Kellogg Company (“K”, or “the company”) is substantially less profitable, more levered, and more expensive than it seems. We believe K will reduce or miss on 2018 guidance targets and cut its dividend or lose its credit rating, says Prescience Point see their short thesis below.

Q1 hedge fund letters, conference, scoops etc

Prescience Point Research Opinions:

- Not the Staple It Used to Be: Kellogg management misjudged the structural decline in demand for sugary and processed foods as cyclical, at the same time implementing short-sighted cost-restructuring programs that have stripped K to the bone. Reversing these mistakes amounts to a costly destruction of shareholder value.

- Even More Unhealthy than You Thought: Kellogg’s cost-cutting programs cannot be reconciled with its operating cash flows; forensic financial analysis reveals K has pulled forward >$1B of revenue from future reporting periods and artificially inflated margins & operating cash flow – overstating all three of the primary determinants of executive

- Kellogg Management Covered Their Tracks: By offering extended customer payment terms and switching its US Snacks business from a ‘sell-through’ to ‘sell-in’ model, Kellogg was able to offset steepening early payment discounts & stuff its channels. Kellogg has evaded investor scrutiny by covering its tracks with factoring and reverse factoring programs, thereby boosting cash flow from operations, suppressing days sales outstanding, and resulting in the illusion of high quality earnings.

- Cluster of Sudden Executive Resignations, a Glaring Red Flag: Sudden and peculiar departures of the CEO, CFO, and President of Kellogg North America – in the midst of one of the most expensive and complex restructuring efforts in company history – is a glaring red flag.

- More Leveraged and More Expensive Than Meets the Eye – Based on our adjustments, which back out unsustainable boosts to K’s performance metrics, we find that K is trading at historically rich, and unjustifiable multiples of 4x NTM P/E and 14.2x EV/EBITDA. We value shares at $39.50, representing 35% downside. Similarly, Kellogg’s adjusted leverage is 4.9x, in line with high yield CPG peers.

Introduction:

A Severely Malnourished Company We are short shares of Kellogg Company, the maker of Froot Loops, Pringles, Rice Krispies and other snacks and cereals. We believe the company is engaged in an unsustainable accounting charade to mask revenue and profit shortfalls and will be forced to choose between cutting its dividend and losing its credit rating; shares could fall 35%.

Kellogg’s stated purpose is “to nourish families so they can flourish and thrive.” Unfortunately, when it comes to its business, the company has ignored its own mantra. Sales of Kellogg’s breakfast cereals and snacks have been falling for years as consumers move to healthier, less-processed alternatives. Instead of innovating and developing new products, it watched from the sidelines as competitors gained market share.

To mask its deteriorating performance, Kellogg has instituted massive cost cuts and used accounting gimmicks and financial engineering to boost short-term sales and cash-flow numbers. These artificial performance enhancers have triggered tens of millions of dollars in bonuses for Kellogg’s executives while employees were systematically laid off. After doubling his compensation to $13 million in 2017, Kellogg’s then-CEO, John Bryant, abruptly retired at the ripe old age of 52.

We believe the chickens are about to come home to roost, and newly-installed CEO Steve Cahillane will need to lower expectations, cut the dividend or find a miracle new product in order to avoid being downgraded to junk. He has referred to 2018 as a “transition year,” which should give pause to any investor expecting positive results.

Our analysis is based on a months-long deep dive into Kellogg’s business, which included forensic analysis of the company’s accounting and financial statements for the past decade, interviews with former employees and industry experts, and an examination of management’s own words on conference calls and in other public venues.

We even spoke to the company directly, asking pointed questions of its Investor Relations department about some of the financial engineering and accounting changes we observed. IR admitted to us that many of the moves were “optical” in order to preserve the appearance of positive.

At its core, the Kellogg story is one we’ve seen many times before in corporate America. An old and venerable brand fails to invest for the long-term in the face of material challenges to its core product line – namely sugary cereals and carb-heavy snacks. Kids and adults just don’t eat as much cereal for breakfast anymore despite Kellogg’s efforts to entice them with new products like Donut Shop Pink cereal and Pop Tarts Strawberry Milkshake. But Kellogg chose to cut costs rather than invest.

“For more than 100 years we’ve been working to serve the world a better breakfast,” Kellogg says on its website. Truth is, they are serving the same thing while their customers have moved on.

K Pulled Forward Revenue & Is More Levered, Less Profitable, With Weaker Cash Conversion Than It Appears

In recent years, we believe the Company’s reported financial statements have become dislodged from economic realities. Specifically, we will explain why we believe:

- Future-period revenue was pulled forward due to extended payment terms, changes to the Company’s distribution model, and potentially full channel inventory levels.

- Sold and Securitized receivables and “reverse factored” payables should be included in the Company’s net debt and leverage ratio calculations given they are akin to short-term financing.

- Comparable operating margin was inflated due to non-operating pension gains and the consistent addback of perpetual restructuring charges.

- Operating cash flow and cash conversion is weaker than it appears due to unsustainable receivable and payable factoring programs.

