By Jim Osman Of Edge Consulting

“The Edge is an excellent source for serious asset allocators looking to complement their own diligence of special situations.” – Tom Hendrickson, Chief Investment Officer, Sunsetter Capital, Canada

THE INVESTOR’S EDGE – Biweekly Education Saving You Time & Money in Investing

This is How The Edge Defines a Special Situation

I got a tremendous response two weeks ago in my letter entitled What is a Spinoff?, where I outlined three of the most important points to look for in a Spinoff investment. I’m glad it helped clarify this obviously profitable but difficult to navigate area. This week I thought I’d detail how The Edge defines a special situation.

The Edge (as you know us today) started as “The Spinoff Report” in 2005. I launched the firm after years and years in the industry analysing, trading and managing money. In all that time, what became desperately apparent to me was that research out there was stale, non-actionable and quite frankly hit-or-miss. Even in my big banking days, the in- house analysts were of little use to me. I concentrated searching for value within small pockets in the market that had something different. Along with that, I always carried out my own research and felt comfortable with all the angles before I executed. By that point, I could only blame myself if things went the wrong way. Moreover, it gave me the confidence to understand that if things did go wrong, I could react in the best way possible, whether this was to increase a position on an adverse Mr. Market move, or a cut to the position should the situation completely change from my initial analysis. Long-term, I was always a winner on this basis.

I encourage you to do the same. Gather as much intelligence as possible, feel comfortable before you trade. Notice I use the word “intelligence.” Here at The Edge, we don’t just do research, but we translate the research into actionable intelligence to make you a return. I’ve said many times robots will add up the numbers quicker than you or us, so

that’s just part of it. To be better than them or the rest, you need to have an “edge.” The edge from our firm is intelligence – it’s what we provide. I have one goal for our partners: Return on Investment. It’s why I created the firm.

The ESR Lite & ESS Lite will provide you monthly insights into how we operate as well as providing actionable investments. These are aimed specifically at the nimble investor, but will also benefit large firms looking for idea flow and superior analysis which is not available in the mainstream.

I often get asked, “what is your process?” or “Jim, what is your secret sauce?” It’s super simple and available to you, our subscriber and partner. It involves three points:

- Identifying the Investment Opportunity

- Uncovering the “Edge”

- Realising the Return on Investment (ROI)

Do you have the right tools?

So how do we go about looking for that opportunity and what exactly is a special situation in our eyes? Well, I’ll tell you what it’s not. We don’t look at risk arbitrage. Other than that, anything that appears to display some sort of hidden value away from the naked eye (and robots) and that requires our expertise and intelligence in realizing the investment opportunity is fair game. These situations can include management change, turnarounds, fallen Spinoffs, structural changes, rights issues, deep value mispricing, privatizations, and anything that might provide a catalyst to move price to value. This last point is very important. Too many people focus on the numbers and say that the stock is cheap. Let me tell you, a stock can stay cheap forever without anything to move it. Lastly, in addition, we are one of the only firms in the world that look globally. Most (if not all) of our ideas are from a long perspective.

When we find an interesting situation on our hands (you will find more in a calendar at the back of every Lite issue), we start the analysis. Our years of expertise on valuing the situation is the bit where you put your trust in us. We unearth what The Street is missing and present the argument. It’s at this point that you get familiar with the thesis, do some of your own work if needed, and execute. We try to look at situations that are big enough and liquid enough so that you can get in and out, but under-covered enough to make sure that the situation has enough juice in it for you to win.

Situations are sourced from around the world in developed countries. On our institutional product, where we service some of the biggest hedge and activist funds around, we use the intel gathered to apply our expertise and give as much chance of success to realize a return on our investment ideas for our partners. Historically, we have been very conservative on our target prices and many go on past our estimated assumptions.

How do you gain on an investment in us going forward? This happens in three ways. Firstly, read the reports. Secondly, feel comfortable. And lastly, execute on what we say. Also, watch out for my personal favorites. I regularly get a good feel for a situation and at that point I will mention it in the monthly reports. Sign up now. What are you waiting for?

Jim Osman

CEO

Like This? Want More?

Contact us for a 10-minute chat here. Grab value from our LinkedIn group here.

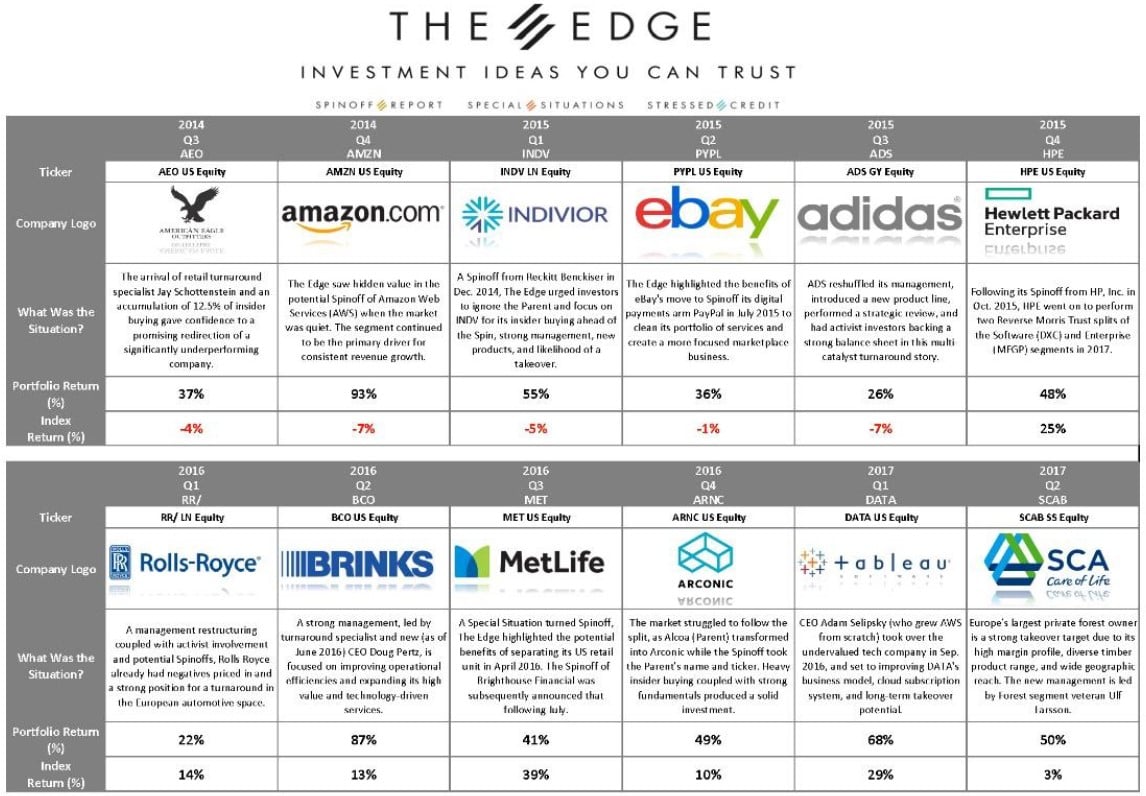

How do our ideas do? Take a look at our performance across 12 consecutive quarters.

Make a Return on Investment. Partner with The Edge.

“Saving time on analysis with a trusted partner makes a huge difference on optimizing capital for investing.” - Cory Janssen, Investor & Co-Founder, Investopedia.com