The role that trend following can play on your roster

Major League Baseball fans will enjoy a historic start of the season this year. All 30 teams will take the field on Opening Day March 29, the earliest in league history.

But just like investing, it’s hard to predict who will still be standing at the end of the season.

A misunderstood trading style

Like pitching or hitting, there are many trading styles out there: value, growth, momentum, etc. But we’re huge fans of trend following. This trading style historically has produced outstanding long-term returns – but we admit it can be frustrating to watch in the short term.

We think this stems from a misunderstanding of the nature of the trading strategy. Rather than “buy low, sell high,” trend following seeks to “buy high, sell higher.”

Mechanically, the strategy hunts for trends within a broad universe of assets, and then throws a lot of balls with the expectation that several will hit the strike zone. The strategy works best on a diversified basket of investments, so that one or two parts of the portfolio outperform when another isn’t working.

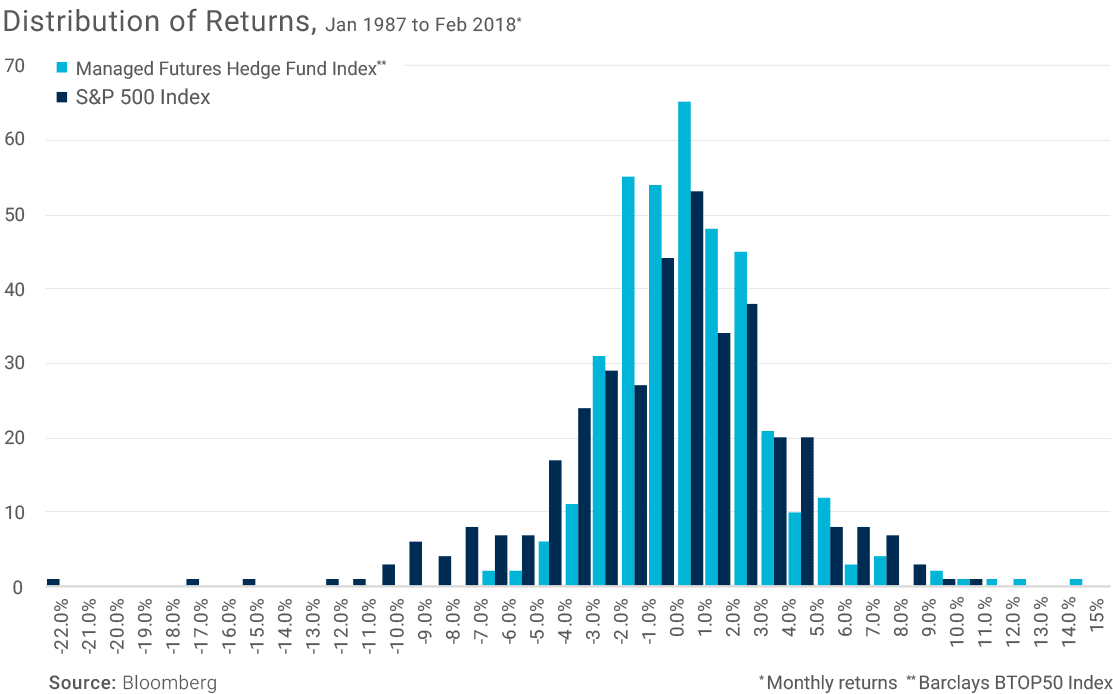

But it can be frustrating when trend following strings together a few months of losing before going on a winning streak. Sometimes it’s one big month, other times it can be sustained for several months. In technical terms, these acceptable losses have the potential to be functionally covered by the larger outlier months i.e. smaller negative returns with outlier returns coming more frequently on the upside.

If this sounds frustrating, consider long-only stocks. Stocks historically have produced smaller, consistently-positive returns with outlier returns coming more frequently on the downside.

A more balanced team

Match these two distribution curves together and you have the potential for a more robust, uncorrelated return stream.

In baseball terms, think of stocks like an high-on-base player. Someone who always draws walks, slaps singles and doubles, or leans into pitches – anything to get on base. They just happen to be injury-prone and can find themselves off the field, sometimes for inexplicable reasons.

Trend following is like a streaky hitter. They may start hot in April and May, only to cool off over the summer. This doesn’t make them bad players who aren’t valuable to the team; it just makes it a challenge to know when they’re going to heat back up. So, you keep them in the line-up because they excel at fielding their position, for example.

When they heat back up, your patience can pay off. Hopefully it’s in the fall and they help carry the team to the World Series! In 2016, the Cubs’ Kris Bryant had a streaky season by some measures, yet ended up winning the National League MVP and helped the Cubs win their first world series since 1908.

When it pays to be patient

A well-diversified, trend following strategy is the streaky hitter in your line-up. It productively contributes to the team by providing unmatched diversification from a broad opportunity set, even if they aren’t always on a hot streak.

So it comes down to this. Are you the kind of coach who’s willing to put up with some bad months in the regular season only to have your player win the MVP and carry your team to the World Series?

Article by Alex Clark, Longboard Funds