If someone slipped you a $10,000 check and told you to invest it, what would you do with the money?

With no strings attached, there is a wide variety of ways that you could deploy that cash.

You could look at it as a one-time windfall that could shore up your personal balance sheet, or you could go at it much more aggressively. It’s money that you didn’t expect to receive, so why not throw it at high-risk, high-reward assets?

How to Invest $10k?

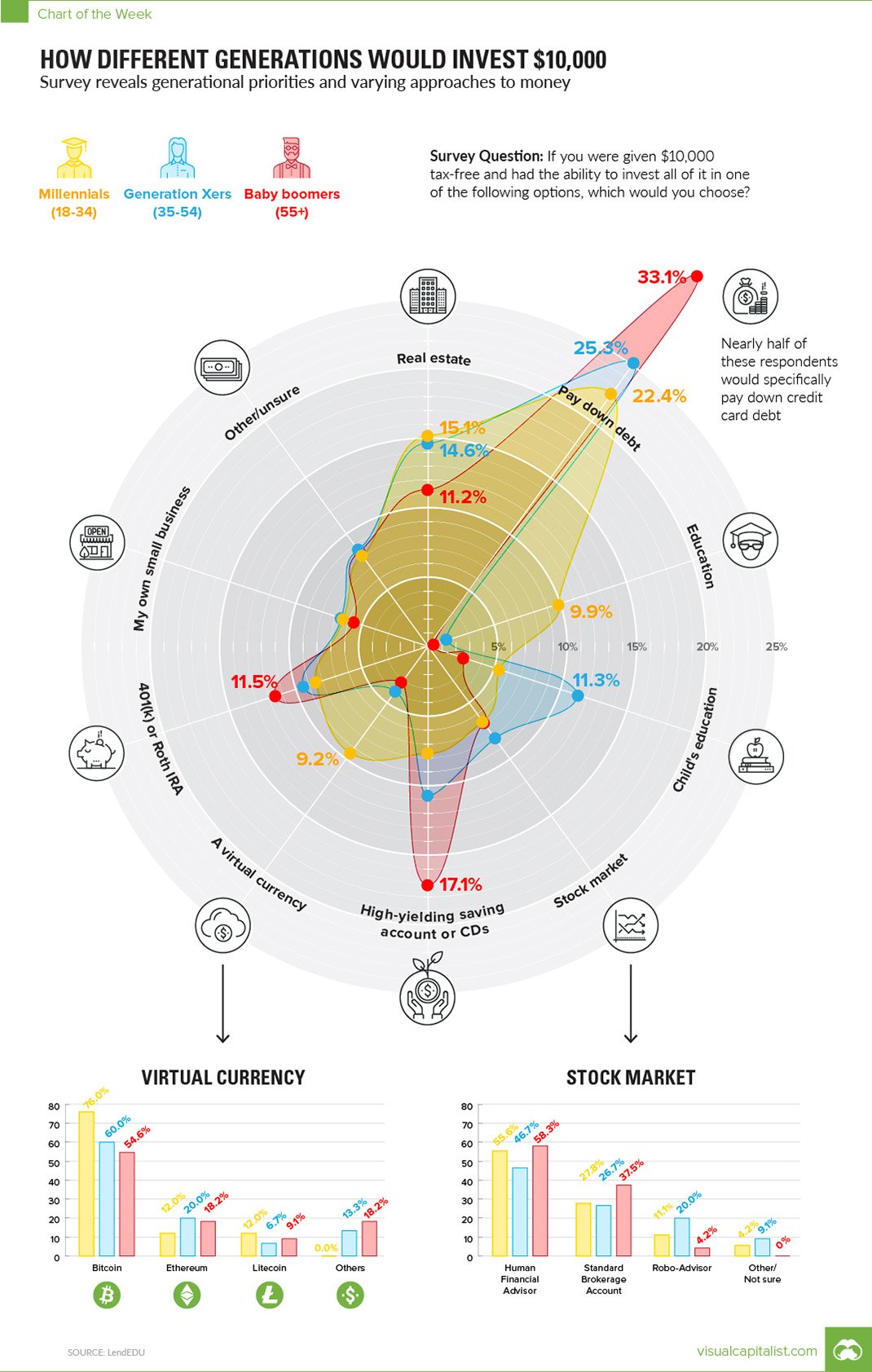

Today’s chart is based on a survey from LendEDU, which posed this exact question to 1,000 Americans in March 2018:

Question: If you were given $10,000 tax-free and had the ability to invest all of it in one of the following options, which would you choose?

Here are the results of the sample as a whole:

| How to Invest $10K? | % of Respondents |

|---|---|

| Pay down debt | 27.3% |

| Real estate | 13.5% |

| Savings account or CDs | 12.2% |

| 401(k) or Roth IRA | 9.9% |

| Stock market | 7.2% |

| Child's education | 6.9% |

| Small business | 6.2% |

| Virtual currency | 5.1% |

| Education | 3.2% |

| Other/Unsure | 8.5% |

Note: We’ve made slight adjustments to the original answers, combining one low-performing category (P2P loans) into the “Other” category

Paying down debt (27.3%) was by far the most popular response. It’s also interesting to see that many people would opt to put the $10k towards their own small business, education, or even digital currencies like Bitcoin, Ethereum, or Litecoin.

Now, here’s the same data grouped together by generations:

Interestingly, certain answers had the same popularity across the board for all generations.

All groups were equally interested in investing in their small businesses. The highest response here came from Gen X at 6.7%, but Millennials and Gen X weren’t far off at 6.3% and 5.6% respectively.

In addition, investing in the stock market was pretty consistent as well, with Millennials at 6.6%, Generation X at 8.1%, and Boomers at 6.7%. All these groups were mostly interested in doing this through a human financial advisor, though Gen X gave robo-advisors a higher rate of consideration (20%) than other generations (11% Millennials, 4% Boomers)

Generational Differences

Some generational differences are as to be expected. For instance, barely any Baby Boomers (0.3%) wanted to put $10,000 towards their own education. This makes sense, since many are at or near retirement already. On the other hand, 9.9% of Millennials opted for an investment in education.

But here’s a situation that might be a bit more peculiar. One would guess that with student debt being at $1.5 trillion in the United States, many Millennials would opt to pay down debt with their $10,000 check. Interestingly, fewer Millennials (22.4%) chose to pay down debt than either Gen X (25.3%) or Boomers (33.1%).

On the same token, Millennials were more likely to choose either real estate (15.1%) or cryptocurrency (9.2%) as an investment. For contrast, look at Boomers, a group that had 11.2% choose real estate and only 3.1% choose crypto.

Article by Jeff Desjardins, Visual Capitalist