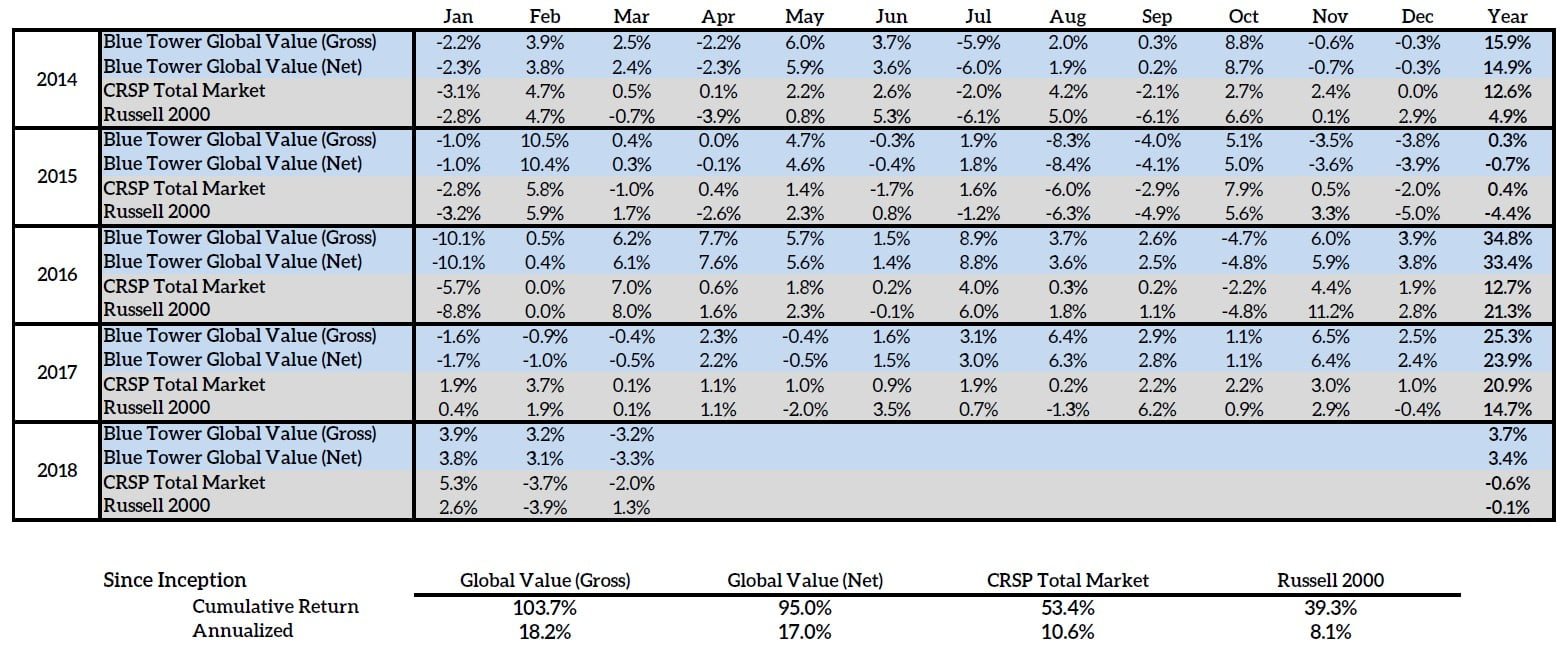

The Global Value strategy composite returned 3.68% gross (3.41% net) for Q1. A major contributor to our performance this quarter was the gain in our financial stocks.

Continuing with the Japan theme of the last two letters, we will explore another Japanese equity in this quarter’s update. Fujitsu Frontech is a listed beneficially owned subsidiary of Fujitsu Ltd, the multinational Japanese information technology company. Owning 53.2% of outstanding shares at the end of FY2017, Fujitsu is the majority shareholder of Fujitsu Frontech.

Additionally, Fujitsu is the main customer of Fujitsu Frontech with 47.9% of sales going to the parent company. While comparatively rare in the United States, the practice of publicly listing beneficially owned subsidiaries is common in Japan.

Overview of Company

Most of Fujitsu Frontech’s products have a user interface component and connect to the IT systems of businesses. This includes point-of-sale devices, self-checkout systems, ATMs, and totalizator terminals for gambling. The company also produces biometric access systems and loss prevention security systems based on RFID. Most of their customers are domestic with sales outside Japan making up 25.2% of total. Fujitsu Frontech lacks sell-side analyst coverage.

Fujitsu Frontech, as well as the fujitsu business group as a whole, has gone through significant business restructuring in the past ten years. In April 2009, Fujitsu Frontech purchased 100% of the shares of Fujitsu Transaction Solutions Inc and rebranded it as Fujitsu Frontech North America. In June 2009, the company purchased the Totalizator Engineering Limited business segment from Fujitsu FSAS Ltd. Both of these transactions added significant goodwill to the balance sheet of Fujitsu Frontech which must be amortized over a set period of years in accordance with Japanese GAAP. There were also large capital expenditures in the fiscal year ending 2010 associated with the integration that have produced depreciation charges in subsequent years. As a result of these noncash charges, free cash flow generation has been significantly higher than net income for the past few years (for the fiscal years ending 2011-2017, the ratio of FCF/NI has been 221%). Investors focused on earnings may give the stock a higher valuation as the accrual-based earnings converge with cash flow.

