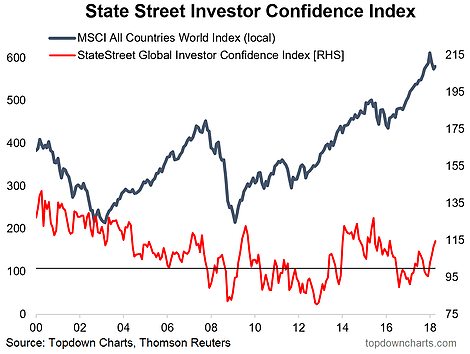

The April round of the State Street global investor confidence indexes showed institutional investors appear to be growing more confident on the outlook for risky assets. The regional indexes showed this uptick in risk appetite has been widespread across the major regions. It appears as though institutional investors are looking through much of the “noise”, and focusing on the reset in sentiment and valuations against the backdrop of decent earnings and economics. With this group of investors controlling large sums of money it will be interesting to see if this increased confidence translates into higher stock prices.

Q1 hedge fund letters, conference, scoops etc

The key takeaways from the latest State Street investor confidence index results are:

-Global institutional investors are increasing allocations to risky assets.

-The uptick in investor confidence is widespread across the major regions.

-The investor confidence indexes are quantitative indicators, and take account of actual changes in allocations across State Street’s $30 trillion global custodian business.

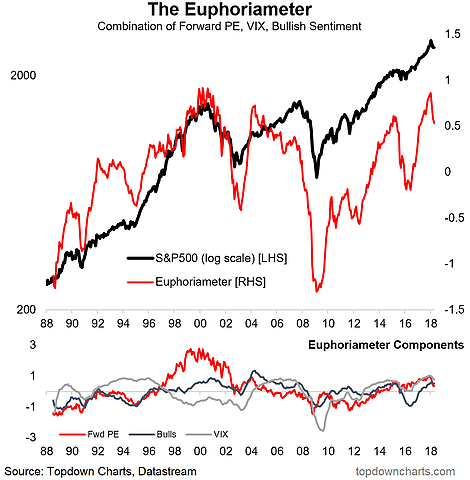

-As the Euphoriameter shows, there has been a reset in ‘investor euphoria’ driven by lower valuations, higher volatility, and less bullishness in the surveys.

- Global Institutional investor Confidence Index: The April reading of the State Street global investor confidence index showed a further rise, +3pts to 114.5, which is the strongest reading since March 2016 – which coincidentally was just after a substantial stock market correction. Basically institutional investors are feeling fairly confident on the outlook for risky assets, and appear to be looking through the noise (trade wars, geopolitics, etc) and focusing on the reset in valuations, decent earnings results, and solid global macro pulse.

- Regional Investor Confidence Indexes: Looking at the regional indexes, the pickup in institutional investor confidence was broad, with all of the regional indexes rising above 110, indicating that globally the generalized trend is for institutional investors to be increasing allocations to risky assets. Given these investors control significant amounts of money it will be interesting to see if this translates into a turnaround in stock prices.

- The Euphoriameter: Speaking of resets, the Euphoriameter preliminary reading for April shows a fairly significant reset, with lower valuations, less bullishness, and higher volatility all contributing to the unwind in what was previously some pretty extreme readings. In fairness, the reset pales in comparison to the magnitude of that seen during the 2015/16 twin corrections, but at the very least, the tax-cut hype has been completely unwound. Given the global economic upturn appears to still be intact it makes for an interesting set up for stocks.

Looking for more actionable ideas? Why not take a free trial for an extra level of insight and service…

Follow us on:

LinkedIn https://www.linkedin.com/company/topdown-charts

Twitter http://www.twitter.com/topdowncharts

Article by Top Down Charts