Wirepoints, a website dedicated to reporting on economic issues in the state of Illinois has some shocking news which is relevant to the entire country. The economics website has issued a new report claiming that Illinois’ State pension Crisis is not due to funding shortfalls. Instead, the authors of this report, Ted Dabrowski and John Klingner, argue that rising pension benefit obligations are the source of the State’s pension ills. Last year, the state experienced difficulty paying $15 billion in unpaid bills and passed a 32% income tax hike in an emergency legislation secession to remain solvent. Some predict that the state will be the first to file bankruptcy since Arkansas, during the great depression.

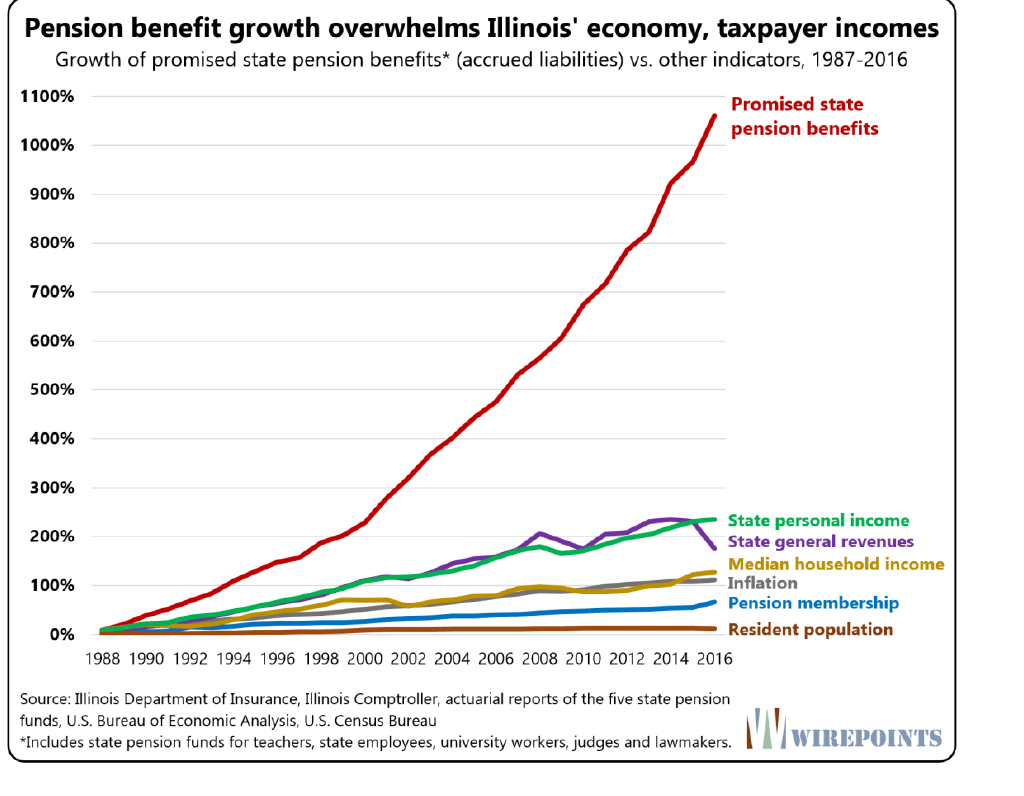

According to the analysis provided by the Wirepoint’s report, the growth of total pension benefits promised by politicians to government employees is bankrupting the state. Going back as far as 1987, the report tracked Illinois pension and economic data and also compared differing pension plans across the country from 2003 to 2015. The data was obtained using Illinois Department of Insurance as well as the Pew Charitable Trusts. The report concludes that total pension benefits for the state have grown tremendously during the past 30 years. To provide clarity, the authors claim that benefits promised in 2016 were in fact 1,000 percent higher than they were three decades ago. Unsurprisingly, no other measure of Illinois economy, including state personal income, state general revenues, median household income, inflation, pension membership or resident population, even come close to the growth observed in pension benefit promises.

source:wirepoints.com

The authors explain that the total pension benefits have grown at an annual compound rate of 8.8 percent from 1987 until the present day. This is growth “six times more than total state general revenue growth (236 percent) over the same period; eight times more than median household income growth (127 percent); and nearly ten times more than inflation (111 percent).”

Also, Illinois’ pension benefits grew faster than any other state pension except New Jersey (which is in a horrid funding crisis) and New Hampshire between 2003 and 2015, according to the report’s analysis.

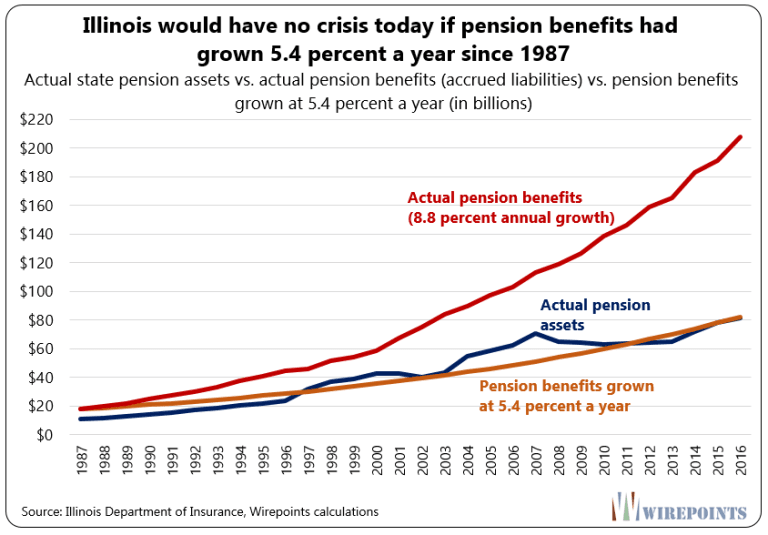

The report seeks to drive home the point that “too little money in the pensions plans” did not cause the current pension crisis, the “state pension assets, buoyed by taxpayer contributions, have also grown exponentially since 1987.” The pension assets are seven times higher than they were 30 years ago in 1987. They have also grown five times more than household incomes and six times more than inflation over the same 30 year period.

If according to the report, Illinois politicians increased the pension benefits at a 5.4 percent annual increase in 1987 until now, instead of the 8.8% yearly increase, the Illinois pension would be fully funded today.

source:wirepoints.com

This report should come as much needed dissection of the Illinois pension benefits crisis that appears similar to other pension crisis’ across the country. As Illinois becomes one of the state’s with the highest amount of depopulation, the time for remedying this crisis is drawing to a close. The report concludes with the following admonishing:

”…Irresponsible increases in benefits leave no choice but to cut benefits further, which will require either a constitutional amendment or a negotiated federal bankruptcy law. And to stop accruing future pension benefits, lawmakers must create 401(k)-style plans for new workers going forward.

Illinoisans shouldn’t be guilted (sic) into paying more into pensions through higher taxes. It’s time to end the narrative that forces ordinary Illinoisans to shoulder the entire burden of fixing the pension crisis.”

Full report here

Editor’s note: A prior verrsion of this article had listed property tax instead of income in the first paragraph – the article has been amended to update to the correct tax – the income one