Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives. This article originally appeared on ETF.COM here.

At the start of 2017, I compiled a list of predictions that market gurus had made for the upcoming year, along with some items I heard frequently from investors, for a sort of consensus on the year’s “sure things.”

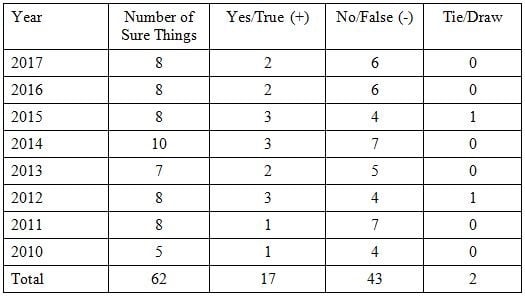

As is my practice, I will give a score of +1 for a forecast that came true, a score of -1 for one that was wrong, and a 0 for one that was basically a tie.

Bonds and the inflation surprise

Our first sure thing was that the Federal Reserve would continue to raise interest rates in 2017, leading many to recommend investors limit their bond holdings to the shortest maturities. Economist Jeremy Siegel at one point even warned bonds were “dangerous.” And on March 15, 2017, the Fed raised interest rates by 0.25 percentage points. It did so again on June 14, 2017, and once more on Dec. 13, 2017.

However, despite the prediction that interest rates would rise having actually come to pass, the Vanguard Long-Term Treasury Index ETF (VGLT) returned 8.6% for the year, outperforming Vanguard’s Intermediate-Term Treasury Index ETF (VGIT), which returned 1.7%, and the Vanguard Short-Term Treasury Index ETF (VGSH), which returned 0.0%. Score: -1.

The second sure thing was that, with the large amount of fiscal and monetary stimulus we have experienced, in addition to the anticipation of a large infrastructure spending program, the inflation rate would rise significantly. On Dec. 13, 2017, the Bureau of Labor Statistics reported that, in November, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4% on a seasonally adjusted basis. The agency also reported that the index for all items rose 2.2% over the 12 months ending November 2017. The index for all items less food and energy had risen just 1.7% over the same period. Score: -1.

GDP gets a boost

The third sure thing was that with the aforementioned stimulus, anticipated tax cuts and a reduction in regulatory burdens, the growth rate of real GDP would improve from 1.6% in 2016 to 2.2% in 2017. But first-quarter real GDP growth last year was just 1.2%. The second quarter came in better, at 3.1%. Third-quarter growth was 3.2%. The current, full-year forecast, released Nov. 13, 2017, from the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters, is for real GDP growth of 2.2% in 2017. We’ll give this a score of +1.

Our fourth sure thing follows from the first two. With the Fed tightening monetary policy and our economy improving—and with the economies of European and other developed nations still struggling to generate growth, and with their central banks still pursuing very easy monetary policies—the dollar would strengthen. The dollar index (DXY) ended 2016 at 102.38. The index closed 2017 at 92.30. Score: -1.

Read the full article here by Larry Swedroe, Advisor Perspectives