Mark Spiegel’s letter for the month of March 2018, discussing Stanphyl Capital’s short position in Tesla Inc (TSLA).

Friends and Fellow Investors:

For March 2018 the fund was up approximately 11.4% net of all fees and expenses. By way of comparison, the S&P 500 was down approximately 2.5% while the Russell 2000 was up approximately 1.3%. Year-to-date the fund is up approximately 1.5% while the S&P 500 is down approximately 0.8% and the Russell 2000 is down approximately 0.1%. Since inception on June 1, 2011 the fund is up approximately 102.7% net while the S&P 500 is up approximately 126.9% and the Russell 2000 is up approximately 98.4%. Since inception the fund has compounded at approximately 10.9% net annually vs 12.7% for the S&P 500 and 10.5% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends.) As always, investors will receive the fund’s exact performance figures from its outside administrator within a week or two; meanwhile I continue to waive the annual management fee until the entire fund regains its high-water mark. (Please keep in mind that your individual returns may differ slightly from those above as some of you are now above your high-water marks although the overall fund isn’t.)

As noted last month, through this entire bull market low interest rates were used to justify egregious earnings multiples on stocks, as well as being responsible for creating much of those earnings via cheap mortgages, auto loans, etc., and yet now those rates appear to have stabilized at higher levels across the board. Even before the arrival of (or perhaps anticipating) a massive amount of deficit-related U.S. debt issuance beginning later this year, the 10-year U.S. treasury bond yield has definitively broken its very long-term downtrend and now sits at around 2.7%, while the 2-year yield of around 2.3% bests the S&P 500’s 1.8%, thereby presenting an attractive alternative to an index priced at nearly 25x trailing GAAP earnings amidst a tariff-imposing Trump administration; in fact, the flattening of that 2-10 curve may even be indicative of a looming economic slowdown. So I think the catalysts are finally here for the high-multiple stock party to end, and we’re positioned for it.

We remain short shares of Tesla, Inc. (TSLA), which I consider to be the biggest single stock bubble in this whole bubble market—a company so landmine-filled that I think it can implode at any moment regardless of what the broad market does. To reiterate the three core points of our Tesla short position:

1) Tesla has no “moat” of any kind; i.e., nothing meaningfully or sustainably proprietary.

2) Tesla loses a huge (and increasing) amount of money despite relatively light competition but will soon be confronted with massive competition in every aspect of its business.

3) Elon Musk is extremely untrustworthy.

March was an action-packed month for Tesla (and not the kind of action you want to see if you’re long!); here are the highlights…

Early in March Jaguar introduced its new I-PACE electric SUV, which will be available in European and U.S. showrooms this June or July. It’s initially priced nearly $10,000 less than the ugly and unreliable Tesla Model X and when Tesla runs out of $7500 tax credits later this year the Jag will be nearly $17,000 cheaper! Have a look and you’ll understand why it suddenly sucks to be a Tesla salesman (or shareholder).

Also in March at the Geneva auto show Audi ran a fleet of 200 pre-production E-tron Quattro electric SUVs that will be in European showrooms this December and in the U.S. early 2019, priced approximately $14,000 cheaper than the roughly equivalent Tesla Model X 100D ($21,000 cheaper after Tesla’s tax credits run out). Also in Geneva, Porsche showed its Mission E Cross Turismo (its next electric car after the 2019 Mission E) and Mercedes released a video of its 2019 EQC electric SUV undergoing winter testing. I think it’s safe to say that with all these superior competitors in the market often at significantly lower prices, Tesla Model X sales will soon approach approximately “zero” and Model S sales will continue to slide.

Next in March, Tesla’s Chief Accounting Officer quit on absolutely no public notice after just 18 months on the job, leaving behind millions of dollars in unvested stock grants, and then just a few days later the Treasurer/VP of Finance quit! And last year Tesla’s Chief Financial Officer quit after just twelve months, leaving behind double-digit millions of dollars in stock. I can think of several possible reasons for these key financial resignations and none of them are bullish for TSLA. (And of course this follows a massive number of executive departures from every other division of the company—feel free to email me for the list.)

Also in March, the Financial Times published a terrific article explaining why the easiest thing about electric cars is designing the powertrain, while the hardest part is everything else, thereby meaning that large, experienced automakers are about to send TSLA the way of PALM. And Seeking Alpha published a fascinating article plus a follow-up theorizing that every Model 3 made requires a hardware retrofit/redesign for its touchscreen mount, potentially either costing the company a significant amount of money and overwhelming its service centers, or mandating a production halt until that part is redesigned, tested (If Tesla even bothers to test it!) and put into production.

