The list of the so called Dividend Kings consists of the companies that have managed to increase their dividends annually for at least 50 years in a row. You can see the full list of all 25 Dividend Kings here.

[REITs]Q1 hedge fund letters, conference, scoops etc

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Naturally many of the companies on the list are huge corporations, as a company must have a long and successful operating history to land on that list.

There are, however, also some smaller companies on that list, many of them being relatively unknown. One of those is American States Water (AWR), which has raised its dividend for 63 years in a row. This article will discuss why American States Water may be overvalued.

Business Overview

American States Water was founded almost ninety years ago, since then the company has expanded geographically across several states in the US.

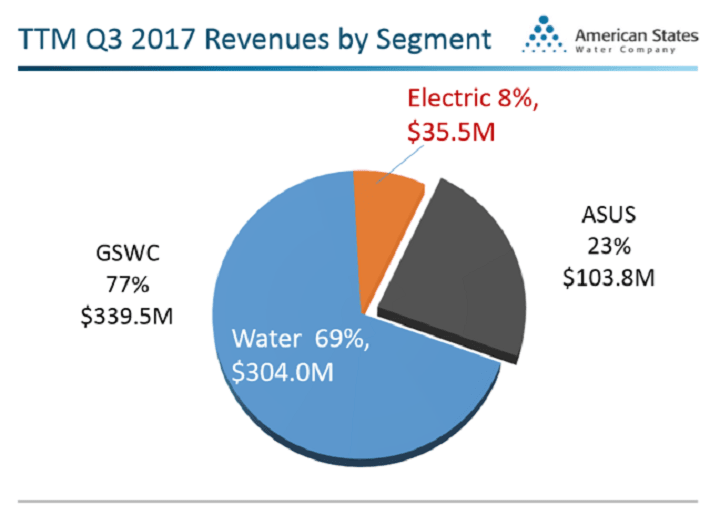

The company’s operations consist of three main segments: Regulated water (in California), regulated electricity (in California), and services for water and wastewater systems (on 11 military bases in the US). The majority of American States Water’s revenues and earnings are derived from the regulated water segment, which serves 260,000 customers:

Source: American States Water’s presentation

Electricity services make up just eight percent of revenues, the American States Utility Services segment is responsible for about one fourth of the company’s revenues.

American States Water’s regulated businesses (water and electricity) are not high-growth businesses, but the company has a big moat there. The utility industry is not one where companies are heavily contesting over customers. American States Water’s services segment is growing at a faster pace, but the company is not facing a lot of competitive pressures there, either.

Source: American States Water’s presentation

The services segment, which was established in 1998, has grown to span eight states, currently serving eleven US military bases, and there is room for more growth going forward.

Growth Prospects

When it comes to American States Water’s growth prospects, we have to differentiate between the regulated and the unregulated business. Water and wastewater services on several more US bases have not yet been privatized, so there is a lot of potential for receiving contracts to service more bases in the future. American States Water states that active bids are in progress for numerous bases, and that several contracts will be awarded during the next five years.

The regulated water & electricity services are somewhat different, the company is not really expanding geographically there. The regulators (California Public Utilities Commission) do, however, allow for revenue growth from the company’s customer base in return for ongoing investments.

CPUC authorizes certain returns on equity and returns on base rate. By investing into its asset base (increasing the capital the company has invested) American States Water can increase the total profits it is allowed to earn going forward.

Due to the fact that the regulated water business is very fragmented, there is significant potential for American States Water to grow inorganically. In an industry with a low number of publicly traded operators American States Water is poised to make consolidating moves. Despite its size being not at all massive (American States Water has a market cap of 2.0 billion), American States Water is one of the biggest water utilities.

On top of that it has a strong balance sheet (with an A+/A2 rating), thus expanding through acquiring smaller competitors is a realistic possibility for the company.

Source: American States Water’s presentation

American States Water’s operations don’t look like a high growth business at all, and yet the company managed to grow its EPS by almost eight percent a year over the last couple of years. The analyst community expects the EPS growth rate to decline to the mid-single digits area going forward. Through a combination of consistent (although not very fast) growth from the regulated business and expansion of the services business a five percent growth rate looks highly achievable even without any M&A action.

Competitive Advantages & Recession Performance

The regulated water business has very high barriers to enter: Regulations, the requirement for huge investments into infrastructure and water rights mean that this isn’t an industry that has to worry about new, upcoming players.

Source: American States Water’s presentation

American States Water’s services business, which is not regulated, is very low-risk as well. There isn’t a lot of competition, and the contracts with the government span 50 years. Since this business unit was only formed 20 years ago, and since many contracts were awarded in recent years, the results over the next decades are practically locked in.

American States Water isn’t an especially huge corporation, but still there is very low risk of competitors stealing any business from the company. This is based on the regulated / contracted nature of American States Water’s business. It is also not surprising that the company’s performance during a recession is not bad at all, either: Even during an economic downturn water and wastewater services are needed.

During the last financial crisis, which made many companies report giant losses, American States Water remained profitable. Earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $1.56

- 2008 earnings-per-share of $1.49 (4.5% decline)

- 2009 earnings-per-share of $1.61 (8.0% increase)

- 2010 earnings-per-share of $1.66 (3.1% increase)

Investors who are looking for very high-growth companies have better choices than American States Water, but when it comes to non-cyclical, low-risk, foreseeable profits, American States Water is one of the best.

Valuation & Expected Returns

Investors like to pay up for quality, and American States Water’s proven track record and low-risk nature have resulted in a premium valuation.

ValueLine analysts expect the company to have earnings-per-share of $1.85 for 2018. This means the stock trades for a price-to-earnings ratio of 28.6. This far exceeds the 10-year average price-to-earnings ratio of 20.3.

Source: ValueLine

American States Water trades at an EV to EBITDA multiple of 15.7, which is rather high on an absolute basis. The combination of a rather high valuation and an earnings growth rate that is not really high means that share price gains could be limited going forward. If American States Water continues to trade at the current valuation and grows its EPS by five percent a year, investors would see share price gains of 5% and total returns (including dividends) of 7% a year.

If American States Water’s valuation would decline, total returns going forward would be lower. Due to the fact that the valuation already is more on the expensive side, further multiple expansion is unlikely. Total returns thus will likely be capped at high single digits going forward (and could be lower).

Depending on one’s goals American States Water could be a compelling investment choice, nevertheless: Mid to high single digits returns from a low-risk business are interesting, and shares of American States Water can stabilize one’s portfolio. Due to the very low beta (0.38), American States Water’s shares don’t really move much during a market downturn, an investment into shares of the company can thus limit the downside of one’s portfolio.

Dividend King American States Water is oftentimes held for its dividend, which yields 1.9% right now. The dividend looks very safe, the payout ratio is slightly higher than 50%. A low payout ratio in combination with a very stable, low-risk business means that the risk of a dividend cut is very low.

The dividend was grown by more than nine percent a year over the last five years, but with the earnings growth rate being lower than that the dividend growth rate will decline somewhat in the long run. American States Water could, however, keep the dividend growth rate around nine percent for a couple of years, as an increase to the company’s payout ratio wouldn’t be problematic at all.

Final Thoughts

American States Water is an under-followed Dividend King with a strong track record. The company operates in non-cyclical, low-risk businesses, and profits will continue to grow in the long run.

By capturing new contracts for additional US military bases or by making acquisitions American States Water could accelerate its growth going forward. Unless this happens, growth rates will not be overly high.

The safe and growing dividend and the low-risk nature of this stock make it worth a closer look for conservative investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.