Stepan Co. (SCL) has a dividend track record that few companies can rival. This year will be Stepan’s 50th consecutive year of increasing dividends, making it one of just 25 companies in the entire market with a dividend increase streak of that length.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

That puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 25 Dividend Kings here.

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash and this article will discuss Stepan’s dividend and valuation outlook.

Business Overview

Stepan traces its origins back to 1932 when it was founded by 23-year old Alfred C. Stepan Jr, known at the time as Chemical Distributors. The fledgling enterprise’s first product was a chemical that controlled road dust on Illinois’ country thoroughfares, sold from a rented desk at Chicago’s North Pier Terminal.

The company is still headquartered in Illinois and manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement and pharmaceutical markets.

It has expanded from that desk at the North Pier Terminal to a truly global reach with its 18 manufacturing sites in 11 countries throughout North and South America, Asia and Europe. Stepan also boasts global R&D centers, a worldwide distribution network and a broad portfolio of products to meet a diverse group of customer needs.

Stepan is organized into three distinct business lines: surfactants, polymers and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan isn’t beholden to a handful of industries; an important trait during an economic downturn.

Source: Robert W. Baird & Co 2017 Global Industrial Conference Presentation

The surfactants business is Stepan’s largest by revenue, accounting for about two-thirds of total sales. A surfactant is an organic compound that contains both water-soluble and water-insoluble components. Surfactants are key ingredients in consumer and industrial cleaning compounds such as detergents, cleansing agents, emulsifiers, foaming or defoaming agents, viscosity builders, degreasers and others.

Stepan offers a broad range of surfactant chemicals and creates custom surfactants and formulated blends to meet unique customer demands. These surfactants are used in a wide variety of applications such as a foaming agent for shampoo, agents used in oil recovery and emulsifiers for agricultural insecticides.

Source: Robert W. Baird & Co 2017 Global Industrial Conference Presentation

The polymers business is Stepan’s second-largest by revenue, producing about 30% of the company’s total. The polymers division is further broken down into three segments: polyester polyols, powder coating resins, and phthalic anhydride. Polyester polyols are used in a wide variety of both polyurethane and polyisocyanurate applications. Stepan produces a full range of aromatic and aliphatic polyester polyols for use in rigid foams, as well as many coatings, adhesives, sealants and elastomers applications.

Polyester resins are designed with either hydroxyl or carboxyl functionality and combine with various curatives to form durable, attractive, environmentally friendly powder coatings. The company’s RUCOTE resins can enhance the quality, performance, and visual appeal of finishes on a wide variety of products.

Phthalic anhydride is an important part of Stepan’s Polymers division. In addition to being used in many of its polyester polyol chemistry, phthalic anhydride is a key raw material for plasticizers and unsaturated polyester resins.

The third division, specialty chemicals, is Stepan’s smallest by revenue, producing only about 5% of the company’s total. The segment produces science-based nutritional oils used in the food, nutrition and pharmaceutical industries. Its products are naturally derived ingredients that provide specific nutritional benefits in end markets like dietary supplements, beverages, nutritional powders, infant nutrition and weight management.

Stepan’s market cap is just under $2B and it is expected to do slightly more than that number in total revenue this year, representing mid-single digit growth over 2017.

Growth Prospects

Stepan’s February Q4 report was a strong one, capping a record year for 2017. Total revenue grew 13% on strength in the surfactant and polymers segments, which saw sales rise by 15% and 13%, respectively. The smaller specialty products segment produced a revenue decline of 15% but given the diminutive size of it, the company’s consolidated results were still excellent. Gross margins improved as did operating margins, although the company’s CEO, Quinn Stepan, said that lost share and lower margins in the North America polymer business would continue into 2018, providing an earnings headwind.

Keep in mind that the polymer business, while providing only about 30% of total revenue, provides about half of Stepan’s operating profits. Any weakness there could mean a meaningful margin decline for the company so that is certainly something to watch for in 2018. Stepan has diversified into polymers more and more in recent years because of the margin advantage so if that fades, so will its earnings growth potential.

