WHEN: Today, Monday, April 23, 2018

WHERE: CNBC’s Business Day programming

Q1 hedge fund letters, conference, scoops etc

Premium coverage on the 2018 Sohn Conference in NY can be found here

Sohn Conference 2018 main event here

Following are excerpts from the unofficial transcripts of CNBC interviews with Chamath Palihapitiya, Social Capital Founder and CEO; Bill Gurley, Benchmark General Partner; Nathaniel August, Mangrove Partners Founder; Seth Stephens Davidowitz, Former Google Data Scientist; Glen Kacher, Light Street Capital CIO and Founder; Larry Robbins, Glenview Capital Management Founder and CEO; and John Pfeffer, Pfeffer Capital Partner. CNBC's Business Day programming today, Monday, April 23rd, live from the Sohn Investment Conference in Partnership with CNBC. Video from the interviews are available on CNBC.com.

SOCIAL CAPITAL CEO CHAMATH PALIHAPITIYA SPEAKS WITH CNBC’S KELLY EVANS ON CNBC’s “CLOSING BELL”

Chamath Palihapitiya explains why Box is his best idea at Sohn from CNBC.

Palihapitiya on Dropbox vs. Box:

Dropbox is a great company and Drew’s a good friend, but what I would tell you is that Box has much deeper penetration into the enterprise. And when you talk about customers who are sticky and who are willing to pay potentially tens of millions of dollars of year on predictable basis, it typically is not consumers who do that, but large Fortune 500 and Fortune 1000 companies, and Box is, I think, penetrated almost 70%.

Palihapitiya on Sticky Box:

The most important thing to look at is this concept called churn, which is how fast are people leaving the service. And specifically you can look at companies leaving the service or the amount of dollars you’re losing. And in any of the metrics, Box is phenomenal. It is probably the top decile in terms its ability to retain customers and grow revenue. So it’s an incredibly sticky thing where once a decision is made, it takes a very long time for it to be unmade.

Palihapitiya on 30B Box:

This is a $3.3 billion company that I think has a huge margin of safety. It is one of the cheapest stocks around. It is growing at incredibly fast rates. And I tend to think, when I think about the businesses, “Can they 10x in ten years?” and I think this is possible to do that as well.

Kelly Evans: Could grow from a $3 billion to a $30 billion.

Palihapitiya: Over ten years I think it can.

Palihapitiya on Regulation:

When somebody gives you free software, or somebody gives you something free in general, you, the consumer, I think you have to ask yourself, “Am I the customer?” and when I’m a customer, I have rights. And so think about for example, when you buy a car, right, you give over money. Ford gives you a great vehicle, but they also give you a warranty. There’s laws that protect you, et cetera, et cetera. But then if you actually don’t pay anything, I think we have to be really open to the idea that maybe we are actually not the customer, but we are part of the product itself.

Kelly Evans: We are the product, yeah.

Palihapitiya: And In that context, I suspect what happens is that governments will have to get more involved, so that they create the proper guardrails

Palihapitiya on Google Privacy:

When we’re talking about privacy, we try to figure out, who knows what. And in the case of google, the reality is they actually don’t know who you are. They know a location of a phone, they may know a random e-mail address, they may know a bunch of search queries tied to the IP address, but it is very hard for them to actually know your first name and last name. There are really only a handful of companies, Apple, Facebook, and handful of others –

Kelly Evans: So you think that’s the difference, those companies that actually are –know us as the person with the name attached. And you don’t Google is one of them?

Palihapitiya: I think there’s a hierarchy of this, and I think that we can ask a pretty logical question about who knows those kinds of things.

Palihapitiya on Successful Businesses:

Where they become successful or they continue to compound success, it probably makes sense to take a step back and start to ask ourselves, where are other markets in old businesses who cannot embrace the same technology, how are they positioned? I think that’s where you are going to see, unfortunately, a lot of job destruction if we’re not careful. You’re gonna see, for sure, a lot of value and market cap disruption. And you’re going to see some really iconic businesses go by the wayside over the next few decades.

Palihapitiya on Facebook:

I think that these guys are doing the right things. I think that they are working in support of privacy. They’re trying to figure it out. It’s a really hard job, it’s super nuanced, they are trying hard and I think they’ll figure it out.

Palihapitiya on Sports:

I really believe in the Buffet idea where once you buy really high quality businesses, best thing is to never revisit them and –

Kelly Evans: And that includes a basketball team?

Palihapitiya: Yeah, and in fact, the reason why I say that is because I think in a world where we are all in front of our phones all the time, things that give us a connection to the people around us, things that bring us together physically in an environment, have huge premium value. And one of those things is sports. Now, movies can do that potentially, music can do that, but I put sports at the top of the pecking order there in terms of the ability to bring people together.

