We are quickly approaching the deadline for filing (and paying) our federal and state income taxes (extended to Tuesday, April 17 this year because April 15 falls on a Sunday and Monday is Emancipation Day), and that means it’s time for my annual post at tax time to help put things in perspective.

1. Some Historical Perspective

“In the beginning,” when the US federal income tax was first introduced in 1913, it used to be a lot, lot simpler and a lot easier to file taxes; so easy in fact that it was basically like filling out your federal tax return on a postcard.

For example, page 1 of the original IRS 1040 income tax form from 1913 appears above. There were only four pages in the original 1040 form, including two pages of worksheets, the actual one-page 1040 form above, and only one page of instructions (view all four pages here). In contrast, just the current 1040 instructions for 2017, without any forms or schedules, runs 107 pages (forms and schedules are available separately here and here).

Individual federal income tax rates started at 1 percent in 1913, and the maximum marginal income tax rate was only 7 percent on incomes above $500,000 (more than $12.7 million in today’s dollars). The personal exemption in 1913 was $3,000 for individuals (more than $76,000 in today’s dollars) and $4,000 for married couples (nearly $102,000 in today’s dollars), meaning that very few Americans had to pay federal income tax since the average annual income in 1913 was only about $750. The Tax Foundation has historical federal income tax rates for every year between 1913 and 2013 here for tax brackets expressed in both nominal dollars and inflation-adjusted dollars and the 2017 tax brackets here.

2. Tax Graphic of the Day

Some more historical perspective….

3. Opportunity Cost

In a 2012 report to Congress (most recent data available), the National Taxpayer Advocate estimated that American taxpayers and businesses spend 6.1 billion hours every year complying with the income tax code, based on IRS estimates of how much time taxpayers (both individual and businesses) spend collecting data for, and filling out their tax forms. In addition, Americans will spend an estimated $10 billion for the services of tax preparation firms and $2 billion on tax-preparation software programs like TurboTax that still require many hours of time.

The amount of time spent for income tax compliance—6.1 billion hours—would be the equivalent of more than 3 million Americans working full-time, year-round (or 2 percent of total US payrolls of 148.2 million). By way of comparison, the federal government currently employs 2.8 million full-time workers, and Wal-Mart, the world’s largest private employer, currently employs 2.2 million workers worldwide and 1.3 million workers in the US (both full-time and part-time). At the current average hourly wage of $22.42 an hour, the dollar value of the opportunity cost associated with tax filing would be $136.7 billion, which is more than the GDP of 18 US states last year.

As T.R. Reid pointed out in a New York Times op-ed last year at this time, it really doesn’t have to be that way. For example:

In Japan, you get a postcard in early spring from Kokuzeicho (Japan’s I.R.S.) that says how much you earned last year, how much tax you owed and how much was withheld. If you disagree, you go into the tax office to work it out. For nearly everybody, though, the numbers are correct, so you never have to file a return.

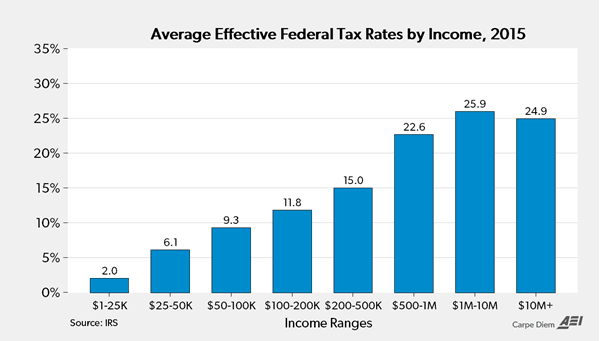

4. Tax Progressivity

And just how progressive is the US federal income tax system? Very, very progressive, see the chart above showing average effective tax rates by various income groups based on IRS data here for 2015 (most recent year available). That pattern of income tax progressivity explains why almost all federal income taxes are paid by the top income groups (see next few items).

5. Tax Progressivity and Tax Burden

According to the most recent IRS data, the federal income tax shares by six different income groups in 2015 are displayed in the chart above. Almost all federal income taxes (97.2 percent) are paid by the top 50 percent, more than 2/3 of income taxes are paid for by the top 10 percent and nearly 40 percent of taxes are paid by the top 1 percent of taxpayers.

For all of the criticism and negative publicity the “Top 1 Percent” get, I’d like to personally thank that group this year at tax time for shouldering such a disproportionate share of our collective tax burden—that group of Americans with income above $480,000 in 2015 generated 20.65 percent of the nation’s Adjusted Gross Income but paid 39 percent of all federal income taxes. It’s a form of “disparate impact” on the 1 percent that we all benefit from! So, I say “Thank You, Top 1 Percent” from all of us in the bottom 99 percent for your valuable and significant contribution to our nation’s tax burden.