The company’s stated growth strategy includes R&D that develops a continuous stream of value-added applications, developing new processes for current products as well as refining existing processes. It also makes targeted acquisitions from time to time when appropriate, picking up manufacturing capacity or some other strategic advantage from its acquisitions. It also grows by establishing manufacturing locations and sales offices where its customers are in the world, meaning it can more efficiently and effectively serve those varied customers.

Finally, it seeks to grow through strategic alliances via joint ventures where Stepan acts as a technical expert to complement the resources of a local partner with resources in the area. This comprehensive growth strategy has worked for Stepan in the past and while it is not a true growth stock, over time it has produced meaningful revenue expansion using these strategies.

In addition to that, Stepan is focused on its internal efficiency program called DRIVE, which works on supply chain optimization, procurement and SG&A expenses. The program is similar to those in other industrial applications – basically, waste is identified and removed at every step of a process – but it has yielded Stepan some substantial results in the past two years.

Source: Robert W. Baird & Co 2017 Global Industrial Conference Presentation

Roughly $15M of operating income is attributed in both 2016 and 2017 and considering operating income was $146M last year, that is certainly a large boost from productivity gains. Stepan continues to work on the DRIVE program, although I’d caution that as the years press on, gains will be more and more challenging to come by.

As we can see from this graphic from the company’s recent investor presentation, DRIVE is a part of every growth initiative as it permeates the culture. That focus has worked in terms of driving margin improvements but again, further gains will be more difficult to achieve.

Revenue is slated to grow in the mid-single digits this year and next year, congruent with Stepan’s long term growth rates. Keep in mind that acquisitions that may pop up could alter that course materially but organically, mid-single digits growth is a reasonable guideline over the long term. Earnings will benefit from a lower tax rate this year but also gains from its DRIVE program.

The only bit of caution to note is that the company’s highest-margin business – polymers – is still suffering from lost share and margin losses in North America. That will weigh on this year’s results and if that weakness continues into 2019, its double digit EPS growth could certainly be in jeopardy.

Stepan’s growth has been somewhat lumpy in the past as revenue and margins move around but on the whole, this company produces respectable growth over the long term. Lower margins in the polymers business is very clearly Stepan’s principal earnings risk right now.

Competitive Advantages & Recession Performance

Stepan’s competitive advantages include its customer base and end market diversity, its global supply chain and distribution network, as well as its technical expertise. Stepan is a true market leader in its niche and this has afforded it much success in the past 80+ years.

Stepan’s customers are extremely diverse, including end markets like agricultural products, construction, dietary supplements, cleaning products, personal care, laundry, oilfield services, pharmaceuticals and many more. There aren’t many businesses in the world that serve such diverse end markets and that offers Stepan exposure to lots of different industries. This creates lots of opportunities for growth as well as recession resistance.

In addition to that, the company operates in 11 different countries around the world. This allows it to have technical experts and sales professionals on the ground where its customers are, developing products and solving problems more quickly and efficiently than if it were centralized here in the US. When you add in its vertical supply chain – which improves margins and reduces supplier risk – Stepan’s global footprint is a sizable asset in and of itself.

Stepan’s products are also needs and not wants, meaning that during recessions, the company fares very well. Indeed, during the Great Recession, it performed tremendously well; Stepan’s earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $0.75

- 2008 earnings-per-share of $1.20 (increase of 60%)

- 2009 earnings-per-share of $2.92 (increase of 143%)

- 2010 earnings-per-share of $2.95 (increase of 1.0%)

Revenue moved higher each year during this period with the exception of 2009, but a tremendous amount of margin improvement during this period saw Stepan drastically increase its earnings despite the economic malaise that had the world in its grips. Operating margins were just 1.4% in 2006 but peaked at 8.2% in 2009, driving the earnings growth Stepan enjoyed during this period.

Stepan is a very recession-resistant business and that is one advantage it provides to shareholders. One cannot expect recession performance like what we see above each time as the company was in the midst of transitioning away from high reliance upon the core surfactants business and thus, significantly boosting margins. However, Stepan should hold up well during the next recession.