BENCHMARK GENERAL PARTNER BILL GURLEY WITH CNBC’s SCOTT WAPNER ON CNBC’s “FAST MONEY HALFTIME REPORT”

State of tech investing with Benchmark's Bill Gurley from CNBC.

Gurley on ride sharing cars:

To impact the ride sharing market, you have to deliver a fully autonomous car that’s level 5 without a steering wheel. Because if you don’t pull the driver out, you don’t change the economics. Below 30k in volume. And I think watching Tesla, we see producing brand-new cars in volume doesn’t happen overnight.

Gurley on Facebook:

You’ve got to get to trust first and you have to figure out what that is that gets you there. I don’t think the advertisers leave until the consumers leave. So the question is, have you created a situation where maybe consumers feel more open-minded at trying something else, if they feel burnt? But I think there’s nothing out there yet, and so I think there’s a window here to regain trust.

Gurley on Facebook v Google Data:

Part of what led to, I think, the intensity of the scrutiny of Facebook is that the way it was exploited touched on political grounds. Which are very emotional to people. And so you ended up with a very emotional response. Google hasn’t had a situation where the data has leaked externally and been used for what consumers consider to be nefarious methods.

Gurley on Apple:

The question that investors can put to the company, right, with the passing of Steve and with Tim being an operations guy is do we have innovation left inside the company? They have historically been prone to an insider only mentality, so you also don’t see a very acquisitive company despite a huge cash prop. So I think the pressure is probably on for them to come forward with a product that proves that they can still innovate.

Gurley on Bitcoin:

The thesis around bitcoin as a store of value versus a bunch of countries that are overinflating is an interesting concept and has a lot of strategic heft to that singular argument. So far to date, no one has developed any technology around the distributed kind of blockchain concept that has technical efficiency.

MANGROVE PARTNERS FOUNDER NATHANIEL AUGUST SPEAKS WITH CNBC’S KELLY EVANS ON CNBC’S “CLOSING BELL”

Mangrove Partners' Nathaniel August on his best idea at Sohn from CNBC.

August on Peabody:

Well, coal is undeniably a cyclical in this, and Peabody is, in my option, the largest and least expensive way to participate in the coal market.

Kelly Evans: Why do you want to participate in the coal market? For years we’ve talked about war on coal, and granted, when this president came into office, he changed the tenor of that a little bit, but there’s a lot of difficulties out there.

August: That’s undeniable that there are in the United States, but actually the majority of Peabody’s EBIDTA is coming internationally, and those markets are growing nicely, so in our opinion. And so in our opinion, you can actually get the U.S. business for free if you buy Peabody today based on the valuation of the international business.

August on Australian Operations:

Peabody is producing the majority of its EBITDA in its Australian operations. By our calculations they should do roughly $800 million in EBITDA out of Australia this year after allocating corporate expense and then another $600 million from the U.S. operations. And the U.S. operations really don’t export at all. They really serve domestic utility customers and they actually sit at the bottom end of the cost curve, so there the most competitive lines in the United States. But the crown jewel in our opinion is the Australian business, again, doing $800 million, and look at comps for the Australian business.

August on Chinese Steel:

Chinese steel production grew about 5% last year, it’s grown steadily every year since 2009 and there are no signs it’s going to end as the company continues to invest in infrastructure and new buildings. And China is not really a major exporter of steel to the United States because tariffs have been on Chinese steel for a while now.

August on Oil Companies:

In the oil patch, our favorite domestic companies are Bonanza Creek, Penn Virginia, and PVC Energy. And what’s interesting about Bonanza Creek and Penn Virginia is that both of those companies eliminated almost all of their debt by going through bankruptcy just like Peabody did, and so you have a clean balance sheet for each of them and they can both grow extremely profitably at current oil prices.

FORMER GOOGLE DATA SCIENTIST SETH STEPHENS DAVIDOWITZ SPEAKS WITH CNBC’S KELLY EVANS ON CNBC’S “CLOSING BELL”

Davidowitz on Google Trust:

Well I think Google does have more information than Facebook does. I don’t know that it’s bad, makes the product better, but people are honest to Google, so they don’t tell Facebook what they are really thinking – their health conditions. So I think—

Kelly Evans: Well, whether they mean to or not. Because they’re typing that it into the search box. Right?

Davidowitz: Exactly. So I think generally, Google’s data set is bigger, more powerful than Facebook's.

Davidowitz on Advertisers:

It would take a lot for advertisers to change it. I think they’re happy with the product googles giving them, but if there was a big outcry, that could change behavior maybe, advertiser behavior. I think I’d more nervous about user behavior. If users think twice before using a site, that could be really, really damaging.

Davidowitz on Google Products:

One of the reasons Google has flown under the radar is because people really do value the products, even more so than Facebook. They trust -- they are happy with Google keeping their information if it’s going to suggest where they might want to go, if it’s going to suggest their home when they type it in Google Maps and finish it before they even put it, they’re like, “Oh, that’s a good service.”

