion phase conditions. Our thesis of a “second wind” for the US economic remains in play.

Recession probability remains largely unchanged from 37% in the prior quarter. In the past, recessions have occurred with at least 70% probability of recession on our model.

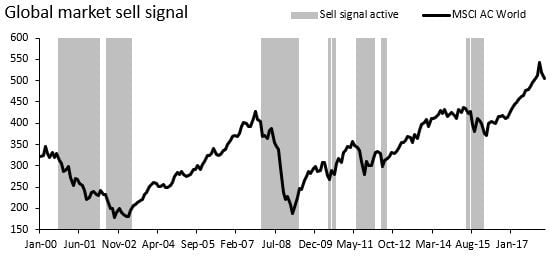

Market valuation, as measured by the Wilshire 5000 All Cap index divided by GDP is near all time highs making the risk-reward of investment in the market index a weak proposition. Portfolio leverage is NOT advised, use derivatives to hedge the portfolio where possible and be prepared to buy the dips.

As we continually approach the middle of 2018, Liquidity based Economic Leading Indicators – which are currently negative biased – will increasingly put increasing downward pressure on economic momentum and risk assets. That said, we are optimistic the effects of fiscal stimulus will continue to outweigh decreasing liquidity in the near-term, and do not believe there is a major cause for concern.

Our stop-loss tool (global market breadth index) has not yet triggered a sell signal.

www.RecessionProtect.com is an organization formed to bring simple, back-tested & rules-based economic analysis to the mass market. No extra fluff.