Valuation & Expected Returns

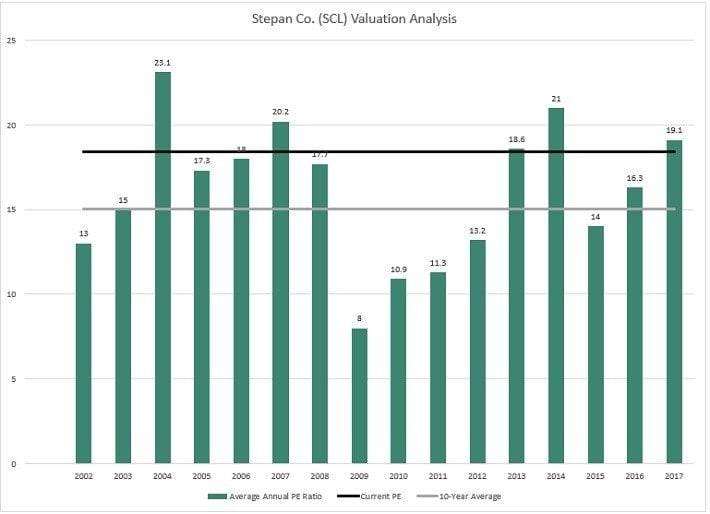

According to ValueLine, Stepan is expected to produce $4.45 in EPS this year and at the current price, that puts its PE at 18.4. That’s pretty reasonable considering Stepan’s recession resistance as well as its longer term growth track record, but keep in mind that margins were under pressure last year and will be again this year.

Source: ValueLine

That will be offset by a lower tax rate in 2018 but once that is part of the comparable base next year, Stepan will need to figure out a way to stop losing share and margin in its polymer business. To reiterate, that segment is about half of Stepan’s total operating income, so it is critical that margins are stabilized in 2019 and beyond.

The company’s PE looks about right given Stepan’s expected growth rates so at this point, it looks fairly valued. In the past 10 years, the stock held an average price-to-earnings ratio of 15.0, and the stock currently trades well above the long-term average. The stock would have to get a lot cheaper to represent good value, and that impacts the total shareholder return prospects of Stepan.

Stepan’s impressive streak of decades of consecutive dividend increases hasn’t given it a strong yield, which comes in at just over 1% today. That certainly doesn’t qualify it as an income stock but it does provide a small tailwind for total returns. As you can see from the chart above, the company’s dividend growth rate is respectable at 7% for the past five years, so the payout is definitely moving higher.

Over time the yield on today’s cost may reach 2% or 3% or more but at the pace Stepan has been going, that looks to be a very long term goal and not a short term catalyst for shareholders. Stepan pays only about one-fifth of its earnings in dividends, choosing instead to use its cash to grow its business. Until that changes, the dividend isn’t likely to be a significant source of shareholder returns.

Stepan’s projected total returns are decent but not great, owed to its current valuation and diminutive current yield. EPS growth should be in the 10% area for this year and next year as Stepan digests a lower tax rate but longer term, mid-single digit earnings growth is more appropriate. The key risk to Stepan’s long term EPS growth at this point is margins from the polymer business. While that is being offset currently with strength in surfactants and a lower tax rate, that may not always be the case.

Thus, if we consider that the valuation is fair today and shouldn’t move much, total returns should be roughly congruent to EPS growth plus the dividend. That puts long-term return potential at mid- to high single digits, and lower if the valuation contracts toward the 10-year average.

Final Thoughts

Stepan doesn’t qualify as an income stock despite its Dividend King status. It also looks fairly valued against future expectations of earnings growth, meaning multiple expansion won’t likely be part of the total returns picture. And, the valuation could have room to fall.

Based upon that, shareholders can expect decent, but not spectacular, total returns from here that should closely match the ~1% yield and longer term EPS growth rates. Stepan is a leader in its niche and it is a strong business, but it is being fairly priced by the market at this point and thus, is no more than a hold.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Josh Arnold, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.