Activist Insight Shorts data show over 70% of stocks targeted by an activist short seller trade lower after a week

In February this year, Bill Ackman’s Pershing Square Capital Management exited its longstanding short position in Herbalife due to its major loss in the holding. Even with a Federal Trade Commission investigation into Herbalife’s business practices, Ackman still lost the bet. In light of this situation, Activist Insight explored the common threads between successful – and unsuccessful – shorts.

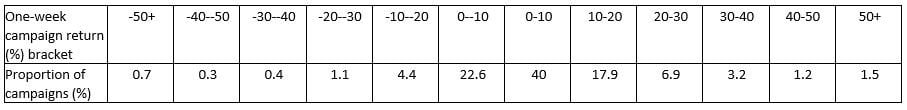

Distribution of one-week campaign returns* (%) following an activist short announcement.

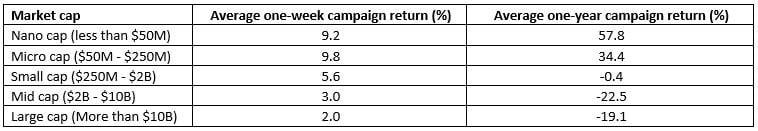

The size of the company also matters, with campaigns progressively more successful on average the smaller the market cap of the company targeted.

Campaign returns* by target market cap.

Short seller allegations of accounting fraud, major business fraud, and stock promotion have the highest average one-week campaign returns, between 11% and 13%. Major business fraud and stock promotion also yield high returns in the long term with one-year average campaign returns of 23% and 41% respectively, according to data available on Activist Insight Shorts. However, returns for accounting fraud theses tend to narrow, with an average one-year campaign return of only 2%, perhaps because the target can fix errors or appoint a new auditor after an allegation of this nature.

More generic allegations like industry issues and competitive pressures yield worse results in both the short and long term. Meanwhile, the pyramid scheme allegation that Ackman used in his campaign at Herbalife produced an average one-year campaign return of 2%.

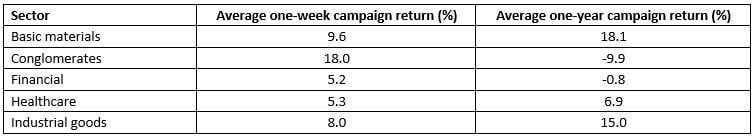

Campaign returns* by sector.

For any questions about the data, or if you have a follow-up request, please contact Josh Black at [email protected]. Please note that bespoke data requests may take 24-48 hours depending on the amount of manual work required.

We look forward to assisting you with your articles.

Kind regards,

Josh Black

*Definitions:

Campaign return: a calculation of the stock price percentage change, minus any dividend payment obligations and adjusted for splits, from the closing price a day before the campaign announcement to the closing price on the day the campaign ends.

One-week campaign return: a calculation of the stock price percentage change, minus any dividend payment obligations and adjusted for splits, from the closing price a day before the campaign announcement to the closing price seven days after the campaign announcement.

One-year campaign return: a calculation of the stock price percentage change, minus any dividend payment obligations and adjusted for splits, from the closing price a day before the campaign announcement to the closing price one year after the campaign announcement.

Note: Positive returns are good for the short seller.

About Activist Insight

Since 2012, Activist Insight (www.activistinsight.com) has provided its diverse range of clients with the most comprehensive information on activist investing worldwide. Regularly quoted in the financial press, Activist Insight is the trusted source for data in this evolving space. Activist Insight offers five industry-leading products: Activist Insight Online, Activist Insight Shorts, Activist Insight Governance, Activist Insight Vulnerability – a tool for identifying potential activist targets – and Activist Insight Monthly – the world's only magazine dedicated to activist investing.

Article by Activist Insight