Also in March, Bernstein Research estimated that fewer than 30% of current Tesla owners decided to exercise their Model 3 reservations, and based on anecdotal evidence from on-line Tesla forums it appears that the reservation uptake among non-Tesla owners may be as low as 15%. (And watch those reservations really vanish when Tesla’s $7500 tax credits are used up later this year while over 100 competing new EV models entering the market over the next few years will still enjoy them.) In February Tesla quietly announced that the “$35,000 Model 3” (which I’ve been saying since 2014 would never be offered in quantity because Tesla would lose at least $10,000 on each one) will be delayed for at least a year, and I believe even then it will only be produced in token amounts (if at all), yet meaningful demand for this car clearly exists only at that lower price point. Finally regarding the Model 3, here’s my monthly reminder that almost nothing can be done in the car without a multi-step process on the touchscreen—not even changing the windshield-wiper speed, adjusting the air vents or opening the glovebox. Thus, operating a Tesla Model 3 may potentially be as dangerous as texting while driving.

Next in March, a Tesla in California suffered a horrific fatal accident which very well may be Autopilot-related, as the Model X slammed straight into a highway barrier at a high rate of speed and Tesla—always quick to proclaim its innocence whenever possible—has yet to deny Autopilot’s involvement. The NTSB has opened an investigation and the victim’s family claims he frequently complained to Tesla about Autopilot malfunction at that exact spot. As the number of Autopilot-related crashes accumulates, it seems increasingly clear that this reckless system should be banned from public roads and deactivated, with appropriate refunds given to any purchaser who wants one.

Late in March Moody’s downgraded Tesla’s 2017 $1.8 billion junk bond to an even lower level of junk, and another downgrade is almost certainly on the way. (Frankly, I couldn’t believe that crappy bond’s rating didn’t start at the lowest possible level, but hey, I’m just an equity manager and not the “smart money” in the bond market who bought that garbage.) The bond—issued at par last August—now trades in the 87s.

And in a month-ending round of hilarity, today Bloomberg reported an internal Tesla email in which the company laid out plans to create an artificially high Model 3 production rate (undoubtedly at a negative EBIT margin which the Model 3 will always have, hence the focus on “production” being a distraction) for the last week of the quarter by pulling unneeded (due to weak demand, no doubt) workers off the Models X & S lines to hand-build Model 3s. Tesla will undoubtedly “press release” this unsustainable rate in early April, and when it does it will be providing yet more evidence for myriad future investor fraud lawsuits. (I guess at this point whatever’s left of Tesla’s scammy management team must figure “in for a penny, in for a pound!”) Here’s my favorite part of the Bloomberg story:

Doug Field, senior vice president of engineering, said if the team can exceed 300 Model 3s a day it would be an “incredible victory” at a time when some investors are casting doubt on the company and shorting its stock. “I find that personally insulting, and you should too. Let’s make them regret ever betting against us,” Field wrote in the March 23 email. “You will prove a bunch of haters wrong.”

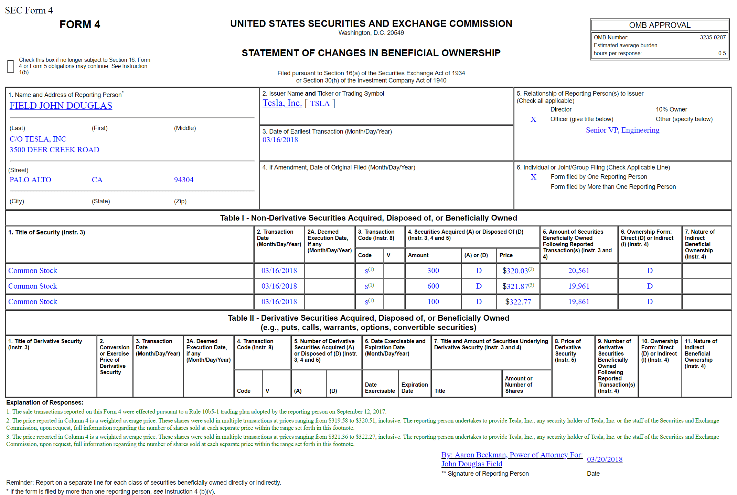

Yes, that would be this “personally insulted,” 10b5-1 TSLA stock-dumping Doug Field:

