Black Bear Value Partners LP commentary for the first quarter ended March 31, 2018.

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” -Sam Ewing

To My Partners and Friends:

Black Bear Value Fund, LP (the “Fund”) returned approximately 0.3% in the 1st quarter of 2018 (1). This compares to -1.2% for the S&P 500 in the quarter. We own a concentrated portfolio that will not mimic the S&P 500 and will deviate both to the up and down. We entered the 2nd quarter of 2018 with an approximate cash balance of ~16% and an average short position of ~29%.

As mentioned in previous letters, a substantial amount of the Fund’s capital is my own. Time and energy are focused on compounding our capital together over the long-term. At Black Bear, every LP’s dollar is treated with the utmost consideration and care. Together, we will build a partnership with deep and long-lasting roots.

A fundamentally-driven and concentrated investment portfolio should outperform various market indices over a long-term horizon with reduced risk of permanent capital impairment. Each investors’ return will vary depending on the timing of the investment.

Shorts (Securities we are betting against)

We are short a variety of bond ETF’s (exchange-traded funds). These structures were not created for illiquid bonds in the event of a large sell-off. The underlying assumption is the market-marker will stand in the middle to prevent the structures from breaking. It is hard to predict how things play out if the market makers lose confidence in the liquidity of the underlying bonds. There is a large retail presence in these ETF’s and I fear everyday people will be irreparably harmed in owning these instruments. In the search for income, many mom/pop investors are buying very risky instruments that are not compensating them for the high risk.

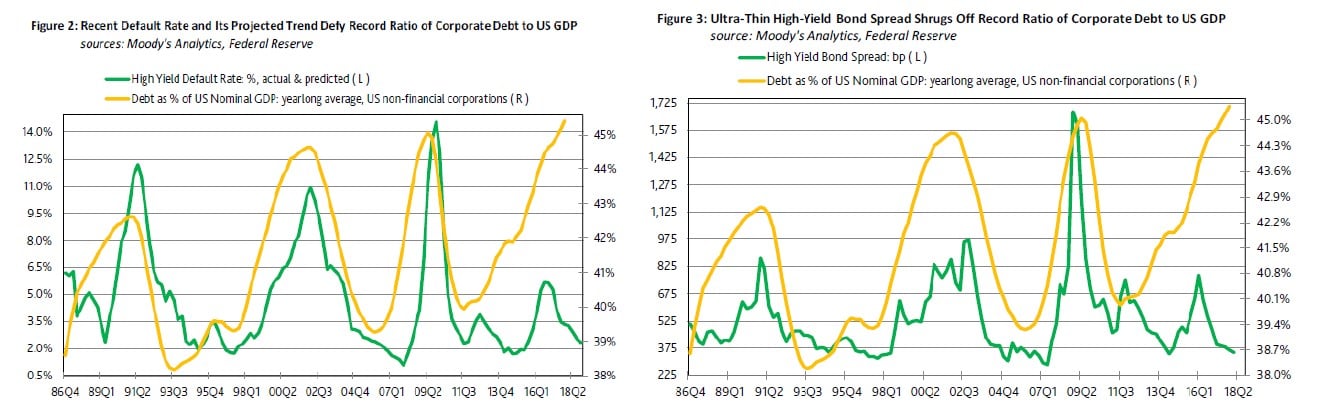

2 charts from Moody’s that highlight some of my concerns are below. In a nutshell we have:

- more debt

- with an expectation for historically low corporate defaults

- and are taking reduced returns as compensation

What happens if expectations are wrong?

The first chart shows a consistent relationship between debt as a % of GDP and high yield default rates. Historically, more debt meant more defaults. Today, more debt equals less defaults. Perhaps low interest rates have helped bail out some companies and allowed them to refinance and avoid default? At some point defaults could pick back up on a lot more debt.

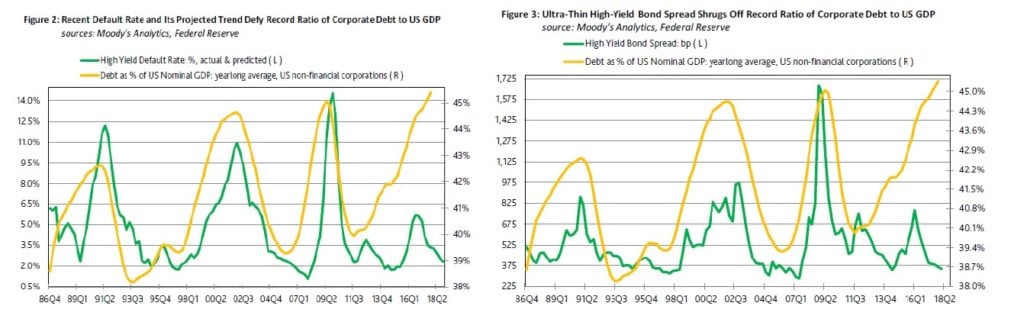

At least those who own high yield debt are getting paid a big spread for this increased risk right? Wrong. The 2nd chart shows the same increase in debt but a reduction in high yield bond spreads.

