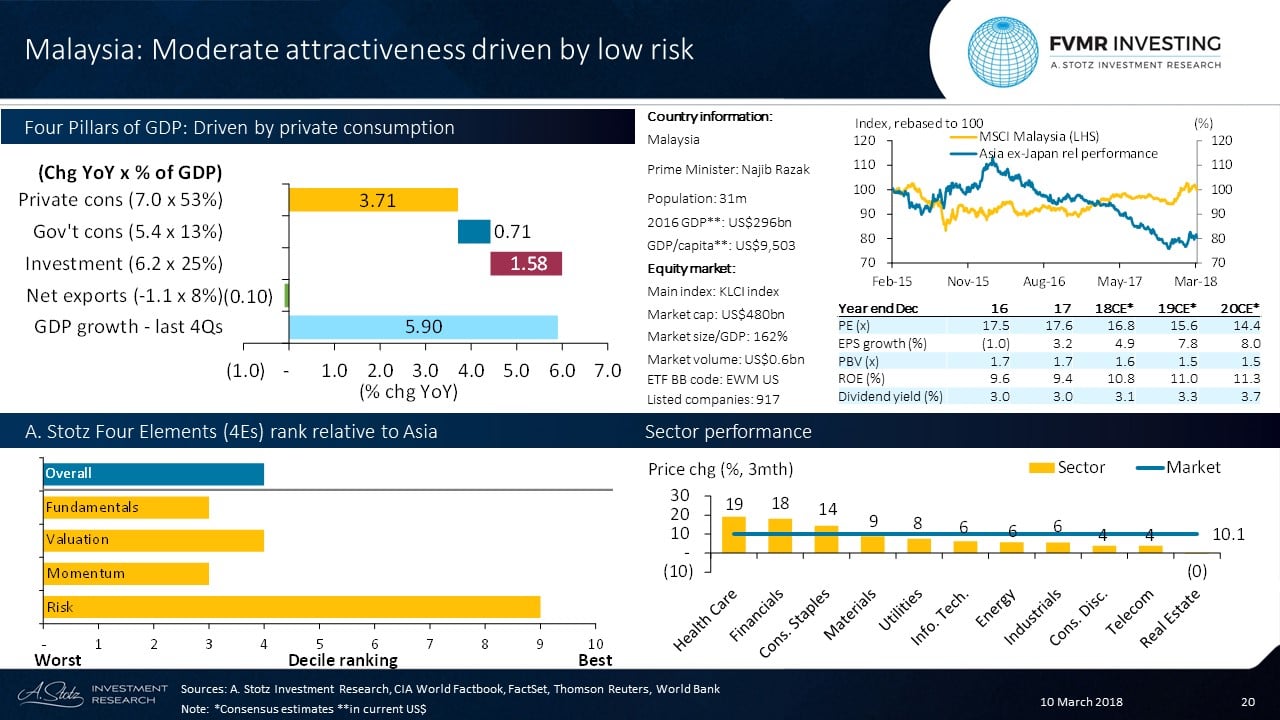

Four Pillars of GDP: Driven by private consumption

Malaysia has relatively fast GDP growth, driven mainly by private consumption and private investments. Net export was a slight drag on GDP growth in the past four quarters.

Malaysia is not cheap and fundamentals don’t impress

Malaysia is not cheap on PE or PB. Fundamentals aren’t impressive, slightly below Asia ex Japan, but decent dividend yield.

A. Stotz Four Elements: Malaysia’s rank relative to Asia

Overall, Malaysia appears moderately attractive in Asia considering all our four elements: Fundamentals, Valuation, Momentum, and Risk.

Fundamentals: Unimpressive, relatively low ROE.

Valuation: Trades above Asia ex Japan on both PE and PB. Decent dividend yield.

Momentum: Moderate price momentum, slow earnings growth.

Risk: Second lowest volatility in Asia.

Health Care and the largest sector Financials were in top

Top 3 largest sectors: Financials: 23% of the market; Consumer Staples: 14%; Industrials: 12%.

Best sector & stock: Health Care: +19.1% & Top Glove Corporation Bhd: +51.8%.

Worst sector & stock: Real Estate: -0.3% & S P Setia Bhd: -3.0%.

*CE is consensus estimates.

Article by Become A Better Investor