And lastly for March, I bet you thought no one could ever figure out how to lose money selling French fries. Well, you thought wrongly:

In February Tesla released its worst quarterly “earnings” report ever– in fact, overall in Q4 (using the total net loss ex ZEV credits) Tesla lost over $28,000 on each car it sold! Additionally, this “hypergrowth” company guided to flat 2018 sales of Models S&X and I think they’ll actually be down, as much nicer Jaguar and Audi electric cars will be in showrooms this summer and winter respectively. And while 2018 is likely to generate Tesla’s worst financial losses ever, 2019 will be even worse when Mercedes and Porsche also begin selling luxury EVs.

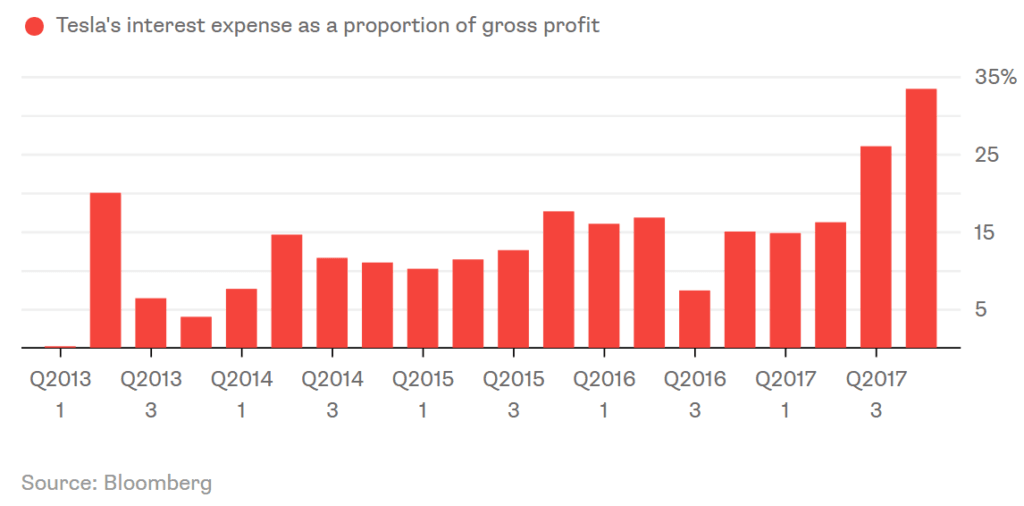

At some point Tesla’s $31.4 billion in combined long-term debt and battery purchase obligations—accompanied by its negative cash flow and massive encroaching competition—will drive it into bankruptcy. In fact, Tesla interest expense is now at a run-rate of nearly $600 million a year which in Q4 amounted to $4884 per car sold—fully one-third of Tesla’s gross profit goes towards servicing its debt!

Also in February, Seeking Alpha published a terrific article explaining why Tesla’s so-called “Superchargers” (and battery format!) are about to be obsoleted by far better technology used by competitors. And speaking of Tesla “technology,” remember that in January Navigant Research published a new “Leaderboard Report” for autonomous driving, in which Tesla tied for dead last among 19 contenders. In fact unlike the rest of the industry, apparently Tesla has NO patents whatsoever related to autonomous driving! And remember that in December Panasonic announced a partnership with Toyota (and possibly other Japanese automakers) that casts a spotlight on how technologically behind Tesla’s cylindrical battery format (the one with that $17 billion purchase obligation!) now is. I urge you to read this excellent summary of the event from The Daily Kanban.

As for the heavily promoted “$180,000, 500-mile” Tesla electric truck, I (and many others) estimate that a 500-mile electric truck will require a 1000/kWh battery pack and—with its fancy carbon fiber cab and chassis– will thus cost at least $250,000 to build. Additionally, Tesla is guaranteeing to cap electricity rates at .07/kWh for the first million miles of the truck’s usage; as national rates average around .12/kWh, I estimate this will cost Tesla—on average—an additional $100,000 for each truck it sells, meaning it will supposedly charge $180,000 for a product that will cost around $350,000 to build and subsidize– a typical Musk “business proposition” if I’ve ever seen one! In other words, the Tesla semi-truck will either never be built and sold (hey by the way—where’s the factory and assembly line for that “2019 product”?) or the real price (with the lifetime .07/kWh electricity subsidy) will be over $400,000 (vs. $120,000 for a conventional truck) and all those big-name “reservations” will disappear even faster than the proceeds from a Tesla financing. And oh, by the way, Tesla is actually behind much of the industry in developing an electric truck.

