By Investor Master Class

I always enjoy reading the letters of investment managers with long term records of success; whether it’s a new investment idea or perhaps a new ways of thinking about the economy, markets, psychology, risk or market history, there is always something to learn. Give me a letter from a practitioner with skin-in-the-game over a Wall Street analyst any day of the week.

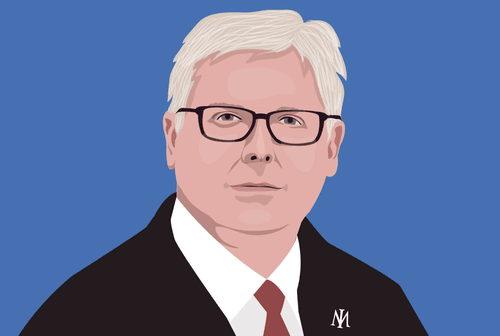

And Christopher Bloomstran’s are no exception.

Christopher Bloomstran founded his firm Semper Augustus Investments in late 1998, toward the peak of the internet bubble. He named the firm Semper Augustus after the most rare and valuable of the high-end tulips during the Tulip mania.

Comeback Kid Delivers At Kerrisdale Capital, Goes Long MOMO

Bloomstran's 2017 Annual Letter, is a fascinating 44 page journey through the current market environment. There are two key areas of learning within its pages. Firstly, as it wades through Bloomstran's perceptions of the market, it compares the similarities between the tech bubble and today, provides insights into the history of Fed hikes, delves into the evolving status of central bank balance sheets, ponders the implications of the transition away from quantitative easing, and provides metrics delineating the Semper Augustus portfolio with the S&P500. It also highlights the trends and risks in passive investing. Secondly, and for me the most enjoyable section of the letter, it identifies the common threads that run through what Bloomstran refers to as, the New Super Investors.

Given its size and the amount of territory it covers, I've decided to split his letter into those two areas and therefore two separate posts - the current market environment, and the topic for this post; the New Super Investors.

The New Super Investors

One of the things that should strike you almost immediately is the striking parallels between the characteristics and traits Chris identifies of these Super Investors, and the topics contained in the Investment Masters Class tutorials.

"It’s not the nuts and bolts that go into a track record that matter. It’s the people behind the record. The light finally went on once real thought went into identifying the commonality between these investors and friends."

It’s not why they own a certain company or even how high is too high a price to pay for an outstanding business. The single common thread shared by the very best investors in our circle is a love of and passion for business analysis. Ours is not a business but a profession, and the best live, breathe and eat it. Understanding a business is like a solving a puzzle. They are curious. They are also deeply devoted to their families and live moral and ethical lives. Knowing them is a privilege. In thinking about them collectively, those who would be perfectly suited at managing our families’ capital if we couldn’t do it, what they earned over the last one, three or five years is irrelevant. Each should outperform markets over the very long haul, but that’s not what’s relevant either. It’s the threads regarding character and philosophy that count, with character being by far the most important.

On Character: Every outstanding investor we know is humble. The investment business teaches it, as does life. At the same time, each is happy and successful.

An ability to admit and know when they are wrong. Investing provides plenty of mistakes to be made and to learn from. Mistakes learned from lead to confidence. Confidence can only be earned through failure. The best freely discuss mistakes and use them as lessons.

All have an insatiable desire to learn, and a high work ethic. Intellectual curiosity is hard wired.

It’s never a job and there is no time clock. Some snuck in annual reports on honeymoons (not advice for you young guys who haven’t yet been initiated to the bliss of marriage). Some friends would lay on the floor reading company filings by the tub as their toddlers bathed.

Many had a chip on their shoulder. Each wanted a better life and independence from worries about money.

Perhaps it’s the nature of our small corner of the value world but everyone is extremely collegial and nice.

Willingness to teach and give back for the gifts of wisdom learned from others is a common thread.

Contrarianism. When it matters, not for the sake of it.

Extreme patience.

Independence of thought. This goes hand in hand with contrarianism. None are hindered by large group think or decision by committee. Even in larger groups, the individual is allowed autonomy of process and thought. In fact, some of the very best investors work together in partnership with like-minded peers and as a group are collectively outstanding.

On Philosophy: All possess a core belief that a disparity can exist between price and value. It’s the key concept of value investing. Price matters greatly. The best are disciplined on both business quality and price. Growth is a part of the value equation and the price paid for it matters. The investment process to each is consistent, repeatable, easily understood and explained, and is a competitive advantage.

Risk is a permanent loss of capital. It’s not the volatility of price. Price volatility simply creates opportunity at times when price and value are disparate. The best I know spend far more time worrying and thinking about what can go wrong than modeling what will go right. Without a deep understanding of the downside, even of the unfathomable, conviction and concentration can be dangerous to disastrous.

Each own concentrated stock portfolios in deeply understood businesses, with high conviction about the business and its value. Without the appreciation of risk, however, these unique aspects of great investing can become the Achilles heel of value investing. We see too many young bucks wanting to build a track record in three years, swinging for the fences in only a few extremely concentrated ideas. Stewardship isn’t on the radar. When the unanticipated comes along, and we’ve seen it with the young and inexperienced as well as with the seasoned, big bets that weren’t well thought out or that misunderstood risk that was there all along, can produce disaster. The best investors understand diversification but know when it’s too much, and when it’s not enough. None are index huggers, it would be anathema to their belief system. None are concerned about having investments across multiple or all sectors. But they all appreciate risk.

