Following President Donald Trump’s China tariffs announcement, Beijing had floated the idea of hitting the US with tariffs on 128 products included dried fruit and pork. Monday, Beijing announced they would be making good on this threat and implementing the tariffs on $3 billion worth of imported US goods. The China tariffs have led many to speculate that a trade war between the worlds two largest economies has begun.

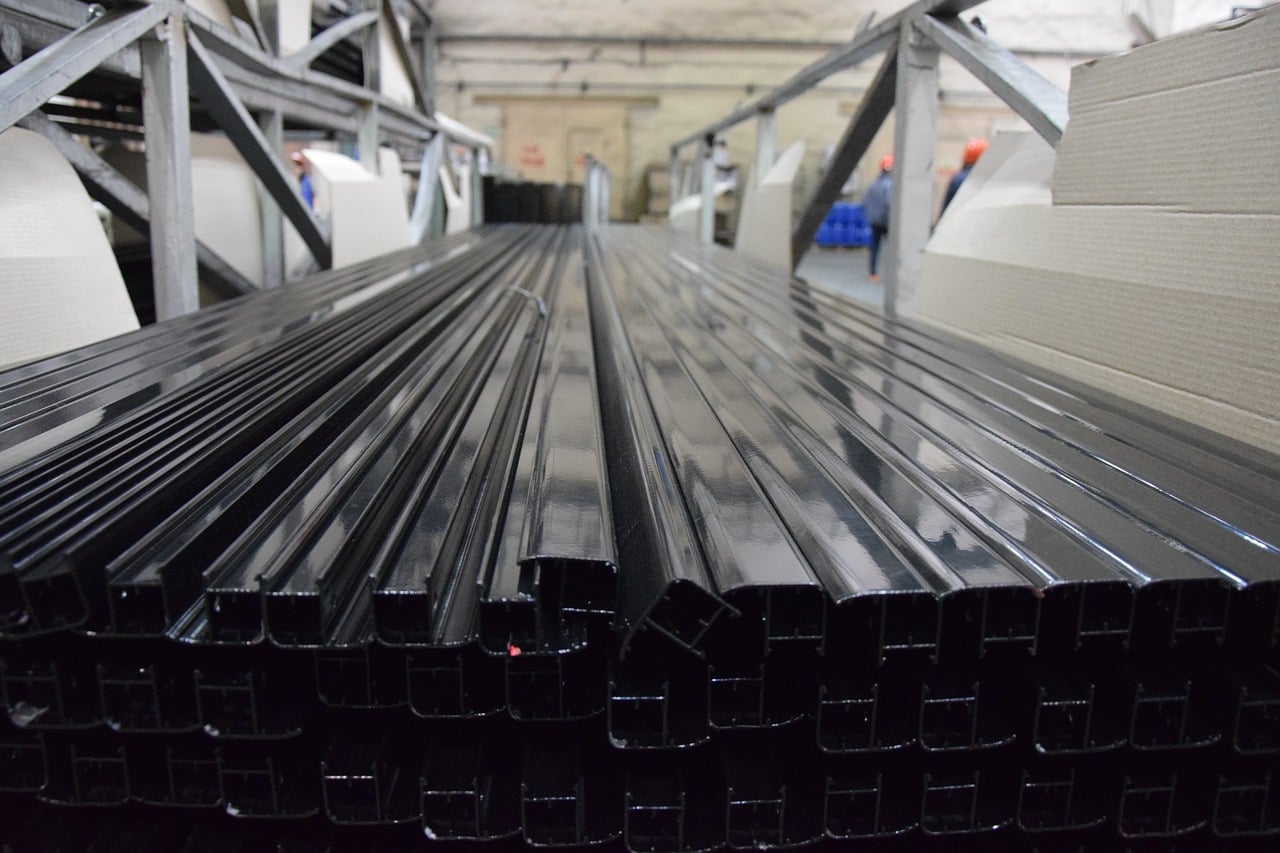

President Trump imposed the 15% aluminum and 25% steel tariffs citing a rarely used trade provision which allows the president to impose tariffs on the grounds of national security. China, along with a number of other trading partners, claim the tariffs are a violation of international trade laws. Several key US allies, including Mexico, Canada, South Korea, and the European Union have been exempted from the steel and aluminum tariffs.