Meanwhile, Tesla is increasingly besieged by a wide variety of lawsuits, for labor discrimination, union-busting, autopilot fraud, sudden acceleration, lemon law violations, investor fraud and, undoubtedly, many others of which I’m not yet aware.

So here is Tesla’s competition in cars (note: these links are continually updated)…

Jaguar Electric I‑Pace SUV Available Summer 2018

Jaguar XJ sedan to transform into electric Tesla Model S rival

Audi E-Tron Quattro electric SUV available 2018

Audi e-tron Sportback in 2019 to be its second EV

Audi A9 e-tron electric sedan production confirmed for 2020

2019 Porsche Mission E to come in three power levels

Porsche Mission E Cross Turismo to be its second EV

Mercedes Wheels Out Electric Car Roadmap, Car And Battery Factories Everywhere

2019 Hyundai Kona Electric gets 250-mile range rating in the U.S.

14 new EV models by Hyundai-Kia by 2025

CHEVROLET BOLT EV: MOTOR TREND CAR OF THE YEAR

GM to introduce 3 more electric cars before 2020, battery cells at <$100/kWh

2018 Nissan Leaf: 150 miles for $30,875, 200+ mile model by late 2018

Nissan Leaf-based SUV coming in 2020

Volvo Electric hatchback due in 2019

Volvo To Start Selling Electric Trucks In 2019, Some Will Hit The Road This Year

VW will build EVs in 16 factories in zero emissions push

Volkswagen I.D. Crozz 311-Mile Electric CUV For $30,000-ish Before Incentives

VW’s All-Electric I.D. Vizzion Coming With 400 Miles of Range

BMW to have 25 electrified models by 2025

Ford plans $11 billion investment, 40 electric vehicles by 2022

Land Rover Defender to go all-electric in 2019

Toyota, Mazda, Denso create company to roll out electric cars beginning 2019

Toyota to market over 10 battery EV models in early 2020s

Infiniti will go mostly electric by 2021

PSA will launch full-electric Peugeot 208 and DS 3 Crossback in 2019

Electric MINI Cooper E confirmed for late 2019

PSA will electrify global product lineup by 2025

SEAT’s first electric car is due in 2020

Opel will launch full electric Corsa in 2020

2019 Skoda e-Citigo confirmed as brand’s first all-electric model

MG E-Motion confirms new EV sports car on the way by 2020

Aston Martin Lagonda revs up for electric car race

Renault to have 8 pure electric models by 2022

Rolls-Royce is preparing electric Phantom for 2022

Citroen preparing EV push with 80 per cent electrified range by 2023

Honda will offer full-EV or hybrid tech on every European model by 2025

All-electric Bentley four-door coupe to use EV tech from Porsche Mission E

Maserati executive confirms electric Alfieri

Subaru to introduce all-electric vehicles by 2021

Ssangyong e-SIV concept previews 2020 EV

Dyson plans three-car EV range

235mph Lucid Air due in 2019 as electric BMW 7 Series rival

Faraday Future raises £747 million for 2018 Production

Borgward BXi7 Electric SUV Flies Under The Radar

Detroit Electric promises 3 cars in 3 years

SF Motors reveals two electric SUVs for 2019 with 300 miles of range

Two new electric cars from Mahindra in India by 2019; Global Tesla rival e-car soon