LIGHT STREET CAPITAL CIO AND FOUNDER GLEN KACHER SPEAKS WITH CNBC’S SCOTT WAPNER AND CNBC’S KELLY EVANS ON CNBC’S “CLOSING BELL”

Light Street's Glen Kacher on his best idea at Sohn from CNBC.

Kacher on Palo Alto:

We’re seeing in the IT industry, we’re moving from traditional enterprise on premises setups to hybrid cloud and enterprise computing networks where data travels over a lot of different clients and a lot of different kinds of networks, and that opens up a new opportunity for Palo Alto as the leader in enterprise to expand their franchise to the cloud model.

Kacher on Hackers:

It’s a battle that is raging every day, and one of the statistics I talked about in the presentation was the amount of time that companies or governments have between the time when the hackers first enter the network and when they discover them and are able to shut them down. That shrank from 400 days on average to 100 days over the past five years, so that – we’re making a lot of progress, but 100 days for criminals to be in your computer network is 100 days too many.

Kacher on Wayfair:

I think there’s other winners, like a Palo Alto Networks that we discussed. I think you have companies like Wayfair that’s -

Scott Wapner: Alibaba, Right?

Kacher: Yes. Alibaba. There have only been a handful of companies beat Amazon.

Kelly Evans: You put Wayfair up there with the fangs? Wayfair?

Kacher: Absolutely.

Kelly Evans: Wayfair.

Kacher: Only companies who beat amazon is Netflix and Alibaba, and Wayfair. Wayfair is crushing Amazon in the furniture e-commerce market, and we’re long it and love the stock.

Glenview Capital Management’s Larry Robbins Speaks with CNBC’s David Faber on CNBC’s “Fast Money”

Top hedge fund manager's best stock picking ideas from CNBC.

Robbins on Amazon Rx Entry:

The barriers to entry are quite high. Let’s take pharmaceutical distribution, like McKesson, Amerisource and Cardinal. UPS looked at getting into this exact same business in 2006. But you need separate custody, pick, pack and ship facilities around the United States. You can’t co-mingle opioids or narcotics with other general merchandise goods. You need cold storage through the entire chain, plus you need to connect all the suppliers with all the customers but the customers aren’t necessarily Amazon’s consumers. The customers are the places where pharmacy actually happens and unlike many businesses which Amazon has appropriately automated, there’s always going to be a human pharmacist that has a role both regulatory as well as consumer preference because we’re dealing with lifesaving medical issues.

Robbins on Cigna Express Scripts:

David Faber: Let’s just stay in this. First of all, Express Scripts getting bought by Cigna. Are you supportive of that deal?

Robbins: We are supportive of that deal. That deal spreads trades at a 23 gross spread. I think the companies think that it will close by the end of the year. The major hurdles to the deal are a shareholder vote by both sides as well as government approval. Even though it has nothing to do with the At&T Time Warner deal, the arbitrage community is watching that deal as a benchmark for vertical integration. So –

Faber: CVS/Aetna is another one that’s been caught up in the same argument of course.

Robbins: Exactly right. And so to the extent that the government fails in its quest to block those deals, I think you can see the spreads somewhat compressed. But by the end of the year they’ll either be a yes or a no. While many people were surprised by Cigna’s acquisition, and we did not own Express before the deal, we do understand respect and buy in to the concept that if you have scale on the managed care side and scale on the pharmaceutical benefit management side that through better data analytics you can actually lower the per member per month cost we think by $20 or 5% per member per month and since Cigna is mostly an ASO business that’ll mostly get passed on to customers. So this merger will actually be pro-competitive and pro-customer.

Robbins on Shire:

In the case of shire, we believe they brought it upon themselves that they’re in this position. The stock was trading below 1.30 per share. Right. They’re gonna earn about $15. I’m talking in U.S. because that’s the way I think in U.S. And so any time a major company that thinks they have a good and growing franchise is trading at 9 times earnings the companies either need to help themselves or they will either attract shareholder activists or in the case of Takeda, a slightly smaller-fish-bigger fish transaction where that corporate is effectively be the activist. The Takeda transaction offers three levers of the value creation.

Robbins on the Cash-Stock Shire Deal:

We would encourage Shire’s board to go through a full and fair process to compare all alternatives including things they can do with themselves but we are not scared of the concept of there being a transaction which as proposed in the fourth proposal would be 45% cash and 55% Takeda equity. In the work that we’ve done in the last several weeks to date, Takada equity at 12 times year one earnings, the deal is 35% accretive to them, looks quite attractive as a longer term investment.

