Skenderbeg Alternative Investments put into perspectives for the month April 2018.

“The whole problem with the world is that fools and fanatics are always so certain of themselves, and wiser people so full of doubts.” – Bertrand Russell

Hedge Funds

Drivers of hedge fund alpha revival

Barclays

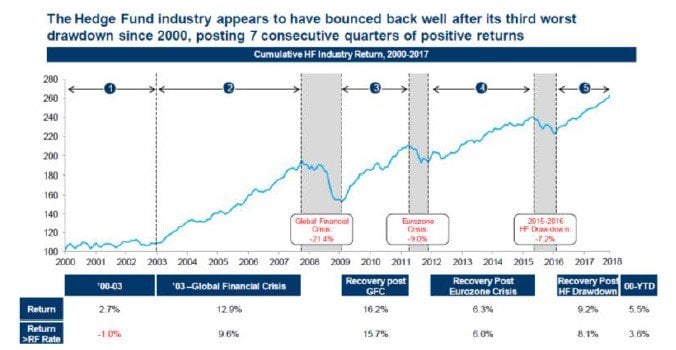

Hedge fund industry performance 2000-2017

Barclays

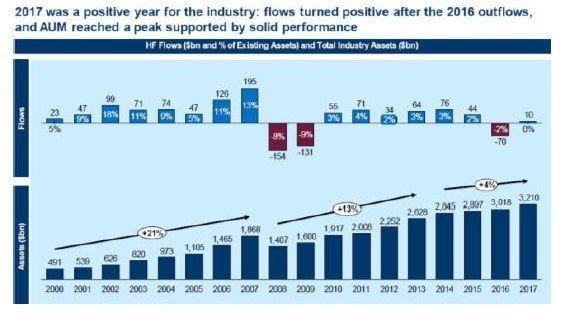

Hedge fund assets and flows

Barclays

Hedge fund mojo is back with investor hopes at six-year high

Hedge funds on the heels of a surprisingly strong performance in 2017 are raising hopes for an encore. Investors expect their managers to return 8.5 percent in 2018, according to a Credit Suisse Group AG survey. That's the most enthusiasm around the smart money since 2012, when global markets were rallying in recovery mode, benefiting from a massive injection of monetary stimulus. While real-money managers have attempted to curb expectations in a world of normalizing rates and increased volatility, hedge fund outlooks have brightened after sur-prising on the upside last year. The average realized return was 8.5 percent in 2017, versus an allocator target of 7.3 percent, according to the survey conducted in December and January, covering 45 participants with $1.1 trillion in hedge funds.

It may be more than just a case of recency bias, however. Whipsaw trading and market-moving headlines have put hedge funds in their com-fort zone, where they can suss out inefficiencies and prove their security-selection mettle. It's an advantage that's been rare in a relentless fixed-income and equity bull market pushing index-trackers higher and higher.

