I love to barbecue outside on the grill. It hardly matters whether I’m cooking steak, pork, chicken, or ribs. But what does matter, for me, is the barbecue sauce. It has to taste distinctive. I like mine extra spicy.

Q1 hedge fund letters, conference, scoops etc

Not all barbecue sauces are the same. Some are vinegar-based; others are created with tomato or mustard. Some have paprika; others use red pepper. How do you pick the one you want? There’s no benchmark or standard. You read the ingredients; you choose what you like. (, a barbecue aficionado, always picks the right one.)

The same could be said for factor-based products. When you pick them for a portfolio, you are likely adding to an existing portfolio. You’re looking for a tilt on value, for instance, or to add an element of momentum.

But as with barbecue sauce, there can be a lot of differences and similarities between them. To know what you’re getting, read the bottle carefully.

When shopping for factors

How factor strategies are constructed and implemented can lead to markedly different results. It might be logical to think that because some are characterized as “indexes,” factor strategies should perform similar to one another. However, factor indexes can vary greatly, even those that have similar names and/or investment strategies. For example, there is no standard definition of value, even if a low price-to-earnings ratio is a commonly used metric.

Numerous important active decisions are made in an attempt to target a particular factor exposure. For most factor funds, the index provider makes these decisions as part of its construction methodology. The asset manager’s responsibility is to manage the portfolio to seek to track the index. As a result, even though a fund can technically be an index fund, the index itself is an active strategy.

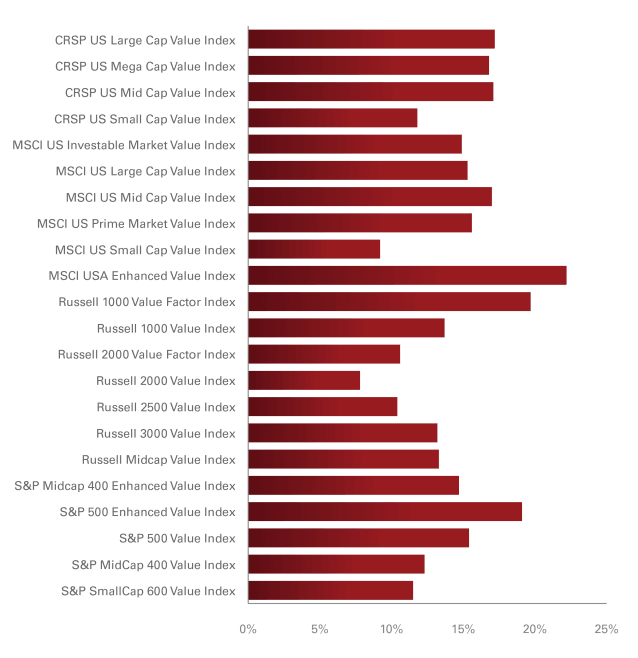

To give you a sense of how active decisions by index providers make a difference, we calculated historical returns for various indexes that target the value factor. The figure below shows that although these indexes may target the same factor, there are a wide range of outcomes.

Value factor index returns for 2017

Source: Vanguard.

Notes: Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. Benchmark comparative indexes represent unmanaged or average returns on various financial assets, which can be compared with funds’ total returns for the purpose of measuring relative performance.

Understand the factor recipe

Once you determine a certain factor is worth pursuing, how do you select the investment vehicle to gain exposure to that factor?

Here are four key questions to ask:

1. What metrics are used to represent the factor?

Let’s continue with the value example. Is the best metric price-to-book? Price-to-earnings? Both? Something else? What is the supporting evidence to suggest that the chosen metrics are a sensible way to access the style factor?

Read the full article here by Doug Grim of Vanguard, Advisor Perspectives