Saab asset owner NEVS plans electric car production

EVelozcity Raises $1 billion For EV Startup

Flush with new cash, electric-car company Faraday Future hopes for a fresh start

And in China…

BYD Plans to Expand Daimler Partnership With New EVs for China

Daimler to invest $755 million in China EV, battery output

Daimler & BAIC Rev Up China EV Production With New $1.9 Billion Factory

Volkswagen Plans $12 Billion Electric-Car Blitz in China

Audi to launch 7 new energy vehicle models in China by 2020

GM plans to launch 10 new energy models in China by 2020

Nissan to invest $9.5 billion in China to boost electric vehicles

Renault-Nissan Alliance To Electrify China’s Trucks And Vans

BMW will develop and produce electric Mini in China

Ford ramps up electric vehicle push in China

China’s BYD has overtaken Tesla in the battery and electric car business

SAIC to spend $2.2 billion on EVs, connectivity, aftersales services

Honda to launch three electric vehicles in China in 2018

Toyota to re-enter EV sector starting in China from 2020

Mazda and Changan Auto join hands on electric vehicles

NIOS ES8 Electric Crossover debuts with half the Tesla Model X’s price tag

Geely invests $5 billion into new electric car factory in China

Changan Spending $15 billion To Have 21 Pure Electric Cars By 2025

Chery Breaks Ground on $240M EV Factory in China

Chery’s second EV plant open in Dezhou

Leapmotor’s electric car to hit the market in 2018

Alibaba-backed Xpeng emerges as Chinese answer to Tesla

WM Motor Technology to put ‘Weltmeister’ electric car brand on road in 2018

GAC Trumpchi to launch range-extended EVs

Chinese-backed electric car start-up Byton woos CES with model 40% cheaper than a Tesla

Great Wall Starts New EV Brand (ORA) In China

The Singulato iS6 From China Is Aimed At The Tesla Model 3

FAW (Hongqi) to roll out 15 electric models by 2025

JAC’s Electric Car Has A Range Of 500 Kilometers

ICONIQ to build electric cars in Zhaoqing with total investment of RMB 16 billion

Quianu Motor aims to grab share of US electric vehicle market

NEVS receives approval for electric car factory with capacity of 200,000 units per year

Wanxiang Gets China Electric Vehicle Permit to Make Karma Cars

Qoros Auto’s new owner plans to be an EV power

Thunder Power electric cars at the Frankfurt motor show

Here’s Tesla’s competition in autonomous driving…

A Tesla self-driving blind spot that few are focusing on

Waymo is first to put fully self-driving cars on US roads without a safety driver

Jaguar and Waymo announce an electric, fully autonomous car

Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

GM ride-hailing fleet would ditch steering wheel, pedals in 2019

An Overview of Audi Piloted Driving

Updated 2017 Mercedes-Benz S-Class – first ride with autonomous technology

NVIDIA and Toyota Collaborate to Accelerate Market Introduction of Autonomous Cars

Volkswagen and NVIDIA to Infuse AI into Future Vehicle Lineup

NVIDIA Partners with Bosch for System Based on Next-Generation DRIVE PX Xavier Platform

Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

Bosch and Daimler join forces to market fully automated, driverless taxis by 2020

Intel’s Mobileye will have 2 million cars (VW, BMW & Nissan) on roads building HD maps in 2018

Volkswagen Group and Aurora Innovation Announce Strategic Collaboration On Self-Driving Cars

Toyota, Intel and others form big data group for autonomous tech

Toyota Adds $2.8 Billion to Software Push for Self-Driving Cars

Nissan’s Robo-Taxis Will Hit the Road in March

Nissan and Mobileye to generate, share, and utilize vision data for crowdsourced mapping

Magna joins the BMW Group, Intel and Mobileye platform as an Integrator for AVs

Intel collaborates with Waymo on self-driving compute design

Fiat Chrysler to Join BMW, Intel and Mobileye in Developing Autonomous Driving Platform

Ford expands fleet of self-driving test cars

Ford Buys Laser System Firm as It Boosts Driverless Car Development

Lyft, Aptiv (formerly Delphi) partner on driverless ride-hailing at 2018 CES in Vegas

Lyft and Waymo Reach Deal to Collaborate on Self-Driving Cars

Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

Hyundai, Aurora to release autonomous cars by 2021

Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks This Year

Byton cooperating with Aurora on autonomous vehicles

Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

Bosch Creates a Map That Uses Radar Signals for Automated Driving

Honda Targeting Level 3 Automated Driving By 2020, Level 4 by 2025

Groupe PSA’s safe and intuitive autonomous car tested by the general public

Baidu unveils autonomous driving platform backed by 90 global partners

Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021

BlackBerry and Baidu Partnering to Accelerate Connected and Autonomous Vehicle Technology