Unconstrained. You don’t know where the next opportunity will come from, you have the capability to research and understand it, and you have the mandate to invest in it. Those that are boxed into certain segments invariably must invest in those segments, even if the entire segment is uninvestable from a business quality or price standpoint. We know very good industry analysts that wouldn’t make for good investors.

Not managing too much money. Many have stopped taking new assets or clients on. An ability to buy smaller cap and mid-sized businesses in meaningful enough size when value exists in smaller names is important to the best we know. One of the silliest things seen is the investor who must sell an outstanding business that has grown too large for his “mandate.” Size is an anchor, but so is too little time. Knowing if you are being pulled in too many directions is a common issue and the best understand and deal accordingly with it. Time for reading and thinking is a necessity and the best guard it well.

Every outstanding investor we know lives in the footnotes. Deep research on individual companies is in their DNA, and it’s a never-ending process. Business changes, risks that didn’t exist appear, sometimes slowly and sometimes suddenly. At the same time, however, living in the footnotes isn’t done so deeply that you get so bogged down in an irrelevant data point that you miss the Mack truck barreling full speed right at you.

Patient temperament that results in low portfolio turnover. Active management shouldn’t require activity. Until you own businesses whose share prices grow to three, five, ten times your original investment, you don’t really have an appreciation for compounding. Time is the arbiter of value, and when you have businesses that grow, and those that don’t, only then, over the passage of time, can you truly understand the drivers of compounding. It’s all right there in a discounted cash flow formula, but until you live and breathe it, I don’t think you can understand or appreciate it. Investors that buy and sell all the time, thinking high levels of activity add value, don’t allow themselves to learn the nature of compounding. All great investors we know have companies in their portfolios that have compounded for years.

Expanding on the last point, by owning businesses that have compounded for years, an appreciation for growth and what growth is worth is a common characteristic. Mr. Munger talks about Mr. Buffett’s evolution as an investor. We see it in the businesses our contemporaries have owned for years and decades. Cash is another anchor, and held too long drags returns downward. Holding cash for long periods of time doesn’t help. We’ve never seen it help others. It certainly hasn’t helped us. Allowing cash to accumulate briefly as part of the investment process can be necessary to the process. When it happens, it should be during the rare times of very high market overvaluation. The opportunity cost of waiting around for years for prices to fall is an expensive one, particularly when cash yields are far below available earnings yields.

Aware of one’s circle of competence. This comes with the humility listed first that we see every day in the best investors, and it also comes with having made mistakes by treading too far outside the circle. Universally, mistakes aren’t brushed under the rug but they are studied and used as teaching tools or reminders. The passion for the business and the amount of ongoing learning that goes on works to expand the circle over time.

Act like business owners. No one thinks about stocks without thinking about owning the business first.

Investing is a profession, not so much a business. They don’t invest using different “strategies”. Investing is not a strategy but a philosophy. Some do have multiple “products” and make it work, but the core research process is the same. The very best don’t have teams covering myriad sectors or caps or regions. The best groups are made up of generalists, and the investment philosophy is universally shared. There is a sacrifice involved in investing well, and it often results in fewer assets managed. You can’t be all things to all people and you can’t serve multiple masters, and they don’t.

Expectation of underperformance, even for many years. Intelligent allocation of capital takes time to work. Good investors understand this, and don’t think in the same time intervals as many who allocate capital to them for management. It’s an enigma of the investment world. Too often, when periods of underperformance create doubt, both from within and from the outside, the temptation exists to change from what is seemingly not working, not producing relative results, for what apparently is. Those who understand why what they do works over time don’t change philosophy and do develop the ability to deal with and address the doubts. It often requires the ability to communicate well.

Whether working individually or as a group, a culture of excellence and stewardship exists. Compensation and ownership is structured logically and avoids any motivation to behave badly.

Much more could be added to these common threads of character and philosophy, only because we are blessed to know some outstanding human beings. Life is easy when the people around you are extraordinary. Whether in the investing arena or at home with family, life is a joy thanks to people that make it that way. The motivation for discussing the commonalities among the great investors and friends we have the privilege of sharing the arena with wasn’t to let you know we have the succession planning box checked. We do, but that’s not it. We wanted to highlight the characteristics of active investors that do it right and who understand risk deeply. With the capital allocation world pouring money into passive strategies, there is going to be a reminder that risk is a four-letter world. The logic behind indexing makes perfect sense, but its overuse today is likely going to harm a lot of people.

It really is no surprise to me that Chris also recognises these success traits among both the Investment Masters and the new Super Investors. Time and time again we see the similarities that exist in all of these people, even as we notice their tremendous track records.

Chris' letter also contains a significant amount of insight into the current market environment and his portfolio characteristics that we will cover in our next post.

Further Reading:

'100 Common Threads of the Investment Masters' Investment Masters Class

Follow us on Twitter: @mastersinvest