More risk for less return…. Pass the Maalox.

History has shown us multiple examples of how a good idea can be taken to extremes resulting in excessive risk-taking and catastrophic outcomes (see 2007 financial crisis). Indexing illiquid junk bonds with limited legal protections is asking for trouble if the waters start to get rocky. Note these “high yield” bonds have a current ~5-6% annual yield with a loss-adjusted yield closer to ~3-4%. When high yield prices inevitably decline and there is a need for liquidity these structures may fall apart.

Longs (Businesses we Own)

Brief descriptions of the top 5 long positions follow in alphabetical order. Business fundamentals do not change that much from quarter to quarter. If something meaningful has popped up I have included it at the top of the description. Otherwise, the previous description is included with some minor updates or changes. These positions comprise ~43% of the portfolio at quarter-end.

Alaska Airlines

Black Bear has invested in a number of companies whose headline business obscures “hidden” or undervalued sticky businesses beneath the surface. ALK fits the bill. Upon closer inspection, ALK has 2 businesses: a transportation/seat-distribution business which has cyclicality and a sticky cash-flowing credit-card business with limited cyclicality. Large amounts of cash are generated by the airlines selling miles to banks irrespective of airline capacity or ticket prices. There is limited disclosure by the airlines so the sell-side focuses on predicting the unpredictable. This translates into volatility and opportunity.

ALK is a cheap, well-managed airline that possesses a cost advantage versus the network carriers (American, Delta and United). ALK also benefits from significant top-line and bottom-line synergies from their recent acquisition of Virgin America. While they have historically focused on traffic in the Pacific Northwest, their semi-recent acquisition of Virgin America results in more transcontinental exposure and a balanced network.

Historically airlines have been a brutal category of investment, with cut-throat competition, huge fixed costs, too much debt and too much capacity. Management teams have acted like overzealous developers who see a hole and want to build (in this case “SEE CLOUDS, BUY PLANES”). The industry appears more rational today as bankruptcies and mergers have resulted in a reduced number of airlines serving customers. I guess enough bankruptcy filings can bring religion. It appears management teams have learned from history but only their actions will prove this. In the meantime, the investment community holds their breath and gives limited credit. At a high-level I think we own Alaska at ~9-10x earnings and ~10-12x free-cash-flow. They should also be a beneficiary of recent tax reform which is not incorporated in the numbers.

Berkshire Hathaway

Describing Berkshire in a simple manner is a challenge. Allan Mecham did an admirable job describing BRK as a “meat grinder that relentlessly piles up value year over year (and decade over decade).” Berkshire is trading ~1.4x book value which underestimates its true intrinsic value. We own BRK at a ~20+% discount to the combined value of their stock portfolio and their operating businesses (at a 10x multiple). Add in the benefits of investing free money (the float from insurance) and a business compounding at high single digits with wide moats and you get the aforementioned meat grinder.

Discovery Communications

DISCA is an international cable network trading ~12%+ free-cash-flow yield. They create and own content with channels that include Discovery Channel, Animal Planet and TLC. It recently closed on the acquisition of Scripps Network which includes HGTV, Food Network and Travel Channel.

The worries/negative sentiments include but are not limited to:

- General cord cutting fears as cable subscribers decline

- Economic concern if advertisers move money away from traditional cable networks

- Execution/integration risks with Scripps

- The DISCA networks being left out of bundled packages offered to subscribers

- Increased leverage at the onset of the acquisition

- Lack of share buybacks while they deleverage from the acquisition

The risks and worries above are real and result in the possibility for downside in the short-term. The Company should meaningfully de-lever over the coming 24 months but leverage always gives us pause and is something to be cognizant of. Below are some mitigants/positives attributed.

- DISCA own nearly all their intellectual property/programming which translates into a large library

- Their programming is cheap to create as it is reality/non-fiction translating to a cost advantage and ultimately a pricing advantage to their customers

- Studio programming can run 5-10x more expensive

- Best practices/synergies: Scripps is better at monetizing advertising& Discovery is better at international distribution – they should be able to help the other with their weaknesses

- As their content is non-fiction it can travel easily into other countries and languages

- John Malone (Liberty Media) is a large owner and on the Board

- Extremely cash-generative – at current prices likely own ~12%+ free-cash flow yield

- Not very capital intensive – capex is ~10-12% of operating cash flow

- Potential for large synergies between the companies as there are both duplicative corporate functions but more importantly best practices that can translate across business lines

This story is going to take time to prove out and over the coming years we should be well-rewarded for our patience. It will be important to keep an open mind and to make sure the company is executing on its goals in the meantime.