Tencent is reportedly testing its own autonomous driving system

JD.com Delivers on Self-Driving Electric Trucks

NAVYA Unveils First Fully Autonomous Taxi

Fujitsu and HERE to partner on advanced mobility services and autonomous driving

Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

First Look Inside Zoox’s Autonomous Taxi

Apple Is Focusing on Making an Autonomous Car System

Samsung, Harman gear up for self-driving automobiles

Mitsubishi Electric Develops Automated Mapping For Autonomous Driving

Hitachi demonstrates vehicle with 11-function autonomous driving ECU

DENSO and NEC Collaborate on Automated Driving and Manufacturing

Nuro’s Robot Delivery Vans Are Arriving Before Self-Driving Cars

Here’s Tesla’s competition in car batteries…

LG Chem targets electric car battery sales of $6.3 billion in 2020

Samsung SDI Unveils Innovative Battery Products at 2018 Detroit Motor Show

SK Innovation to produce EV batteries with 500 km range in 2018

New Toshiba EV Battery Allows 320km Charge in 6 Minutes

Daimler opens its sixth battery factory

General Motors China To Open Battery Factory In Shanghai

Panasonic Opens New Automotive Lithium-Ion Battery Factory in Dalian, China

Panasonic forms battery partnership with Toyota

China to build many gigafactories’ worth of electric-car battery plants

China’s BYD takes aim at Tesla in battery factory race

CATL’s Chinese battery factory will be bigger than Tesla’s Gigafactory

CATL Zeroes In On a European Battery Plant

Energy Absolute Plots Asian Project Rivaling Musk’s Gigafactory

European Battery Alliance (EBA) is taking shape

ABB teams up with Northvolt on Europe’s biggest battery plant

Chinese Battery Maker to Open Factory Next to Swedish EV Plant

Sokon aims to be global provider of battery, electric motor, electric control systems

BMW Group invests 200 million euros in Battery Cell Competence Centre

BMW Brilliance Automotive opens battery factory in Shenyang

BMW announces partnership with solid-state battery company

Toyota promises auto battery ‘game-changer’

Hyundai Motor developing solid-state EV batteries

Honda considers developing all solid-state EV batteries

Continental eyes investment in solid-state batteries

Wanxiang is playing to win, even if it takes generations

UK provides millions to help build more electric vehicle batteries

Rimac is going to mass produce batteries and electric motors for OEMs

Elon Musk Has A New Battery Rival (Romeo Power) Packed With His Ex-Employees

Bracing for EV shift, NGK Spark Plug ignites all solid-state battery quest

ProLogium Technology Will Produce First Next Generation Lithium Ceramic Battery For EVs

Here’s Tesla’s competition in storage batteries…

Panasonic

LG

AES + Siemens (Fluence)

GE

Mitsubishi

Hitachi Chemical

Saft

EnerSys

SOLARWATT

Kokam

Sharp

Kreisel

Leclanche

Lockheed Martin

UniEnergy Technologies

ENGIE

Blue Planet

Clean Energy Storage Inc.

Younicos

Powervault

Schmid

And here’s Tesla’s competition in charging networks…

EVgo Installing First 350 kW Ultra Fast Public Charging Station In The US

BMW and Volkswagen Take on Tesla Motors With a New U.S. Fast-Charging Network

Tritium’s First 350-kW DC Fast Chargers Coming To U.S.

Porsche’s 189 US dealers will offer 350kw fast charging stations for its Mission E sedan

Nissan and EVgo to build i-95 Fast-Charge ARC connecting Boston and Washington D.C.

Shell, BMW, Daimler, Ford, VW, Audi & Porsche form IONITY European 350kw Charging Network

E.ON to have 10,000 150KW TO 350KW EV charging points across Europe by 2020

Enel kicks off the E-VIA FLEX-E project for the installation of European ultra-fast charging stations

Europe’s Allego “Ultra E” ultra-fast charging network now operational

Allego & Fortum Launch MEGA-E High Power Charging network for Europe’s Metropolitan areas

Chargepoint Europe Gets $82 million in new funding from Daimler

ChargePoint – InstaVolt partnership; more than 200 UK rapid charge systems

UK’s Podpoint installing 150kW EV rapid chargers this year; 350kW by 2020

UK National Grid plans 350kW EV charge point network

ChargePoint Express Plus Debuts: Offers Industry High 400 kW DC Fast Charging

Fastned building 150kw-350kw chargers in Europe

ABB powers e-mobility with launch of first 150-350 kW high power charger

DBT unveils the 1st 150 kW universal ultra-fast charging station

5 European fast charging networks form Open Fast Charging Alliance

Shell buys European electric vehicle charging pioneer NewMotion

BP in talks with electric carmakers on service station chargers

Total planning EV charging points at its French stations

Yet despite all that deep-pocketed competition, perhaps you want to buy shares of Tesla because you believe in its management team. Really???