Fujitsu Frontech has ¥20.7 Billion of cash & cash equivalents on its balance sheet (equal to 45.8% of its market cap).

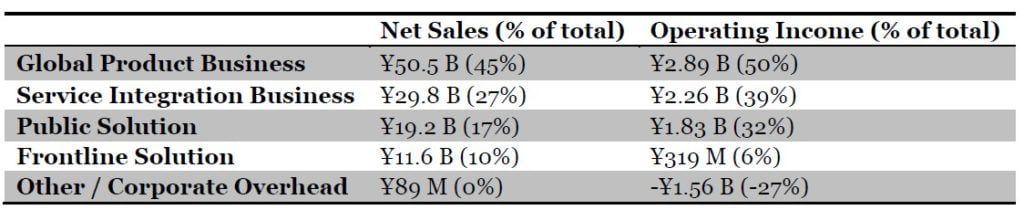

Business Segment Data – FY ending 2017

Like many Japanese listed affiliates, the company has a collection of small lines of business. The company currently has four business segments: Global Product, Service Integration, Public Solution, and Frontline Solution.

Global Product

This is the largest segment for the company and includes their ATMs, banking terminals, bill counters, and currency recyclers. For banks that still offer passbook-based bank accounts, their equipment can also manage the printing of transactions to those passbooks. They also have specialized devices for specific overseas customers in the airline industry; these include boarding ticket printers and baggage tag printers.

Service Integration

This segment focuses on services related to the types of products that the business markets. This includes cash management services for the retail outlets and ATM outsourcing for banks. This segment also includes the sale of service agreements to maintain the company’s products. Retail outlets and banks that use their equipment can also contract Fujitsu Frontech to manage their company’s data on cloud systems. All of these services are attractive to us as they provide recurring revenue to Fujitsu Frontech after initial sales.

Public Solution

This segment includes equipment related to large public gatherings of people. Included in this category are display systems and scoreboards for sports stadiums, totalizator systems for the sale of betting tickets for racetracks and the calculation of the payouts of those tickets, display systems and timetables for subways and train stations, display systems for hospitals and public facilities, and computer terminals for public auctions. This segment includes all aspects of these lines of business from services, maintenance, manufacturing, marketing, and R&D.

Frontline Solution

This is their segment for the biometric access solutions and RFID security systems. Their palm vein scanners are sold both as stand-alone scanners and as part of software development kits. Their loss prevention security systems include equipment for writing to new RFID tags, and integrate with the POS and cloud systems of their other business segments.

Fujitsu Frontech’s business is made up of loyal business customers. The integration with other services and products of the company creates a switching cost for customers. The recurring revenue and their loyal customer base allowed the company to remain profitable even during the global financial crisis. The niche nature of many of these lines of businesses act as an economic moat of a sort as competitors are less likely to be attracted to competing fiercely for any of them.

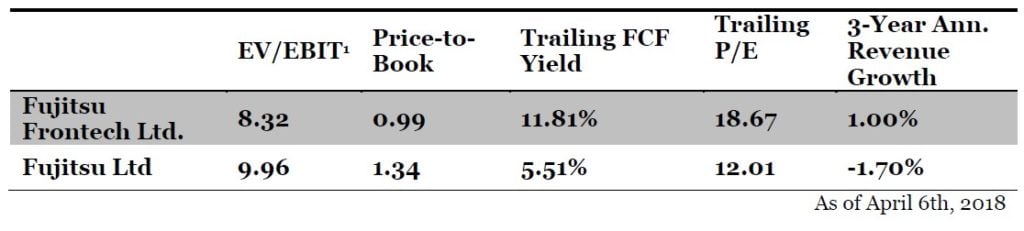

Valuation

Like many listed affiliates of Japanese conglomerates, Fujitsu Frontech trades at a discount to its parent company. Some of these Japanese conglomerates have taken to deploying their capital by buying up their undervalued subsidiaries. An example of this was the 2017 purchase of PanaHome by Panasonic. In these buyouts, it is usually better to be a holder of the target than the acquirer as the acquisitions are made at a premium to market prices.

Summary of Our Investment Thesis

1) Improving Corporate Governance in Japan

2) Relatively cheap valuation and huge cash balance

3) Convergence of earnings with free cash flow

4) Possibility of parent company acquiring its subsidiaries at a premium

Risks

Many of Fujitsu Frontech’s product lines deal with cash. The worldwide trend has been towards a cashless society of electronic transactions which may reduce demand for these product lines in the future. This may be offset by growth in Fujitsu Frontech’s other product lines such as palm vein biometrics and RFID.

I hope our clients have enjoyed this letter, better understand Blue Tower’s view on Fujitsu Frontech, and why we have made it our third largest position.

Sincerely,

Andrew Oskoui, CFA

Portfolio Manager

Global+Value+Monthly+Performance+Summary+Mar2018