Liberty SiriusXM Holdings

This investment was covered in Q3 2017. We added to the position on weakness as the discount to the underlying SIRI stock widened to ~30%. The business continues to perform well. An increase in royalty rates (their content costs) went up and spooked some investors. It will be a near-term headwind to margins but over the next 2 years the impact should roll off as new pricing is rolled out through their customer base. The management at Liberty has indicated an interest in buying back the stock at these discounts but as of this writing nothing has been finalized or communicated.

Liberty Sirius XM Group is a tracking stock for Liberty Media’s ~70% stake in SiriusXM. We own SiriusXM at a ~30% discount to where the underlying SIRI stock trades. Sirius operates satellite radio in the US providing 140+ channels to their 31mm subscribers for monthly subscription fees. SIRI is a sticky subscriber model with high margins (high 30’s) trading ~6% free-cash-flow yield. At our discount, it is closer to ~8.5% free-cash-flow yield. Management has used free-cash-flow to shrink their share count by ~20% over the past few years. This investment suffers from multiple avenues of negative investment sentiment.

- Tracking stock: Tracking stocks are hard to understand

- Auto: We are at peak auto so there will be less of these systems sold every year

- Technology: Who needs satellite radio when people have all sorts of ways to listen to music

From a high level, it seems like the headlines/concerns ignore or lose focus of some key points.

- Tracking stock: John Malone and Liberty have been terrific partners across a variety of businesses and intend on closing the 30% gap between the tracker and the underlying stock

- Auto: We are likely at peak auto but there are opportunities for increased volume from used cars and increased price due to unique content (Howard Stern, ESPN, CNBC etc.)

- Technology: Terrestrial radio is their biggest competitor and while new technology is easy to use, so far, they lack the content the Sirius listener wants. This is something to keep an eye on.

TiVo

The Company announced a strategic review which will result in some form of corporate news in the coming months. At this point it is pure speculation as to which road they choose but the alternatives range from selling all or parts of the company to buying other companies. It is hard to opine on which is the best outcome without knowing the prices contemplated for each transaction. What gives me comfort is an aligned Board and management team which all own a lot of stock.

TiVo may be one of the more misunderstood businesses in existence today. I would put this company in the low-risk/high-uncertainty camp. The company should be able to generate its entire market cap in free-cash flow over the next 3-4 years. The market seems to under value their patent cashflow, the synergies from a recent acquisition and the upside from a potential settlement with a large former customer (Comcast).

The average investor, including me at first, typically thinks this is a B2C (sells to consumers) hardware company that sells DVR’s. It is now predominantly a B2B (sells to businesses) licensing and intellectual property company who forms the backbone of the guides, DVR’s, OTT interfaces. You don’t know you are using TiVo technology when you click around or use your DVR. TiVo is actually 2 companies: Rovi and TiVO who recently merged. They are going to remove $100MM of costs as the 2 companies had overlapping expense structures. The negatives and bear case for the stock are as follows:

1) General negativity for all things media as people fear cord-cutting

2) A protracted legal battle with Comcast who was a large customer

3) New CEO

4) Lack of disclosure about patent run-offs

The new CEO, Enrique Rodriguez, is a former disciple of Jim Meyer (CEO of Sirius and also Chairman of the TiVo board). He personally bought $1mm in stock and accepted a pay package that is almost entirely dependent on the stock compounding at 20-30+% annually over the next 3 years. The Board also benefits from having Glenn Welling, a thoughtful activist-investor from Engaged Capital.

There are many ways for us to win ranging from the realization that the ecosystem is shifting not disappearing, to a settlement with Comcast or to an outright sale of the company. Some additional corporate disclosure of the patents and likely medium-term cashflow would help bridge the understanding for the investment community. As they produce the cashflow and work through the issues with Comcast the uncertainty should lessen.

Volatility

It is important to know what you own and why you own it. It is especially pertinent when markets are volatile. We have seen an end to the unusual placid and upward trending market which has woken up some complacent market participants from their slumber. Rocky waters require extra care in avoiding the noise and to focus. Investing is not easy, nor should it be, and requires patience and an ability to ignore much of the noise and commotion.

Markets go up and markets go down. If you have a gameplan in place and know your businesses you are less prone to get distracted by predicting the trajectory of markets and falling prey to emotional decision making.

Having the right investor base is critical and we are particularly appreciative of our Partners. Predicting where the market will go in the short-run is an exercise in futility so do not be swayed by those who seem so sure.

We have a patient and long-term approach with great Partners and can use periods of weakness to our advantage. We know the businesses we own and try to objectively assess their prospects in a variety of outcomes. We have taken the opportunity to selectively add some names which got cheaper over the last 4 weeks.

Volatility is our friend and I hope we see more of it.

General partnership business

2017 K-1’s and financial statements were sent to LP’s the 1st week of March. Thank you to our service providers for getting these out in such a timely manner.

Thank you for your trust and support,

Black Bear Value Partners, LP