China has indicated that their tariffs were issued in retribution to President Trump’s steel and aluminum tariffs which targeted a number of countries, including China. Tariffs are often seen as retaliatory measures and the China tariffs are no exception, indicating growing tensions between the two countries. The China tariffs were originally proposed 10 days ago, leading to speculation over whether Beijing would actually implement them.

The US isn’t the only trading power taking issue with China’s economic policies. Japan and Europe have also clashed with the communist country over its state-led model which violates free trade agreements and limits access to the market.

China Tariffs from Beijing

As on Monday, Beijing is implementing a 15% tariff on 120 American goods including fruits, nuts, and steel pipes. Another eight products will be sanctioned at 25% including recycled aluminum and pork. Sunday, Beijing also announced they will be adding a 15% tariff on US imported ethanol, increasing the duty to 45%.

The ethanol tariff eliminates the cost difference between buying Chinese ethanol and the cheaper American ethanol. In an effort to reduce the infamous smog that covers many Chinese cities, the Chinese government plans to mandate that all gasoline be blended with ethanol by 2020. This plan calls for 16.5 million tons of ethanol, which requires nearly 50 million tons of corn to produce. Currently, China only produces around 2.7 tons of ethanol annually. Experts believe the Chinese market will be unable to meet the demand for domestically produced ethanol. Brazil is the largest producer of ethanol in the world, but their prices are still much to high for China. Economists believe this will force China to once again turn to US production of ethanol.

Experts point out that the $3 billion fingered by China for tariffs is just a small percentage of the hundreds of billions of dollars in goods that flow annually between the US and China. Tariffs are unlikely to hinder this trade relationship anytime soon, but they could have serious consequences for certain industries. US pork producers worry that the 25% tariff on pork could have a significant impact on rural America. Chinese voices have called for a tariff on US imported soybeans. China currently stands as the largest market for US soybeans. A tariff on soybeans could have further consequences for rural America, an import fraction of President Trump’s base.

Some of the largest US pork producers are actually Chinese owned companies. It is not yet clear whether Chinese owned organizations will be exempt from the tariffs.

Trump’s China Tariffs

In addition to the controversial steel and aluminum tariffs, President Trump has also announced duties specifically targeting China.

Friday, March 23, President Trump announced tariffs on $50 billion of Chinese goods in response to Chinese theft of American intellectual property and Beijing’s alleged pressuring of foreign companies to hand over technology. President Trump indicated these tariffs were only the beginning stages of his actions against China. The Trump administration has not indicated which goods specifically can be expected to be hit with tariffs, but Chinese machinery, aerospace, and technology industries can expect to see tariffs. Washington has said they will also take steps to limit Chinese investment into US tech.

The Trump administration has opened up a 30 day comment period for businesses before implementing the tariffs. The official announcement is expected to come April 6th.

While on the campaign trail, then Candidate Trump often targeted the trade deficit with China, Beijing’s currency manipulation, and Chinese intellectual property theft as causes behind rising unemployment and shuttered factories in the US. The trade deficit with China stands at $375 billion as of 2017. A recent study conducted by the United States Trade Representative found the annual cost of Chinese intellectual property theft on the US economy amounts to up to $600 billion a year. These numbers confirm an earlier 2017 study led by Commission on the Theft of American Intellectual Property.

While campaigning, Trump promised to be tough on trade with China, leading many experts to warn that this could lead to a trade war and an increase in the cost of consumer goods. Trump supporters loved his tough rhetoric in the election cycle, but many experts wonder whether they will be willing to see a potential increase in the cost of living due to a trade war with Beijing following the first round of China tariffs.

Despite criticism and even panic from political pundits, as well as the fresh China tariffs, President Trump hasn’t backed down on his stance on trade with China, promising further measures coming down the line.

A Coming Trade War?

For the past few weeks analysts and economists around the world have been contemplating whether a trade war between the US and China is rapidly evolving. Monday’s implementation of China tariffs seems to indicate that a trade war is brewing. Despite the tough rhetoric, Chinese officials have indicated their willingness to negotiate, but are also “prepared for the worst.”

Treasury Secretary Steven Mnuchin has said that US and Chinese officials are communicating behind the scenes to avoid escalation.

Asian markets in Shanghai and Tokyo closed low on Monday following the China tariff announcement on Monday.