Robbins on owning CBS:

We own the stock because the underlying cash flows are cheap and we think CBS is a reasonably scarce asset. At the end of the day, it’s about the quality and the content of their programming. Viacom is a very different story where they had historically successful brands which have great brand recognition but their programming was lacking over the intermediate term and they’re in the midst of a turn around with a very valuable asset in the Paramount Studios, probably worth more than its current EBITDA. With the case of CBS, both Showtime and CBS programming has been wonderful, largely fuelled by the human capital that runs CBS.

Robbins on CBS-Viacom Merger:

I think it’s in the controlling shareholders best interest to combine the companies but to provide them with the best human capital. There’s a sacred covenant between controlling shareholders and the public markets that scratch each other’s back. Look at all John Malone has done over time, he’s at times been a quasi-controlling shareholder but the reason he’s been so successful over time is because his partnered with the public markets rather than been an adversary of them. There’s an opportunity for national amusements to partner with the public markets going forward and we hope that’s the path they choose.

PFEFFER CAPITAL’S JOHN PFEFFER SPEAKS WITH CNBC’S MELISSA LEE ON CNBC’S “FAST MONEY”

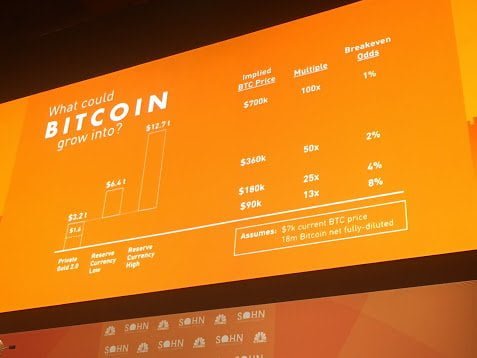

Pfeffer on Bitcoin:

People should think of crypto assets as a venture capital investment. It could go to zero but there’s a chance that they could be worth much more. In the case of bitcoin, the $90,000 price would be what it would be worth if bitcoin became equal to private gold bullion holdings, about $1.6 trillion of total value compared to 150 billion or thereabouts today. And, you know, it’s a bet. It’s a risk that I think is interesting and I’d be willing to take.

Pfeffer on Gold:

I don’t think this is about about paying for coffee. At least that’s not -- that’s certainly not my thesis. So I completely agree. In developed country like the U.S., there’s no screaming need. In developing countries, or certainly countries with collapsed currency it is more important and could be used for daily use. When I think about the displacement argument, I start with gold because I think that gold frankly is kind of silly. I mean, we’re a space-fearing digital society and we're still using a yellow metal as our non-sovereign store of value. At some point we’re going to come up with a better technology than that. And bitcoin is the first candidate to do that.

Pfeffer on 90K Bitcoin:

$90,000 is in my view relatively, quote, low bar. That’s only about – I mean, only, about ten times the current price. Right now it’s mostly retail investors, not much institutional investors. I could see private sector institutional investors helping it get to that price, you know, in the next couple of years. I don’t know. I’m not -- to be honest, I don’t want to make time point estimates because it’s a venture capital bet and venture capital is a long-term thing. But yeah, I think that it could be sooner. The higher number of some kind of foreign reserve displacement that’s a much longer term thing.

For more information contact:

Jennifer Dauble

CNBC

t: 201.735.4721

m: 201.615.2787

Emma Martin

CNBC

t: 201.735.4713

m: 551.275.6221

About CNBC:

With CNBC in the U.S., CNBC in Asia Pacific, CNBC in Europe, Middle East and Africa, and CNBC World, CNBC is the recognized world leader in business news and provides real-time financial market coverage and business information to more than 409 million homes worldwide, including more than 91 million households in the United States and Canada. CNBC also provides daily business updates to 400 million households across China. The network's 15 live hours a day of business programming in North America (weekdays from 4:00 a.m. - 7:00 p.m. ET) is produced at CNBC's global headquarters in Englewood Cliffs, N.J., and includes reports from CNBC News bureaus worldwide. CNBC at night features a mix of new reality programming, CNBC's highly successful series produced exclusively for CNBC and a number of distinctive in-house documentaries.

CNBC Digital delivers more than 50 million multi-platform unique visitors each month. CNBC.com provides real-time financial market news and information to CNBC’s investor audience. CNBC Make It is a digital destination focused on making you smarter about how you earn, save and spend your money by zeroing in on careers, leadership, entrepreneurship and personal finance.

CNBC has a vast portfolio of digital products across a variety of platforms including: CNBC.com; CNBC PRO, the premium, integrated desktop/mobile service that provides live access to CNBC programming, exclusive video content and global market data and analysis; a suite of CNBC mobile products including the CNBC Apps for iOS, Android and Windows devices; and additional products such as the CNBC App for the Apple Watch and Apple TV.

Members of the media can receive more information about CNBC and its programming on the NBCUniversal Media Village Web site at http://www.nbcumv.com/programming/cnbc.

For more information about NBCUniversal, please visit http://www.NBCUniversal.com.