6. Tax Burden of the Top 1 Percent vs. the Bottom 95 Percent

The chart above gives us another perspective on the tax burden of the top 1 percent of taxpayers over time and compares the tax share of that group to the tax burden of the bottom 95 percent in every year between 1980 and 2015 (most recent year available from the IRS). In 2015, the top 1 percent earned 20.65 percent of the total income reported to the IRS (as mentioned above) and paid more than 39 percent of all federal income taxes collected ($588 billion).

The bottom 95 percent of US taxpayers earned 64 percent of total income (almost three times as much as the top 1 percent) and paid only 40.4 percent of the total income taxes collected ($588 billion). So once again, to the 1.4 million taxpayers in the top 1 percent, I say, “Thank You” for paying almost as much in federal income taxes in 2015 as the nearly 140 million taxpayers in the bottom 95 percent by income.

7. Bowling vs. Taxes

Speaking of the progressivity of income taxes, here’s a thought about the way we tax income vs. the way we score bowling. Under the scoring rules of bowling, you get rewarded, not penalized, for being successful. If you get a spare, the scoring system rewards you by adding the pins from the next ball into the current frame, and if you get a strike you get rewarded by adding your next 2 balls into the current frame.

Under our progressive income tax system with 7 tax rates in 2015 increasing from 10 percent to 39.6 percent, you get penalized, not rewarded, for being successful, productive, and entrepreneurial because the more you earn, the higher the tax rate you pay. The top marginal income tax rate has been as high as 91 percent in the 1950s and 1960s, and 70 percent in the 1970s. If we scored bowling the way we tax income, we would subtract, not add pins for a spare or strike, i.e., penalize successful bowling. If we taxed income the way we score bowling, we would have lower, not higher, tax rates on our most successful income-earners.

8. Coincidence?

Why are Tax Day (April 15) and Voting Day (first Tuesday in November) so far apart? Couldn’t we move Tax Day to the first Monday in November or Voting Day to the first Tuesday following April 15? And maybe end tax withholding so that Americans would pay their federal income taxes as a lump sum right before voting?

9. What’s In a Name?

Why do we call the IRS a "service"? Couldn’t it have been named a department like Labor, a bureau like the BLS or the FBI, a commission like the FTC, an administration like FDA, an agency like EPA, etc.? And have you ever noticed that “The IRS” spells “Theirs”? Hmmmmmmm…..

10. Inspirational Quotes about Taxes

Here are a few good ones from Forbes:

“The taxpayer: that’s someone who works for the federal government, but doesn’t have to take a civil service examination.” – Ronald Reagan

“We have what it takes to take what you have.” – Suggested IRS Motto

“It is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the tax rates.” – John F. Kennedy

"I am proud to be paying taxes in the United States. The only thing is I could be just as proud for half of the money.” – Arthur Godfrey

“A liberal is someone who feels a great debt to his fellow-man, which debt he proposes to pay off with your money.” – G. Gordon Liddy

Happy Tax Day 2018!

Bonus Chart

The chart below shows the annual percent of US tax filers/tax units fro 1950 to 2017 who are “nonpayers.” According to this 2012 Tax Foundation report:

Recent debates over the equity of the income tax system have centered chiefly on whether high-income Americans are paying their “fair share” in taxes. There has been less discussion about the growing number of Americans who pay no federal income tax—the so-called nonpayers. Today, the percentage of tax filers who pay no income taxes due to the generous credits and deductions in the tax code has reached levels not seen since the income tax became a “mass tax” in 1940. This trend raises serious concerns about the equity of the U.S. tax system, the fiscal stability of the federal government, and the political implications of disconnecting millions of citizens from the primary means of funding government programs.

As the chart shows (based partly on Tax Policy Center data here), the number of “nonpayers” of federal income tax last year as a share of all taxpayers was nearly 44 percent, more than double the roughly 20 percent of “nonpayers” between 1950 and 1990. When it comes to the issue of “fairness” about paying federal income taxes, we only ever hear about how “the rich” don’t pay their “fair share” but never about the rising percentage of Americans who are “nonpayers”—which has doubled over the last 25 years.

Reprinted from the American Enterprise Institute.

Mark J. Perry

Mark J. Perry is a scholar at the American Enterprise Institute and a professor of economics and finance at the University of Michigan’s Flint campus.

This article was originally published on FEE.org. Read the original article.