Tesla SEC Correspondence Shows A Pattern Of Inaccurate, Incomplete & Misleading Disclosures

Tesla: Check Your Full Self-Driving Snake Oil Expiration Date

As Musk Hyped and Happy-Talked Investors, Tesla Kept Quiet About a Year-Long SEC Probe

The Truth Is Catching Up With Tesla

With Misleading Messages And Customer NDAs, Tesla Performs Stealth Recall

Who You Gonna Believe? Elon Musk’s Words Or Your Own Lying Eyes?

How Tesla and Elon Musk Exaggerated Safety Claims About Autopilot and Cars

When Is Enough Enough With Elon Musk?

Musk Talked Merger With SolarCity CEO Before Tesla Stock Sale

Tesla Continues To Mislead Consumers

Tesla Misses The Point With Fortune Autopilot Story

Tesla Timeline Shows Musk’s Morality Is Highly Convenient

Tesla Scares Customers With Worthless NDAs, The Daily Kanban Talks To Lawyers

Tesla: Contrary To The Official Story, Elon Musk Is Selling To Keep Cash

Tesla: O, What A Tangled Web We Weave When First We Practice To Deceive

I Put 20 Refundable Deposits On The Tesla Model 3

Tesla: A Failure To Communicate

Elon Musk Appears To Have Misled Investors On Tesla’s Most Recent Conference Call

Understanding Tesla’s Potemkin Swap Station

Tesla’s Amazing Powerwall Reservations

So in summary, Tesla is losing a massive amount of money even before it faces a huge onslaught of competition (and things will only get worse once it does), while its market cap matches that of Ford and is nearly as large as GM’s despite a $2.5 billion annualized net loss selling a bit over 100,000 cars while Ford and GM make billions of dollars selling 6.6 million and 9 million cars respectively. Thus this cash-burning Musk vanity project is worth vastly less than its approximately $55 billion enterprise value and—thanks to its roughly $31 billion in debt and purchase obligations—may eventually be worth “zero.”

Elsewhere among our positions…

We continue (since late 2012) to hold a short position in the Japanese yen via the Proshares UltraShort Yen ETF (ticker: YCS) as Japan continues to print nearly 10% of its monetary base per year after more than tripling that base since early 2013. One result of this insane policy (in 2018 the BOJ has bought 75% of JGB issuance!) is there was a day in March when no Japanese government bonds traded! In February Prime Minister Abe reiterated his commitment to continue this massive printing and not only re-nominated money-printing BOJ head Kuroda (who in March reiterated that same commitment) but also nominated a deputy governor who’s even a bigger money-printer. The BOJ’s balance sheet is now larger than the entire Japanese economy– it owns over 44% of all government debt and over 75% (!) of the country’s ETFs by market value. Meanwhile Abe’s October landslide reelection gave him the green light to continue this path of fiscal and monetary irresponsibility from which there is no longer any escape.

Just the interest on its debt consumes 9.2% of Japan’s 2018 budget despite the fact that the country pays a blended rate of less than 1%. What happens when Japan gets the 2% inflation it’s looking for and those rates average, say, 3%? Interest on the debt alone would consume over 27% of the budget and Japan would have to default! But on the way to that 3% rate the BOJ will try to cap those rates by printing increasingly larger amounts of money to buy more of the debt (in fact it’s already happening), thereby sending the yen into its death spiral.

When we first entered this position USD/JPY was around 79; it’s currently in the 106s and long-term I think it’s headed a lot higher—ultimately back to the 250s of the 1980s or perhaps even the 300s of the ‘70s before a default and reset occur.

We continue to hold a short position in the Vanguard Total International Bond ETF (ticker: BNDX), comprised of dollar-hedged non-US investment grade debt (over 80% government) with a ridiculously low “SEC yield” of 0.82% at an average effective maturity of 9.3 years. As I’ve written since putting on this position in July 2016, I believe this ETF is a great way to short what may be the biggest asset bubble in history, as with Eurozone inflation now printing approximately 1.2% annually these are long-term bonds with significantly negative real yields, and the ECB is now buying half as many of them as it had been as recently as December. The borrow cost for BNDX is only around 0.1% a year (plus the yield) and as I see around 5% potential downside to this position (vs. our basis, plus the cost of carry) vs. at least 30% (unlevered) upside, I think it’s a terrific place to sit and wait for the inevitable denouement.

We remain short the Russell 2000 index (IWM) which, with a trailing GAAP PE ratio of 109 (no, that is not a misprint) is easily the most egregiously overvalued of the major U.S. equity indexes.