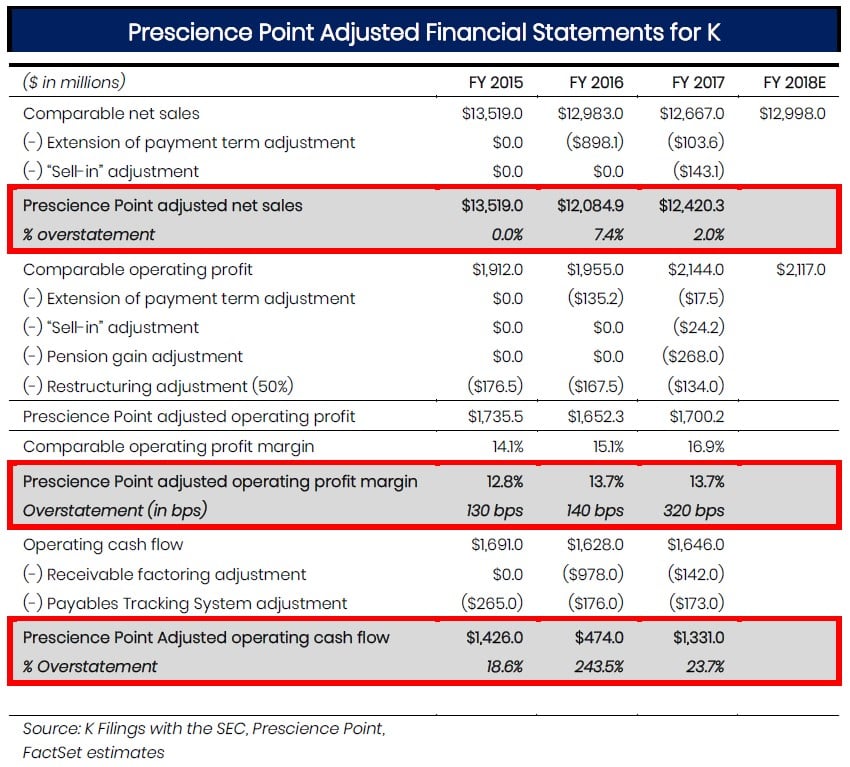

Adjusted financials suggest revenue, comparable operating margin, and operating cash flow were overstated After taking into consideration the Company’s Monetization Program, Securitization Program, Factoring Program, “sell-in” benefit from its new warehouse distribution model, one-time pension gain, and “non-recurring” restructuring charges, we find:

- K’s reported comparable net sales has been inflated for the last two years.

- K’s reported operating profit margin was inflated by 140 basis points in FY 16 and 330 basis points in FY 17.

- K’s reported operating cash flow was overstated by 23.7%.

Kellogg Pulls Forward Future-Period Revenue & Implements Several Receivable “Factoring” Programs to Suppress DSO

Extended terms program implemented; receivable factoring program initiated to “mitigate” DSO impact

In Q1’2016, Kellogg executed a discrete customer program to extend customer payment terms. In addition, throughout FY 2016, Kellogg implemented several receivable sales programs to “mitigate” the net working capital impact from the extended term program.1

During the quarter ended April 2, 2016, we executed a discrete customer program to extend customer payment terms. In order to mitigate the net working capital impact of the extended terms, we entered into an agreement to sell, on a revolving basis, certain trade accounts receivable balances to a third party financial institution.

(Q1’2016 10Q) [emphasis added]

Extended terms program may have been implemented in response to large customers pushing aggressive terms on to Kellogg

Based on conversations with several individuals in the consumer packaged goods industry and analyst community, we believe Kellogg’s extended payment terms program may have been implemented to offset the income statement impact from aggressive terms from some of Kellogg’s largest customers (e.g.

Walmart). For example, a large customer tells Kellogg it can pay sooner but wants a large discount for doing so or it’s going to extend payments beyond its ordinary terms. As a result, Kellogg then uses the same strategy on its own vendors. In effect, Kellogg is able to conserve its income statement (i.e. not take a hit from accepting large discounts) at the expense of its working capital levels (i.e. accepting the extended payment terms from is own customers). Alternatively, Kellogg could have also instituted the program to generate and/or incentivize additional purchases from customers.

Extended terms can provide a transitory benefit to revenue growth

Extending payment terms to customers allows a company to:

- Pull forward future-period revenue, as customers are enticed to purchase more product/inventory than they otherwise and normally would

- Eliminate early payment/pre-payment discounts

Receivable factoring programs allow companies to show stronger operating cash flow and lower DSOs

There are two primary benefits of a receivable factoring program:

- Cash management – Collecting receivables earlier than normal (i.e. boosting reported operating cash flow)

- Financial statement optics – Showing lower reported days sales outstanding (DSOs), as sold receivables are removed from the balance sheet

Outstanding balances under receivable programs reach over $1.0 billion

As illustrated in the table below, accounts receivable sold, but outstanding surged throughout FY 16 to nearly $1.0 billion. At the end of 2017, receivables sold, but outstanding increased even further to $1.1 billion.

Article by Prescience Point Capital

See the full PDF below.