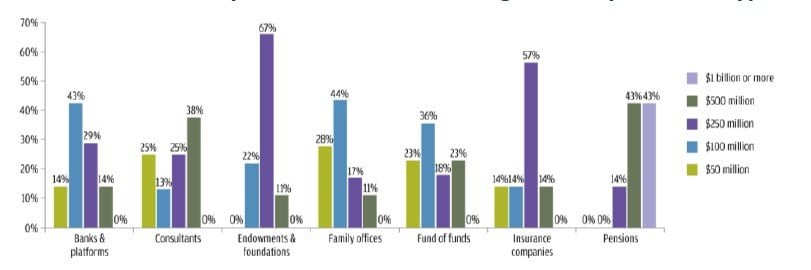

Minimum AuM required to invest in a hedge fund by investor type in 2017

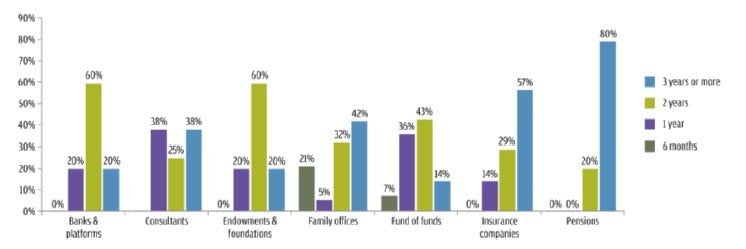

Minimum track record required to invest in a hedge fund by investor type in 2017

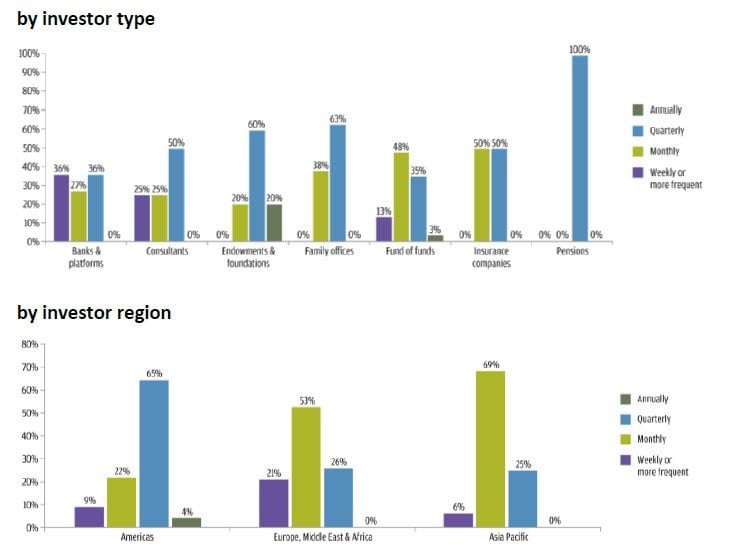

Liquidity preference in 2017

Career risk and market discipline in asset management

Andrew Ellul

Indiana University - Kelley School of Business - Department of Finance; Centre for Economic Policy Research (CEPR); European Corporate Governance Institute (ECGI); University of Naples Federico II - CSEF - Center for Studies in Economics and Finance

Marco Pagano

University of Naples Federico II - Department of Economics and Statistics; Centre for Studies in Economics and Finance (CSEF); Einaudi Insti-tute for Economics and Finance (EIEF); Centre for Economic Policy Research (CEPR); European Corporate Governance Institute (ECGI)

Annalisa Scognamiglio

CSEF; University of Naples Federico II - Department of Economic and Statistical Sciences

Abstract: We establish that the labor market helps discipline asset managers via the impact of fund liquidations on their careers. Using hand-collected data on 1,948 professionals, we find that top managers working for funds liquidated after persistently poor relative performance suffer demotion entailing a yearly average compensation loss of $664,000. Scarring effects are absent when liquidations are preceded by normal performance or involve mid-level employees. Based on a model with moral hazard and adverse selection, we find that these results can be ascribed to reputation loss rather than bad luck. The findings suggest that performance-induced liquidations supplement compensa-tion-based incentives.

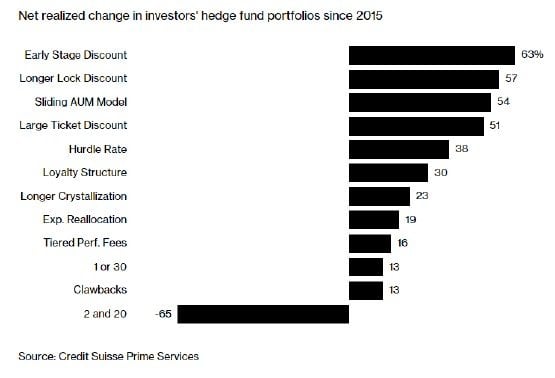

How hedge funds are winning back investors

Buy losers and sell winners? Reverse your thinking and be careful about avoiding or exiting losers

The general view is that an investor should pick good managers who have had a track record of success, but a more nuance look at data suggests that buying when good managers underperform can be valuable. Whether past performance provides some indication on future success has been one of the key issues facing any investor. We now have an interesting perspective from Brad Cornell, Jason Hsu, and David Nanigian in their Journal of Portfolio Management paper, "Does Past Performance Matter in Investment Management Success".

The authors followed a simple rule that is consistent with the behavior of many investors. They looked at the previous three-year returns and then buckets the performance into winners and losers. They then tracked the performance over the next 36 months relative to a benchmark. What they found may surprise many investors.

The losers did better than the winners. Hence, a switching strategy of selling losers and holding winners may actually lead to poorer performance. Now a consultant or advisor who advocates looking to increase allocations to losers may be viewed as crazy, but the data make a compelling case that an "off with their heads" approach to poor performance is financially dangerous.

The reason for this mean reversion is still not completely clear, but the flow of money into winners may affect performance is a leading candidate. Herding hurts the future performance of past since new money flow dilutes limited alpha.

So what should be the key take-away from this research? Do your homework and make your judgements on manager allocations through criteria that look beyond performance. The authors suggest some criteria focus by other researcher such as: fund manager compensation, fund manager ownership and commitment of capital, a high active share, outsourcing of non-investment services, having PhDs in key portfolio roles, and a strong positive firm culture.

Our view is that performance is one measure of success, but it should not be the definitive criteria for any allocation decision. Know your manager beyond the numbers.

Article by Skenderbeg Alternative Investments

See the full PDF below.