New to the fund this month is a modestly sized short position in NVIDIA Corp. (NVDA), a graphics and data-center chipmaker which we shorted in the $249s/share (nearly 50x trailing earnings). The stock has had a huge run based primarily on purchases of its chips for cryptocurrency mining and hype about prospects for its autonomous driving chips, and yet prices of “cryptos” have declined to the point where mining them is no longer profitable and recent accidents have kicked autonomous driving further into the future. (In fact, in March NVIDIA temporarily halted on-road autonomous chip testing due to a deadly autonomous Uber accident in Phoenix.) I’m thus looking for the stock price of NVIDIA (a hugely cyclical company) to be cut down significantly.

And now for the long positions…

I added in March to our position in Aviat Networks, Inc. (ticker: AVNW), a designer and manufacturer of point-to-point microwave systems for telecom companies, which in February reported a Q4 2017 roughly in-line with previous guidance. Following extensive restructuring, Aviat is now a GAAP profitable company with around $250 million of annual 32% gross margin revenue, $6 million in free cash flow, $33 million of net cash and approximately $340 million of U.S. NOLs, $16 million of U.S. tax credit carryforwards, $232 million in foreign NOLs and $4 million of foreign tax credit carryforwards. Assuming 5.4 million shares outstanding and valuing the company at just 50% of revenue on a EV basis plus adding in just $30 million for all the NOLs and tax credits makes this a mid-$30s stock vs. our basis in the $15s. The company has an ongoing process to investigate “strategic alternatives” and may sell itself, buy something that can utilize the NOLs or return some cash to shareholders, or it could decide to simply follow its current course of gradual improvement. I’m comfortable owning it at our price basis in any of those circumstances.

We continue to own the PowerShares DB Agriculture ETF (ticker: DBA), bought in December when I looked around for the most beaten-down sector I could find that wasn’t a “buggy whip” (something on the way to obsolescence) or cyclical from a demand standpoint, and came up with “agricultural commodities.” How beaten down is this sector? Since its last peak in mid-2011 through the mid-December date I put on the position (at a blended basis of $18.26/share), the “DBIQ Diversified Agriculture Index Excess Return” on which DBA is based was down around 40% while the S&P 500 was up around 100%: in fact, when we bought DBA its underlying index was the lowest it had been since 2003. Here’s an interesting argument as to why many ag commodities have gotten as cheap as they have (crop insurance allowed debt-fueled overproduction) and why they probably can’t get much cheaper (production is now capped by maxed-out farmer balance sheets). Agricultural products have always been cyclical and—considering the general inflation we’ve had since prices were last here in 2003 (the CPI is up around 35%)—this could be the washed-out bottom of the cycle, and now we may have weather on our side. Also, ag prices can be a great counter-cyclical to stocks and you know how I feel about the current price of those.

We continue to own Echelon Corp. (ticker: ELON), an “industrial internet of things” networking company with approximately $32 million of annual 53% gross margin revenue and an enterprise value of less than $3 million. In February Echelon reported Q4 2017 revenue of $8 million (up slightly vs. Q3’s $7.8 million) and guided to a roughly flat Q1 2018, with operating cash burn disappointingly continuing at a bit over $1 million per quarter. Echelon is now focusing its growth on “smart” commercial & municipal LED lighting (although its fab-less chip business has apparently now stabilized after a long decline), and if the lighting business accelerates (and it could, due to recent sales force hires and new products), I think there’s a chance it can hit a break-even annualized revenue run-rate of $40 million by Q4-2019 (pushed back from my earlier hoped-for timeline) at which point—assuming $14 million of remaining net cash (vs. an estimated $18 million at the end of Q2 2018) and 4.7 million shares outstanding (vs 4.52 million today), an enterprise value of 1x revenue on this 53% gross margin company would put the stock in the mid-$11s per share. Additionally, Echelon has approximately $255 million in federal NOLs and $127 million in state NOLs, worth tens of millions of dollars if it can utilize them. So if it can pull this off (and theoretically, the market for the networking of commercial and municipal LED lighting should be huge between the U.S. and Europe), this stock can be a home run for us. So far though (as noted above) there seems to be little sign of improvement, although revenue at least has stabilized and that flush balance sheet does give it a long runway to succeed. In September the company hired a new V.P. of Sales; now time to hire a new CEO!

Thanks and regards,

Mark Spiegel