Listen to this podcast on our site by clicking here or subscribe on iTunes here.

Ten years ago, we experienced a financial crisis that almost collapsed the global economy. In 2007, as the stock market was at its peak and talking heads on TV were still arguing over a Goldilocks economy, Financial Sense’s Chris Puplava warned to “Watch Out Below!” and “Proceed With Caution” because the “Worse Is Yet to Come.”

This time on our podcast, Financial Sense Newshour discusses the threads of the last crisis and how surging debt levels combined with rising interest rates will create problems for the US and global economy once again.

Fed’s Herculean Efforts and Where We Stand Today

During the last financial crisis in 2008 and 2009, the Federal Reserve and other central banks implemented unprecedented tactics in an effort to pull the global economic system back from the precipice, and their efforts required trillions of dollars to hold the system together, reflate financial assets, and restart economies.

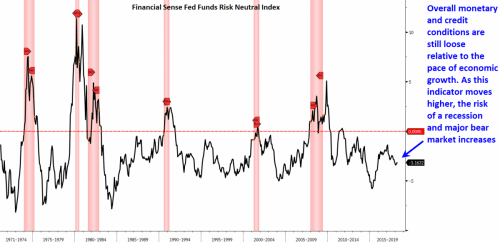

Today, that’s left markets near record price levels, and global economies are experiencing synchronized growth. Also, the US has embarked on a major fiscal stimulus program at this late stage in a business cycle. At the same time, the Federal Reserve has begun raising interest rates, leaving these two trends on a collision course.

Source: Bloomberg, Financial Sense Wealth Management

If we examine the forces at play in the last crisis, many of the same issues at work back then are still present with us today. First, we see ample capital flows across borders. Second, we see record amounts of debt at the corporate, consumer, and government levels, and exploding debt-to-GDP ratios.

Third, we have ultra-low interest rates, which encourages risk-taking. Forth, we've seen the removal of safeguards from the financial system and lending. Fifth, we're seeing risk appetites increase across the globe as investors scramble for yield.

Sixth, emerging markets are heavily indebted in dollar-denominated loans, which presents a problem as rates rise and also if the dollar appreciates, leaving those loans more expensive. Lastly, we have the second-highest equity valuations in stock market history.

“Those are the known risks that we see today,” Financial Sense President Jim Puplava said. “But the real question is, there's the risk that no one is looking at.”

Deficits and Debt Will Add Up

Today, the major source of credit expansion has moved away from banks that could be overseen by regulators and the Fed, to the bond market serving as the major supplier of credit. This has enabled many governments and businesses to surpass their pre-crisis debt levels, Puplava noted, especially in emerging markets which have borrowed heavily in US dollars.

The US government could be on the way to trillion dollar deficits as soon as this year, and definitely by next year with US Debt now at 250 percent of GDP. Also, China has surpassed US debt levels in comparison to the size of their economy.

Low-interest rates are allowing governments, corporations, and consumers to roll over that debt at very low-interest rates, which is why we haven't seen a flare up in the form of a new crisis.

“The one saving grace is that we are at the lowest interest rates in human history,” Puplava said. “What that adds up to is, it's making servicing those debts much easier. … Overall interest expense on all the government's debt, private and public is only 2.34 percent. Now that figure is rising, it's up by almost 30 basis points from last year and will continue to rise.”

Risks Around the Corner

Global QE has kept a cap on rates, making the probability of a crisis at this point very low. This will change, however, as central banks led by the Fed change course for higher rates.

All the while, risk has not vanished from the financial system, as seen in bond and private credit markets, Puplava noted, which are highly correlated.

“We're seeing leveraged volatility in financial products as investors around the globe stretch for yield, meaning they're taking higher risk,” Puplava said. “At the same time, American consumer debt continues to surge everywhere.”

As the Fed raises interest rates, and the effects work their way through the financial system, because of the delayed market response, we could see one rate hike too many push the economy into a recession.

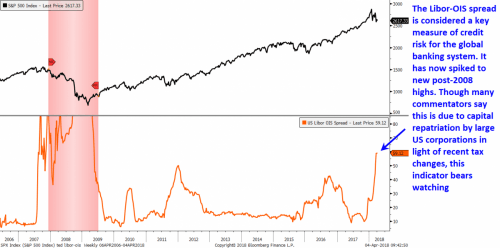

LIBOR rates, which are used to set interest rates on $200 trillion of dollar-based financial contracts globally, are on the rise, Puplava noted. As LIBOR rises, it will have far-ranging effects on markets around the world.

Source: Bloomberg, Financial Sense Wealth Management

“Here's the alarming fact,” Puplava said. “LIBOR has been rising for the last two and a half years, but, more importantly, it has started to accelerate. It's up by nearly 1 percent over the last six months, outpacing the Fed, and it will rise further as the Fed continues to raise rates.”

On top of this, we’re also seeing trillions of dollars being repatriated with the changes to the US tax code. Those trillions of dollars from overseas were being used as dollar funding loans, which kept LIBOR rates down. The largest source of demand for US dollars is coming from foreign banks, with a wide spread between US Treasury rates and foreign rates.

“There's no longer an advantage necessarily of going into US debt because of the wider interest rates,” Puplava said. “This is going to impact global capital flows into the United States. … The Fed has created a Frankenstein monster and now they're trying to kill it to extract themselves from the loose monetary policies they put in place to take us out of the last financial crisis. … They're more than likely going to take us into another crisis.”

For more information about Financial Sense® Wealth Management, click here. For a free trial to our FS Insider podcast, click here.

Article by Financial Sense