Small businesses make a sizeable contribution to the United States economy. They account for 99.7% of employer firms, and while they may be small, they contribute about 50% of private sector jobs. Most well-known companies have thousands of employees, but still only represent about half the jobs. That means the little guys, at least collectively, represent a formidable force in the US labor market.

Problems Small Businesses Face

One problem for small businesses is their lack of resources for professional business planners, strategy developers, and general consultants. Since the small businesses usually don’t have enough cash flow for these services, they are on their own when it comes to implementing industry best practices and surviving in a competitive market.

Small businesses (SBs) are, by definition, small. According to the United States Small Business Administration, that means fewer than 500 employees. 500 employees may not fit the stereotype of the 5-employee firm operating out of a garage, but it should be noted that the same SBA publication linked above shows that 73% of small businesses are sole proprietorships, meaning they have only a single individual. So while the strict definition may be 500 employees, it is certainly admissible to consider most small businesses are actually being small.

And we also know that small businesses start out with only a few employees then grow. So, growth and transition are integral to the small business field. Of course, as with any changing situation, there are growing pains and behaviors to avoid.

Different entrepreneurs, venture capitalists, and employees themselves have different thoughts on the most important behaviors to avoid, but they follow a general pattern.

First, the venture needs to conserve cash, generate cash, or find financing. For large businesses, the capital markets are a viable option; not so for the small guy. So, after a round of financing, the SB must decide where to spend its money. Marketing is essential, as people need to know about your product. There are cheaper and there are more expensive ways to market.

The business also needs to pay its employees. Unfortunately, some owners interpret cash conservation as the need to reduce employee wages. If a SB pays its employees subpar wages for the industry, there is likely to be an exodus as people find more stable jobs at bigger companies that pay more. Of course, startups are unable to pay employees like Wall Street, but keeping employees happy (through various avenues) is very important. Perhaps more importantly for employee happiness, though, is management’s avoidance of blaming the employees. If the employees are working as hard as possible, management needs to acknowledge that. After all, businesses are built on the backs of employees, not the shoulders of management.

On the topic of cash, let’s not forget about growth rates and customer retention. Businesses that grow too fast are subject to nasty solvency issues and a lack of funds. Once an idea is released into the wild, unless it exists under patent or copyright, competitors will spring up. If a SB has overextended itself, not only will it run into trouble with competitors, it will run into trouble with customers demanding more product, only to be rebuffed with an “out-of-stock” reply.

However, SBs are reliant on repeat business. Focusing on one-time sales and taking returning customers for granted are major managerial issues. There is a delicate balance between overextending growth and customer retention. Striking the balance is vital to small business survivorship.

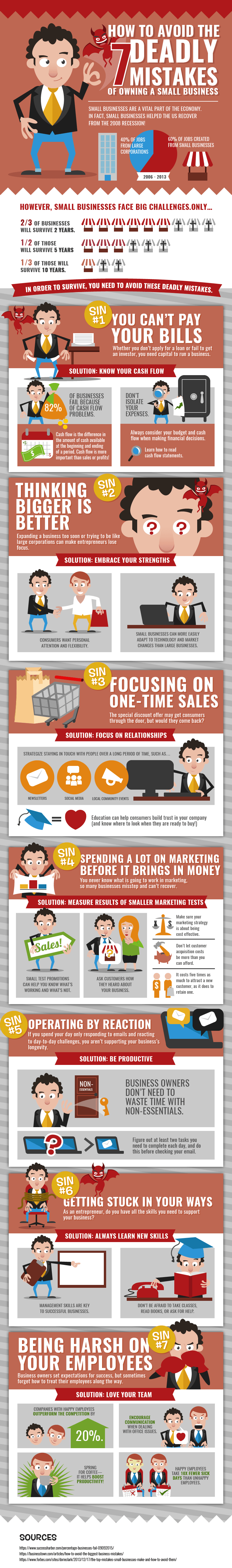

We found an infographic that nicely summarizes “7 deadly sins” of small business management, and those sins can lead to the corporate death – which, for small businesses, is unsurprisingly high. They include some of the points here as well as a couple more.